1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Betting And Gaming?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Betting And Gaming

Online Betting And GamingOnline Betting And Gaming by Type (Mobile, Desktop), by Application (Social Exuberant, Gambling Enthusiasts, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The online betting and gaming market is experiencing robust growth, driven by increasing smartphone penetration, readily available high-speed internet, and the evolving preferences of younger demographics towards digital entertainment. The market's expansion is fueled by the rising popularity of mobile betting, particularly among social and gambling enthusiasts. While traditional desktop platforms remain significant, the shift towards mobile accessibility is reshaping the competitive landscape. This trend is further amplified by continuous technological advancements, including the integration of virtual and augmented reality features in gaming, leading to more immersive and engaging experiences. Geographic variations exist, with mature markets like North America and Europe exhibiting steady growth alongside the burgeoning potential of Asia-Pacific and other emerging regions. Regulatory changes and responsible gaming initiatives are key factors influencing market dynamics, creating both opportunities and challenges for operators. Competition is fierce, with established players like 888 Holdings, Bet365, and William Hill facing pressure from newer entrants and innovative gaming technologies. The market's future hinges on the successful navigation of regulatory complexities, the adoption of advanced technologies, and the ability of operators to cater to evolving consumer preferences for diverse and engaging betting experiences.

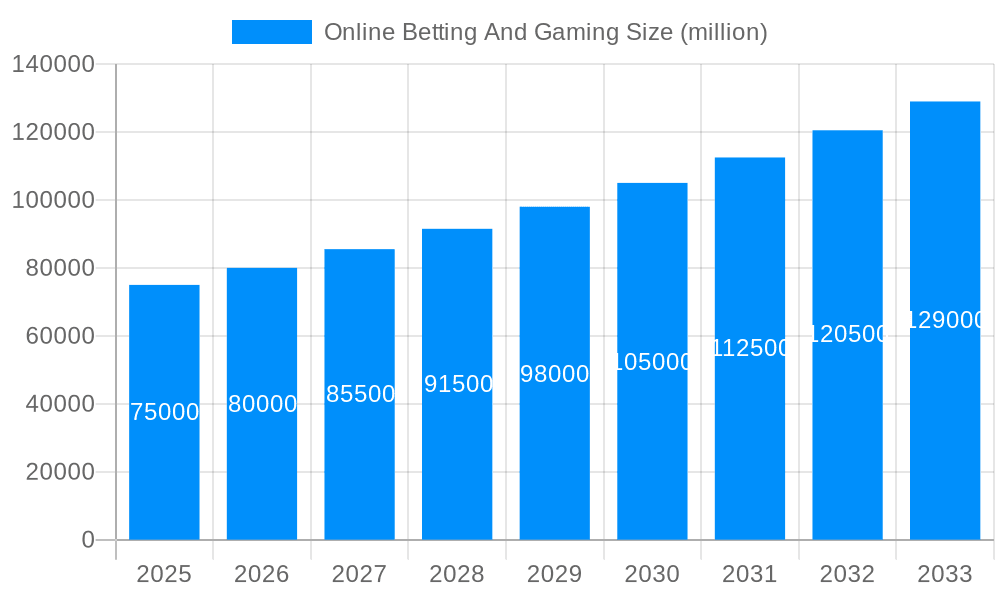

The forecast period (2025-2033) anticipates sustained growth, although the exact CAGR will be influenced by macroeconomic factors, technological disruptions, and regulatory environments in various regions. Specific segments, such as mobile betting and social gaming apps, are expected to outperform the overall market average. The increasing adoption of eSports betting and the integration of blockchain technology for secure and transparent transactions will also significantly influence the market trajectory. Successful companies will be those that can effectively leverage data analytics to personalize user experiences, offer responsible gaming tools, and adapt to evolving legal frameworks. Understanding diverse regional preferences and tailoring offerings accordingly will also be crucial for long-term success in this competitive and dynamic market. Overall, the online betting and gaming market presents a significant growth opportunity for businesses that can adapt and innovate to meet the evolving demands of consumers.

