1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Food Delivery Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Food Delivery Services

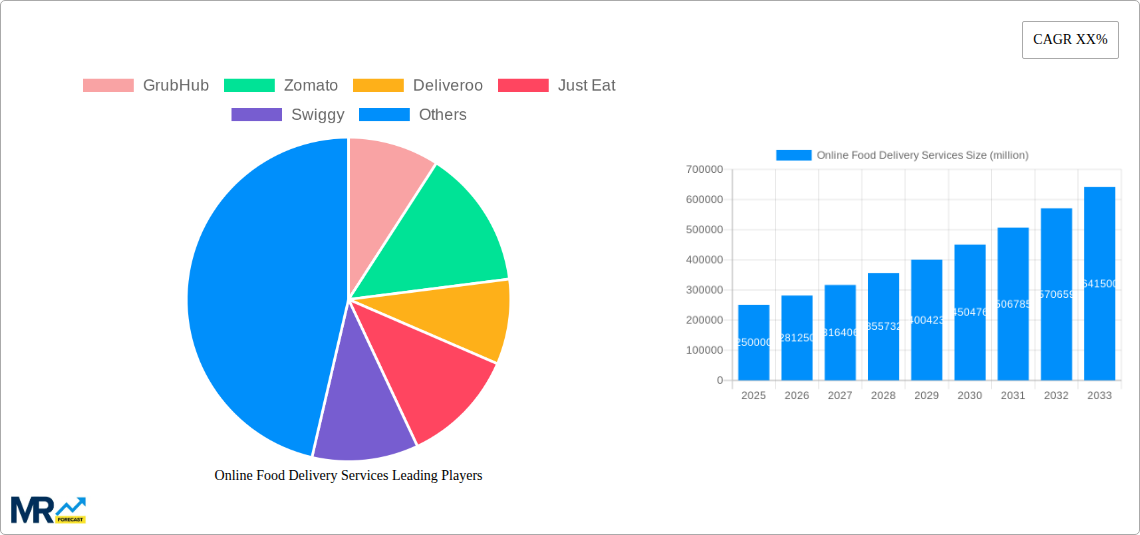

Online Food Delivery ServicesOnline Food Delivery Services by Type (Restaurant-to-Consumer, Platform-to-Consumer), by Application (B2B, B2C, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

