1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Car-Hailing Platform?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Car-Hailing Platform

Online Car-Hailing PlatformOnline Car-Hailing Platform by Type (Full-Time Online Car-Hailing Platform, Part-Time Online Car-Hailing Platform), by Application (Android System, IOS System), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

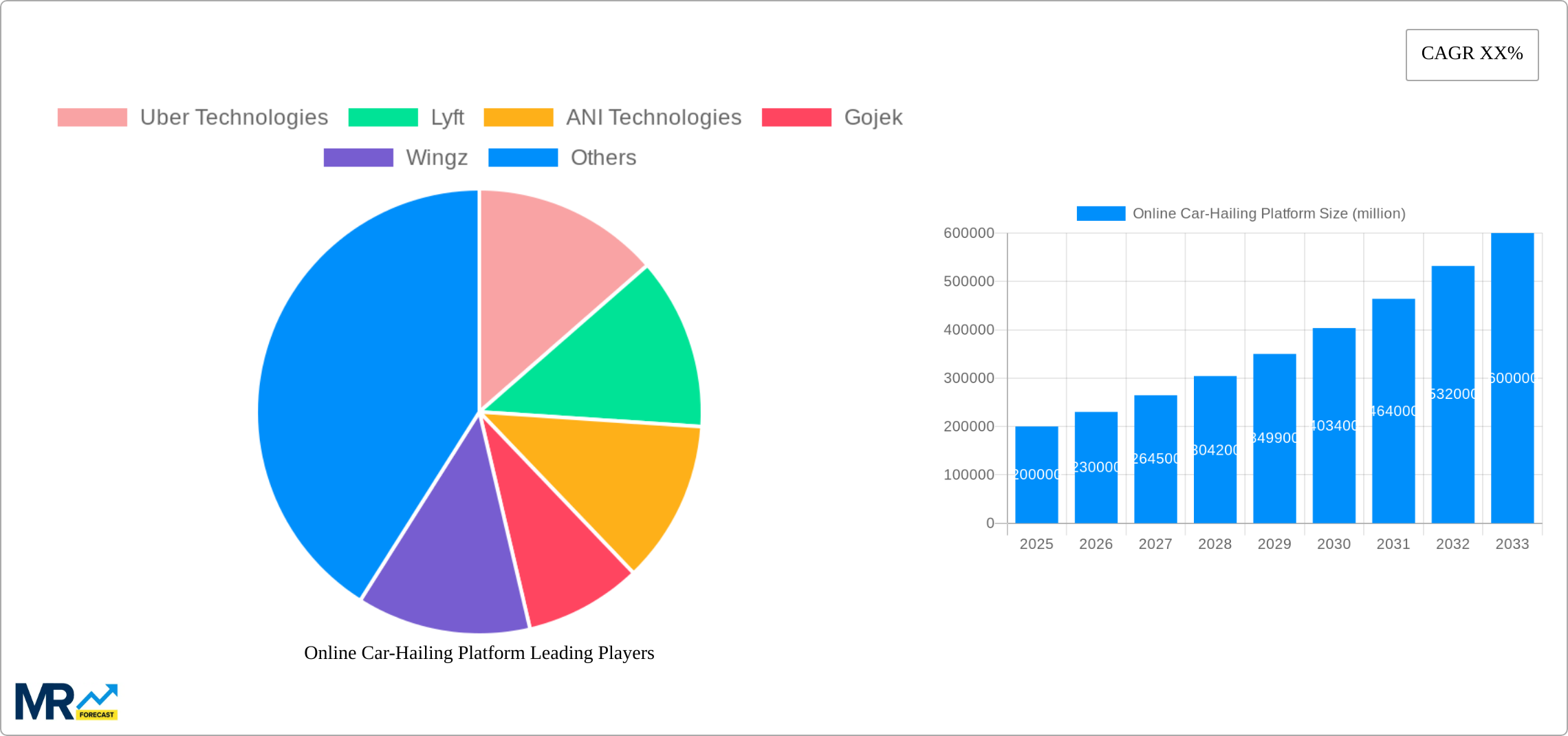

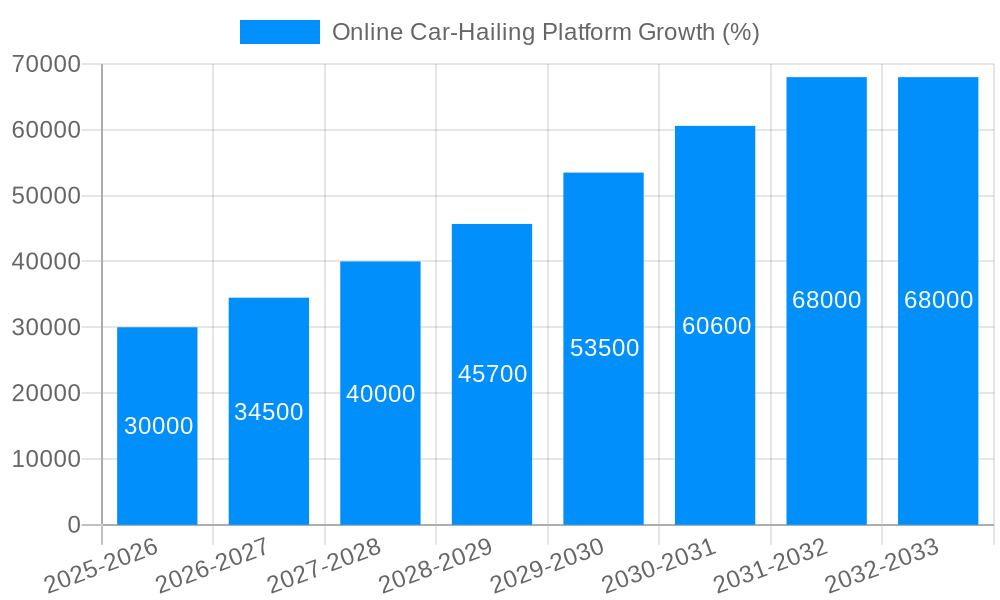

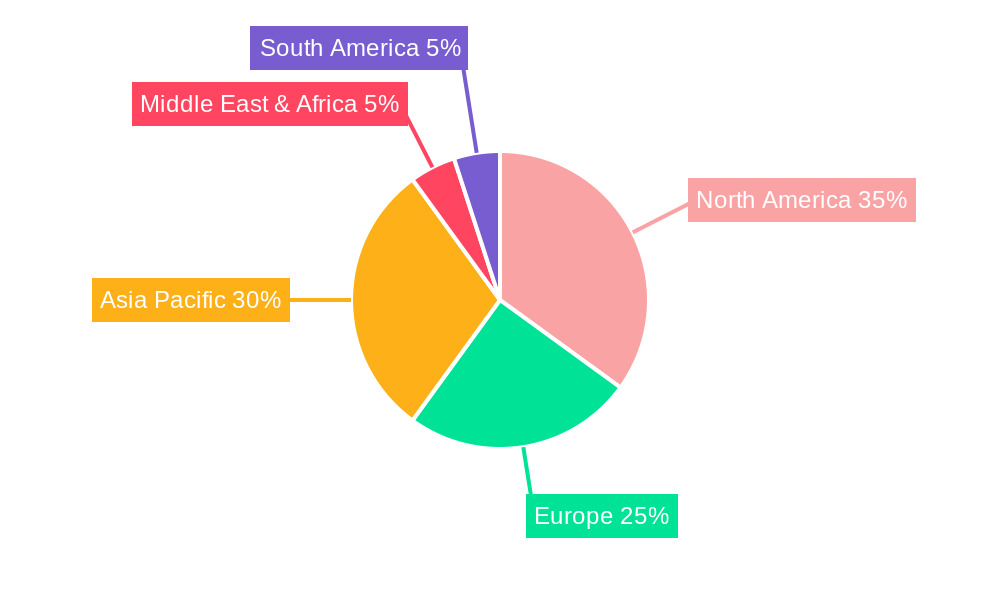

The online car-hailing platform market is experiencing robust growth, driven by increasing smartphone penetration, urbanization, and the rising preference for convenient and affordable transportation alternatives. The market, estimated at $200 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching an impressive $600 billion by 2033. Several factors contribute to this expansion. Technological advancements, including improved app functionality, GPS integration, and real-time tracking, enhance user experience and driver efficiency. The emergence of diverse business models, such as full-time and part-time platforms, caters to a broader range of users and drivers. Furthermore, the integration of various payment options and increasing investments in platform security bolster market acceptance. Geographically, North America and Asia Pacific currently dominate the market, fueled by high adoption rates and strong presence of major players like Uber and Didi Chuxing. However, emerging economies in regions like South America and Africa present substantial growth potential as infrastructure improves and digital literacy expands. The competitive landscape remains dynamic, with established giants facing competition from regional players and new entrants innovating with value-added services such as ride-sharing options, corporate solutions, and integrated logistics capabilities. The market's future success hinges on addressing regulatory challenges, ensuring driver welfare, and mitigating concerns about data privacy and security.

The segmentation of the online car-hailing market reveals significant differences in market share based on platform type (full-time vs. part-time) and operating system (Android vs. iOS). Full-time platforms typically command a larger share due to their greater operational capacity and brand recognition. However, part-time platforms are witnessing rapid growth, as individuals seek flexible income streams. Similarly, while Android holds a larger market share due to its global prevalence, iOS users contribute significantly to revenue generation, particularly in developed markets. Regional variations in market dynamics further shape the competitive landscape. While North America and Asia Pacific are mature markets characterized by intense competition and sophisticated technology, other regions demonstrate varying levels of growth potential, largely determined by local economic conditions, infrastructure development, and regulatory environments. Successfully navigating these diverse aspects will be crucial for both existing players and new entrants seeking to capitalize on the immense growth prospects within the online car-hailing sector.