The online betting and gaming market experienced explosive growth during the historical period (2019-2024), exceeding several billion dollars in revenue. This surge was fueled by increased smartphone penetration, improved internet connectivity, and the evolving preferences of younger demographics who readily embrace digital entertainment. The market is projected to maintain its upward trajectory throughout the forecast period (2025-2033), with estimates suggesting a total market value reaching tens of billions of dollars by 2033. Several key factors are contributing to this sustained growth. Firstly, the continuous innovation within the industry, including the introduction of virtual reality (VR) and augmented reality (AR) gaming experiences, is enhancing user engagement and attracting new players. Secondly, the ongoing evolution of mobile gaming technology is driving increased accessibility and convenience, leading to a significant expansion of the player base. Thirdly, the increasing popularity of esports and the integration of betting features within these platforms are generating substantial new revenue streams. Finally, targeted marketing strategies and personalized gaming experiences are fostering greater loyalty and driving repeat business. While the market faces challenges (discussed later), the overall trend points towards continued expansion and market consolidation, with larger companies likely acquiring smaller players to gain market share. The estimated market value in 2025 is expected to be in the tens of billions of dollars, reflecting a strong growth rate compared to the base year. The widespread adoption of mobile betting platforms is a significant driver of this growth, exceeding the revenue generated from desktop platforms in several key markets.

Several powerful forces are driving the phenomenal growth of the online betting and gaming market. The most significant is the widespread adoption of smartphones and tablets, offering unparalleled accessibility to a vast array of games and betting options anytime, anywhere. This convenience is a key differentiator compared to traditional brick-and-mortar casinos and betting shops. Furthermore, the advancements in internet connectivity, especially the proliferation of high-speed broadband and 5G networks, ensure smooth, lag-free gaming experiences, crucial for maintaining player engagement. The rise of esports and the integration of betting features within these platforms are creating entirely new revenue streams and attracting a younger demographic accustomed to digital entertainment. Moreover, sophisticated marketing and personalized gaming experiences are fostering greater customer loyalty and driving repeat business. Finally, regulatory changes in various jurisdictions, while sometimes presenting challenges, are also opening up new markets and creating opportunities for expansion. The ongoing innovation in game development, with immersive VR and AR technologies pushing the boundaries of interactive entertainment, further strengthens the industry's appeal and growth potential. The cumulative effect of these factors suggests a robust and sustainable growth trajectory for the foreseeable future.

Despite its impressive growth, the online betting and gaming market faces several challenges and restraints. Stringent regulations and licensing requirements in different jurisdictions create hurdles for companies seeking to expand globally. These regulations often involve complex compliance procedures and substantial financial investments, limiting the entry of smaller players. Furthermore, the risk of addiction and responsible gambling concerns are major considerations for both operators and regulators. Measures to mitigate these risks, such as self-exclusion options and age verification systems, add operational complexities and costs. Competition within the market is fierce, with established players constantly vying for market share and new entrants striving to gain traction. This competition often leads to aggressive marketing campaigns, driving up advertising costs and potentially contributing to problem gambling. Fluctuations in currency exchange rates can also significantly impact profitability, especially for companies operating internationally. Finally, evolving technological landscapes require continuous investment in infrastructure and software upgrades to stay ahead of the curve and maintain a competitive edge. Successfully navigating these challenges is crucial for sustained growth and long-term success within the industry.

