1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Clothing & Dress Rental?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Clothing & Dress Rental

Online Clothing & Dress RentalOnline Clothing & Dress Rental by Type (Men Clothing, Women Clothing, Kids Clothing), by Application (Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Consumer (C2C)), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

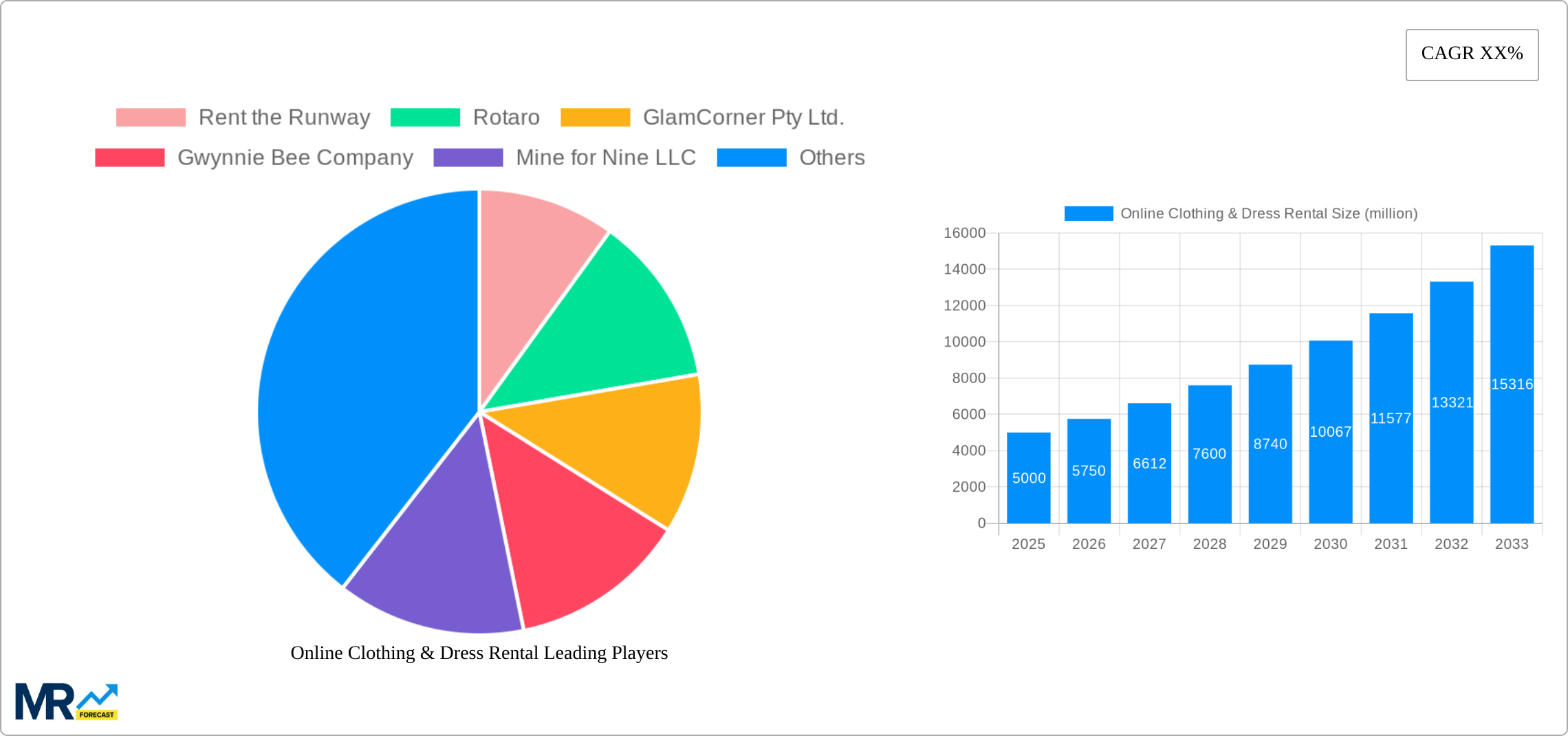

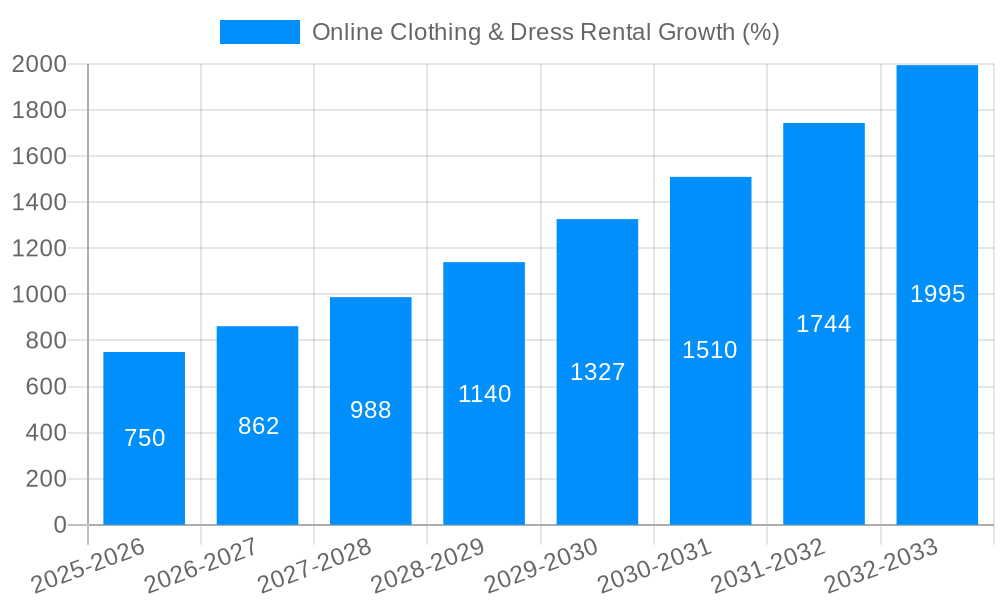

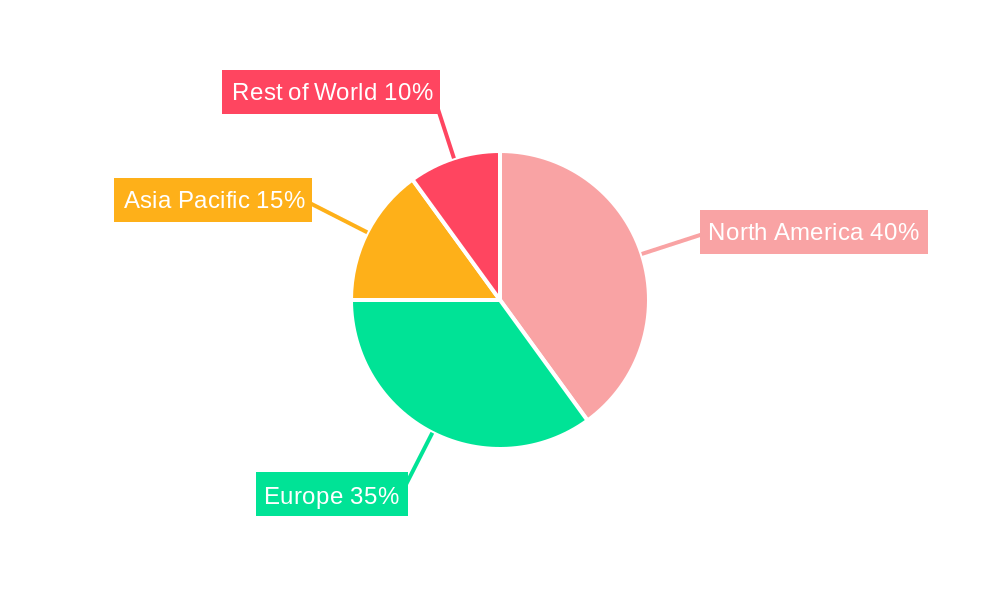

The online clothing and dress rental market is experiencing robust growth, driven by increasing consumer demand for sustainable fashion, affordability, and access to diverse styles without the commitment of ownership. The market's value, while not explicitly stated, can be reasonably estimated based on current market trends and the presence of numerous established players. Considering the significant number of companies operating in the space and the diverse geographical spread, a 2025 market size of approximately $5 billion USD seems plausible. A Compound Annual Growth Rate (CAGR) of 15-20% is realistic for the forecast period (2025-2033), projecting substantial market expansion. Key drivers include rising environmental consciousness, the popularity of subscription models, and the convenience offered by online platforms. Trends such as the rise of luxury rental services, personalized styling options integrated into rental platforms, and the expansion into various clothing categories (men's, women's, children's) further contribute to market growth. However, restraints include potential concerns about hygiene and garment condition, competition from traditional retail, and logistical challenges associated with managing inventory and delivery across diverse locations. Segmentation reveals that B2C (Business-to-Consumer) currently dominates, though B2B (Business-to-Business) applications, for instance in corporate events or film productions, present a significant growth opportunity. Geographically, North America and Europe are currently leading markets, but Asia-Pacific shows substantial potential for future growth, driven by increasing disposable incomes and rising fashion awareness.

