1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Crowdfunding Platform?

The projected CAGR is approximately 11.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Crowdfunding Platform

Online Crowdfunding PlatformOnline Crowdfunding Platform by Type (/> Reward-based Crowdfunding, Equity Crowdfunding, Donation), by Application (/> Medical, Cultural Industries, Technology, Education, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

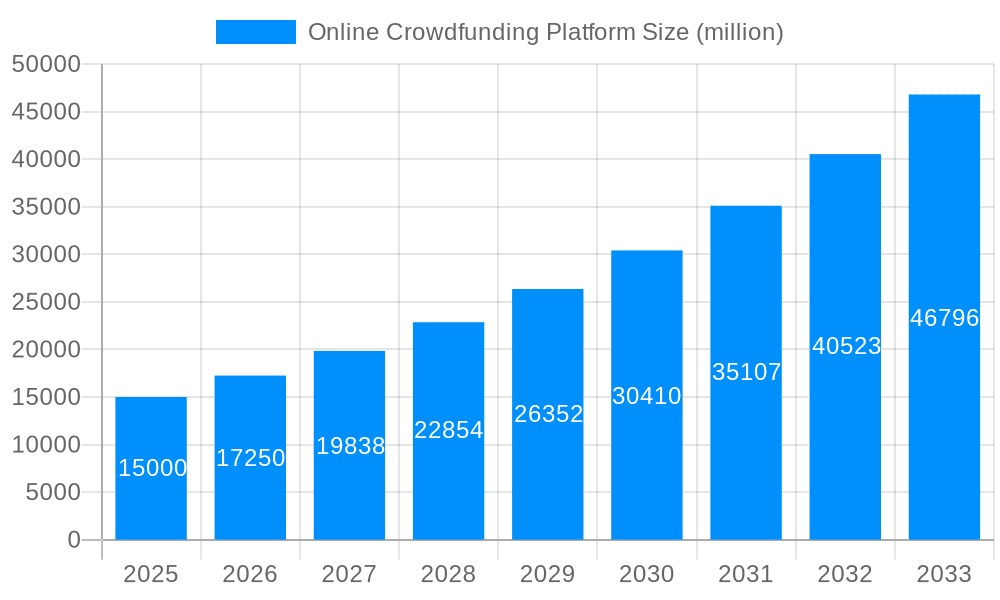

The online crowdfunding platform market is projected for substantial growth, propelled by rising entrepreneurial spirit, a growing demand for alternative financing, and advancements in technology. The market's expansion is attributed to a wide array of platforms supporting diverse projects, from artistic and social initiatives to business and real estate ventures. Industry trends indicate a market size of $16.61 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 11.6% from 2025 to 2033. This growth underscores the increasing adoption of crowdfunding by individuals and businesses seeking funding solutions beyond conventional channels. Key growth factors include enhanced platform user experience, elevated investor trust, and expanded global reach. Significant market segmentation, with specialized platforms for art, technology, and social impact projects, further stimulates market expansion.

