1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Jewelry Stores?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Jewelry Stores

Online Jewelry StoresOnline Jewelry Stores by Type (Gold Jewelry, Diamond Jewelry, Platinum Jewelry, Others), by Application (Below 25, 26~35, 36~45, 46~60, Above 60), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

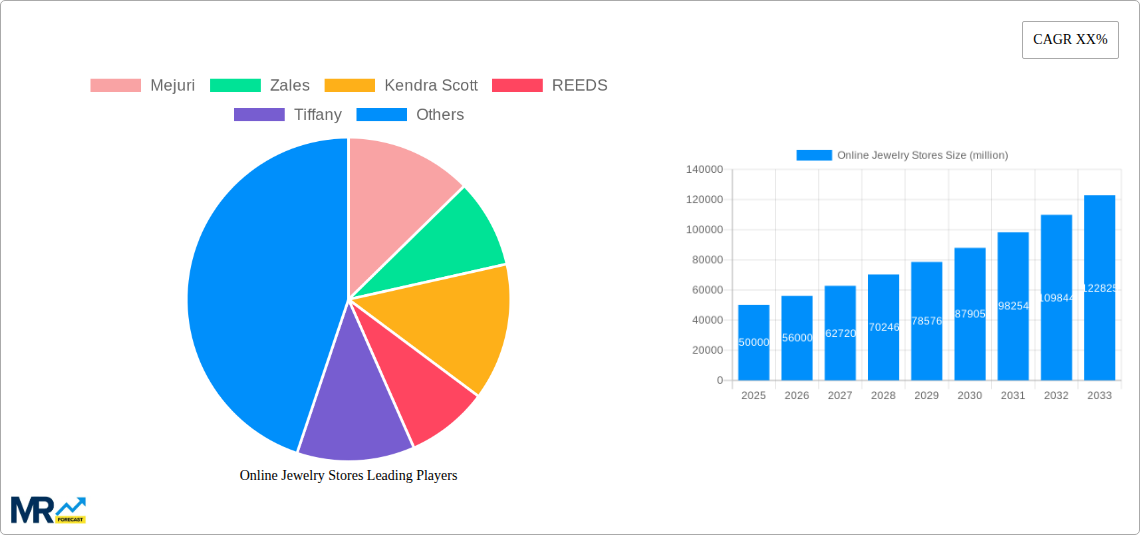

The online jewelry market is experiencing robust growth, driven by increasing internet penetration, the convenience of e-commerce, and a shift in consumer preferences towards digital shopping experiences. The market, estimated at $50 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching an impressive $150 billion by 2033. This expansion is fueled by several key factors, including the rise of direct-to-consumer brands offering unique designs and personalized experiences, the growing popularity of online marketplaces providing diverse selections, and innovative marketing strategies leveraging social media and influencer collaborations. The segment with the highest growth potential is diamond jewelry, followed closely by gold jewelry, reflecting enduring consumer demand for these precious metals. Furthermore, the age demographic 26-45 years represents the most significant consumer segment, indicating a strong presence of millennials and Gen X shoppers within the online jewelry market. While challenges like security concerns surrounding online transactions and the inability to physically examine jewelry before purchase exist, these are being mitigated by secure payment gateways, high-quality product photography, and detailed descriptions, alongside the implementation of enhanced return policies.

Despite the considerable growth, certain restraints remain. These include concerns about product authenticity and the potential for counterfeits, logistical challenges related to international shipping and returns, and intense competition amongst established and emerging brands. The market is segmented by jewelry type (gold, diamond, platinum, others) and consumer age group (Below 25, 26-35, 36-45, 46-60, Above 60). Major players such as Mejuri, Zales, Kendra Scott, REEDS, Tiffany, Kay, Jared, and Blue Nile are strategically investing in enhanced online platforms, personalized customer service, and targeted marketing campaigns to capture market share. Regional variations in market size and growth are expected, with North America and Asia-Pacific regions projected to dominate the market due to high internet usage and disposable incomes.

The online jewelry market experienced phenomenal growth between 2019 and 2024, driven by the increasing adoption of e-commerce and a shift in consumer preferences towards convenient and personalized shopping experiences. The market size, valued at several billion dollars in 2024, is projected to reach tens of billions of dollars by 2033. This expansion is fueled by several factors including the enhanced visual presentation of jewelry online, the rise of influencer marketing and targeted advertising, and the growing trust in secure online payment gateways. Consumers, particularly millennials and Gen Z, are increasingly comfortable purchasing high-value items like jewelry online, particularly due to the ease of comparison shopping and the ability to browse a wider selection than available in brick-and-mortar stores. The market is witnessing a diversification of product offerings, with a growing demand for unique, handcrafted pieces alongside traditional designs. This trend is reflected in the success of online-only brands like Mejuri, which cater to a younger demographic seeking modern and affordable luxury. Furthermore, established brands like Tiffany & Co. and Zales are adapting their strategies to effectively leverage online channels, incorporating features like virtual try-on tools and personalized recommendations to enhance the online shopping experience. The integration of augmented reality and virtual reality technologies is further shaping the future of online jewelry retail, providing consumers with immersive and realistic previews before purchase. The historical period (2019-2024) witnessed a substantial shift in consumer behavior, establishing a strong foundation for continued growth during the forecast period (2025-2033). The estimated market size for 2025 is expected to be significantly higher than previous years, reflecting the ongoing trend of online jewelry sales.

