1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Investment Platform?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Investment Platform

Online Investment PlatformOnline Investment Platform by Type (/> Web-based, Mobile-based), by Application (/> Banks, Investment Management Firms, Trading & Exchange Firms, Brokerage Firms, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

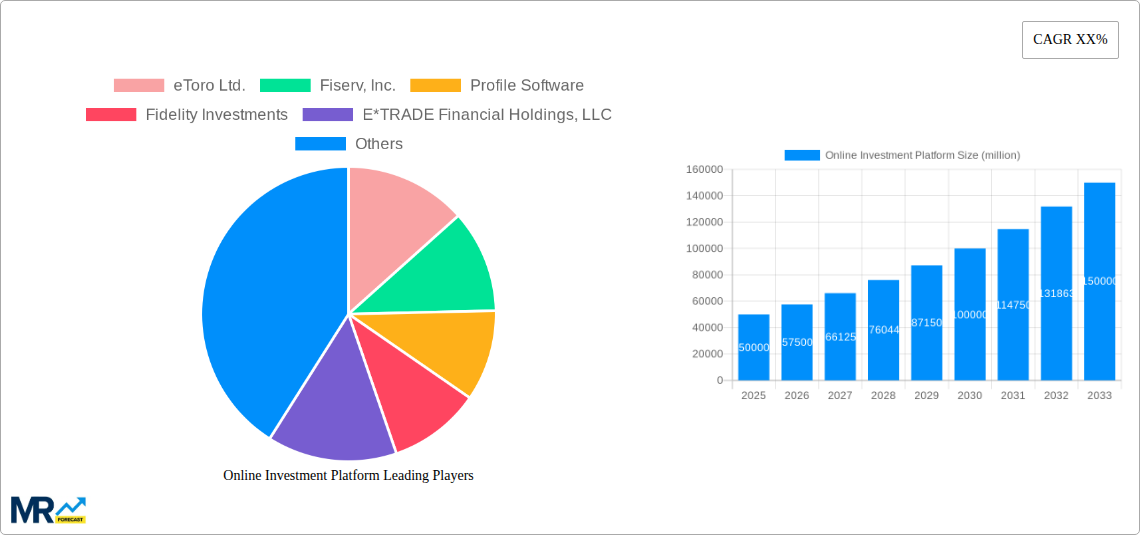

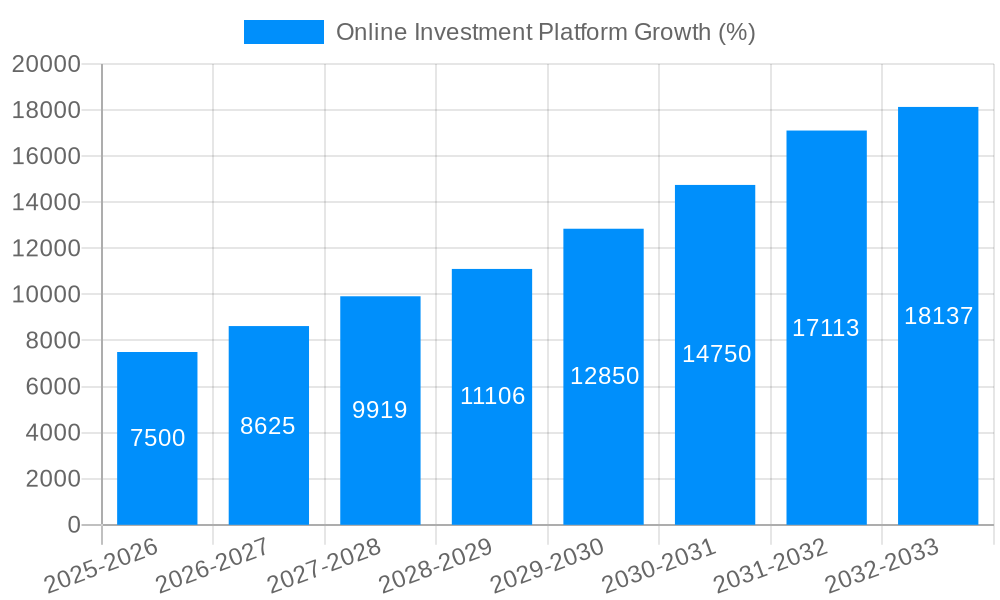

The online investment platform market is experiencing robust growth, driven by increasing digital adoption, the rise of mobile-first investing, and a growing demand for accessible and cost-effective investment solutions. The market's expansion is further fueled by technological advancements, including artificial intelligence (AI)-powered robo-advisors and sophisticated trading platforms that cater to diverse investor needs and risk profiles. This has led to increased competition among established players and the emergence of innovative fintech startups, pushing the boundaries of investment accessibility and personalization. While regulatory hurdles and cybersecurity concerns pose challenges, the overall market trajectory remains positive, with a projected Compound Annual Growth Rate (CAGR) of approximately 15% between 2025 and 2033. This translates to a significant market expansion, with the total market value expected to reach approximately $150 billion by 2033, considering a 2025 market size of $50 billion. The market is segmented based on various factors including platform type (robo-advisors, brokerage platforms), user demographics (retail investors, institutional investors), and geographical location.

The competitive landscape is characterized by a mix of large established financial institutions and agile fintech companies. Established players such as Fidelity Investments and E*TRADE leverage their brand recognition and existing customer bases, while fintech companies like eToro utilize innovative technologies and user-friendly interfaces to gain market share. The key success factors include robust security measures, user-friendly interfaces, personalized investment advice, and competitive pricing models. Future growth will be significantly influenced by the integration of blockchain technology, the development of more sophisticated AI-driven investment strategies, and the ongoing regulatory landscape evolution concerning financial technologies and cybersecurity. Continued innovation and adaptation to changing investor preferences will be crucial for sustained success in this dynamic and rapidly growing market.

The online investment platform market is experiencing explosive growth, driven by a confluence of factors including increased internet penetration, the rise of mobile technology, and a growing preference for self-directed investing. The study period (2019-2033) reveals a significant upward trajectory, with the estimated market value in 2025 exceeding several billion dollars. This growth is fueled by a younger generation of investors who are comfortable managing their finances digitally and seek greater control over their investments. The convenience and accessibility of online platforms, coupled with their often lower fees compared to traditional brokerage houses, are key attractors. Furthermore, the increasing sophistication of these platforms, offering features such as robo-advisors, fractional share trading, and advanced charting tools, caters to a wider range of