1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Home Rental Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Home Rental Services

Online Home Rental ServicesOnline Home Rental Services by Type (Apartments, Resorts, Villas, Hostels, B&Bs, Office, Guest Houses, Other), by Application (Commercial, Personal), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

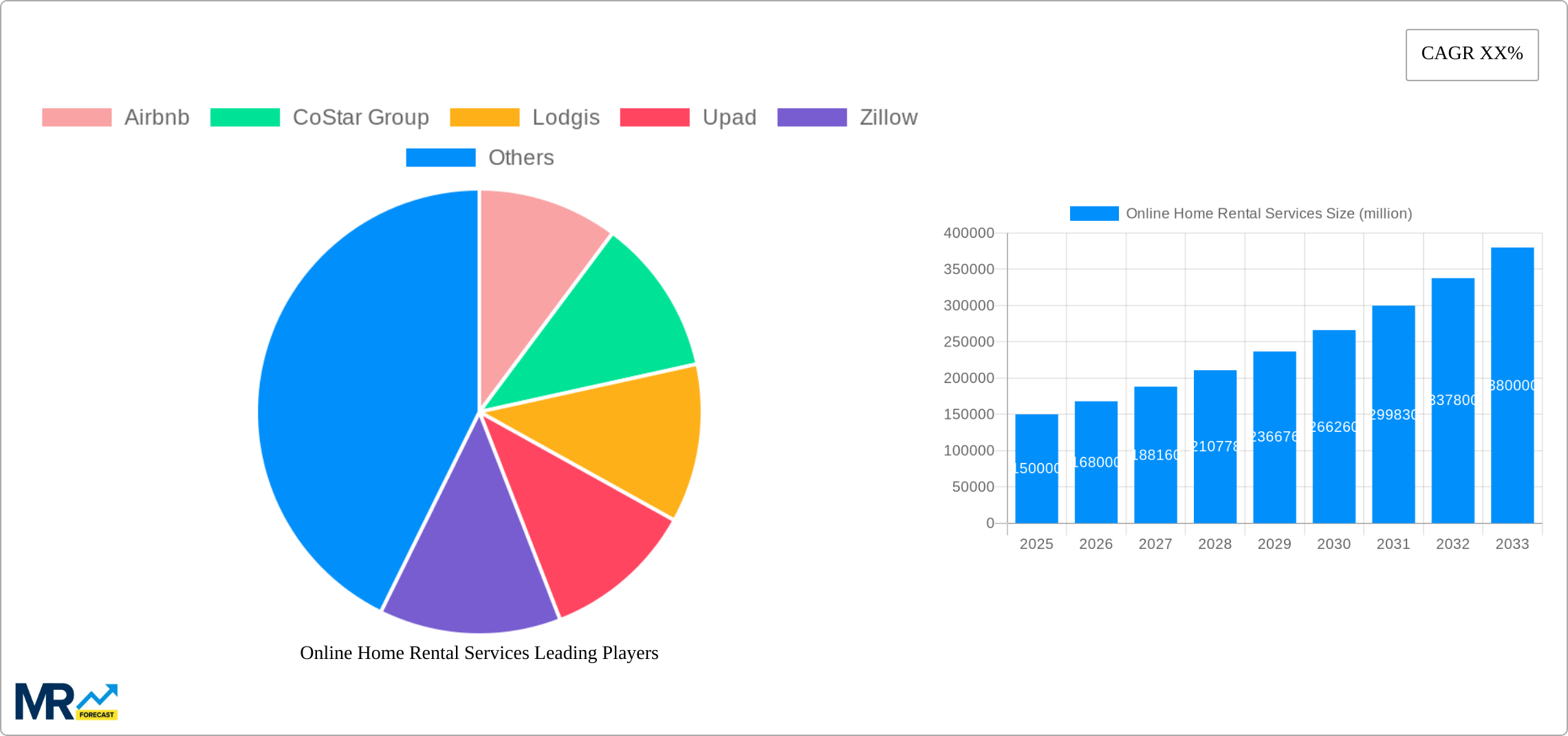

The online home rental market is experiencing robust growth, driven by increasing urbanization, the rise of the sharing economy, and the convenience offered by digital platforms. The market, encompassing diverse property types like apartments, villas, and hostels, caters to both commercial and personal needs. While precise market size figures for 2025 are not provided, considering a plausible CAGR (let's assume 12% based on industry trends) applied to a hypothetical 2019 market size of $500 billion, the 2025 market size could be estimated around $800 billion. This growth is fueled by several factors, including the increasing preference for short-term rentals among travelers, the expansion of remote work opportunities leading to increased demand for long-term rentals in diverse locations, and the continuous technological advancements improving the user experience on booking platforms. Key players like Airbnb, Booking.com, and Zillow dominate the market, but regional variations exist, with companies like Magicbricks (India) and 5i5j Holding Group (China) catering to specific geographic needs.

