1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Crowdfunding?

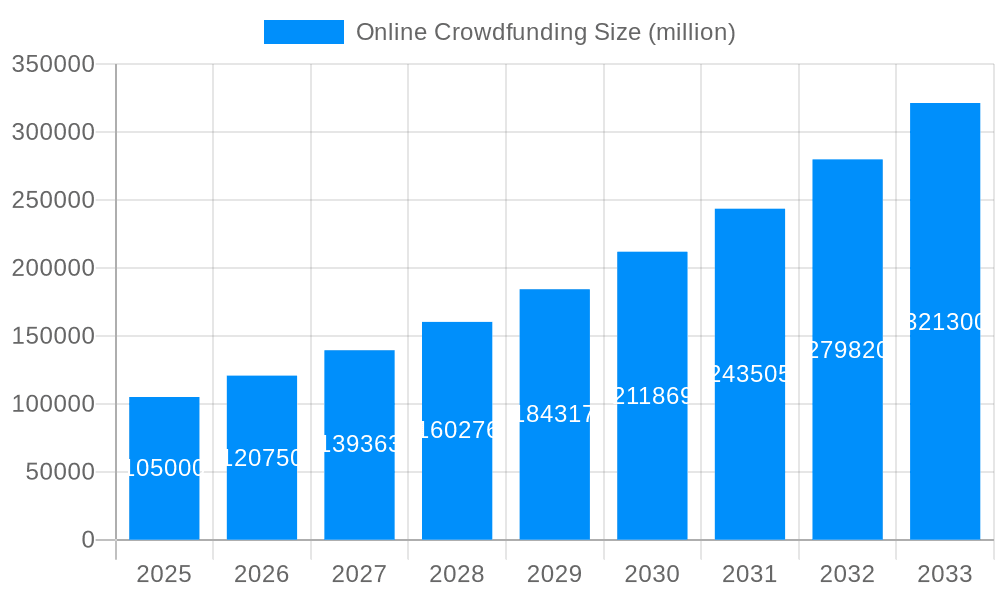

The projected CAGR is approximately 13.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Crowdfunding

Online CrowdfundingOnline Crowdfunding by Type (/> Reward-based Crowdfunding, Equity Crowdfunding, Donation and Other), by Application (/> Cultural Industries, Technology, Product, Healthcare, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The online crowdfunding market, encompassing reward-based, equity, and donation models, is experiencing robust growth, driven by increased digital adoption, a burgeoning entrepreneurial landscape, and evolving investor preferences. While precise figures for market size and CAGR are absent from the provided data, a reasonable estimation, considering the substantial global presence of platforms like Kickstarter and GoFundMe and the consistent upward trend reported in numerous industry analyses, suggests a 2025 market size exceeding $100 billion USD, with a projected compound annual growth rate (CAGR) between 15% and 20% for the forecast period 2025-2033. This growth is fueled by several key drivers: the increasing accessibility of online platforms, enabling individuals and businesses to reach wider audiences; the growing preference for alternative funding sources, particularly among startups and small businesses seeking to avoid traditional venture capital routes; and a rise in social impact investing, where donors and investors prioritize projects with ethical or societal benefits.

