1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Gaming Software?

The projected CAGR is approximately 8.85%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Gaming Software

Online Gaming SoftwareOnline Gaming Software by Type (On-Premise, Cloud Based), by Application (PCs, Moblie Phones, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The online gaming software market is experiencing substantial growth, propelled by surging online gaming popularity, mobile technology advancements, and expanding global high-speed internet access. The market, valued at $440.6 billion in 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.85% from 2024 to 2032, reaching an estimated $440.6 billion. This expansion is driven by rising smartphone adoption, continuous technological innovation enhancing player engagement, and the burgeoning esports sector.

Key market segments include deployment types (on-premise, cloud-based) and applications (PCs, mobile phones). Cloud-based solutions are expected to lead due to scalability and cost-effectiveness, while mobile gaming continues to dominate market share due to accessibility and portability. Geographically, North America and Europe currently lead, with Asia-Pacific exhibiting significant growth potential. Major industry players are actively pursuing R&D, strategic alliances, and M&A to strengthen their market presence and leverage emerging opportunities in the dynamic online gaming software sector, fostering innovation and advanced solution development.

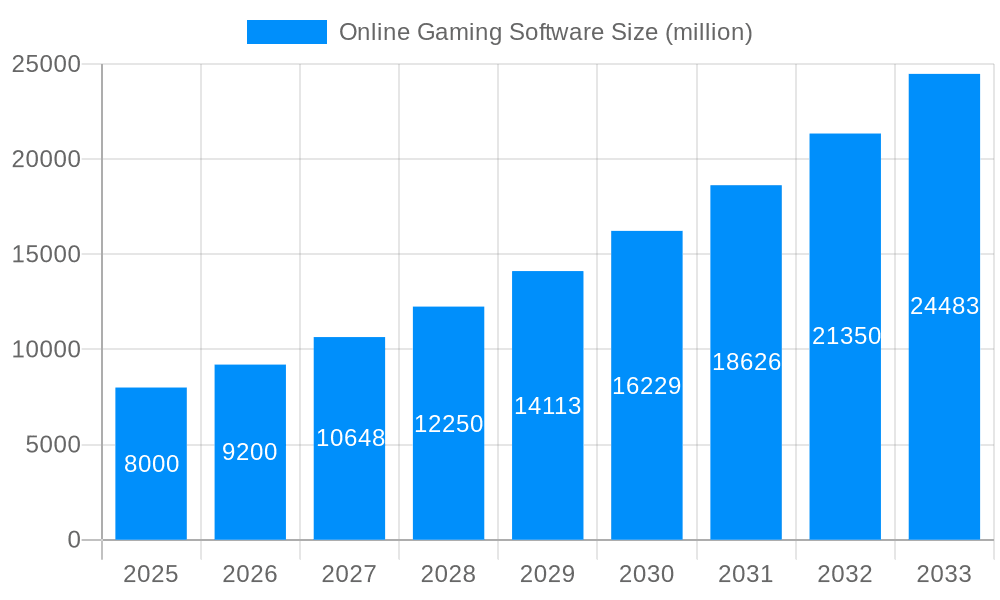

The online gaming software market is experiencing explosive growth, driven by the increasing popularity of online gaming and advancements in technology. The study period from 2019 to 2033 reveals a trajectory of significant expansion, with the market valued in the multi-billion dollar range. The estimated market value for 2025 is projected to reach several hundred million dollars, poised for substantial growth during the forecast period (2025-2033). Key market insights indicate a strong preference for cloud-based solutions due to their scalability, flexibility, and cost-effectiveness compared to on-premise deployments. Mobile gaming continues to dominate the application segment, exceeding PC-based gaming in terms of user engagement and revenue generation. This trend is further fueled by the proliferation of smartphones and improved mobile internet access globally. The historical period (2019-2024) showcased a steady increase in market size, setting the stage for the accelerated growth projected in the coming years. This growth isn't uniform across all segments; certain regions exhibit faster adoption rates and higher spending on online gaming than others. The market is also becoming increasingly competitive, with established players constantly innovating and new entrants vying for market share. This competition fosters innovation, leading to enhanced gaming experiences, greater security features, and a wider range of game offerings. The increasing sophistication of gaming technology, including the integration of virtual reality (VR) and augmented reality (AR), also contributes to the market’s expansion, captivating a broader audience and driving further investment. Finally, the ongoing regulatory changes and the evolving legal landscape of online gaming are significant factors influencing market trends and shaping the competitive dynamics within the industry.

