1. What is the projected Compound Annual Growth Rate (CAGR) of the Online On-Demand Home Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online On-Demand Home Services

Online On-Demand Home ServicesOnline On-Demand Home Services by Type (/> Cellular, Non-Cellular), by Application (/> Food, Retail, Media & Entertainment, Healthcare, Beauty, Home Welfare, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

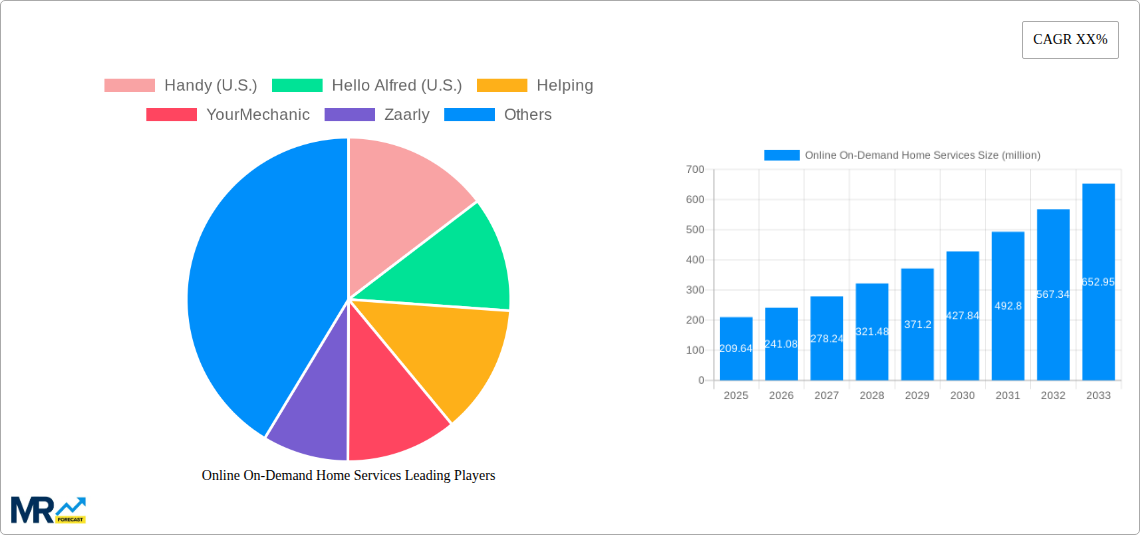

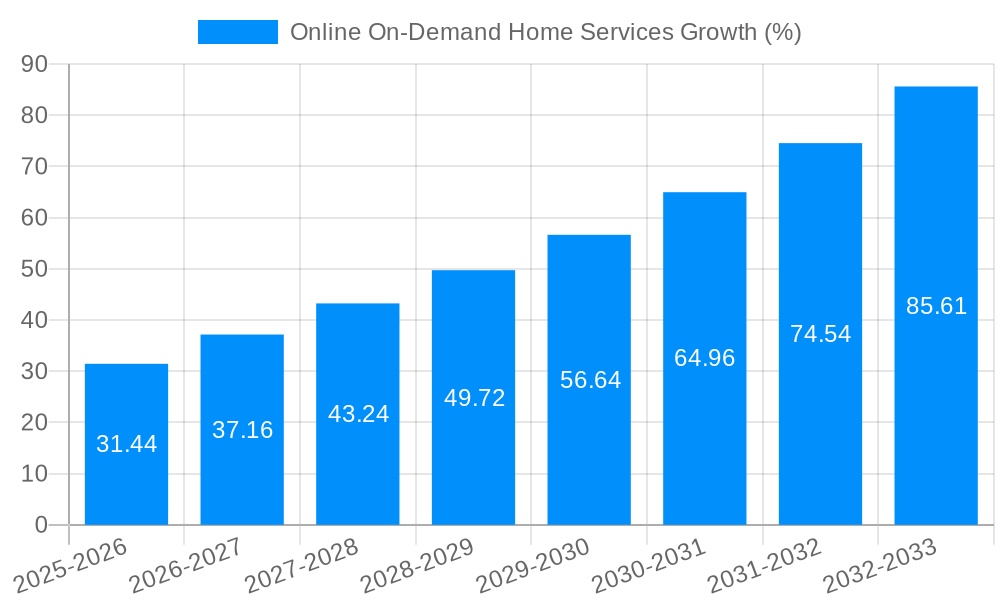

The online on-demand home services market, valued at $209.64 million in 2025, is experiencing robust growth. This burgeoning sector, fueled by increasing consumer demand for convenience and readily available skilled labor, is projected to exhibit significant expansion over the forecast period (2025-2033). Factors driving this growth include the rising adoption of smartphones and internet penetration, coupled with the increasing preference for outsourcing household tasks. The convenience of booking and managing services through user-friendly mobile applications, alongside competitive pricing and transparent service offerings, further contribute to market expansion. While data limitations prevent precise CAGR quantification, considering similar market trends in the gig economy and on-demand services, a conservative estimate places the CAGR for this sector in the range of 15-20% annually. This implies substantial market value increases throughout the forecast period.