Despite its rapid expansion, the online home rental market faces challenges. These include regulatory hurdles related to licensing and taxation, concerns about property safety and security, and the ongoing competition among numerous established and emerging players. The market also needs to address issues related to data privacy and security, and ensure fair pricing practices to maintain consumer trust and prevent market instability. Effective strategies for managing seasonal fluctuations in demand, particularly in regions heavily reliant on tourism, are crucial for sustainable growth. Future growth will likely be influenced by factors such as economic conditions, technological innovations (e.g., improved search algorithms, virtual tours), and evolving consumer preferences in the short and long-term rental sectors. Market segmentation, particularly by property type and target customer (business traveler vs. leisure traveler), will become increasingly important for targeted marketing and improved service delivery.

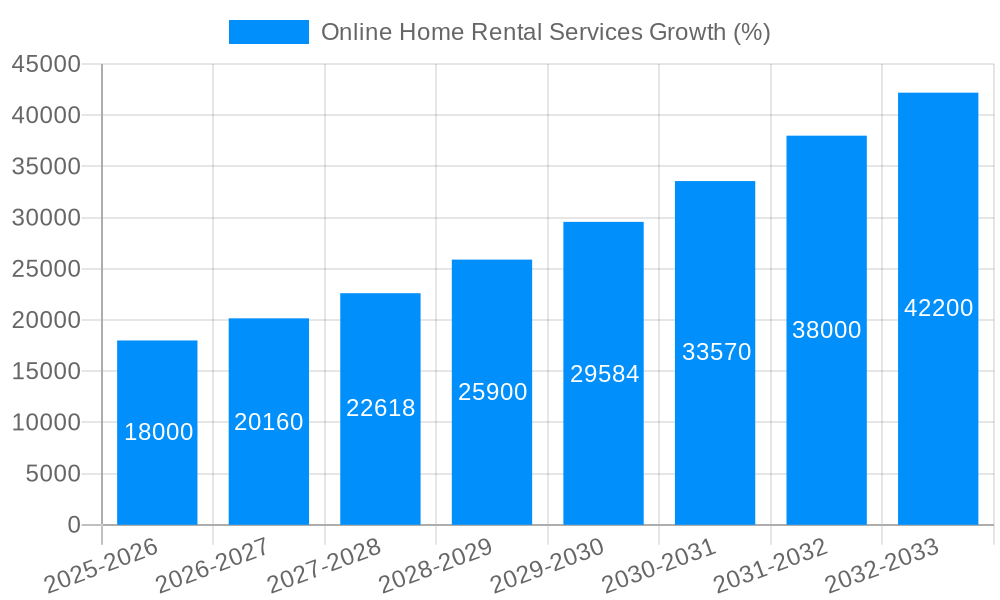

The online home rental services market experienced explosive growth throughout the historical period (2019-2024), driven by increasing urbanization, the rise of the sharing economy, and the ease and convenience offered by digital platforms. The market value surged into the multi-billion-dollar range, exceeding expectations in several segments. While the base year of 2025 shows a slight consolidation following rapid expansion, the forecast period (2025-2033) projects continued robust growth, albeit at a more moderate pace. This maturation is anticipated due to increased market saturation in certain regions and the emergence of more stringent regulations in others. The shift towards longer-term rentals, particularly for apartments and even office spaces, is a significant trend, impacting the business models of several key players. The increasing integration of technology, including AI-powered pricing optimization and virtual tours, is enhancing the user experience and efficiency of the entire rental process. Furthermore, the market is witnessing a diversification of offerings, with specialized platforms emerging to cater to niche segments like luxury villas and serviced apartments. While the traditional brick-and-mortar real estate agencies still hold a share of the market, their influence is being gradually challenged by the seamless and cost-effective solutions provided by online platforms. This competition is forcing traditional players to adapt and integrate digital strategies into their business models. The overall trend points towards continued growth, diversification, and technological advancements within the online home rental services sector over the next decade, exceeding USD 100 billion by 2033.

Several factors contribute to the remarkable growth of online home rental services. Firstly, the increasing preference for flexible and short-term accommodations caters to the needs of both business travelers and leisure tourists, fueling demand for platforms like Airbnb. Secondly, technological advancements, including user-friendly mobile apps and robust search engines, make finding and booking properties remarkably convenient and efficient. This ease of access surpasses traditional methods, significantly influencing consumer choice. Thirdly, the rise of the sharing economy, encouraging peer-to-peer transactions, has disrupted the traditional hospitality industry and expanded the supply of rental properties dramatically. This has created opportunities for both property owners and renters to bypass traditional real estate agencies and access a broader market. Fourthly, globalization and increased international travel further contribute to this upward trajectory. People are exploring destinations previously inaccessible, boosting demand for short-term rentals in varied locations. Finally, cost-effectiveness plays a crucial role. Online platforms often offer more competitive pricing compared to hotels or traditional rentals, especially for short stays. This makes them attractive to budget-conscious travelers and long-term renters, reinforcing their position within the market.