Several factors are propelling the growth of the online gaming software market. The widespread adoption of smartphones and readily available high-speed internet access has significantly broadened the reach of online gaming, making it accessible to a much larger audience. This accessibility, combined with the convenience of playing games anytime and anywhere, has contributed significantly to the market's expansion. Moreover, the increasing popularity of esports and competitive online gaming has attracted significant investment and created new revenue streams for game developers and publishers. The continuous innovation in game development, including the integration of advanced technologies like VR and AR, offers richer and more immersive gaming experiences, attracting new players and retaining existing ones. Furthermore, the development of sophisticated game engines and tools has simplified the process of game creation, enabling independent developers and smaller studios to enter the market. This increased competition fuels innovation and diversifies the range of games available to consumers. Finally, the growing preference for cloud-based gaming solutions has made online gaming more accessible, removing the barrier of expensive hardware requirements and promoting wider participation across different geographical locations and demographics.

Despite the significant growth potential, the online gaming software market faces certain challenges and restraints. Stringent regulations and licensing requirements in various jurisdictions can create significant barriers to entry for new players and increase the operational costs for existing ones. Maintaining data security and protecting user privacy are crucial concerns, particularly with the increasing amount of sensitive personal and financial information handled by online gaming platforms. Any security breach or data leak can severely damage a company's reputation and lead to significant financial losses. The ever-evolving technological landscape requires continuous investment in research and development to stay competitive. Keeping up with technological advancements, adapting to changing user preferences, and integrating new technologies necessitates substantial financial resources and expertise. Furthermore, the increasing competition from established players and new entrants can put pressure on pricing and profit margins. Finally, the risk of addiction and the potential negative social and psychological impacts of excessive gaming remain significant concerns that need to be addressed responsibly by industry players and regulatory bodies.

The online gaming software market is geographically diverse, with significant variations in growth rates and market penetration across different regions. However, North America and Europe consistently show strong market performance. Asia-Pacific is a rapidly growing region, with countries like China, Japan, and South Korea demonstrating exceptional potential due to their large populations and increasing adoption of online gaming.

Mobile Phones: This segment is poised to dominate the market due to its accessibility, convenience, and widespread adoption. The growth of smartphone penetration, coupled with the ease of accessing mobile games, creates a substantial market opportunity. Moreover, mobile gaming is often characterized by free-to-play models with in-app purchases, generating significant revenue streams. The constantly improving mobile gaming technology, better graphics, and improved network infrastructure continue to bolster this segment's growth. The convenience factor of mobile gaming — the ability to play anytime, anywhere — is a major driver, attracting a broad demographic. Finally, the integration of social features within mobile games enhances player engagement and creates a strong sense of community, further accelerating market growth.

Cloud-Based Solutions: This segment is rapidly gaining popularity due to several key advantages. Cloud-based solutions offer scalability, flexibility, and reduced infrastructure costs compared to on-premise solutions. They eliminate the need for companies to invest heavily in and maintain their own hardware and software infrastructure. Cloud-based platforms offer increased accessibility and enable cross-platform compatibility, allowing gamers to seamlessly switch between devices. Furthermore, updates and maintenance are efficiently managed by the cloud provider, reducing operational burdens for gaming companies. Finally, the improved security offered by cloud-based solutions is attracting more businesses concerned about data breaches and security threats.

The online gaming software industry is fueled by several growth catalysts. The rising popularity of esports and competitive gaming is creating significant opportunities for software developers and publishers. Technological advancements, such as VR and AR integration, are enhancing the gaming experience and attracting new players. The increasing accessibility of high-speed internet and the widespread adoption of smartphones are broadening the market reach.

This report provides a comprehensive analysis of the online gaming software market, covering market size, growth drivers, challenges, and key players. It offers insights into various market segments, including deployment models (on-premise, cloud-based), applications (PCs, mobile phones, others), and geographical regions. The report also includes detailed profiles of leading companies in the industry, their strategies, and their market share. The comprehensive nature of this report provides valuable information for businesses, investors, and other stakeholders interested in the online gaming software market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.85% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.85%.

Key companies in the market include IGT, Playtech, Microgaming, Betconstruct, Softgamings, Betsys, BetRadar, SBTech, Digitain, GammaStack, EveryMatrix, SB Betting Software, Novomatic, .

The market segments include Type, Application.

The market size is estimated to be USD 440.6 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Online Gaming Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Gaming Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.