1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Groceries?

The projected CAGR is approximately 20.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Groceries

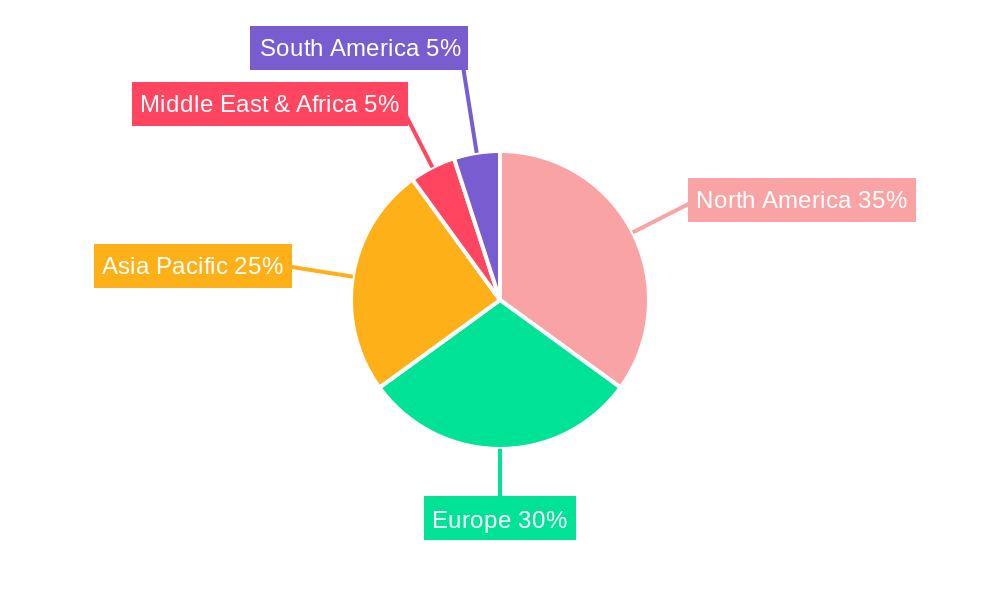

Online GroceriesOnline Groceries by Type (Home Delivery, Click and Collect), by Application (Merchant, Personal), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

