1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Grocery Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Grocery Services

Online Grocery ServicesOnline Grocery Services by Type (Packaged Foods, Fresh Foods), by Application (Personal Shoppers, Business Customers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

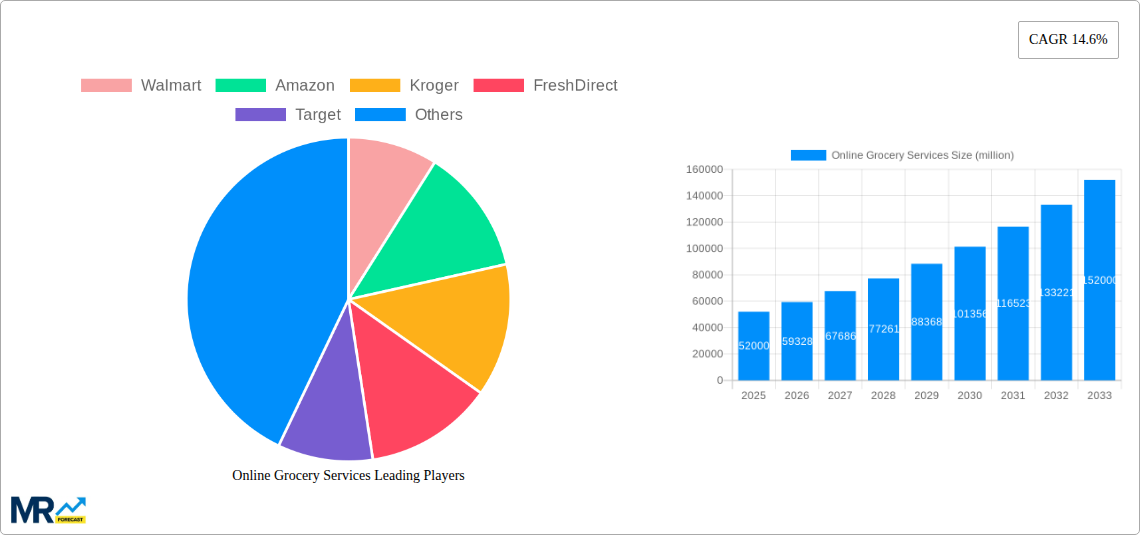

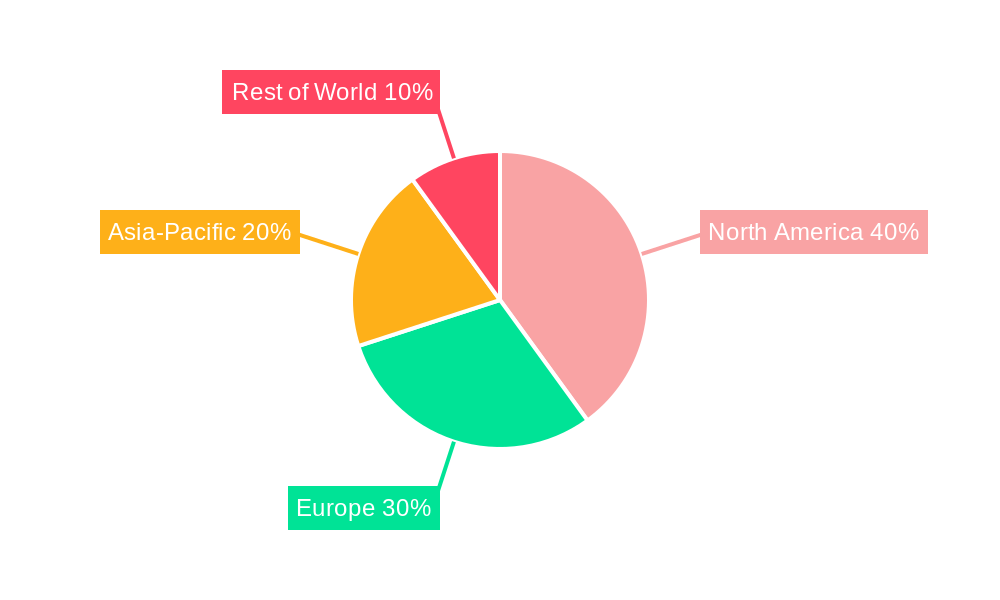

The online grocery market, valued at $135.34 billion in 2025, is experiencing robust growth, driven by increasing consumer preference for convenience, time-saving benefits, and the expanding reach of e-commerce. The market's segmentation highlights the diverse offerings catering to both individual consumers (personal shoppers) and businesses (business customers), with packaged and fresh foods comprising the primary product categories. Key players like Walmart, Amazon, and Kroger dominate the landscape, leveraging their established infrastructure and extensive supply chains to capture significant market share. However, the rise of specialized online grocers like FreshDirect and regional players such as BigBasket (India) and Coles Online (Australia) demonstrates the market’s capacity for niche players to thrive. Growth is further fueled by technological advancements, including improved delivery logistics, user-friendly mobile applications, and personalized shopping experiences. While challenges remain, such as maintaining freshness and overcoming logistical hurdles in certain regions, the overall market trajectory points towards sustained expansion. The integration of advanced technologies like AI-powered recommendation engines and automated warehouses will likely enhance efficiency and further drive market expansion. The North American market currently holds a significant share, but rapid growth is projected in regions like Asia-Pacific, fueled by rising internet penetration and increasing disposable incomes.

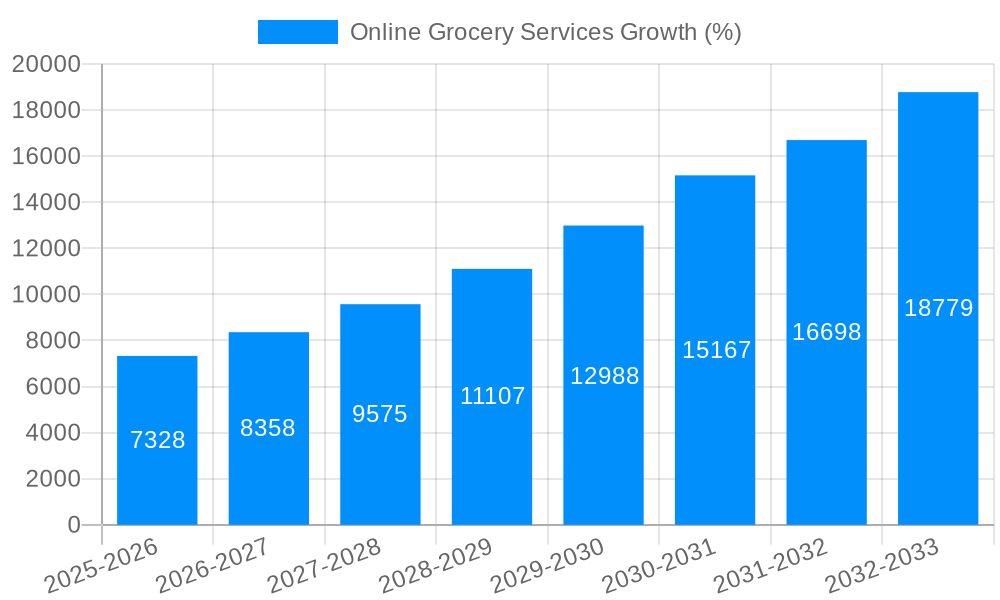

Looking ahead to 2033, continued market expansion is anticipated. To estimate the Compound Annual Growth Rate (CAGR), we need additional information, but assuming a conservative growth rate of 10% based on industry trends, this would translate to a substantial increase in market value over the forecast period. Factors like evolving consumer preferences (e.g., a shift towards healthier