1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Takeaway and Food Delivery?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Takeaway and Food Delivery

Online Takeaway and Food DeliveryOnline Takeaway and Food Delivery by Type (Delivery, Takeaway, Dining), by Application (Office Staff, Student, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

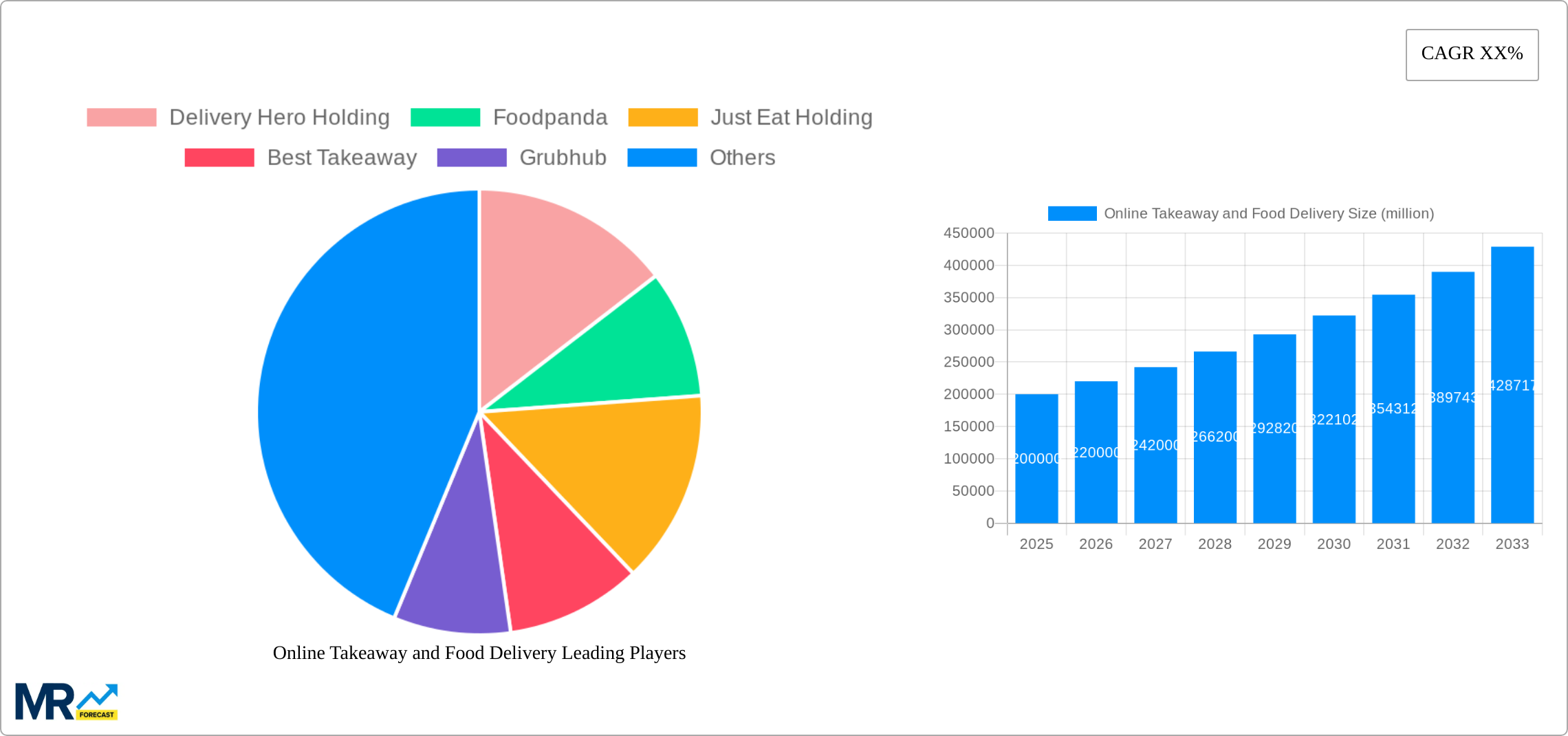

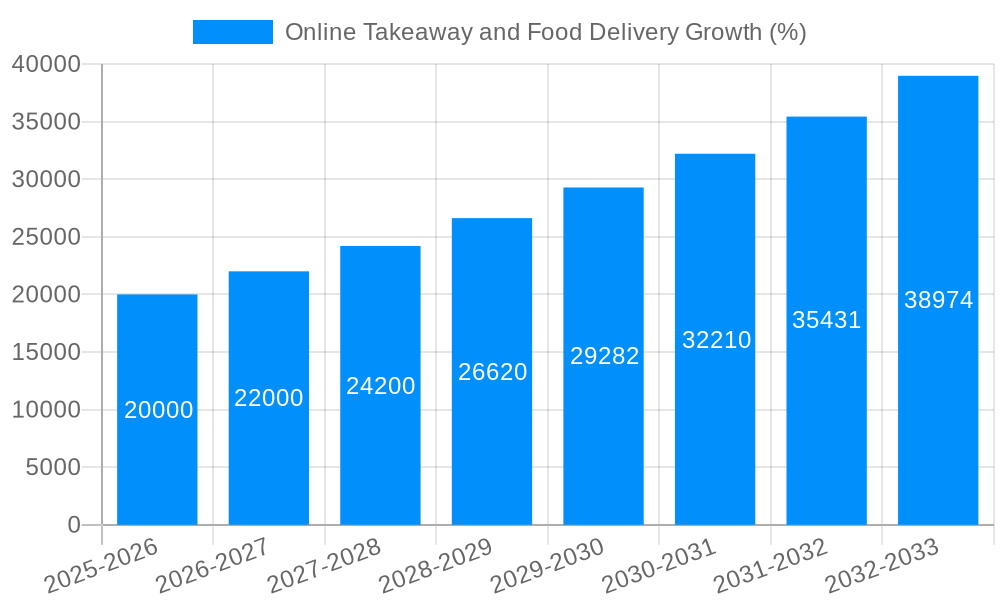

The online takeaway and food delivery market is experiencing robust growth, fueled by increasing smartphone penetration, changing consumer lifestyles favoring convenience, and the expansion of diverse food options available through digital platforms. The market, valued at approximately $200 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033, reaching an estimated $500 billion by 2033. Key drivers include the rising popularity of food delivery apps, the increasing availability of diverse cuisines, and aggressive marketing strategies by established players and new entrants. Consumer preferences are shifting towards healthier options and customizable meals, creating opportunities for businesses focusing on these trends. Despite the high growth potential, the market faces certain restraints, including fluctuating food costs, competition for market share, and the challenges of maintaining consistent food quality and delivery times.

