1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Pharmacy?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Pharmacy

Online PharmacyOnline Pharmacy by Type (/> Prescription Drugs, Over the Counter Drugs), by Application (/> App only, Online store), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The online pharmacy market is experiencing robust growth, driven by increasing internet penetration, rising healthcare costs, and the convenience of home delivery. The market's expansion is fueled by a growing preference for telehealth services and the increasing adoption of digital health technologies. Consumers are increasingly comfortable managing their medication needs online, leading to higher adoption rates across various demographics. While precise market sizing requires proprietary data, considering the presence of major players like PharmEasy, Netmeds, and CVS Health, alongside a significant CAGR (let's assume a conservative 15% based on industry trends), we can project a substantial market value. Assuming a 2025 market size of $50 billion USD, a 15% CAGR would lead to approximately $60 billion in 2026, $70 billion in 2027, and continue this exponential growth trajectory throughout the forecast period. This projection factors in the continued expansion of e-commerce, the increasing demand for personalized medicine, and the strategic investments by major players in improving their online platforms and delivery networks.

Significant restraints include concerns surrounding data security and privacy, regulatory hurdles for online prescription fulfillment, and the need to address potential logistical challenges in delivering medications, especially to remote areas. However, these challenges are actively being addressed through technological advancements, improved regulatory frameworks, and innovative delivery solutions. Market segmentation is likely based on prescription type (chronic vs. acute), age demographics, geographic location, and product type (branded vs. generic). Competitive analysis highlights the presence of both large multinational corporations and specialized online pharmacies, leading to a dynamic market with opportunities for innovation and consolidation. The future of the online pharmacy market is promising, with continued growth driven by technology and evolving consumer preferences.

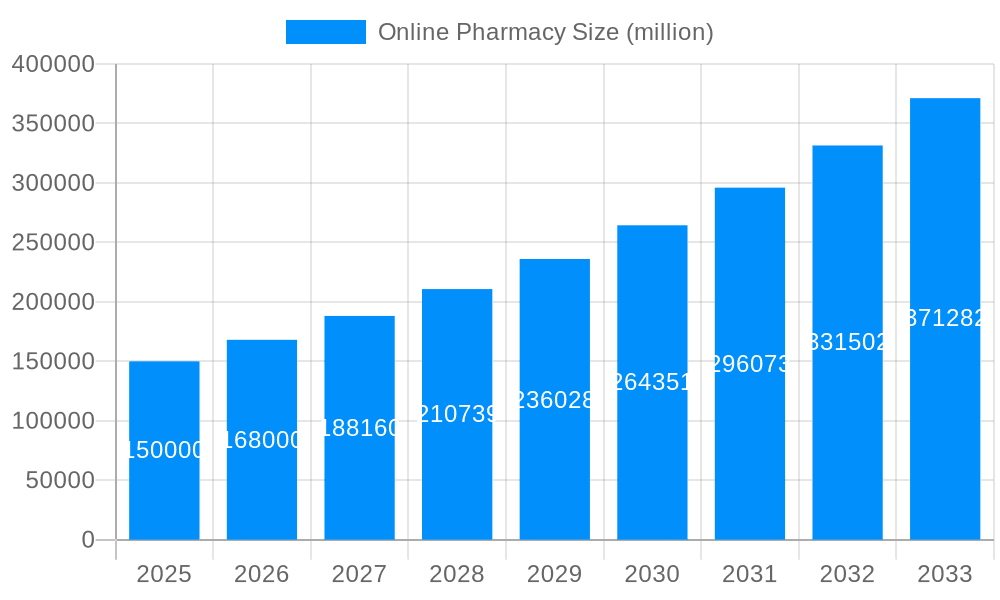

The online pharmacy market experienced explosive growth during the study period (2019-2024), fueled by increasing internet penetration, smartphone adoption, and a rising preference for convenient healthcare solutions. The market's value soared into the multi-billion-dollar range, with key players like PharmEasy, Netmeds, and CVS Health capturing significant market share. The estimated market value for 2025 sits at several billion dollars, reflecting continued strong growth. This growth is not solely confined to established markets; emerging economies are also witnessing a rapid rise in online pharmacy adoption, driven by factors such as improved logistics infrastructure and increased healthcare awareness. The forecast period (2025-2033) projects continued expansion, though potentially at a slightly moderated pace as the market matures. Several factors, discussed later, are expected to contribute to this sustained growth, including the expansion of telehealth services, increasing government support for digital healthcare initiatives, and the ongoing development of innovative technologies within the online pharmacy sector. The historical period (2019-2024) provided valuable insights into consumer behavior and market dynamics, shaping strategies for companies operating within this rapidly evolving landscape. Competition is intense, with both large multinational corporations and agile startups vying for market dominance through strategic acquisitions, technological innovation, and aggressive marketing campaigns. The focus is increasingly on personalized medicine, improved customer experience, and ensuring secure and reliable delivery of medications. The base year of 2025 provides a crucial benchmark to assess the market's trajectory towards 2033 and beyond. Millions of consumers are now relying on online pharmacies for their medication needs, highlighting the transformative impact of e-commerce on the healthcare industry. This shift demands a robust regulatory framework to maintain quality, safety, and patient trust.