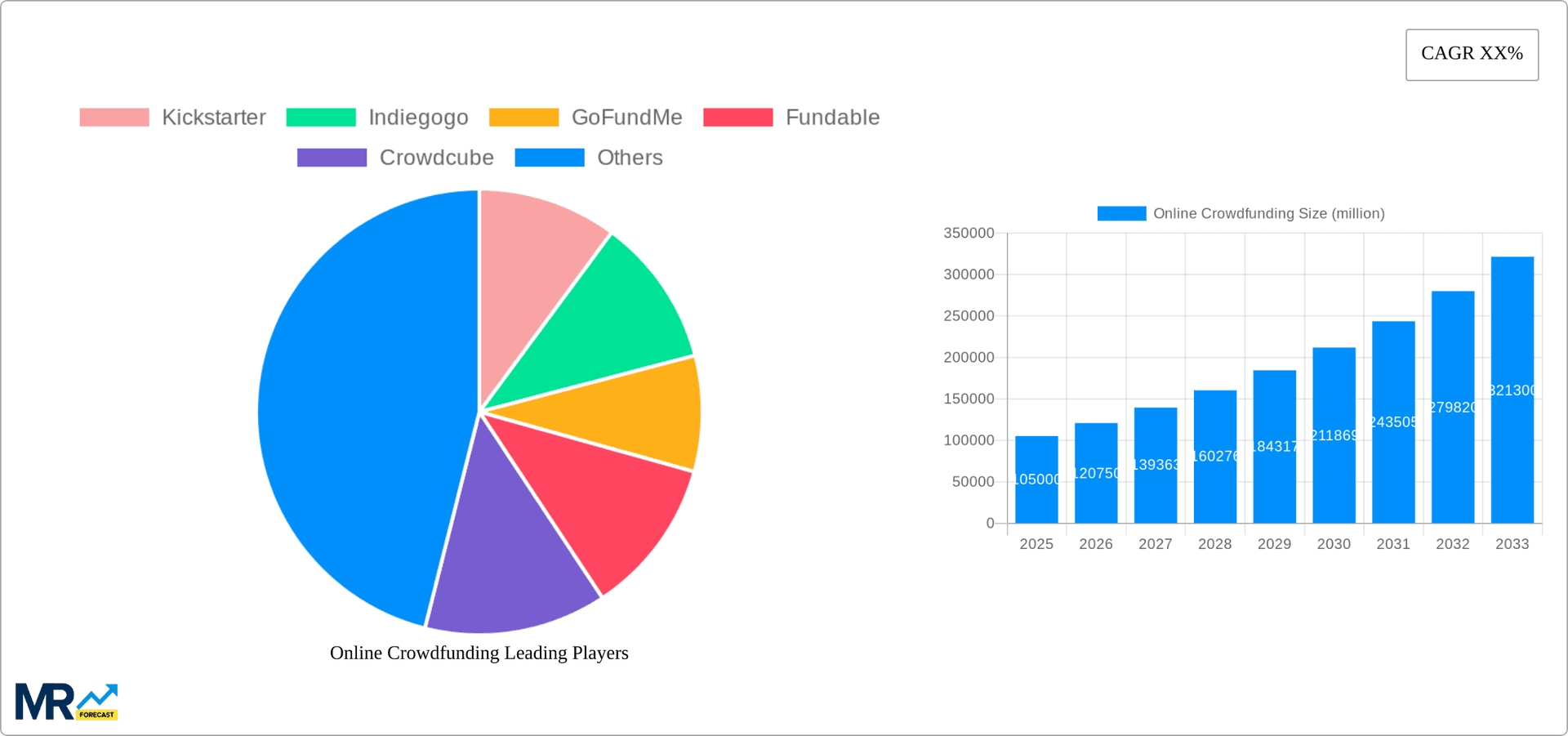

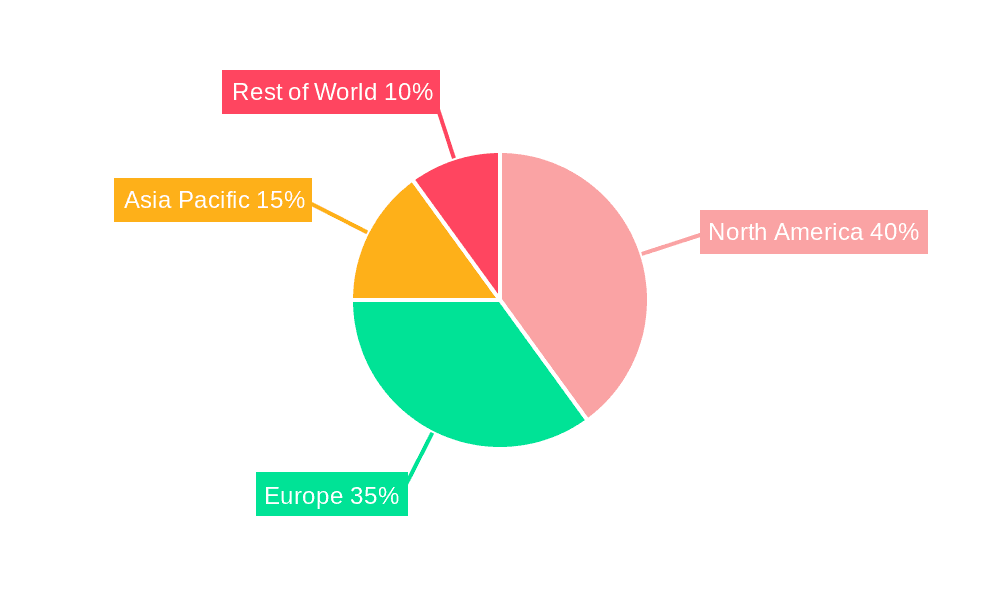

Segment-wise, reward-based crowdfunding remains dominant, benefiting from its ease of use and broad appeal. However, equity crowdfunding and donation-based platforms are witnessing significant expansion, propelled by regulations that have broadened accessibility and investor confidence. Geographically, North America and Europe currently represent major market shares, but rapid growth is expected in Asia-Pacific regions, notably China and India, driven by increasing internet penetration and rising disposable incomes. Challenges include regulatory hurdles in some regions, the risk of fraudulent campaigns, and the need for enhanced investor protection mechanisms. Despite these, the overall market trajectory points towards sustained growth, shaped by technological advancements, shifting investor behavior, and the increasing integration of crowdfunding into established financial ecosystems.