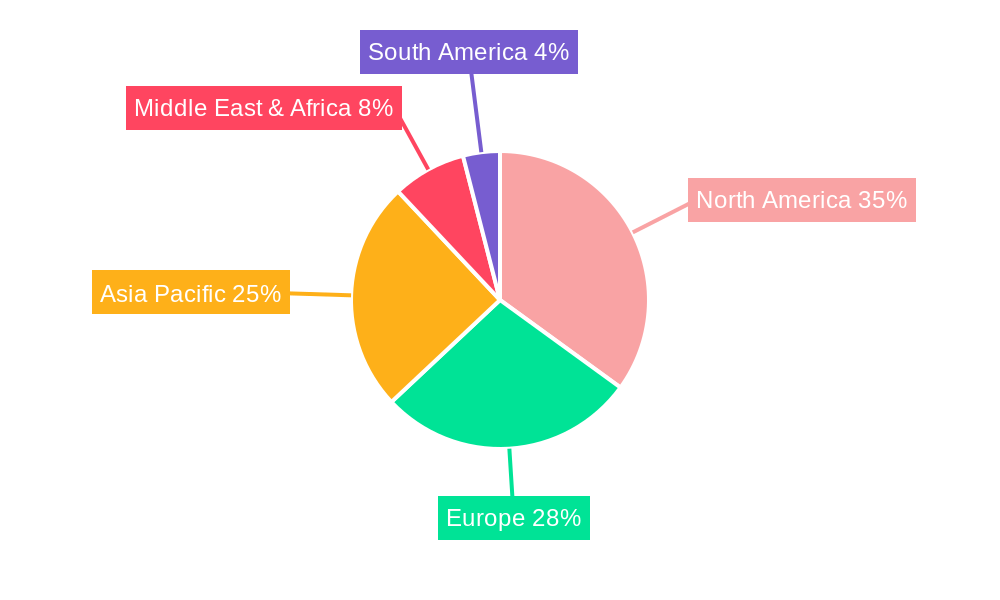

Market segmentation reveals diverse opportunities. The delivery segment, encompassing both restaurant-operated delivery and third-party delivery services, dominates, followed by takeaway and dining-in options facilitated by online ordering. Customer demographics are equally diverse, with office staff, students, and families representing significant market segments. Leading companies like Delivery Hero, Foodpanda, Just Eat, Uber Eats, and DoorDash, along with established restaurant chains integrating their own delivery services (e.g., Domino's, McDonald's), are shaping the competitive landscape. Geographic variations exist, with North America and Asia Pacific currently holding significant market share, however, strong growth is anticipated across all regions, particularly in emerging markets fueled by increased internet and smartphone access. The ongoing focus on improving logistics, enhancing customer experiences (including loyalty programs and personalized recommendations), and exploring new technologies such as AI-powered order prediction and drone delivery will be crucial for success in this dynamic and competitive market.

The online takeaway and food delivery market experienced explosive growth during the study period (2019-2024), fueled by increasing smartphone penetration, evolving consumer lifestyles, and the convenience offered by digital platforms. The market's value soared into the hundreds of millions, with projections suggesting continued expansion through 2033. Key market insights reveal a shift from traditional dining experiences towards the convenience of having meals delivered directly to homes or offices. This trend is especially pronounced amongst younger demographics, like students and young professionals, who readily adopt new technologies and value time-saving solutions. The rise of cloud kitchens and virtual restaurants has also significantly contributed to the market's expansion, offering a cost-effective way for restaurants to expand their reach and cater to the growing demand. Competition is fierce, with established players like Delivery Hero Holding and Just Eat Holding vying for market share alongside newer entrants and specialized services catering to niche dietary requirements or specific cuisines. The market is dynamic, constantly adapting to evolving consumer preferences and technological innovations. This includes the integration of advanced technologies like AI for optimized routing and delivery predictions, and the exploration of autonomous delivery solutions promising further efficiencies and cost reductions. The market segmentation shows strong growth across all types (delivery, takeaway, dining) and applications (office staff, students, other), indicating the broad appeal of online food ordering services across different consumer segments and lifestyles. The base year of 2025 reflects a market value in the billions, setting the stage for significant future expansion in the forecast period (2025-2033).

Several powerful forces are driving the phenomenal growth of the online takeaway and food delivery market. Firstly, the widespread adoption of smartphones and readily available internet access has made ordering food online incredibly easy and convenient. Secondly, increasingly busy lifestyles and a preference for convenience are pushing consumers towards quicker, more accessible meal solutions. The rise of the gig economy has also been instrumental, providing a readily available pool of delivery drivers to meet the escalating demand. Furthermore, innovative business models like cloud kitchens and virtual restaurants have minimized the overhead costs associated with traditional brick-and-mortar establishments, facilitating quicker market entry for new players and increasing overall market capacity. The development of sophisticated delivery platforms with advanced features, such as real-time order tracking and various payment options, has further enhanced the user experience, boosting customer satisfaction and encouraging repeat business. Finally, strategic partnerships between delivery platforms and restaurants, along with aggressive marketing campaigns highlighting the convenience and diverse culinary options, have significantly contributed to the market's rapid growth. The ongoing evolution of technology and its application within the food delivery sector will continue to be a key driver in the years to come.