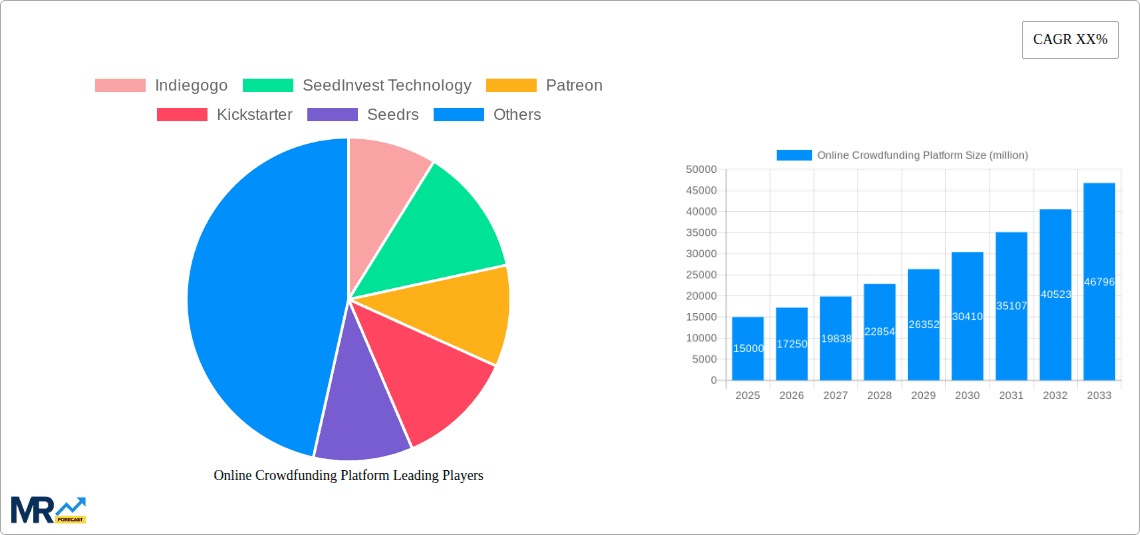

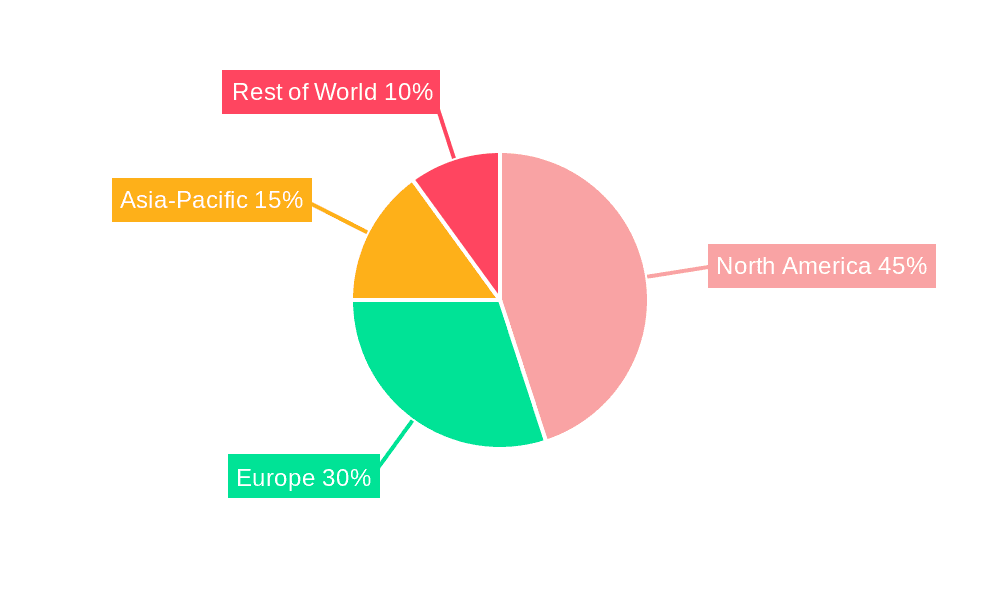

Market restraints include regional regulatory variations, inherent investor risks in early-stage ventures, and ongoing challenges in fraud prevention and platform security. Nevertheless, the overall growth outlook remains positive. Increasing platform sophistication, coupled with improved due diligence processes and investor education, is anticipated to alleviate these concerns. Intense competition among established platforms such as Kickstarter, Indiegogo, and GoFundMe drives innovation and enhances user experience. The emergence of new platforms and the integration of blockchain technology present both opportunities and challenges for market participants. Geographic dominance is expected to persist in North America and Europe, though emerging economies are demonstrating considerable growth potential. The online crowdfunding market is on track for sustained expansion, driven by continuous technological evolution and evolving financing paradigms.

The online crowdfunding platform market witnessed robust growth between 2019 and 2024, exceeding expectations and establishing itself as a significant channel for fundraising across diverse sectors. The total market value surged past $XX million in 2024, driven by increased adoption by businesses, non-profits, and individuals seeking alternative funding routes. Key market insights reveal a clear shift towards platforms offering specialized services, catering to niche industries and funding models. The rise of reward-based crowdfunding, equity crowdfunding, and donation-based campaigns contributed significantly to this growth. Furthermore, technological advancements, including improved payment gateways, sophisticated analytics dashboards for campaign management, and enhanced security features, significantly enhanced user experience and platform appeal. The increased accessibility and user-friendliness of these platforms broadened their reach, attracting a wider demographic of both fundraisers and investors. A notable trend is the increasing integration of social media marketing strategies within crowdfunding campaigns, leading to heightened visibility and campaign success rates. The historical period reveals a growing preference for platforms offering robust investor relations tools and comprehensive reporting functionalities, facilitating transparent communication and strengthening trust between fundraisers and backers. The predicted growth for the forecast period (2025-2033) indicates a continuous upward trajectory, with the market value projected to reach several hundred million dollars by 2033, driven by expanding technological capabilities, regulatory advancements, and increasing awareness among potential users. Competition among platforms will intensify, fostering innovation and leading to an ever-evolving landscape of increasingly sophisticated and specialized services.