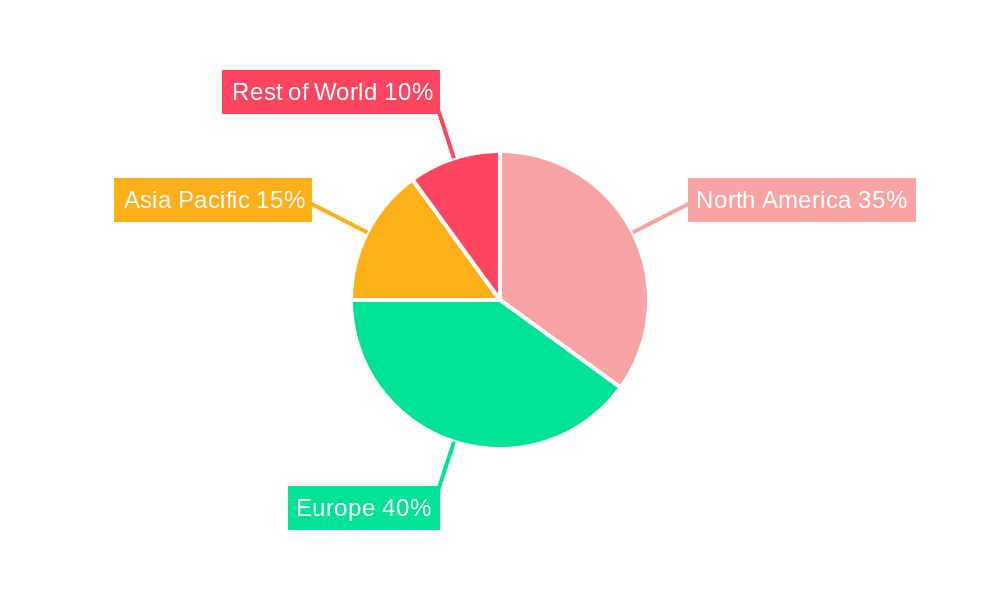

The online betting and gaming market demonstrates significant regional variations in growth and dominance. While precise market share figures fluctuate, several regions consistently perform well.

North America (US & Canada): This region consistently holds a significant portion of the global market share, driven largely by the US market's increasing legalization of online betting and gaming in various states. The large and affluent population combined with high internet and smartphone penetration make it highly lucrative.

Europe (UK, Germany, France): Europe holds a substantial market share, with the UK, Germany, and France consistently ranking among the top markets. Established regulatory frameworks in these countries provide a stable and attractive environment for operators.

Asia (Japan, South Korea, China): While subject to varying levels of regulation, Asia shows significant growth potential. High population densities and growing disposable incomes in countries like Japan and South Korea contribute to a large player base. However, regulatory hurdles and varying degrees of legal acceptance in some Asian markets remain significant factors.

Dominant Segment: Mobile

The mobile segment is unequivocally the key driver of growth and market dominance within the online betting and gaming sector. Several reasons underpin this:

Accessibility: Mobile devices offer unparalleled convenience and accessibility, allowing users to bet and play games anytime, anywhere.

Technological Advancements: Significant advances in mobile gaming technology, including improved graphics, intuitive interfaces, and seamless gameplay, have greatly enhanced the user experience.

Demographic Trends: Younger demographics, who make up a substantial portion of the gaming and betting population, strongly favor mobile platforms.

Marketing and Promotion: Targeted mobile advertising campaigns and in-app promotions effectively reach and engage this demographic, resulting in high conversion rates. The seamless integration of mobile payment methods further enhances convenience. The mobile segment is expected to continue its dominance and outperform desktop and other platforms throughout the forecast period (2025-2033), driving a substantial portion of the overall market revenue growth.

Several key factors are catalyzing growth within the online betting and gaming industry. These include the ongoing technological advancements, especially in mobile gaming and virtual reality, which enhance user experience and attract new players. The increasing acceptance and legalization of online gambling in various jurisdictions are expanding the market significantly. Strategic partnerships between gaming companies and sports organizations are also driving growth, as are the rise of esports betting and the integration of social media features within gaming platforms that boost user engagement and create viral marketing opportunities.

This report provides a comprehensive overview of the online betting and gaming market, analyzing key trends, drivers, challenges, and growth opportunities. It offers detailed insights into the market segmentation (mobile, desktop, different user applications), regional performances, and leading players, providing a valuable resource for businesses, investors, and stakeholders seeking to understand and navigate this dynamic industry. The report also incorporates historical data, current market estimations, and future projections, offering a well-rounded analysis of the market's past, present, and future.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