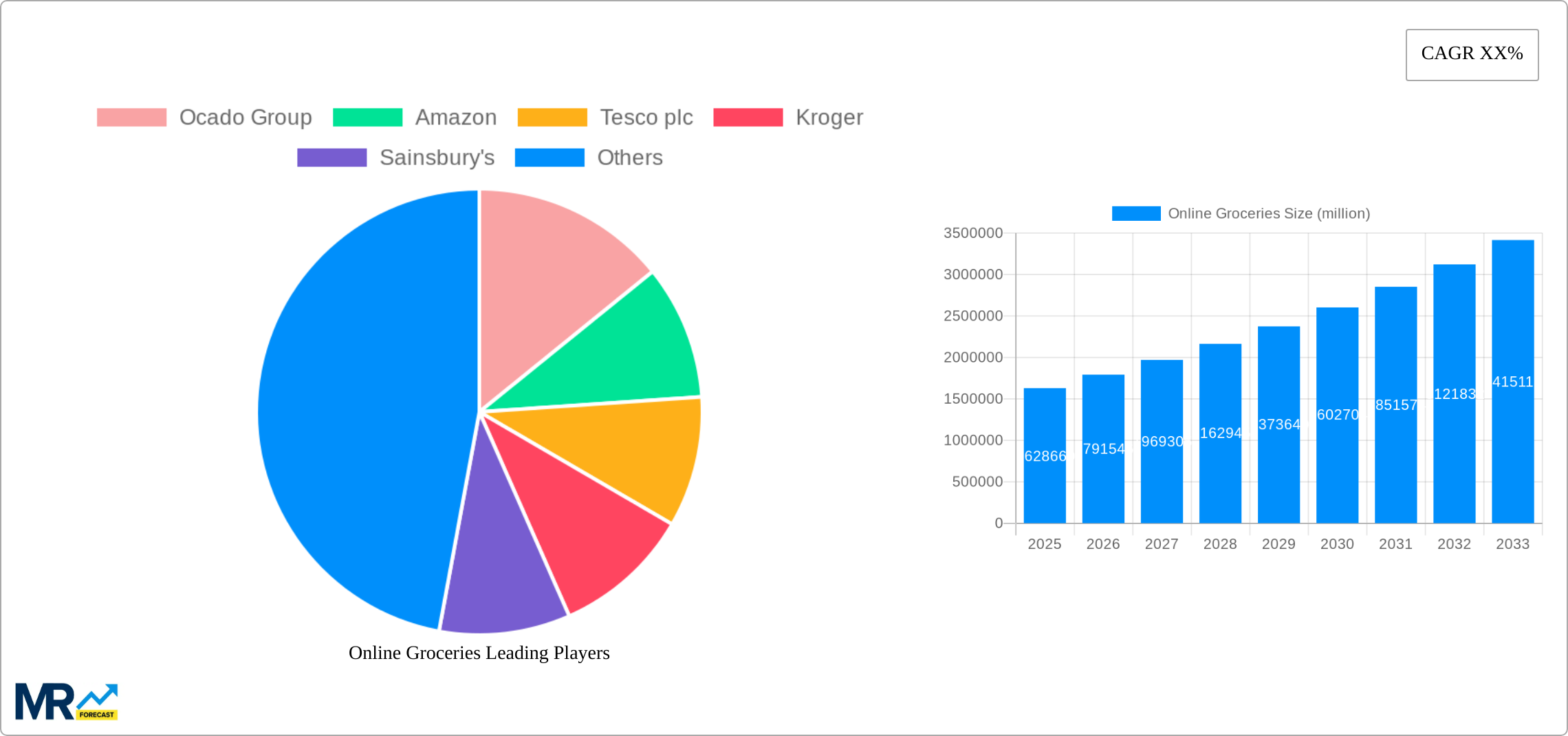

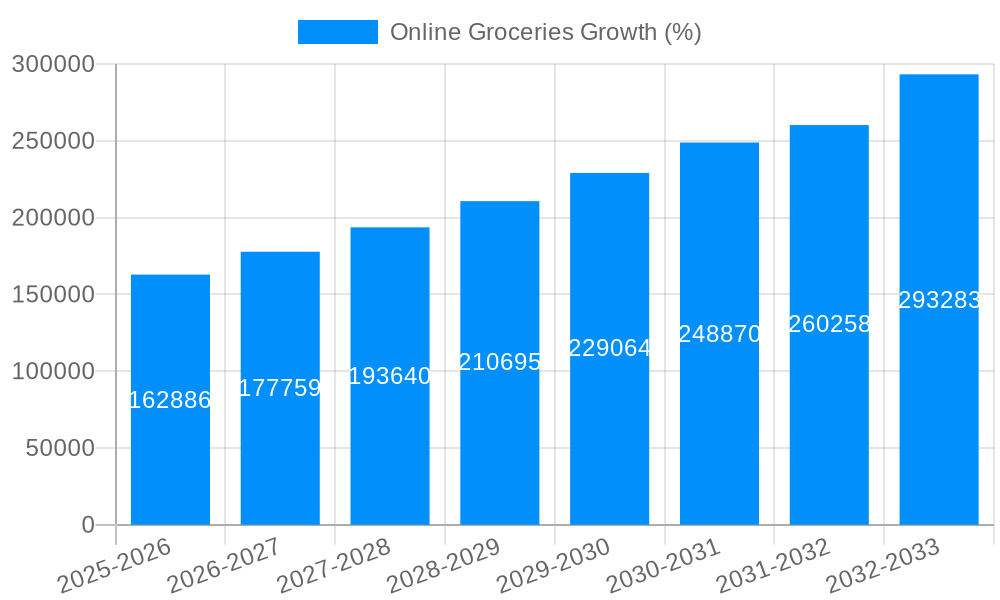

The online grocery market, valued at $432.3 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 20.9% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of smartphones and internet access, coupled with consumers' shifting preferences toward convenience and time-saving solutions, fuels the demand for online grocery shopping. E-commerce platforms offer wider selections, competitive pricing, and personalized shopping experiences, further enticing consumers. Furthermore, the rise of quick commerce, emphasizing rapid delivery times, is significantly contributing to market growth. The market is segmented by delivery type (home delivery and click-and-collect) and application (merchant and personal), with home delivery currently holding the larger market share due to its convenience. Leading players like Amazon, Tesco, and Walmart are investing heavily in enhancing their online grocery offerings, including advanced logistics and delivery networks, to maintain a competitive edge. Regional variations exist, with North America and Europe currently dominating the market, although significant growth potential exists in Asia-Pacific and other emerging markets as internet penetration and consumer purchasing power increase. Challenges remain, such as maintaining freshness and quality control, overcoming logistical hurdles in last-mile delivery, and addressing concerns about food safety and security. Nevertheless, the long-term outlook for online grocery remains positive, indicating continued expansion and market consolidation in the coming years.

The competitive landscape is intensely dynamic, with established grocery retailers facing competition from dedicated e-commerce giants and specialized online grocery platforms. Companies are strategizing to enhance customer experience through personalized recommendations, loyalty programs, and seamless integration of online and offline channels (omnichannel strategies). Technological advancements, including AI-powered inventory management, improved delivery optimization, and innovative packaging solutions, are also playing a crucial role in shaping the future of online grocery. While challenges like rising labor costs and evolving consumer demands necessitate continuous adaptation, the industry is well-positioned for sustained growth, driven by an evolving consumer landscape increasingly reliant on digital solutions for everyday needs. Further market segmentation based on demographic factors and purchase behavior will also likely inform targeted strategies within the sector.

