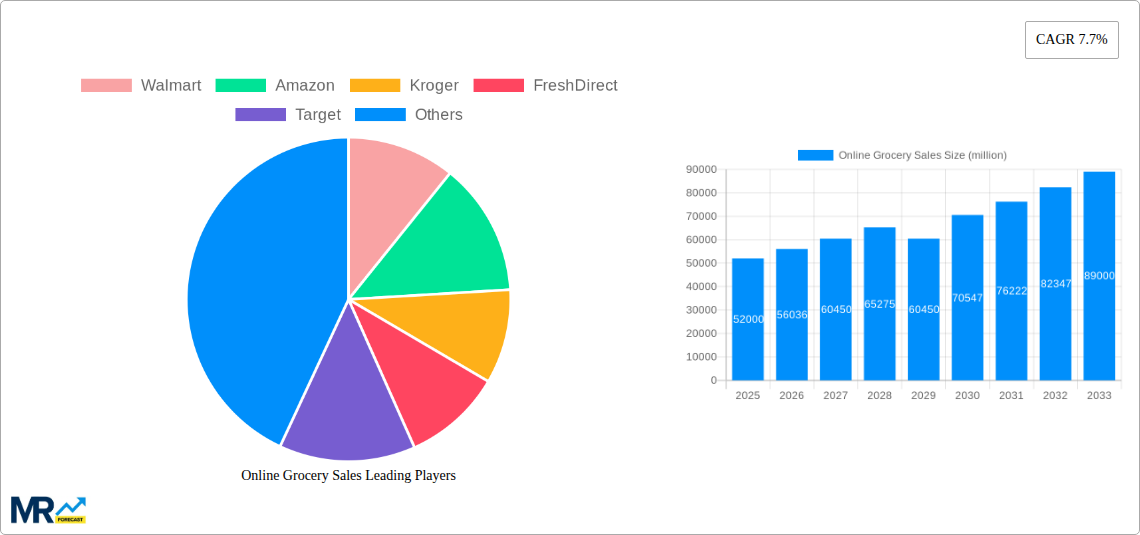

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Grocery Sales?

The projected CAGR is approximately 7.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Grocery Sales

Online Grocery SalesOnline Grocery Sales by Type (Packaged Foods, Fresh Foods), by Application (Personal Shoppers, Business Customers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

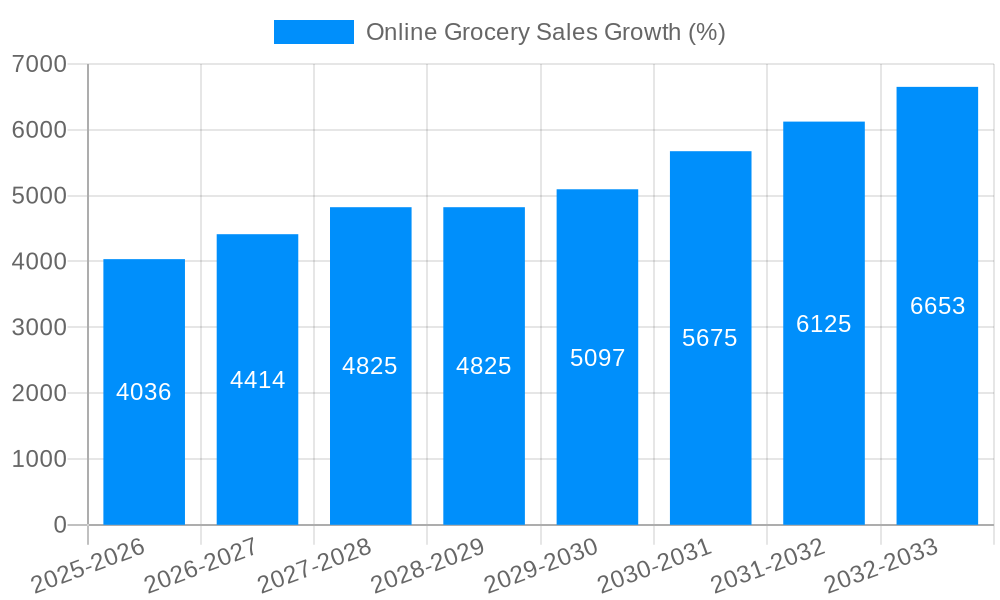

The online grocery market, currently valued at $52,000 million (2025), is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.7% from 2025 to 2033. This expansion is fueled by several key factors. The increasing preference for convenience among consumers, coupled with the rising adoption of e-commerce and smartphone penetration, is significantly driving market growth. Furthermore, technological advancements such as improved delivery infrastructure, user-friendly mobile apps, and personalized shopping experiences are enhancing customer satisfaction and attracting new users. The expansion of grocery delivery services into underserved areas and the introduction of innovative features like subscription boxes and click-and-collect options are also contributing to market expansion. Competitive pressures from major players like Walmart, Amazon, Kroger, and international chains such as Tesco and Alibaba are fostering innovation and efficiency within the industry, ultimately benefiting consumers.

