1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Takeaway and Food Delivery?

The projected CAGR is approximately 7.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Takeaway and Food Delivery

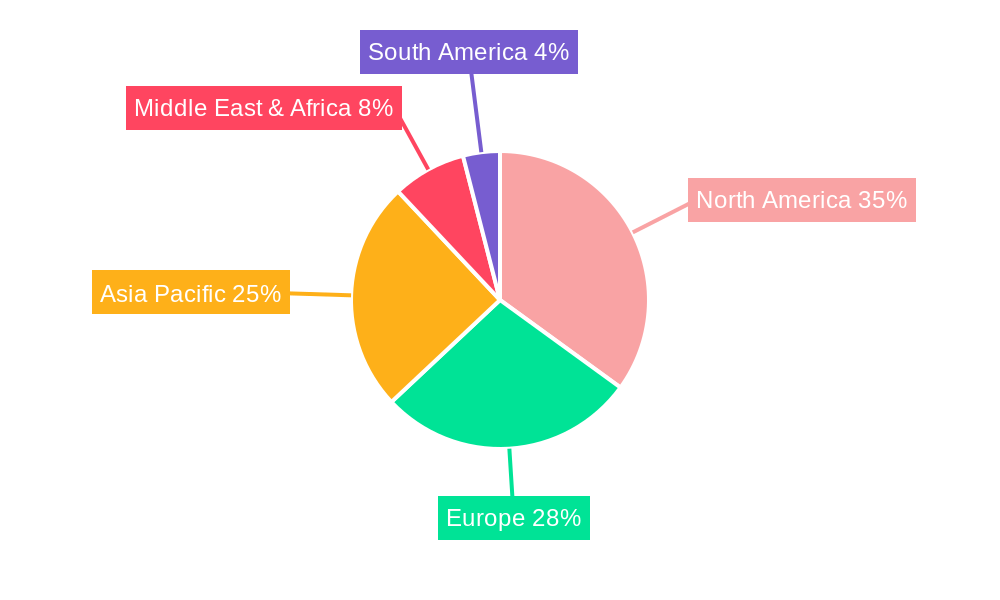

Online Takeaway and Food DeliveryOnline Takeaway and Food Delivery by Type (Subscription-Based Services), by Application (Office Staff, Student, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