and sustainable options), innovative business models (e.g., subscription boxes and meal kits), and intensifying competition will continuously shape the online grocery landscape. Strategic partnerships between established grocery chains and tech companies are becoming increasingly prominent, indicative of the collaborative nature of this evolving sector. Effective inventory management, last-mile delivery optimization, and competitive pricing strategies will be critical for players striving to maintain a strong market position in this dynamic and rapidly expanding market.

The online grocery services market experienced explosive growth during the study period (2019-2024), driven primarily by the COVID-19 pandemic and the increasing adoption of e-commerce. The market, valued at several billion dollars in 2024, is projected to reach tens of billions by 2033. This expansion is fueled by evolving consumer preferences, technological advancements, and strategic investments by major players. Consumers are increasingly valuing the convenience and time-saving benefits of online grocery shopping, particularly among younger demographics and busy professionals. The rise of quick commerce, offering ultra-fast delivery within minutes or hours, further accelerates market expansion. Simultaneously, companies are investing heavily in improving their online platforms, enhancing delivery infrastructure, and optimizing the overall customer experience. This includes the integration of advanced technologies such as AI-powered personalization, improved inventory management systems, and sophisticated logistics networks. The market is witnessing a shift towards omnichannel strategies, where retailers seamlessly integrate online and offline experiences, leveraging the strengths of both to maximize customer reach and engagement. Competition remains fierce, with established players like Walmart and Amazon battling emerging players and specialized services. The future of online grocery shopping will likely be characterized by further technological innovation, enhanced personalization, sustainable practices, and an increasing focus on offering value-added services like meal kits and personalized shopping recommendations. The market's trajectory suggests a future dominated by sophisticated technology, streamlined logistics, and an ever-evolving customer experience.