However, challenges remain. Maintaining consistently high-quality fresh produce and preventing spoilage during delivery pose logistical hurdles. Concerns regarding food safety and hygiene, along with the need for robust cold-chain logistics, require significant investment. Moreover, maintaining profitability in a highly competitive market, particularly considering factors like rising labor costs and fluctuating fuel prices, necessitates efficient operational strategies and value-added services. Despite these challenges, the long-term outlook for online grocery sales remains optimistic, driven by the continued evolution of technology and the enduring preference for convenience and efficiency in grocery shopping. This market presents considerable opportunities for established players and new entrants alike.

The online grocery sales market experienced explosive growth during the 2019-2024 historical period, driven initially by evolving consumer preferences and further accelerated by the COVID-19 pandemic. While precise figures for individual companies are proprietary, the overall market witnessed a multi-billion dollar surge, with major players like Walmart, Amazon, and Kroger capturing significant market share. The convenience factor, coupled with the ability to browse a wider selection than typical brick-and-mortar stores, proved highly appealing to consumers. This trend is projected to continue throughout the forecast period (2025-2033), with an estimated market value in the hundreds of billions of dollars by 2033. However, the rate of growth is anticipated to moderate compared to the pandemic-fueled boom of the earlier years. Factors like easing pandemic restrictions, inflation impacting consumer spending, and the increasing focus on sustainability in delivery practices will influence the future trajectory. Competition is fierce, with established giants like Walmart and Amazon battling newer entrants and regional players for market dominance. The battleground is not just about price; it's about optimizing delivery speed and efficiency, enhancing the online shopping experience, and expanding product ranges to cater to diverse customer needs and dietary preferences. This involves leveraging advanced technologies like AI-powered recommendations and personalized shopping experiences, as well as investing heavily in robust logistics and last-mile delivery solutions. Understanding the evolving needs of consumers—from diverse delivery options (same-day, next-day, scheduled) to personalized offers and loyalty programs—will be crucial for success in this dynamic market. The market is increasingly segmented, with niche players focusing on organic produce, specific dietary needs, or hyperlocal deliveries to compete effectively. The overall market is poised for continued growth, though at a more sustainable pace than witnessed during the initial phase of online grocery adoption.

Several key factors are driving the growth of online grocery sales. The increasing prevalence of smartphones and readily available internet access has significantly contributed to the ease and convenience of online grocery shopping. Consumers appreciate the ability to shop anytime, anywhere, and avoid the hassles of in-store shopping, especially during peak hours. The rise of e-commerce giants like Amazon and the expansion of existing grocery chains into the online space have created a highly competitive market, further benefiting consumers through wider product selection, competitive pricing, and innovative delivery options. Furthermore, the pandemic acted as a powerful catalyst, accelerating the adoption of online grocery shopping by demographics previously hesitant to embrace it. The convenience of home delivery became crucial for many during lockdowns and restrictions, solidifying online grocery shopping as a preferred method for many. Beyond convenience, the ability to compare prices, read reviews, and benefit from personalized offers also plays a significant role. The growing demand for personalized shopping experiences—tailored recommendations, subscription boxes, and curated selections—further enhances consumer engagement and fuels market growth. Finally, the integration of technology, such as AI-powered recommendation systems and optimized delivery routes, contributes to an improved overall customer experience and increased efficiency in the supply chain, making the process even more attractive for both consumers and businesses.

Despite the impressive growth, the online grocery sector faces several challenges. High delivery costs, particularly for perishable goods requiring specialized handling and temperature control, pose a significant hurdle. Maintaining the freshness and quality of produce during transportation remains a critical concern, impacting customer satisfaction and potentially leading to returns or wasted inventory. Competition is fierce, with thin profit margins putting pressure on companies to constantly optimize their operations and pricing strategies. The need to invest heavily in infrastructure, logistics, and technology (warehousing, cold storage, delivery fleets, and advanced software) also represents a considerable financial burden. Consumer concerns regarding food safety and hygiene in online deliveries are another factor influencing market growth. Concerns about data privacy and security in online transactions must also be addressed. Furthermore, scaling up operations to meet the increasing demand while maintaining efficiency and cost-effectiveness requires sophisticated logistics management and supply chain optimization. Finally, addressing the environmental impact of deliveries, including packaging waste and carbon emissions associated with transportation, is becoming increasingly important as consumers become more environmentally conscious. Effectively navigating these challenges will be key to achieving sustainable growth in this sector.