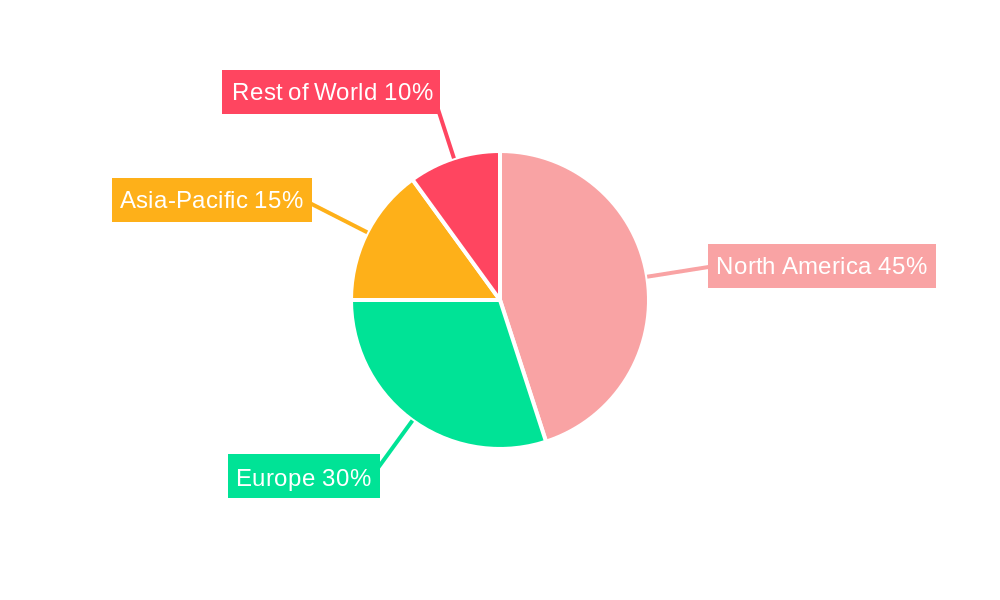

Several segments within the online on-demand home services market contribute to its growth. These include cleaning services, handyman services, home repair and maintenance, and specialized services such as painting or furniture assembly. The competitive landscape is characterized by a mix of established players like Handy and Hello Alfred, and a growing number of smaller, specialized service providers. Geographic variations exist, with North America and Europe currently holding significant market share; however, emerging economies are also presenting considerable growth opportunities as internet access expands and disposable incomes rise. Continued technological innovation, focused on enhancing user experience and service provider efficiency, will be crucial in shaping the future of the online on-demand home services market. This includes developments in AI-powered scheduling, improved customer service interactions, and enhanced background checks for service professionals to instill greater trust and confidence among consumers.

The online on-demand home services market is experiencing explosive growth, driven by the increasing adoption of smartphones, readily available internet access, and a rising preference for convenience. The market, valued at several billion dollars in 2024, is projected to reach tens of billions of dollars by 2033, representing a Compound Annual Growth Rate (CAGR) exceeding 15% during the forecast period (2025-2033). This robust growth is fueled by a confluence of factors, including the increasing urbanization and time-constrained lifestyles of consumers. People are increasingly willing to outsource tasks traditionally handled personally, opting for the efficiency and convenience offered by on-demand platforms. This trend is particularly strong amongst millennials and Gen Z, who are digitally native and comfortable using mobile apps for various services. Furthermore, the market is witnessing a significant diversification of services offered, beyond basic cleaning and handyman services, to include specialized offerings like interior design consultations, pet care, and even grocery delivery. This expansion caters to an increasingly diverse range of consumer needs and preferences, driving further market expansion. The competitive landscape is also dynamic, with both established players and emerging startups vying for market share through innovative service offerings, competitive pricing, and strategic partnerships. The historical period (2019-2024) already showcased significant expansion, establishing a strong foundation for the projected growth trajectory during the forecast period. The estimated market value for 2025 provides a crucial benchmark to track progress against future projections, providing insights into the rate of adoption and market saturation in various regions and segments. The study period (2019-2033) provides a comprehensive overview of the market evolution, capturing both the initial growth phase and the anticipated mature phase.