Despite the rapid growth, the online takeaway and food delivery industry faces several challenges. Maintaining consistent food quality and hygiene across a vast network of restaurants and delivery drivers presents a significant hurdle. Ensuring timely and reliable deliveries, especially during peak hours, is also crucial for customer satisfaction. Competition is intense, with margins often squeezed by the need to maintain competitive pricing and attract both customers and restaurants to their platforms. Furthermore, regulatory hurdles relating to food safety, labor laws, and licensing requirements differ across geographical regions, adding complexity to operations. Fluctuations in fuel prices and the availability of delivery personnel can also impact profitability and operational efficiency. The sustainability concerns associated with the environmental impact of numerous food deliveries are increasingly under scrutiny and require innovative solutions. Finally, maintaining customer data security and protecting against fraud are important considerations that require significant investment in infrastructure and security protocols. Addressing these challenges effectively will be vital for the continued healthy growth of the market.

The online takeaway and food delivery market exhibits significant regional variations, with certain areas demonstrating faster growth than others. While a precise ranking would require specific data analysis beyond the provided information, some regions and segments stand out as particularly strong performers.

Key Regions: Developed economies with high smartphone penetration rates, such as North America and Western Europe, have historically been major contributors to the market's growth. However, developing economies in Asia, especially India and parts of Southeast Asia, are demonstrating phenomenal growth potential driven by increasing urbanization and disposable incomes.

Dominant Segment: Delivery: The "Delivery" segment consistently constitutes a substantial portion of the market, driven by the inherent convenience it provides. Consumers highly value the ability to have their meals delivered directly to their doorstep, regardless of their location.

High-Growth Segment: Students: The "Student" application segment shows significant growth potential. Students typically have limited time and cooking capabilities, making them prime users of food delivery services. The affordability of many delivery options also resonates with this demographic. Their increased digital proficiency and propensity for trying new things also means they are early adopters of new trends and services in the market.

Other Significant Segments: The "Office Staff" segment also demonstrates significant growth due to the increasing number of people working in offices and the convenience of ordering lunch during work breaks. The "Other" segment represents a large and diverse user base that contributes significantly to overall market volume.

In summary, while developed markets continue to be significant contributors, the rapid expansion in developing economies, coupled with the dominance of the delivery segment and the remarkable growth of the student segment, paint a picture of a dynamic and geographically diverse market, with future opportunities spread across a wide spectrum of regions and consumer groups.

Several key factors are catalyzing growth within the online takeaway and food delivery industry. The continuing rise of smartphone usage and internet penetration, along with the increasing popularity of cashless transactions, are facilitating easy access and usage for a wider consumer base. The ongoing development of sophisticated delivery platforms with advanced features, combined with the emergence of innovative business models like cloud kitchens and virtual brands, significantly enhance efficiency and expand market offerings. Furthermore, strategic partnerships between delivery platforms and restaurants, alongside targeted marketing campaigns, attract a broader range of customers and expand market reach. Finally, the growing prevalence of healthier and more diverse food options available through online platforms caters to evolving consumer preferences, further boosting market expansion.

This report provides a comprehensive overview of the online takeaway and food delivery market, covering key trends, driving forces, challenges, and future growth prospects. It analyzes market segmentation by type (delivery, takeaway, dining), application (office staff, students, other), and leading players. The report also highlights significant industry developments and forecasts market growth over the period 2025-2033. This in-depth analysis offers valuable insights for businesses, investors, and stakeholders seeking to understand and navigate this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Delivery Hero Holding, Foodpanda, Just Eat Holding, Best Takeaway, Grubhub, Domino's Pizza, Pizza Hut, Deliveroo, Ubereats, McDonalds, Seamless, Subway, Zomato, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Takeaway and Food Delivery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Takeaway and Food Delivery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.