Several factors are driving the phenomenal growth of the online pharmacy market. The convenience factor is paramount; online pharmacies offer 24/7 access to medications, eliminating the need for physical visits to traditional pharmacies, particularly beneficial for individuals with mobility issues or those in remote areas. The ease of ordering and doorstep delivery adds to this appeal. Furthermore, online platforms often offer lower prices compared to brick-and-mortar stores, driven by reduced overhead costs and increased competition. This cost advantage is a significant pull factor, particularly for patients with chronic conditions requiring ongoing medication. The rise of telehealth services has synergistically boosted online pharmacy growth; virtual consultations often seamlessly integrate with online prescription fulfillment, creating a highly efficient and integrated healthcare experience. Increased consumer awareness of online pharmacies, aided by targeted marketing and positive word-of-mouth, has played a crucial role. Government initiatives promoting digital healthcare are also creating a favorable environment for online pharmacies to flourish. Finally, the continuous development and adoption of technology, ranging from secure online payment gateways to sophisticated logistics and delivery systems, further enhances the appeal and reliability of online pharmacy services, making them a increasingly preferred choice for millions.

Despite the remarkable growth, the online pharmacy market faces several challenges. Security and privacy concerns regarding patient data remain a major hurdle. Maintaining the confidentiality of sensitive health information requires robust cybersecurity measures and compliance with stringent data protection regulations. Counterfeit medications pose a significant threat, requiring stringent quality control measures and verification systems to ensure the authenticity and safety of dispensed drugs. Regulatory hurdles and varying legal frameworks across different regions complicate expansion and standardization, leading to inconsistencies in operational practices and consumer protection. Logistical challenges, especially in ensuring timely and reliable delivery in remote areas or regions with underdeveloped infrastructure, hinder market penetration. Public skepticism and concerns about the legitimacy and safety of online pharmacies remain, requiring strong efforts to build trust and educate consumers. Moreover, the intense competition within the market necessitates constant innovation and adaptation to remain competitive and capture market share. Finally, managing the complexities of prescription drug regulations and ensuring compliance across various jurisdictions demands significant expertise and resources.

North America (USA & Canada): North America is projected to hold a substantial market share, driven by high internet penetration, advanced healthcare infrastructure, and a strong regulatory framework (though challenges remain). The large aging population in this region also fuels demand for convenient prescription access. The established presence of major players like CVS Health and Walgreens contributes to market dominance.

Asia-Pacific (India & China): This region exhibits exponential growth, particularly in countries like India and China, where expanding internet access and a growing middle class with rising disposable incomes drive increased demand. Companies like PharmEasy, Netmeds, and Alibaba Health Information Technology (part of the Alibaba Group) are key players in this region. The vast population base and the relatively lower cost of healthcare services provide strong growth potential. However, regulatory hurdles and infrastructure challenges exist in certain parts of this region.

Europe: Europe is also a significant market, characterized by established regulatory structures and high healthcare standards. However, growth may be comparatively slower than in Asia-Pacific, due to existing well-established brick-and-mortar pharmacy networks. Countries like Germany, with its advanced digital infrastructure, present an attractive market. Companies like Zur Rose AG are key players.

Segments:

Prescription Drugs: This segment will continue to be the largest contributor to market revenue, driven by the rising prevalence of chronic diseases and an aging population.

Over-the-Counter (OTC) Medications: The OTC segment is expanding rapidly due to ease of access and convenience.

Medical Devices: Online pharmacies are increasingly offering basic medical devices alongside medications, expanding their offerings and revenue streams.

The key regions and segments above are projected to witness significant growth over the forecast period (2025-2033), surpassing hundreds of millions in revenue. The combination of increasing demand, improved technology, and supportive regulatory changes continues to shape this dynamic market.

Several factors are catalyzing growth in the online pharmacy industry. Technological advancements, including AI-powered chatbots for customer service and improved delivery logistics, enhance efficiency and user experience. Government regulations supporting telehealth and online prescriptions create a favorable regulatory environment. Rising smartphone and internet penetration drive wider adoption, and the convenience and cost-effectiveness of online pharmacies are strong motivators for consumers. These elements together are driving significant expansion and creating opportunities for market players.

This report provides a comprehensive analysis of the online pharmacy market, encompassing market size, growth drivers, challenges, key players, and future trends. The report offers in-depth insights into various segments and key geographical regions, providing stakeholders with valuable information for strategic decision-making. It leverages data from the historical period (2019-2024) to forecast market trends until 2033, offering a long-term perspective on market evolution. The report is designed to cater to industry professionals, investors, and researchers seeking a thorough understanding of this dynamic and rapidly growing sector. Data is presented in millions of units, providing a clear and concise view of the market's quantitative aspects.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PharmEasy, Netmeds, CVS Health, Walgreen, Cigna, Giant Eagle, Zur Rose AG, Kroger, Rowlands Pharmacy, UnitedHealth Group, 1mg, MyDawa, Shanghai Yibang Medical Information Technology Co., Ltd., 111,Inc., China Resources, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Pharmacy," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Pharmacy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.