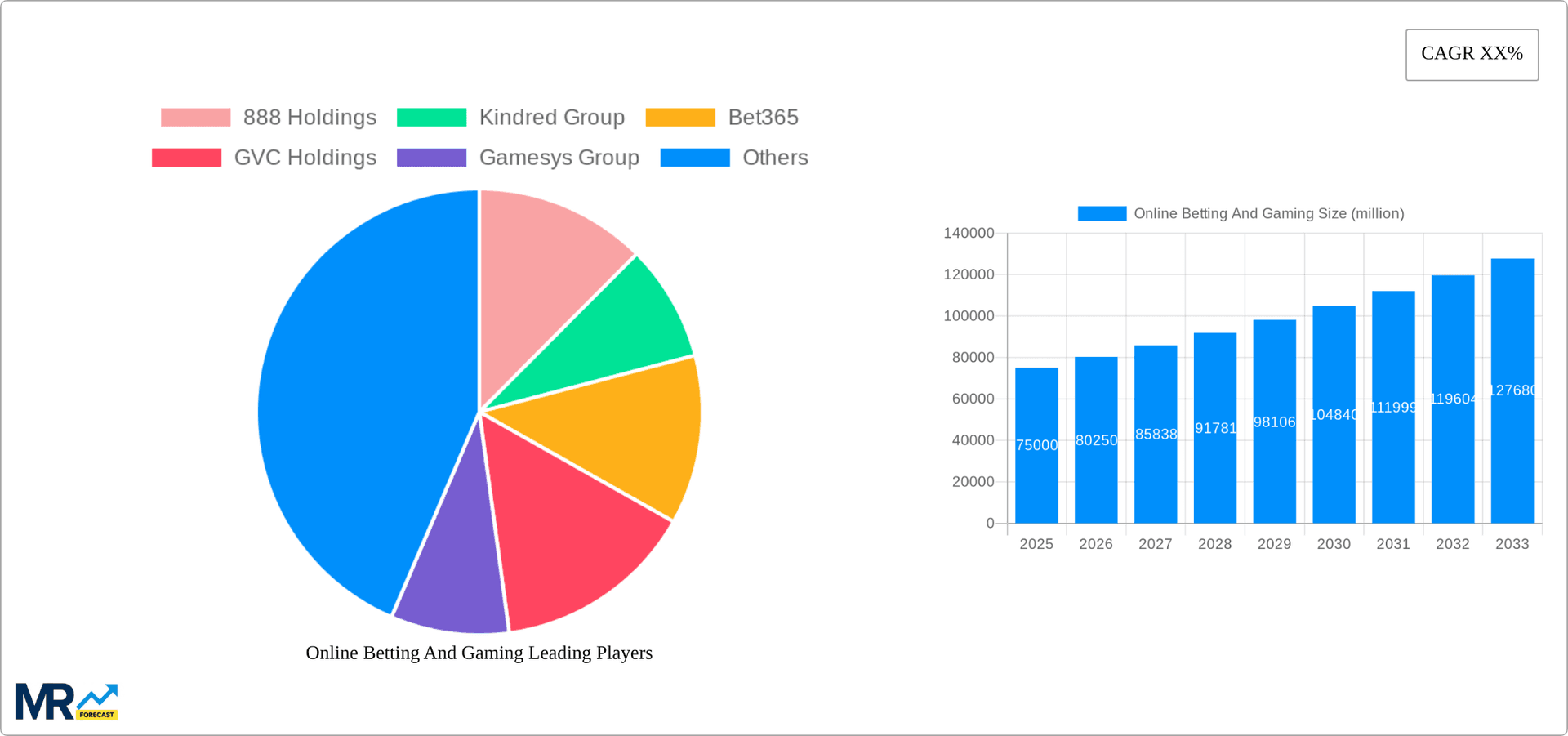

Key companies in the market include 888 Holdings, Kindred Group, Bet365, GVC Holdings, Gamesys Group, Jackpotjoy, Mecca Bingo, Foxy Bingo, Gala Bingo, Tombola, Paddy Power, Ladbrokes, William Hill, Unibet, Playtech, Microgaming, Virtue Fusion, Jumpman Gaming, Rank Group, Stride Gaming, Daub Alderney, Bwin, Stars Group, Dragonfish, Relax Gaming, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Betting And Gaming," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Betting And Gaming, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.