The online crowdfunding market, encompassing platforms like Kickstarter, Indiegogo, and GoFundMe, exhibited robust growth throughout the historical period (2019-2024), exceeding several billion dollars in aggregate funding. This growth trajectory is projected to continue, with the estimated market value in 2025 reaching tens of billions of dollars and further expanding to hundreds of billions by 2033. This surge is fueled by several factors: increasing internet penetration and smartphone adoption, particularly in emerging markets, fostering wider access to online platforms. A shift in consumer behavior towards supporting innovative projects and social causes through direct contribution plays a crucial role. Furthermore, the diversification of crowdfunding platforms catering to niche markets—from equity financing for startups (Crowdcube, Companisto) to donation-based campaigns for charitable causes (GoFundMe, DonorsChoose)—has broadened the market’s reach. The increasing sophistication of crowdfunding platforms, offering better analytics, marketing tools, and streamlined processes, has also contributed to the market's expansion. This trend shows a growing preference for alternative financing options among entrepreneurs, social enterprises, and individuals, and the ease of access offered by these online platforms makes them increasingly attractive. The rise of social media marketing, in turn, enhances exposure for crowdfunding campaigns, accelerating their success. The forecast period (2025-2033) suggests a sustained period of strong growth, indicating a mature and expanding online crowdfunding ecosystem.

Several key factors are driving the phenomenal growth of the online crowdfunding market. Firstly, the accessibility and affordability of launching a crowdfunding campaign have democratized fundraising. Previously, securing funding was heavily reliant on traditional financial institutions, making it challenging for many entrepreneurs and social enterprises. Crowdfunding platforms eliminate these barriers, providing a low-cost alternative for raising capital. Secondly, the inherent transparency and community engagement fostered by crowdfunding platforms build trust. Potential backers can meticulously scrutinize project details, communicate directly with creators, and track progress, fostering a greater sense of involvement and accountability. This fosters stronger relationships between funders and projects, increasing confidence in the projects' success. Thirdly, the significant reduction in intermediary costs compared to traditional fundraising methods allows a larger portion of the raised capital to reach the project's intended purpose. This efficiency attracts both funders and project creators. Lastly, the growing awareness and acceptance of crowdfunding as a legitimate fundraising channel among both investors and the general public continuously fuel the market's expansion.

Despite the impressive growth, online crowdfunding faces several challenges. One significant hurdle is the high failure rate of crowdfunding campaigns. Many projects fail to reach their funding goals, leading to frustration for creators and potential investors. This is often attributed to inadequate market research, poorly executed marketing strategies, and a lack of a compelling project narrative. Regulatory uncertainty is another challenge, particularly for equity crowdfunding, where compliance requirements vary across jurisdictions. The lack of standardized regulations can deter both investors and platforms. Furthermore, the potential for fraud and scams remains a persistent concern. Although platforms implement measures to mitigate risks, the sheer volume of campaigns makes complete prevention difficult. Lastly, competitive pressures among numerous platforms lead to a race to the bottom on fees, potentially impacting the sustainability of individual platforms. Platforms must balance attracting users with maintaining a profitable business model.

The North American market, particularly the United States, has historically dominated the online crowdfunding landscape, accounting for a substantial portion of global funding volume. However, rapid growth is observed in Asia, specifically China, driven by platforms like Alibaba, Jingdong, and Suning, catering to a massive and increasingly digitally-savvy population. Europe also displays significant potential, with numerous established and emerging crowdfunding platforms actively competing.

In-depth Analysis: The dominance of North America can be attributed to its established technological infrastructure, higher per capita disposable income, and a culture of supporting entrepreneurial ventures. However, the rapid expansion of the internet and mobile penetration in developing economies, particularly in Asia and parts of Africa, creates immense opportunities for online crowdfunding growth. The reward-based crowdfunding model remains highly popular due to its straightforward nature, clear value proposition for both creators and backers, and reduced regulatory complexities compared to equity-based models. Technology and product-focused campaigns consistently attract significant funding because of the tangible nature of the projects and the potential for high returns or innovative solutions. The Healthcare segment is also experiencing increasing traction, driven by the demand for innovative medical devices, treatments, and research.

The online crowdfunding industry's future growth is bolstered by increasing digital literacy, a rising preference for alternative finance options, and the expanding regulatory frameworks promoting transparency and investor protection. Technological advancements, including improved platform features and enhanced security measures, further enhance user experience and trust, fueling market expansion.

This report provides a comprehensive overview of the online crowdfunding market, analyzing its trends, drivers, challenges, and key players. It offers detailed insights into the market's historical performance, current status, and future growth projections, considering key segments and geographical regions. The report identifies emerging opportunities and potential risks, providing valuable information for stakeholders across the industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13.5%.

Key companies in the market include Kickstarter, Indiegogo, GoFundMe, Fundable, Crowdcube, GoGetFunding, Patreon, Crowdfunder, CircleUp, AngelList, DonorsChoose, Crowdfunder UK, FundRazr, Companisto, Campfire, Milaap, Crowdo, CrowdPlus, Modian, Idianchou, Alibaba, Jingdong, Suning.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Online Crowdfunding," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Crowdfunding, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.