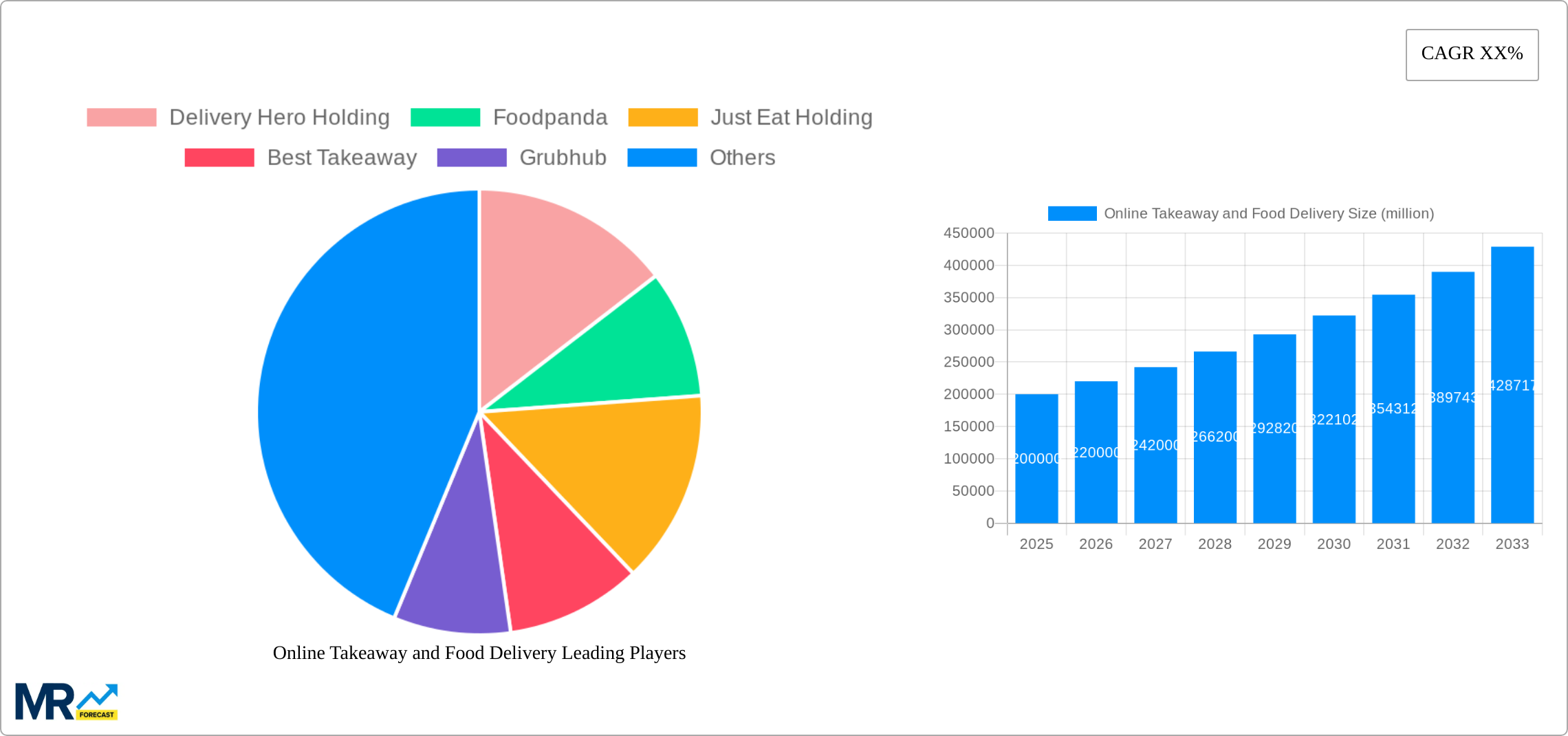

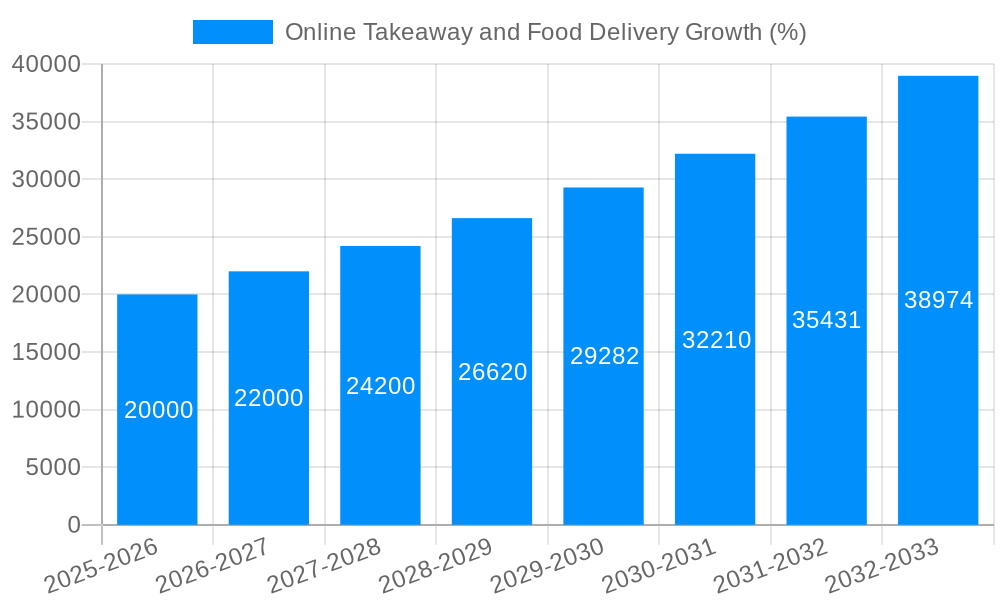

The online takeaway and food delivery market, valued at $29.07 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.2% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing prevalence of smartphones and readily available mobile applications has significantly broadened accessibility, making ordering food online incredibly convenient for consumers. Busy lifestyles and a growing preference for convenience are also major contributing factors, with consumers increasingly prioritizing ease and speed in their daily routines. Furthermore, the expansion of delivery networks, coupled with strategic partnerships between food delivery platforms and restaurants, has enhanced the overall efficiency and reach of the service. The market is segmented by service type (subscription-based and a-la-carte), user demographics (office staff, students, and others), and geographic regions, allowing for targeted marketing and strategic business development. The competitive landscape is fiercely contested, with prominent players such as Delivery Hero, Foodpanda, Just Eat, Uber Eats, and many established restaurant chains vying for market share through competitive pricing, promotional offers, and technological advancements.

The projected market value for 2033, extrapolated based on the provided CAGR of 7.2%, is approximately $55.8 billion. However, several restraining factors could potentially impact this growth trajectory. Increasing operating costs, including delivery fees and labor expenses, pose a significant challenge. Fluctuations in food prices and the need to maintain consistent food quality across delivery operations also present hurdles. Intense competition and the emergence of new entrants in the market further add to the complexity of the business environment. Despite these challenges, the long-term outlook remains positive, driven by evolving consumer preferences and technological innovations that enhance delivery efficiency and user experience. Future growth will likely depend on continued investment in technology, effective marketing strategies, and strategies that mitigate cost pressures. The success of individual players within this market will be largely determined by their ability to adapt to these evolving dynamics.

The online takeaway and food delivery market experienced explosive growth between 2019 and 2024, driven by factors such as increasing smartphone penetration, changing consumer lifestyles, and the rise of on-demand services. The market size, while not explicitly stated in the provided information, easily reached hundreds of millions of dollars during this period. The convenience offered by these services – ordering food from the comfort of one's