Several key factors are driving the rapid growth of the online grocery services market. The increasing prevalence of smartphones and internet access has significantly broadened the reach of online grocery platforms, making them accessible to a wider consumer base. The convenience factor is paramount; online shopping eliminates the need for physical trips to the store, saving consumers valuable time and effort. Busy lifestyles, coupled with the desire for greater convenience, are major contributors to this trend. The COVID-19 pandemic acted as a significant catalyst, accelerating the adoption of online grocery shopping as consumers sought safer and contactless methods for obtaining essential goods. Moreover, technological advancements, such as improved delivery infrastructure, advanced inventory management systems, and personalized shopping recommendations, have enhanced the overall customer experience and fueled market growth. Aggressive marketing strategies employed by major players have also played a vital role, making consumers aware of the benefits of online grocery services. Finally, the expanding range of product offerings, including fresh produce, prepared meals, and specialized dietary options, further caters to the diverse needs and preferences of consumers. The convergence of these factors signifies a long-term upward trajectory for the online grocery sector.

Despite its impressive growth, the online grocery services market faces several significant challenges. Maintaining the freshness and quality of perishable goods like produce and meat during delivery remains a considerable hurdle. Efficient last-mile delivery presents ongoing logistical complexities, especially in densely populated urban areas. High delivery costs and fees can deter some customers, especially those with tight budgets. Concerns regarding food safety and hygiene standards are also important considerations. The intense competition among established players and emerging startups creates a highly dynamic and competitive landscape, requiring ongoing innovation and investment to maintain market share. Building trust with consumers regarding data privacy and security is another crucial aspect. Finally, overcoming the limitations of digital literacy amongst certain demographic segments remains a challenge in ensuring universal access and inclusion within the online grocery market. Addressing these obstacles is critical for the sustainable growth and long-term success of online grocery services.

The online grocery market is experiencing robust growth across numerous regions globally, but several key areas and segments stand out as particularly dominant. The North American market, particularly the United States, is a major player, driven by high internet penetration and the presence of large players such as Walmart and Amazon. Similarly, Western European countries demonstrate considerable growth. Asia-Pacific regions, notably China, with its massive population and rapid technological advancement, are showing immense potential. The segment showing particularly strong performance is Fresh Foods. Consumers are increasingly valuing the convenience of having fresh produce and groceries delivered directly to their doorstep. While packaged foods remain a significant portion of the market, the demand for fresh, high-quality ingredients is driving substantial growth in this sector.

The Personal Shoppers application segment is also experiencing a surge in popularity. This service offers customers a personalized shopping experience, where trained professionals select products based on individual preferences and dietary needs. The added convenience and assurance of quality contribute to the segment's increasing appeal. This translates to considerable market value projections in the billions for this segment within the overall online grocery landscape.

The online grocery industry is fueled by several key growth catalysts. These include technological advancements in delivery infrastructure, e.g., drone deliveries and autonomous vehicles, which improve efficiency and reduce costs. Continued investment in personalized shopping experiences, incorporating AI and big data, allows retailers to offer tailored recommendations and enhance customer loyalty. The expansion into new product categories, such as ready-to-eat meals and meal kits, further drives market expansion, catering to diverse customer preferences. Finally, the increasing integration with other services, such as online pharmacies or household goods delivery, creates bundled offerings that add value and enhance customer convenience. The convergence of these factors ensures the online grocery sector's continued growth and expansion.

This report provides a comprehensive analysis of the online grocery services market, covering historical data (2019-2024), an estimated year (2025), and a forecast period (2025-2033). It delves into market trends, driving forces, challenges, key players, and significant developments, offering valuable insights for businesses operating within or planning to enter this dynamic sector. The report segments the market by type (packaged foods, fresh foods), application (personal shoppers, business customers), and key geographic regions, providing a granular understanding of the market's structure and growth potential. The detailed analysis assists in strategic decision-making and market forecasting.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Walmart, Amazon, Kroger, FreshDirect, Target, Tesco, Alibaba, Carrefour, ALDI, Coles Online, BigBasket, Longo, Schwan Food, Honestbee, .

The market segments include Type, Application.

The market size is estimated to be USD 135340 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Grocery Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Grocery Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.