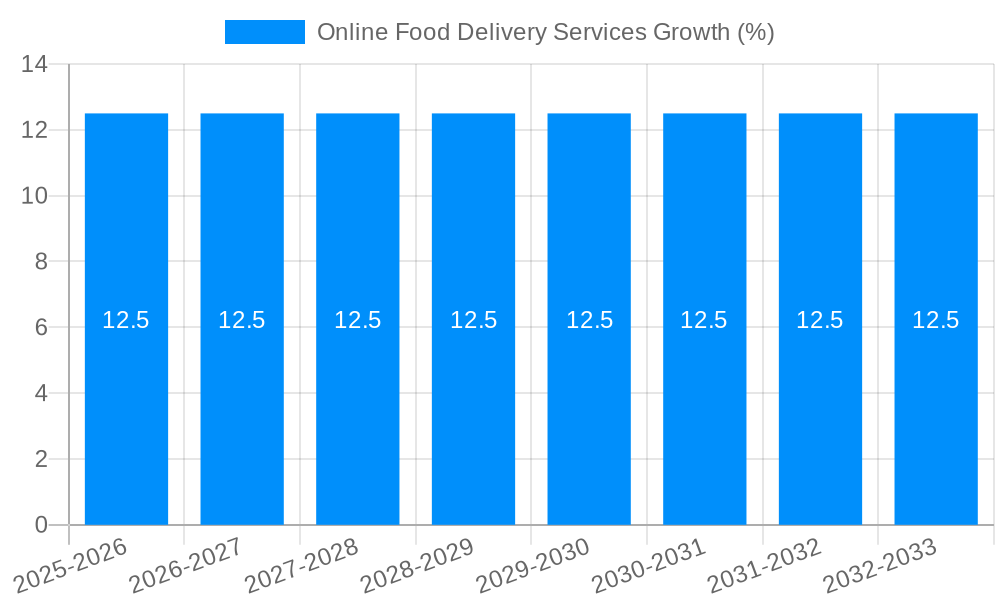

The online food delivery market is experiencing robust growth, driven by increasing smartphone penetration, changing consumer lifestyles favoring convenience, and the expansion of restaurant partnerships with delivery platforms. The market, valued at approximately $200 billion in 2025 (a reasonable estimate based on publicly available data for similar periods and market reports), is projected to maintain a strong Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033. This growth is fueled by several key trends, including the rise of cloud kitchens, the integration of advanced technologies like AI-powered recommendation systems and automated delivery solutions, and the increasing popularity of subscription models offering discounts and benefits. However, challenges remain, such as high operational costs, stringent regulatory environments in some regions, and intense competition among established players and new entrants. The market is segmented by business model (Restaurant-to-Consumer and Platform-to-Consumer) and target audience (B2B and B2C), with the B2C segment dominating due to high consumer demand. Geographic variations exist, with North America and Asia-Pacific showing the highest market penetration and growth potential. The competitive landscape is highly fragmented, with major players like DoorDash, Uber Eats, Grubhub, and Deliveroo vying for market share, driving innovation and service improvements.

The future of the online food delivery sector depends on several factors. Continued technological advancements, particularly in areas such as autonomous delivery vehicles and personalized food recommendations, will likely shape the market trajectory. Strategic partnerships and mergers & acquisitions are anticipated to further consolidate the market, leading to increased efficiency and economies of scale. Successfully navigating regulatory hurdles and addressing sustainability concerns related to packaging and delivery emissions will be critical for long-term growth. Addressing consumer concerns around food safety and hygiene will also be paramount. Companies focused on improving customer experience, offering diverse cuisines, and enhancing delivery speed will be best positioned to succeed in this dynamic and competitive market.

The online food delivery services market experienced explosive growth between 2019 and 2024, driven by the increasing popularity of smartphones, rising disposable incomes, and changing consumer lifestyles. This trend shows no signs of slowing down. The market, valued at several hundred million dollars in 2019, is projected to reach billions by 2033. Key market insights reveal a significant shift towards convenience and digitalization in food consumption. Consumers are increasingly opting for the ease and speed of ordering food online, rather than preparing meals themselves or dining out. This is especially true in urban areas with high population densities and busy lifestyles. The rise of cloud kitchens and dark stores, catering exclusively to online delivery orders, further exemplifies this trend. These facilities optimize food preparation and delivery efficiency, contributing to faster service and potentially lower costs for consumers. The industry also witnessed significant consolidation, with mergers and acquisitions shaping the competitive landscape. This trend towards larger players with wider reach and more efficient operations is expected to continue throughout the forecast period (2025-2033). The competitive dynamics are complex, influenced by factors such as technological innovation, marketing strategies, and strategic partnerships. The market is also seeing the emergence of new business models, such as subscription services and personalized recommendations, aimed at enhancing customer engagement and loyalty. Furthermore, the increasing integration of technology, such as AI-powered recommendation systems and advanced delivery logistics, is further streamlining the overall customer experience and optimizing efficiency within the industry.

Several factors are propelling the growth of online food delivery services. The proliferation of smartphones and ubiquitous internet access has made ordering food online incredibly convenient. Consumers can browse menus, place orders, and track deliveries all from their mobile devices, regardless of location. The increasing urbanization and busy lifestyles of consumers also contribute significantly to the market's expansion. People often lack the time or inclination to cook, making online food delivery a convenient alternative. Moreover, the rise of diverse cuisines and restaurant options available through these platforms caters to increasingly sophisticated palates and varied dietary needs. The competitive pricing strategies employed by many delivery platforms, often featuring discounts and promotional offers, incentivize consumers to opt for online ordering. This also spurs competition among restaurants, motivating them to leverage these platforms for increased visibility and market share. The evolution of delivery logistics, with sophisticated routing algorithms and real-time tracking capabilities, ensures timely and reliable service, enhancing customer satisfaction. Finally, the investment in technological advancements, such as AI-powered recommendation engines and personalized marketing, further enhances the customer experience and increases order frequency. These factors collectively contribute to the robust growth and expansion of the online food delivery services sector.

Despite its rapid growth, the online food delivery services industry faces several challenges and restraints. High commission fees charged by delivery platforms to restaurants can significantly impact restaurant profitability, potentially leading to strained relationships and limited participation. Fluctuating food costs and rising operational expenses, including labor and delivery costs, can squeeze profit margins for both restaurants and delivery companies. Maintaining food quality and temperature during delivery is crucial for customer satisfaction; however, inconsistencies in delivery times and food quality can lead to negative reviews and diminished customer loyalty. Competition within the market is fierce, necessitating ongoing investment in technology and marketing to maintain a competitive edge. Regulatory hurdles, including licensing and permit requirements, can pose obstacles for both restaurants and delivery platforms, particularly in different regions or countries. Ensuring data security and protecting customer privacy are also increasingly important concerns, as online platforms handle sensitive user information. Finally, the dependence on gig workers for delivery presents challenges related to labor costs, worker classification, and worker rights. Addressing these challenges effectively will be critical for the long-term sustainability and growth of the online food delivery services sector.