Despite significant growth, the online home rental services sector faces several challenges. Regulation is a primary concern, with governments grappling with issues like taxation, property licensing, and tenant protection. Inconsistent regulations across different jurisdictions create operational complexities for platforms and legal uncertainties for renters and property owners. Security and safety are also significant concerns, with risks associated with fraudulent listings, property damage, and tenant disputes. Platforms are constantly working to improve safety measures, but eliminating these risks entirely remains a challenge. Competition is fierce, with established players battling emerging startups for market share. This competitive landscape necessitates continuous innovation and adaptation to maintain a competitive edge. Furthermore, the reliance on technology makes the platforms vulnerable to cyberattacks and data breaches, potentially harming user trust and brand reputation. Finally, the economic climate and fluctuations in travel patterns significantly influence demand. Global economic downturns or unforeseen events (like pandemics) can significantly impact the market's growth trajectory.

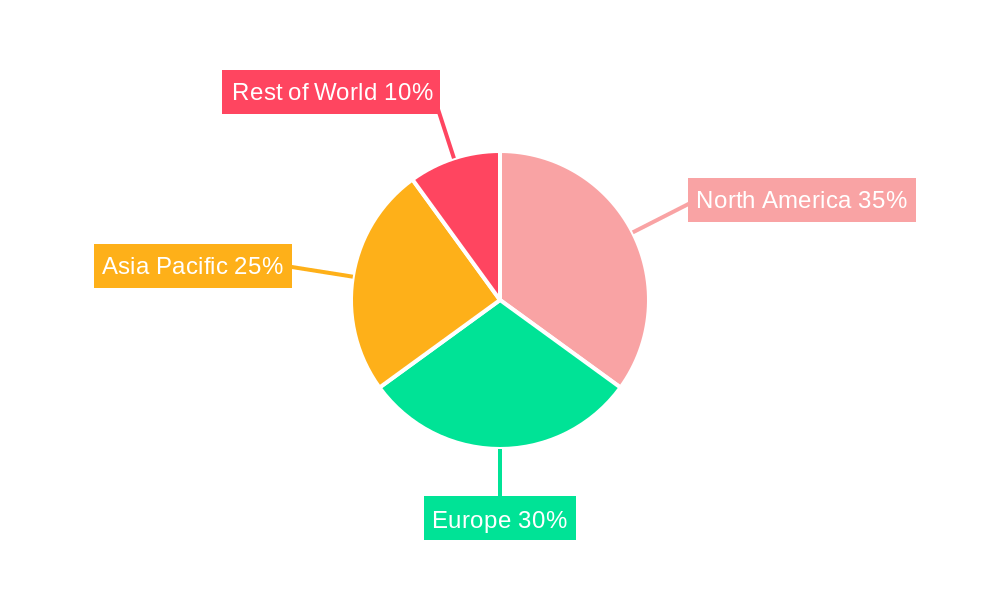

North America (US & Canada): This region consistently holds a leading position due to high levels of disposable income, robust tourism, and the early adoption of online rental platforms. The segment of apartments and personal applications is dominant here. The significant presence of established players like Airbnb and Zillow further consolidates its position.

Europe (Western Europe): Strong tourism and a well-developed digital infrastructure contribute to the region's significant market share. Apartments and personal rentals are major drivers in urban centers. However, differing regulations across countries might hinder uniform growth.

Asia-Pacific: This region is experiencing rapid growth, particularly in countries like China and India, driven by rising middle classes and increasing urbanization. Apartments and personal applications are dominant. However, challenges remain in terms of establishing trust and infrastructure improvements.

Dominant Segments:

Apartments: This segment consistently demonstrates the highest demand due to its affordability and suitability for both short-term and long-term stays.

Personal Application: The majority of rentals are for personal use, whether for vacations, relocation, or temporary housing needs.

The overall market is characterized by a diverse range of rental types, reflecting varying needs and preferences. However, the apartment rental segment under the personal application umbrella is overwhelmingly the largest and continues to be a key focus for online platform development and expansion.

The online home rental services industry's growth is fueled by several key catalysts, including the growing preference for flexible and short-term accommodations, the increasing adoption of mobile technology and the expansion of high-speed internet access. The rise of the sharing economy and globalization have further boosted demand, while technological innovations such as AI-driven pricing and virtual tours are enhancing the user experience.

This report provides a detailed analysis of the online home rental services market, encompassing historical data, current market trends, and future projections. It examines key players, regional variations, and dominant segments, providing a comprehensive overview of this dynamic sector and its potential for continued growth. The report will equip stakeholders with the insights needed to navigate this evolving landscape and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Airbnb, CoStar Group, Lodgis, Upad, Zillow, Zumper, Realtors.com, Homes.com, RentPath, Booking.com, idealista, Engel&Völkers, Magicbricks, Ziroom, 5i5j Holding Group, Anjuke.com, GPlusMedia, DID-GLOBAL, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Home Rental Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Home Rental Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.