The segmentation by clothing type (men's, women's, children's) and business model (B2C, B2B, C2C) allows for tailored marketing strategies. While B2C currently holds a dominant share, there's significant potential for B2B growth in corporate settings and special events. Further expansion into underserved markets, particularly in the Asia-Pacific region, and continuous improvements in logistical efficiency and customer service are crucial for maximizing market penetration. Investing in technology to enhance the online experience, provide accurate sizing, and improve the overall customer journey will be critical for continued success in this competitive landscape. Finally, adapting to evolving consumer preferences regarding sustainability and ethical fashion will play a key role in shaping the future of the online clothing and dress rental market.

The online clothing and dress rental market experienced explosive growth during the study period (2019-2024), exceeding XXX million units in 2024. This surge reflects a significant shift in consumer behavior, driven by factors such as increasing awareness of sustainability, a desire for greater fashion variety without the commitment of ownership, and the convenience offered by online platforms. The market is highly fragmented, with a mix of large established players like Rent the Runway and smaller, niche businesses catering to specific demographics or styles. The B2C segment currently dominates, fueled by the accessibility and ease of use of rental platforms. However, the B2B segment shows significant potential for growth, especially within the corporate event and film industries. The women's clothing segment constitutes the largest share of the market, followed by men's and children's apparel. The forecast period (2025-2033) projects continued strong growth, potentially reaching XXX million units by 2033, driven by technological advancements, improved logistics, and increasing adoption of subscription models. This report delves deeper into the specific trends, providing valuable insights for businesses operating in or considering entering this dynamic market. The shift towards rental reflects a wider societal move towards a more circular economy, minimizing textile waste and offering consumers a more sustainable approach to fashion.

Several key factors are propelling the growth of the online clothing and dress rental market. The rising popularity of the sharing economy is a significant driver, aligning with consumer preferences for access over ownership. Environmental concerns about the environmental impact of fast fashion are pushing consumers towards more sustainable alternatives, with rental emerging as a compelling solution. The convenience and affordability of rental services, particularly subscription models, attract a wide range of consumers. The ability to experiment with different styles and brands without the financial burden of purchasing enhances the appeal. Technological advancements, including improved online platforms, streamlined logistics, and sophisticated size matching algorithms, are enhancing the customer experience and driving market expansion. Furthermore, the increasing popularity of special events, such as weddings and corporate functions, contributes to the demand for high-quality rental garments, stimulating growth in the B2C sector. Finally, the marketing efforts of companies like Rent the Runway have successfully built brand awareness and trust in the rental model, influencing consumer adoption.

Despite the significant growth, the online clothing and dress rental market faces several challenges. Maintaining the quality and condition of rented garments is crucial; damage, wear and tear, and inadequate cleaning can negatively impact customer satisfaction and profitability. Competition is fierce, requiring companies to continually innovate and differentiate their offerings. Effective logistics and delivery systems are essential, particularly for timely returns and efficient processing. Concerns about hygiene and sanitation remain a significant hurdle, requiring robust cleaning and sanitization protocols to alleviate customer anxieties. The relatively high cost of managing inventory, including warehousing, storage and handling is a challenge. Additionally, accurate sizing and fitting remain an issue, especially with clothing that requires a precise fit, leading to potential customer dissatisfaction and returns. Finally, legal and insurance complexities related to handling damaged or lost items are inherent challenges for businesses in this sector.

The B2C segment is projected to dominate the online clothing and dress rental market throughout the forecast period.

The women's clothing segment also holds the largest market share:

Geographically, North America and Europe are anticipated to lead the market, driven by high disposable incomes, strong fashion consciousness, and early adoption of sustainable consumption patterns. However, significant growth opportunities exist in developing economies in Asia and other regions as consumer awareness and disposable income increase.

The online clothing and dress rental industry is poised for continued robust growth fueled by several key factors. The increasing adoption of sustainable consumption practices by environmentally conscious consumers is a significant driver. Technological advancements such as improved virtual try-on technologies, advanced logistics, and AI-powered recommendations are enhancing customer experience and efficiency. The expanding reach of e-commerce and the widening availability of high-speed internet access are broadening market reach and access to rental services. Furthermore, the ongoing evolution of marketing strategies and promotional initiatives contributes to increasing brand awareness and customer acquisition.

This report provides a comprehensive analysis of the online clothing and dress rental market, offering a detailed examination of current trends, growth drivers, challenges, and key players. It provides valuable insights into market segmentation, geographical distribution, and future growth projections, equipping businesses with the knowledge necessary to make informed strategic decisions in this dynamic and rapidly evolving industry. The report's detailed analysis allows for a precise understanding of the market's complexity and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Rent the Runway, Rotaro, GlamCorner Pty Ltd., Gwynnie Bee Company, Mine for Nine LLC, Dress Hire AU, ThreadTread, Nuuly, Rent The Front Row LLC, Dress & Go Company, Chic by Choice Company, Style Lend Company, Rent It Bae Company, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Clothing & Dress Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Clothing & Dress Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.