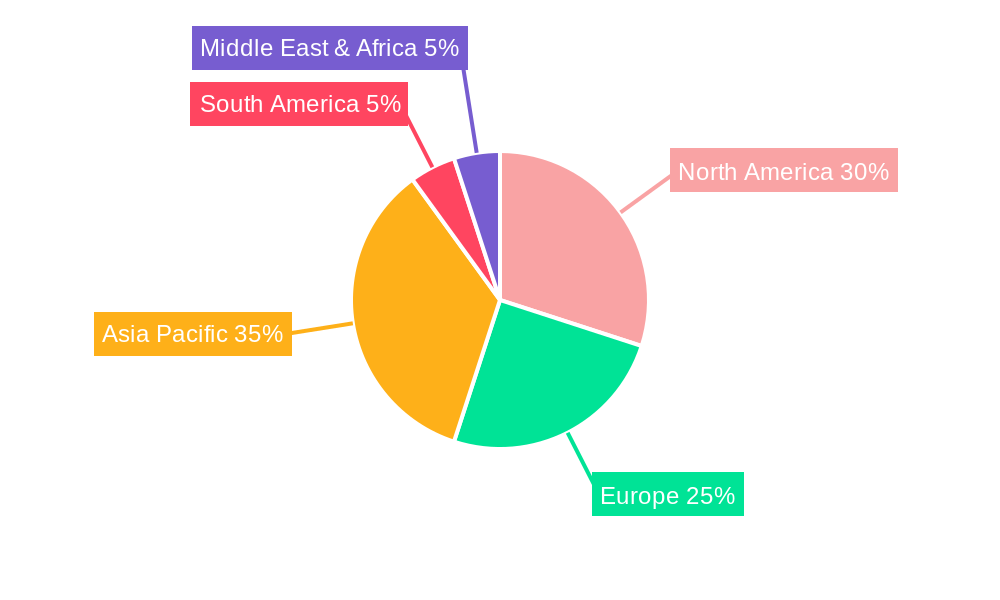

The online food delivery market is experiencing significant growth globally, but certain regions and segments are poised to dominate.

Key Regions: Asia, particularly India and China, are expected to witness substantial growth due to their large populations, increasing smartphone penetration, and rising middle-class incomes. North America also holds a significant market share, driven by high consumer spending and a preference for convenience. Europe is also showing robust growth, albeit at a slightly slower pace compared to Asia and North America.

Dominant Segment: Restaurant-to-Consumer (R2C). This segment represents the traditional model of online food delivery, where restaurants partner with delivery platforms to reach a wider customer base. Its dominance stems from its established presence, broad reach, and familiarity with consumers. The R2C model offers restaurants a cost-effective way to expand their reach without significant capital investment in their own delivery infrastructure. The established infrastructure and consumer familiarity make this segment the current market leader. While other models, such as platform-to-consumer, are emerging, the R2C model is expected to maintain its dominance through the forecast period. This segment benefits from network effects, where a larger number of restaurants and customers creates a more valuable platform for both.

The paragraph above discusses the key regions and the Restaurant-to-Consumer (R2C) segment in detail and provides a more comprehensive perspective.

Several factors are catalyzing growth within the online food delivery services industry. Technological advancements, such as improved delivery logistics and AI-driven recommendation systems, are enhancing efficiency and customer experience. The expansion of cloud kitchens and dark stores is increasing delivery speed and reducing operational costs. Increasing smartphone penetration and internet access are making online ordering more accessible to a wider consumer base. Finally, evolving consumer preferences, favoring convenience and diverse culinary options, are driving the demand for online food delivery services.

This report provides a comprehensive overview of the online food delivery services market, covering historical data (2019-2024), an estimated year (2025), and a detailed forecast (2025-2033). It analyzes key market trends, driving forces, challenges, and growth catalysts, while identifying the leading players and significant developments in the sector. The report also segments the market based on various criteria and offers detailed regional and country-specific insights. It is a valuable resource for investors, businesses, and anyone seeking a thorough understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GrubHub, Zomato, Deliveroo, Just Eat, Swiggy, Takeaway, Delivery Hero, Food Panda, Alibaba Group(Ele.me), OLO, MEITUAN, Uber Eats, DoorDash, Caviar, Postmates, Spoonful, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Food Delivery Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Food Delivery Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.