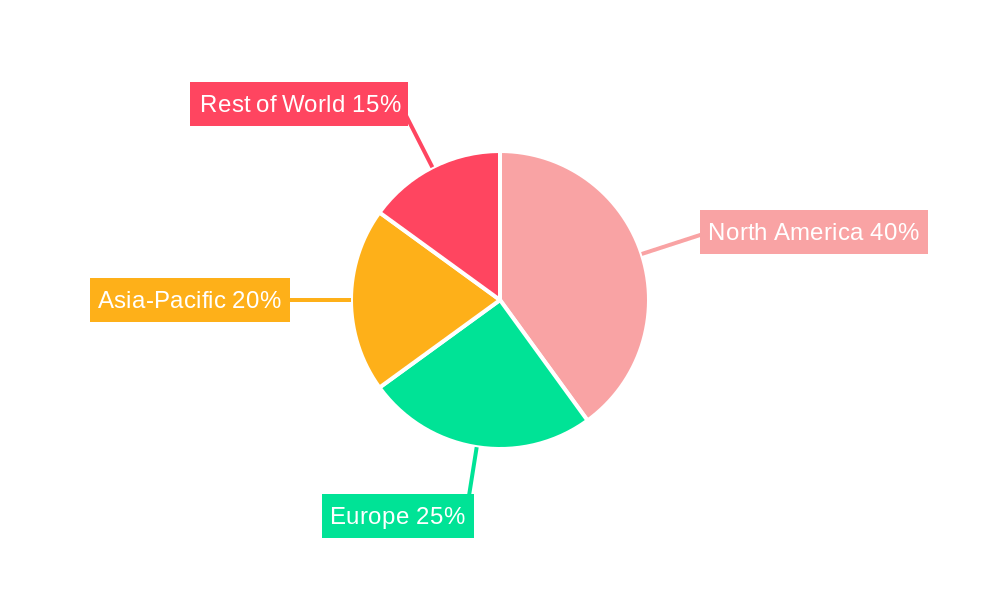

North America (USA & Canada): This region is expected to hold a significant market share due to high internet penetration, strong e-commerce adoption, and the presence of major players like Walmart, Amazon, and Kroger. The well-developed logistics infrastructure further facilitates efficient delivery operations. The significant disposable income in these countries also contributes to the higher spending on online grocery services.

Western Europe (UK, Germany, France): The region benefits from a high level of digital literacy and a growing preference for convenience among consumers. Tesco (UK), Carrefour (France), and ALDI (Germany) are leading players in this market. Stricter regulations regarding food safety and sustainability are influencing the operational practices of online grocery businesses in this region.

Asia-Pacific (China, India): Alibaba (China) and BigBasket (India) are key players. This region exhibits strong growth potential due to rapid urbanization, increasing internet penetration, and a young population increasingly adopting online shopping. However, the development of reliable logistics networks and addressing issues like varying levels of internet access across different demographics is crucial to unlock the full potential of this market.

Segments: The fresh produce segment, while posing logistical challenges, is expected to witness significant growth due to the demand for high-quality, fresh grocery items. Prepared meals and ready-to-eat products are also gaining popularity, driven by busy lifestyles and the convenience they offer. The organic and specialty foods segment demonstrates strong growth potential as consumers become increasingly health-conscious and seek sustainable food options. Furthermore, the subscription boxes segment is expected to show continuous growth, providing consumers with regular delivery of their favorite groceries and removing the hassle of repetitive online orders.

The paragraph above lists the key regions and segments that will significantly contribute to the growth of the Online Grocery Sales Market. The combination of high internet penetration, well-developed logistics networks, and a consumer base that embraces online conveniences will make North America and Western Europe leading players. Meanwhile, Asia-Pacific’s vast population and rapidly expanding e-commerce sector present enormous growth opportunities. However, the success of these regions depends on overcoming logistical hurdles, addressing digital divides, and meeting the demand for various grocery segments, specifically fresh produce, ready-to-eat meals, and organic products. Subscription box services will further increase consumer convenience, contributing to higher market value.

Several factors are driving the growth of the online grocery sales industry. The increasing adoption of smartphones and readily accessible internet is crucial for convenience. The rise of e-commerce giants and the expansion of existing chains into the online space create a competitive landscape benefiting consumers. The pandemic significantly boosted online grocery adoption, and this trend persists. The demand for personalized experiences and improved technology like AI-powered recommendations enhance engagement.

This report provides a detailed analysis of the online grocery sales market, covering historical performance, current trends, and future projections. It offers insights into key market drivers and challenges, dominant players, and promising segments. The report's comprehensive scope makes it a valuable resource for businesses, investors, and anyone interested in understanding this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.7%.

Key companies in the market include Walmart, Amazon, Kroger, FreshDirect, Target, Tesco, Alibaba, Carrefour, ALDI, Coles Online, BigBasket, Longo, Schwan Food, Honestbee, .

The market segments include Type, Application.

The market size is estimated to be USD 52000 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Grocery Sales," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Grocery Sales, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.