The online grocery market experienced explosive growth during the study period (2019-2024), driven primarily by the COVID-19 pandemic. This surge in demand propelled the market to an estimated value of XXX million units in 2025. However, the rate of growth is anticipated to moderate in the forecast period (2025-2033), settling into a steady expansion fueled by ongoing consumer preference shifts and technological advancements. Key market insights reveal a clear preference for home delivery services, although click-and-collect options continue to maintain significant market share. The rise of dedicated grocery delivery apps and the integration of online grocery services within broader e-commerce platforms are major factors shaping the market landscape. Furthermore, the increasing adoption of advanced technologies such as AI-powered recommendation engines and automated warehousing systems is enhancing efficiency and improving the overall customer experience. Competition is fierce, with both established supermarket chains and dedicated online grocery players vying for market dominance. The market is witnessing a trend towards personalized experiences, with tailored offers and subscription services gaining traction. Consumer expectations regarding speed, convenience, and freshness continue to drive innovation and investment in the sector. The shift toward sustainable practices, including reduced packaging and eco-friendly delivery options, is also influencing the industry's evolution. Pricing strategies remain a key battleground, with companies navigating the delicate balance between profitability and competitive pricing to attract and retain customers. Data analytics play a pivotal role in understanding consumer preferences, optimizing inventory management, and personalizing the shopping journey. Overall, the online grocery market is characterized by dynamic growth, intense competition, and a continuous drive toward innovation to meet the ever-evolving demands of consumers.

Several factors are propelling the growth of the online grocery market. The increasing convenience offered by online shopping, particularly for busy consumers, is a primary driver. The ability to shop anytime, anywhere, without the constraints of store opening hours, is a significant attraction. Technological advancements, including user-friendly mobile apps, improved website interfaces, and sophisticated delivery logistics, have greatly enhanced the customer experience. The COVID-19 pandemic served as a catalyst, accelerating the adoption of online grocery shopping as consumers sought to minimize in-person contact. The expansion of e-commerce infrastructure, including broader internet penetration and improved delivery networks, has broadened the market's reach. Furthermore, the introduction of innovative services like subscription boxes, personalized recommendations, and loyalty programs are enhancing customer engagement and retention. The growing preference for contactless delivery and the integration of online grocery services into broader e-commerce platforms are also contributing factors. Finally, the increasing urbanisation and the resulting time constraints on consumers create a strong demand for convenient grocery shopping solutions. These combined factors create a compelling narrative of sustained growth for the online grocery sector.