Several key factors contribute to the burgeoning online crowdfunding platform market. The increasing accessibility to technology and the internet globally empowers individuals and businesses in underserved communities to access capital previously out of reach. The reduced reliance on traditional financial institutions, perceived as slow and complex, further propels the adoption of online crowdfunding as a more agile and efficient alternative. The social aspect of crowdfunding, fostering community building and shared investment opportunities, serves as a powerful motivator for both fundraisers and backers. Furthermore, regulatory changes in various countries are gradually streamlining the legal frameworks surrounding equity crowdfunding, removing obstacles and encouraging greater participation. The growing recognition of crowdfunding as a legitimate funding source by established businesses, coupled with increasing investor confidence, creates a positive feedback loop, driving the market's expansion. The evolution of crowdfunding platforms themselves, incorporating advanced features like sophisticated analytics, automated marketing tools, and integrated payment systems, also contributes significantly to their appeal and efficiency, improving campaign success rates and broadening the market's reach. The rising number of successful crowdfunding campaigns showcases the viability of this method, encouraging greater adoption among entrepreneurs and non-profit organizations alike.

Despite its significant growth, the online crowdfunding platform market faces several challenges. Regulatory uncertainty in certain regions continues to pose significant hurdles, creating complexities for both platform operators and fundraisers. The prevalence of fraudulent activities and scams remains a major concern, impacting user trust and platform reputation. Competition among numerous platforms is fierce, requiring continuous innovation and adaptation to maintain a competitive edge. The fluctuating economic climate can impact investor sentiment and willingness to participate, potentially slowing down funding for certain campaigns. Reaching a wider audience and overcoming geographical limitations can be difficult for some platforms, especially those focused on niche markets. Moreover, securing sufficient investment to sustain platform operations and implement necessary technological upgrades requires careful financial management and strategic planning. Addressing these challenges requires platforms to implement stringent verification processes, invest in robust security measures, and constantly enhance user experience to maintain trust and attract new users. Clearer regulations, coupled with effective industry self-regulation, can help overcome some of these limitations and foster sustainable growth.

Dominant Segments:

The paragraph above highlights how North America and Europe currently hold larger market shares, however the Asia-Pacific region demonstrates the highest projected growth rates, suggesting a future shift in the geographic distribution of market dominance. The synergy between these geographic trends and the segment-specific growth, especially in equity crowdfunding, illustrates a complex yet promising future for the online crowdfunding platform market.

The online crowdfunding industry is experiencing accelerated growth fueled by several catalysts. Technological advancements continuously improve user experience, enhance security, and offer more sophisticated analytics. Favorable regulatory changes in key markets are removing barriers to entry and promoting greater investor participation. Increased awareness among both entrepreneurs and investors about the benefits of crowdfunding contributes to rising adoption rates. The rising popularity of social media marketing for crowdfunding campaigns further expands reach and increases campaign visibility. These factors, combined with a shift toward specialized platforms targeting niche industries, are collectively driving impressive growth within the online crowdfunding platform market.

This report provides a comprehensive overview of the online crowdfunding platform market, encompassing historical performance (2019-2024), current status (2025), and future projections (2025-2033). It examines key market drivers, challenges, and growth catalysts, providing detailed insights into market segmentation, geographic trends, and the leading players in the industry. The report aims to provide valuable information for investors, businesses, and stakeholders seeking to understand and participate in this dynamic market. The report's analysis covers diverse crowdfunding models, assesses regulatory landscapes across key regions, and forecasts future growth based on current trends and emerging technologies.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.6%.

Key companies in the market include Indiegogo, SeedInvest Technology, Patreon, Kickstarter, Seedrs, Mightycause, StartEngine, GoFundMe, WeFunder, Crowdfunder, Crowdcube, CircleUp, GoGetFunding, Fundable, FundRazr, Companisto, Fundly.

The market segments include Type, Application.

The market size is estimated to be USD 16.61 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Online Crowdfunding Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Crowdfunding Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.