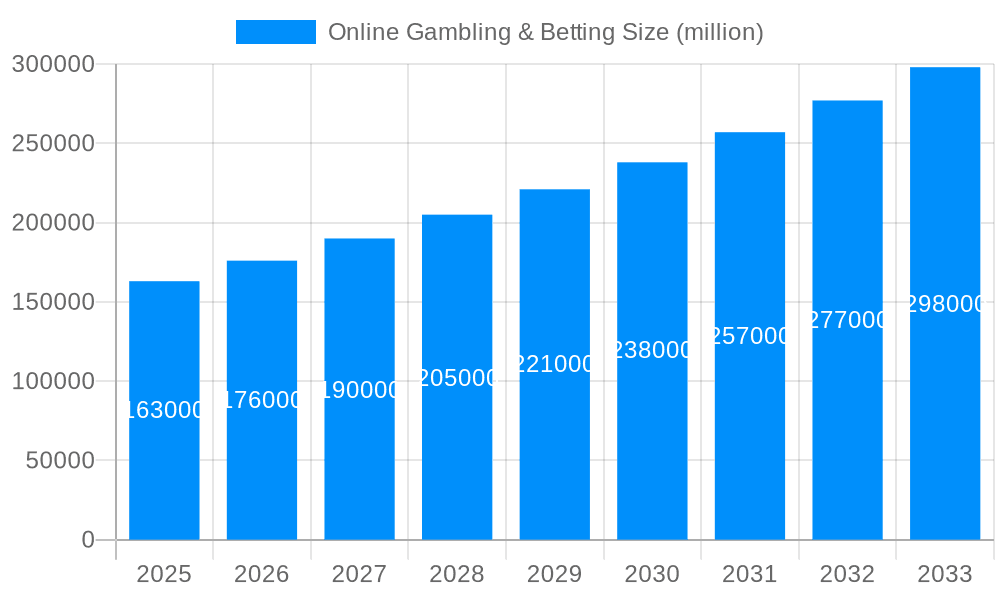

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Gambling & Betting?

The projected CAGR is approximately 10.54%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Gambling & Betting

Online Gambling & BettingOnline Gambling & Betting by Type (/> Casino, Sports Betting, Poker, Bingo, Lottery, Others), by Application (/> Desktop, Mobile Devices), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global online gambling and betting market is poised for substantial growth, projected to reach $155.423 billion by 2025. This expansion is fueled by escalating smartphone adoption, widespread high-speed internet access, and the burgeoning popularity of esports and virtual sports. The market offers a comprehensive array of gaming options, including casino games, sports betting, poker, bingo, and lotteries, appealing to a broad demographic. Key regions driving market performance are North America and Europe, with significant untapped potential in Asia-Pacific, Africa, and South America. Leading industry players such as Bet365, Flutter Entertainment, and DraftKings, alongside dynamic regional operators, are shaping a competitive landscape. Continuous innovation in user interfaces, immersive gaming technologies, and sophisticated data analytics for personalized engagement are pivotal growth catalysts. Evolving regulatory frameworks and a commitment to responsible gambling will also significantly influence market trajectory and operational strategies.

Despite the promising outlook, the market faces hurdles. Stringent regulatory environments in select regions present challenges for market entry and expansion. Addressing concerns surrounding problem gambling and implementing robust player protection measures are paramount for operators and regulators. Economic volatility and shifts in consumer discretionary spending can introduce periods of moderated growth. The intense competitive arena, marked by established giants and agile newcomers, demands relentless innovation and strategic agility. To thrive, operators must embrace technological advancements, champion responsible gambling, and adapt to dynamic regulatory demands. Prioritizing personalized user journeys, effective targeted marketing, and strategic collaborations will be instrumental for sustained success.

The online gambling and betting market experienced explosive growth throughout the historical period (2019-2024), exceeding several billion dollars in revenue. This upward trajectory is expected to continue, with projections indicating a market value exceeding tens of billions of dollars by 2033. Key market insights reveal a strong shift towards mobile applications, with a substantial portion of revenue now generated from smartphone and tablet usage. The increasing prevalence of mobile betting and casino apps has broadened accessibility and convenience for players globally. Furthermore, the integration of innovative technologies, such as virtual reality (VR) and augmented reality (AR), is transforming the player experience, adding further impetus to market expansion. The rise of esports betting and the diversification of game offerings, including the inclusion of fantasy sports and lottery-style games, contribute to this growth. Geographical variations exist, with certain regions showing significantly faster growth rates than others due to factors such as regulatory changes, technological infrastructure, and cultural acceptance. The competitive landscape is fiercely contested, with established giants facing competition from agile newcomers utilizing advanced data analytics and personalized marketing strategies to capture market share. The estimated market value in 2025 is expected to be in the tens of billions, showcasing the sustained momentum of the online gambling and betting sector. The forecast period (2025-2033) promises to deliver even more substantial growth, driven by factors discussed further in this report. This period will be significantly influenced by advancements in technological capabilities, regulatory shifts, and evolving consumer preferences.