home or office, with food arriving within a reasonable timeframe – proved immensely appealing to a wide demographic. This trend was amplified during the COVID-19 pandemic, as lockdowns and social distancing measures further restricted dine-in options, pushing consumers even more towards online ordering. The historical period (2019-2024) saw significant investments in the sector, with established players consolidating their positions and new entrants emerging. This competition spurred innovation in areas like delivery speed, order accuracy, and customer service, improving the overall user experience. By 2025, the market is estimated to be worth billions (the exact figure is missing from the data provided), demonstrating the sustained appeal of this sector. The forecast period (2025-2033) projects continued growth, although at a potentially slower pace than the initial surge, as the market matures and penetration rates increase. This maturation will likely focus on refining operational efficiencies, enhancing customer loyalty programs, and exploring new revenue streams, such as subscription models and partnerships with grocery retailers. The evolving competitive landscape will see a focus on differentiation through unique offerings, sophisticated data analytics, and strategic acquisitions.

Several key factors are driving the expansion of the online takeaway and food delivery market. The increasing penetration of smartphones and readily available internet access has significantly lowered the barrier to entry for consumers, making it incredibly easy to place orders. The evolving lifestyles of consumers, particularly in urban areas, with busier schedules and less time for cooking, make online food delivery a convenient and appealing option. The rise of the gig economy, offering flexible employment opportunities for delivery drivers, has enabled the expansion of delivery networks to reach wider geographical areas. Technological advancements in areas like GPS tracking, order management systems, and payment gateways have significantly streamlined the entire process, improving speed and reliability. Moreover, the emergence of sophisticated marketing strategies, targeted advertising, and loyalty programs from the major players has successfully cultivated customer loyalty and attracted new users. The COVID-19 pandemic played a significant role by accelerating the shift towards online ordering, turning it from a convenient alternative into a necessity for many consumers. This increased usage has fostered sustained growth into the post-pandemic era, as the convenience factor remains attractive. The continued development of user-friendly applications and improved delivery infrastructure will ensure this trend continues throughout the forecast period.