Several key factors are driving the expansion of the online jewelry market. Firstly, the widespread adoption of smartphones and high-speed internet access has significantly increased the accessibility and convenience of online shopping. Consumers can now browse and purchase jewelry anytime, anywhere, leading to a surge in online sales. Secondly, the rise of social media marketing and influencer collaborations has played a crucial role in increasing brand awareness and driving consumer engagement. The ability to showcase jewelry through visually appealing content on platforms like Instagram and TikTok has proven highly effective in attracting new customers. Thirdly, the emergence of innovative technologies, such as augmented reality (AR) and virtual reality (VR), is enhancing the online shopping experience. AR and VR allow consumers to virtually try on jewelry before purchasing, reducing the risk and enhancing customer confidence. Furthermore, the growing preference for personalized experiences is driving the demand for customized jewelry and bespoke designs. Online platforms offer greater flexibility in customization options, catering to individual preferences and tastes. Finally, the competitive pricing offered by many online retailers, often coupled with attractive discounts and promotions, attracts budget-conscious consumers. This price competitiveness, alongside the convenience and vast selection available, is a significant factor influencing the shift towards online jewelry purchases.

Despite the significant growth potential, the online jewelry market faces certain challenges. One major concern is the difficulty in accurately portraying the quality and authenticity of jewelry online. High-resolution images and detailed descriptions are essential, but they can’t fully replicate the tactile experience of handling a piece of jewelry. This leads to higher return rates compared to physical stores. Security concerns regarding online payments and the risk of fraud remain significant obstacles. Consumers need to feel confident that their financial information is protected, and retailers must invest in robust security measures to build trust. The inability to physically examine jewelry before purchase is also a major factor influencing consumer hesitancy. While technologies like AR/VR aim to mitigate this, they are not yet universally adopted or perfectly accurate. Additionally, the competitive landscape of online retail means that maintaining profitability requires effective marketing strategies and efficient logistics. Managing inventory, ensuring timely delivery, and handling returns can present logistical difficulties, especially for smaller online jewelry retailers. Finally, building customer trust and fostering strong relationships online requires substantial effort in providing excellent customer service and addressing concerns promptly and professionally.

The online jewelry market is expected to witness significant growth across various regions, with North America and Europe currently leading the market. However, the Asia-Pacific region is poised for rapid expansion driven by rising disposable incomes and increasing internet penetration. Within the segments, the following are expected to dominate:

Diamond Jewelry: The enduring appeal of diamonds, coupled with their suitability for online display, ensures this segment's continued dominance. High-value diamond jewelry purchases often benefit from the extensive product information and detailed descriptions provided online, leading to a higher level of confidence in purchasing.

Gold Jewelry: The versatility and affordability of gold jewelry make it popular across various age groups and demographics. Online platforms offer a wide selection of gold jewelry styles, catering to diverse tastes.

Age Group 26-45: This demographic holds significant purchasing power and an affinity for online shopping, making them a key driver of growth in the online jewelry market. They are more likely to embrace new technologies and are comfortable making high-value purchases online.

In paragraph form:

The key drivers for market dominance are multifaceted. The high-value nature of diamond jewelry necessitates detailed information and assurance of authenticity, areas where online platforms can excel. The widespread appeal and affordability of gold jewelry across diverse populations make it an ideal online product. The 26-45 age bracket, characterized by higher disposable income and tech-savviness, forms a core consumer base for online luxury goods, including jewelry. These factors combine to project a sustained and rapid growth trajectory for these particular segments within the broader online jewelry market. The geographic distribution of growth will see the continuous dominance of North America and Europe, with the Asia-Pacific region becoming a significant force in the coming years.

The online jewelry industry is experiencing a surge in growth propelled by several key catalysts. Firstly, the increasing adoption of e-commerce and the rise of mobile shopping are significantly boosting online sales. Secondly, the use of innovative technologies, such as augmented reality (AR) and virtual reality (VR), is revolutionizing the online shopping experience by allowing consumers to virtually try on jewelry before purchase. Furthermore, the rise of social media marketing and influencer collaborations is driving brand awareness and customer engagement. Finally, the expanding range of personalized and customized jewelry options available online is attracting customers seeking unique and bespoke pieces.

This report provides a comprehensive analysis of the online jewelry market, covering historical data (2019-2024), estimated figures for 2025, and forecasts up to 2033. It delves into market trends, driving forces, challenges, key players, and significant developments, providing valuable insights into this rapidly expanding sector. The report also offers a detailed segmentation analysis by jewelry type (gold, diamond, platinum, others) and consumer demographics (age groups), allowing for a nuanced understanding of market dynamics and future growth potential. The comprehensive nature of this analysis makes it an indispensable resource for industry stakeholders, investors, and anyone seeking to understand the complexities and opportunities within the online jewelry market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Mejuri, Zales, Kendra Scott, REEDS, Tiffany, Kay, Jared, Blue Nile, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Jewelry Stores," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Jewelry Stores, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.