Several powerful factors are driving the expansion of the online gambling and betting market. The widespread adoption of smartphones and high-speed internet access has made online gambling incredibly accessible to a vast global audience. This accessibility, coupled with the convenience of playing from anywhere at any time, has dramatically increased participation rates. Furthermore, the continuous innovation in gaming technology, including immersive graphics, engaging game mechanics, and the integration of social features, enhances the overall player experience, attracting and retaining users. The development of sophisticated algorithms and AI-driven personalization strategies allows operators to tailor their offerings to individual player preferences, increasing engagement and spending. Targeted marketing campaigns, often leveraging social media and influencer marketing, further contribute to market growth. Moreover, the legalization and regulation of online gambling in various jurisdictions have provided a more secure and transparent environment for both operators and players, fostering increased confidence and investment in the sector. The rise of esports betting provides a new, rapidly expanding sector within online gambling, attracting younger demographics and injecting fresh dynamism into the market. Finally, favorable regulatory environments in specific regions are creating fertile ground for rapid expansion.

Despite its remarkable growth, the online gambling and betting market faces several significant challenges. Stringent regulations and licensing requirements in many jurisdictions create hurdles for operators seeking to enter new markets or expand their existing operations. These regulations often involve high compliance costs and complex procedures. Concerns about problem gambling and the potential for addiction pose a significant ethical and societal challenge, requiring robust responsible gambling initiatives and player protection measures. The prevalence of fraudulent activities, such as money laundering and match-fixing, necessitates strong security protocols and regulatory oversight. Competition in the online gambling sector is intensely fierce, requiring companies to continually innovate and invest heavily in marketing and technology to maintain a competitive edge. Fluctuations in currency exchange rates and economic downturns can negatively impact player spending and the overall profitability of the market. Furthermore, technological vulnerabilities, including cybersecurity threats and data breaches, represent significant risks to operators and players alike. Finally, the evolving regulatory landscape and the potential for future legislative changes present a degree of uncertainty that impacts long-term investment strategies.

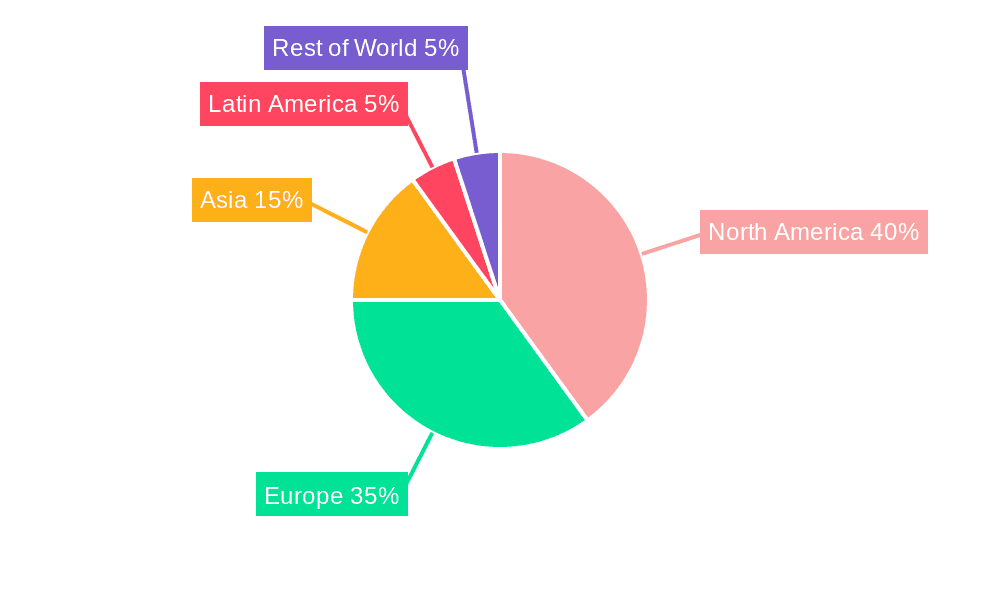

The online gambling and betting market shows significant regional variations in growth and dominance. While specific market shares are constantly shifting, several regions and segments stand out for their substantial contributions:

North America: The legalization of online gambling and sports betting in several US states has propelled this region to a position of significant market dominance, particularly within the Sports Betting segment. The US market is expected to continue its explosive growth, driven by increasing legal frameworks and high consumer interest.