Despite its considerable growth potential, the online grocery market faces several significant challenges. Maintaining the freshness and quality of perishable goods throughout the delivery process remains a persistent hurdle. High delivery costs, particularly for smaller orders, can impact profitability and affordability for consumers. Competition is fierce, necessitating substantial investment in technology, logistics, and marketing to gain and maintain market share. Concerns regarding food safety and hygiene protocols require stringent implementation and monitoring. The last-mile delivery challenge, especially in densely populated areas, remains a logistical complexity requiring innovative solutions. Managing inventory effectively to minimize waste and spoilage is a key operational challenge. Furthermore, integrating online grocery operations with existing physical store networks presents considerable logistical and operational complexities. The need to build consumer trust and overcome concerns about data privacy is also crucial. Finally, attracting and retaining qualified personnel for delivery and warehouse operations is a significant human resource challenge for the industry.

The online grocery market is witnessing significant regional variations in growth trajectories. North America and Europe currently hold substantial market share, driven by high internet penetration, established e-commerce infrastructure, and a relatively high level of consumer disposable income. However, Asia-Pacific is experiencing rapid growth, fueled by increasing smartphone penetration and a burgeoning middle class. Specific countries like the United States, United Kingdom, China, and Germany are key markets within these regions.

Home Delivery: This segment dominates the market due to its unparalleled convenience. Consumers appreciate the ability to have groceries delivered directly to their homes, eliminating the need for travel and in-store shopping. This segment is further bolstered by the expansion of quick-commerce services, offering ultrafast delivery options.

Merchant Application: This segment holds a considerable market share, driven by the participation of major supermarket chains and e-commerce giants. The integration of online grocery services into existing e-commerce ecosystems offers significant advantages in terms of reach and customer acquisition. Established players benefit from existing logistics networks and strong brand recognition.

The forecast period (2025-2033) anticipates continued dominance of the home delivery segment, further propelled by technological advancements in logistics and delivery optimization. The merchant application segment will also exhibit steady growth, driven by strategic partnerships and ongoing expansion of e-commerce platforms. The overall market will be significantly shaped by consumer preference for convenience and the ongoing investments in technology by major players.

The growth of the online grocery industry is fueled by several key catalysts, including the rising adoption of smartphones and e-commerce platforms. The increasing convenience and speed of online grocery shopping are major drivers, along with technological innovations like AI-powered recommendation engines and improved delivery logistics. The increasing disposable income of the middle class and the growing urban population, particularly in emerging markets, are also significant factors. Government initiatives promoting digitalization and e-commerce are also contributing to market expansion.

This report provides a detailed analysis of the online grocery market, covering key trends, drivers, challenges, and market segmentation. It offers a comprehensive overview of the leading players and their strategies, regional market dynamics, and future growth prospects, providing invaluable insights for businesses operating in or seeking to enter this dynamic sector. The report utilizes extensive data analysis and market forecasts to offer a clear and concise understanding of the online grocery market's current state and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 20.9%.

Key companies in the market include Ocado Group, Amazon, Tesco plc, Kroger, Sainsbury's, Morrisons, Carrefour, Walmart, Albertsons, Ahold Delhaize, Wm Morrison Supermarkets PLC, The Kroger Company, Shopfoodex Co Inc., Schwan Food Company, Reliance Retail Limited (Reliance Industries Limited), Koninklijke Ahold Delhaize N.V., HappyFresh, Fresh Direct LLC, Edeka Zentrale AG & Co. Kg, Costco Wholesale Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD 432300 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Groceries," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Groceries, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.