Several key factors are propelling the rapid expansion of the online on-demand home services market. Firstly, the increasing prevalence of smartphones and ubiquitous internet access has made it incredibly easy for consumers to access and utilize these services. The user-friendly interfaces of mobile applications allow for seamless booking, scheduling, and payment processes, eliminating the friction previously associated with accessing such services. Secondly, the changing demographics and lifestyles of consumers, particularly in urban areas, are contributing significantly to market growth. Busy professionals and families with limited free time are increasingly outsourcing household tasks to reclaim valuable time and reduce stress. Thirdly, the expanding range of services offered by these platforms is attracting a wider customer base. Initially limited to basic services like cleaning and handyman work, these platforms now provide a diverse array of services catering to various needs. This diversification is crucial for sustained growth, ensuring that the platforms remain relevant and appealing to an evolving consumer base. Finally, the competitive landscape is characterized by continuous innovation in technology and service offerings. Platforms are constantly seeking ways to enhance user experience, improve efficiency, and expand their service portfolios. This drive for innovation fuels growth and prevents market stagnation.

Despite the impressive growth, the online on-demand home services market faces several challenges. One significant hurdle is maintaining consistent service quality. The reliance on a network of independent contractors can lead to variability in the quality of service provided, which can negatively impact customer satisfaction and loyalty. Effective quality control mechanisms and robust vetting processes are critical for addressing this issue. Another challenge lies in managing operational costs, particularly the costs associated with recruiting, training, and managing a large network of contractors. Ensuring profitable operations while maintaining competitive pricing requires efficient operational management and strategic cost control. Furthermore, competition in this market is fierce, with both established players and new entrants vying for market share. This requires constant innovation, investment in technology, and effective marketing strategies to differentiate services and attract customers. Finally, security and safety concerns are paramount. Ensuring the safety of both service providers and customers is crucial for maintaining trust and building a sustainable business model. Stringent background checks, robust communication systems, and clear safety protocols are necessary to mitigate these risks.

North America (U.S. and Canada): This region is expected to dominate the market due to high disposable incomes, early adoption of technology, and a preference for convenience services. The established presence of major players like Handy and Hello Alfred further strengthens this dominance.

Europe (Western Europe): Significant growth is anticipated in Western European countries, driven by rising urbanization and increasing awareness of on-demand services. However, the market maturity may lag behind North America due to cultural differences and varying levels of technology adoption.

Asia-Pacific: This region exhibits substantial growth potential, with rapidly expanding urban populations and increasing disposable incomes in several key markets. However, regulatory hurdles and infrastructural limitations in some areas could pose challenges.

Cleaning Services: This segment is currently the largest and fastest-growing, driven by the convenience it offers busy individuals and households.

Handyman Services: This segment is expected to witness strong growth due to the increasing need for home repairs and maintenance.

Specialized Services: Niches like pet care, interior design, and furniture assembly are experiencing rapid expansion, driven by growing consumer demand for specialized and convenient solutions.

The market's dominance by North America reflects several factors including higher disposable incomes allowing for outsourcing of household tasks, early adoption of technology and associated apps, and the presence of many well-established companies. The cleaning services segment's lead arises from its basic, readily understood need and broad applicability across varied demographics. The continuing growth of specialized services is indicative of the market's evolution beyond core offerings, catering to ever more specific consumer needs. The future growth in the Asia-Pacific region hints at a shift towards a more geographically diversified market, but the current limitations suggest that North America will retain a significant lead for the foreseeable future.

Several factors are accelerating growth within the online on-demand home services industry. The increasing adoption of smart home technology creates opportunities for integration with on-demand service platforms, improving efficiency and customization. Strategic partnerships between on-demand platforms and established retail or home improvement brands expand service offerings and reach new customer segments. Finally, ongoing technological advancements in areas like AI and machine learning improve service matching, scheduling optimization, and overall user experience, further enhancing the appeal and accessibility of these services.

This report offers a comprehensive analysis of the online on-demand home services market, providing detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. It covers a broad range of services and segments, offering granular market size and share estimates for the study period (2019-2033). The report’s detailed analysis is invaluable to businesses, investors, and anyone seeking a thorough understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Handy (U.S.), Hello Alfred (U.S.), Helping, YourMechanic, Zaarly, Airtasker, AskForTask, CLEANLY, MyClean, Paintzen, SERVIZ.

The market segments include Type, Application.

The market size is estimated to be USD 209640 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online On-Demand Home Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online On-Demand Home Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.