investors, from beginners to seasoned professionals. The historical period (2019-2024) saw significant adoption, particularly in developed markets, but the forecast period (2025-2033) anticipates a surge in emerging economies as internet access and financial literacy improve. This expansion is not limited to stock trading; it encompasses a broader range of investment products, including bonds, mutual funds, ETFs, and even alternative assets like cryptocurrency. Competition is fierce, with established players constantly innovating and newer entrants leveraging technological advancements to carve out market share. The market's dynamic nature requires continuous adaptation and a focus on user experience to remain competitive. The base year of 2025 serves as a crucial benchmark to understand the market's current state and project its future growth.

Several key factors are propelling the growth of online investment platforms. Firstly, the increasing affordability and accessibility of the internet and mobile devices are making online investing a viable option for a larger population. Secondly, the rising adoption of fintech solutions is streamlining the investment process, making it simpler and more user-friendly for both beginners and experienced investors. Robo-advisors, for example, are automating portfolio management, thus lowering the barrier to entry for those who lack the time or expertise for active trading. Thirdly, regulatory changes in many jurisdictions are fostering a more conducive environment for online investment platforms, leading to increased competition and innovation. The demand for lower-cost investment solutions is also a significant driver. Online platforms often offer significantly lower fees compared to traditional brokers, making them a more attractive proposition for cost-conscious investors. Finally, the expanding range of investment products available on these platforms, including fractional shares and alternative investments, further fuels their growth and appeal to a diverse investor base. This combination of technological advancements, regulatory changes, and increasing consumer demand creates a potent force driving the market's expansion.

Despite the rapid growth, the online investment platform sector faces several challenges. Security concerns remain paramount, with the risk of cyberattacks and data breaches posing a significant threat to user trust and the industry's reputation. Robust cybersecurity measures are crucial for maintaining user confidence. Regulatory compliance is another major challenge, as the industry is subject to evolving regulations that vary across jurisdictions. Navigating these complexities and ensuring compliance can be expensive and time-consuming. Furthermore, the increasing competition necessitates constant innovation and the need to offer cutting-edge features to attract and retain customers. The potential for market volatility and economic downturns poses a risk, as investor sentiment can dramatically impact platform usage and profitability. Maintaining a high level of customer service is also essential, particularly for resolving issues and handling complaints efficiently. Finally, the increasing sophistication of fraudulent activities targeting online investors requires continuous vigilance and proactive measures to protect users from scams and financial losses. Addressing these challenges effectively is essential for the sustainable growth and stability of the online investment platform market.