Despite the significant growth, the online takeaway and food delivery industry faces several challenges. Maintaining consistent food quality and temperature during delivery remains a key concern, impacting customer satisfaction and potentially leading to negative reviews. High operational costs, including driver fees, marketing expenses, and restaurant commissions, can impact profitability, particularly for smaller companies. Competition is fierce, requiring continuous innovation and strategic investment to maintain a competitive edge. Regulatory hurdles related to food safety, licensing, and labor laws vary across different regions, adding complexity to operations and potentially increasing costs. Concerns around data security and privacy, particularly regarding customer information and payment details, must be addressed with robust security measures. Fluctuations in fuel prices and driver availability can disrupt operations and affect delivery times, potentially leading to customer dissatisfaction. Furthermore, managing negative customer reviews and maintaining a positive brand image are crucial to retaining customer loyalty. Addressing these issues effectively is vital for the continued success of companies in this dynamic market.

The data provided doesn't specify which region or country dominates. However, we can analyze the provided segments. Let's consider the "Application: Office Staff" segment.

High Demand: Office workers represent a large, geographically concentrated customer base with high disposable income and limited time for meal preparation. This makes them an ideal target for online food delivery services.

Predictable Ordering Patterns: Office lunch breaks create a predictable demand surge, allowing businesses to optimize their operations and staffing levels.

Targeted Marketing: Marketing campaigns can be easily tailored to reach office workers through workplace-specific channels.

Corporate Partnerships: Collaborations with businesses can lead to bulk order discounts and exclusive promotions, further increasing market penetration.

Growth Potential: As more businesses return to office settings, there will be sustained demand. Continued growth in urban areas globally will support this segment's market dominance.

Challenges: Competition in densely populated urban areas is intense, necessitating effective differentiation and competitive pricing. Reliable delivery during peak hours presents a logistical challenge. Seasonal fluctuations or company-specific policies on food delivery could lead to unexpected dips in demand.

The "Office Staff" segment shows strong potential for dominance due to its combination of high demand, predictable ordering patterns, and the potential for strategic partnerships. However, success within this segment requires efficient operations, a strong brand image, and competitive pricing to overcome fierce competition in this sector.

The online takeaway and food delivery industry's growth is fueled by several key factors: rising disposable incomes, increased smartphone and internet penetration, the growth of the gig economy, and the evolution of consumer lifestyles that favor convenience. Technological innovations such as advanced order management systems and improved delivery logistics continually optimize the customer experience and increase efficiency. The ongoing development of user-friendly mobile applications and efficient payment gateways further enhances the overall accessibility and usability of the service, driving adoption rates across a wider range of consumers.

Specific development dates are not provided in the prompt. A detailed report would need to include these for a complete picture.

This report provides a comprehensive overview of the online takeaway and food delivery market, analyzing its growth trends, driving forces, and challenges. It highlights the potential of specific segments and identifies key players in the industry. A detailed report would include specific market size data, regional breakdowns, and an in-depth competitive analysis of major companies, allowing for better informed business decisions based on the latest market intelligence.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.2%.

Key companies in the market include Delivery Hero Holding, Foodpanda, Just Eat Holding, Best Takeaway, Grubhub, Domino's Pizza, Pizza Hut, Deliveroo, Ubereats, McDonalds, Seamless, Subway, Zomato, .

The market segments include Type, Application.

The market size is estimated to be USD 29070 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Takeaway and Food Delivery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Takeaway and Food Delivery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.