Europe: This region remains a significant player, with well-established markets in several countries, especially the UK. While competition is intense, the presence of many established operators with significant brand recognition keeps the region strong.

Asia: While facing varying regulatory landscapes across different countries, the sheer size of the Asian population presents a massive potential market. Rapid technological adoption in this region significantly influences online gambling's penetration rate.

Dominant Segments:

Sports Betting: This segment consistently demonstrates strong growth rates, driven by increasing popularity of sports events globally and the convenience of online betting. The integration of live-streaming and in-play betting features significantly enhances user engagement in this sector.

Casino: Online casinos offer a wide array of games, catering to diverse player preferences. Technological advancements, such as virtual reality and enhanced user interfaces, continue to improve the player experience in this segment.

Mobile Devices: The mobile application segment is experiencing explosive growth as the primary mode of access for online gambling. Smartphone penetration, combined with user-friendly apps, greatly boosts the accessibility and convenience of online gambling platforms.

The interplay between these regions and segments is crucial in understanding the overall growth trajectory of the online gambling and betting market. The convergence of technological advancements, regulatory shifts, and cultural influences further shapes this complex landscape.

The online gambling and betting industry's continued expansion is fueled by several key catalysts. Technological innovations, such as virtual reality and augmented reality, significantly enhance the player experience and attract new audiences. The increasing legalization and regulation of online gambling in various jurisdictions create a more secure and transparent environment, attracting significant investments. Strategic partnerships and mergers between operators create a more competitive landscape and lead to growth. Furthermore, the expanding acceptance of online gambling among younger demographics drives growth rates significantly. Finally, the expansion of payment options and the seamless integration of cryptocurrencies continue to support the market's growth potential.

This report provides a comprehensive overview of the online gambling and betting market, analyzing its trends, growth drivers, challenges, and leading players. The report covers key segments such as sports betting, casino, poker, and lottery, examining their performance and growth prospects. It also offers a detailed geographical analysis of the market, highlighting key regions and countries with substantial growth potential. Furthermore, the report includes a detailed competitive analysis of major players and their strategies, while also forecasting market growth and development trends for the study period (2019-2033).

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.54% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.54%.

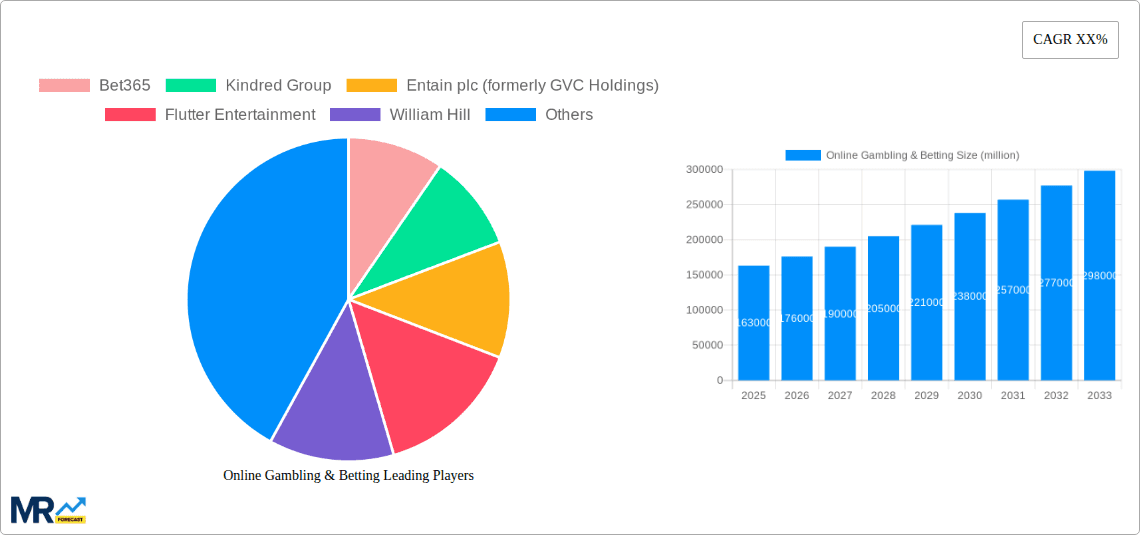

Key companies in the market include Bet365, Kindred Group, Entain plc (formerly GVC Holdings), Flutter Entertainment, William Hill, Pinnacle, The Stars Group, Betvictor, Betsson AB, Gamesys, 888 Holdings, Bet-at-home.com, Intertops, Betway, Betfred, Interwetten, SBOBET, Sportech, EGB, BetOnline, DraftKings, BetWinner, Sports Interaction, .

The market segments include Type, Application.

The market size is estimated to be USD 155.423 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Online Gambling & Betting," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Gambling & Betting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.