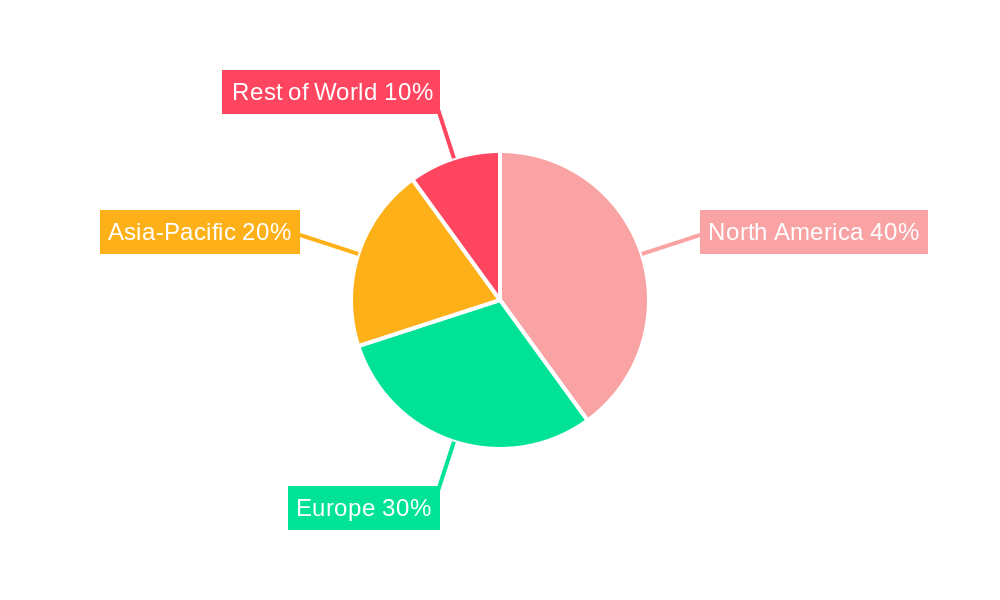

North America: The region holds a significant share of the market, driven by high internet penetration, a strong financial infrastructure, and a culture of active investing. The US, in particular, has a mature and competitive market with a large number of established players and a significant number of active retail investors. Canada also contributes significantly to the regional market share due to its developed economy and relatively high levels of financial literacy. The forecast period expects continued dominance, bolstered by ongoing technological innovations and the growing popularity of robo-advisors.

Europe: Europe presents a diverse market with varying levels of adoption across different countries. While mature markets like the UK and Germany show strong growth, Southern European countries are experiencing a faster rate of adoption as technology becomes more accessible and financial literacy increases. Regulatory changes and the expanding availability of online investment services are contributing to the region’s growth potential.

Asia-Pacific: This region is poised for substantial growth, driven by increasing internet penetration, a burgeoning middle class, and a growing interest in wealth management and investment products. Countries like China, India, and Japan, with their large populations and rapidly developing economies, are key drivers of growth in this market. However, regulatory hurdles and varying levels of financial literacy across different countries present some challenges.

Segment Domination: Robo-advisory services: Robo-advisors are experiencing particularly strong growth due to their ease of use, affordability, and accessibility. They cater to a broad range of investors, from beginners to those seeking diversified and low-cost portfolio management. This segment is expected to continue its impressive growth trajectory throughout the forecast period, especially in regions with growing digital adoption.

Several factors are propelling growth in this sector. The increasing adoption of mobile-first technology enhances accessibility and convenience, making investment easier for busy individuals. Furthermore, the integration of AI and machine learning allows for personalized financial planning and portfolio management, enhancing the user experience. Finally, the constant innovation in the development of new features and the expansion of available investment products drives continued adoption and attracts a wider range of investors.

This report provides a comprehensive overview of the online investment platform market, analyzing its historical performance (2019-2024), current state (2025), and future prospects (2025-2033). It covers key market trends, driving forces, challenges, regional variations, and the leading players, providing valuable insights for businesses, investors, and regulators in the financial technology sector. The report’s detailed analysis and projections offer a clear understanding of this dynamic and rapidly evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include eToro Ltd., Fiserv, Inc., Profile Software, Fidelity Investments, E*TRADE Financial Holdings, LLC, Temenos AG, SS&C Technologies, Inc., FIS, InvestEdge, Inc., Calypso Technology, Inc..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Investment Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Investment Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.