The online car-hailing platform market experienced explosive growth during the historical period (2019-2024), driven by the increasing adoption of smartphones, rising urbanization, and a growing preference for convenient and affordable transportation solutions. The market size, estimated to be in the tens of billions of dollars in 2025, is projected to reach hundreds of billions by 2033, indicating a sustained period of robust expansion. Key market insights reveal a shift towards integrated mobility solutions, where car-hailing platforms are incorporating features like ride-sharing, bike rentals, and even public transportation information into their apps. This trend signifies a move beyond simple point-to-point transportation towards a comprehensive urban mobility ecosystem. Furthermore, the increasing adoption of electric vehicles (EVs) by car-hailing platforms is contributing to a greener transportation landscape. This sustainability focus aligns with growing environmental concerns among consumers and governments alike, making it a significant factor driving the market's trajectory. The competition within the industry is fierce, with established giants like Uber and Didi Chuxing facing challenges from numerous regional players and new entrants constantly innovating with technologies such as AI-powered route optimization and dynamic pricing strategies. This competitive landscape fosters continuous improvement and innovation within the sector, ensuring that the user experience constantly evolves. The market also demonstrates a clear geographical disparity, with developed nations showing greater adoption rates than developing countries, though the latter show significant growth potential fueled by rapidly expanding urban populations and rising middle classes. The successful integration of new technologies like autonomous vehicles promises to significantly alter the operational structure of the online car-hailing sector in the years to come.

Several key factors contribute to the remarkable growth of the online car-hailing platform market. The widespread adoption of smartphones and the ubiquitous access to high-speed internet connectivity have created the ideal infrastructure for these platforms to thrive. Users can easily access and book rides, manage payments, and track their journeys with unmatched convenience. Furthermore, the increasing urbanization across the globe, especially in developing economies, necessitates reliable and readily available transportation solutions. Online car-hailing platforms perfectly fulfill this need, providing a cost-effective alternative to private car ownership, especially in areas with inadequate public transportation. The flexibility offered by both full-time and part-time driver options also significantly boosts the platform's appeal. Part-time drivers can supplement their income, while full-time drivers can enjoy more independent working arrangements. This dual approach allows the platform to meet varying demands and cater to a broader spectrum of users. Moreover, the constantly evolving technological innovations within the industry contribute to its continued growth. Improvements in ride-matching algorithms, dynamic pricing mechanisms, and the integration of advanced safety features are all enhancing the user experience and attracting more customers. The incorporation of data analytics helps companies optimize their operations, improve efficiency, and understand consumer needs.

Despite the positive growth trajectory, the online car-hailing platform market faces several challenges and restraints. Stringent government regulations regarding licensing, insurance, and safety standards can significantly impact operational costs and profitability. The evolving regulatory landscape varies across different regions, creating complexity for companies seeking to operate internationally. Competition is fierce, with established players constantly battling for market share, forcing companies to innovate and invest heavily in marketing and technology to stay ahead. Driver shortages and labor disputes can disrupt operations and negatively impact service availability, particularly during peak demand periods. The safety and security of both passengers and drivers remain paramount, with concerns about incidents such as accidents, harassment, and fraudulent activities requiring continuous improvement in safety protocols and background checks. Fluctuating fuel prices directly impact driver earnings and operational costs, posing challenges to maintaining profitability in the long term. Finally, the significant initial investment required to develop robust technology platforms, secure adequate funding, and expand into new markets can act as a barrier to entry for smaller companies.

The online car-hailing market exhibits geographical variance in its dominance. While North America and Europe boast strong mature markets, Asia-Pacific, particularly India and Southeast Asia, demonstrates exceptional growth potential fueled by burgeoning populations and rapid urbanization. Within market segments, the Full-Time Online Car-Hailing Platform is expected to maintain a leading position due to its ability to offer consistent and reliable service. This segment benefits from drivers dedicated to the platform, potentially leading to higher overall service quality and greater customer satisfaction.

Asia-Pacific (India, China, Southeast Asia): This region is experiencing explosive growth due to rising urbanization, increasing smartphone penetration, and a growing middle class with higher disposable incomes. The sheer volume of potential users makes this region incredibly attractive.

North America (US, Canada): While the market is mature here, consistent innovation and integration with other mobility solutions sustain strong market performance. The high level of technological advancement fuels a continuous improvement cycle.

Europe: Europe's market is characterized by a strong regulatory environment and varying levels of adoption across different countries. However, the presence of large cities and developed economies provides a substantial market base.

Full-Time Online Car-Hailing Platform: This segment offers greater reliability and predictability for both passengers and the platform itself, leading to a stronger market position. The dedicated nature of full-time drivers results in better driver retention and improved service consistency.

Android System Application: Given the global market share of Android devices, the platform's availability on this operating system is crucial for market penetration and access to a vast customer base.

Several factors are accelerating the growth of the online car-hailing platform industry. The increasing integration of ride-sharing options provides increased efficiency and cost savings. The incorporation of AI-powered features, including smart route optimization, improved safety measures, and enhanced customer service, leads to improved user experience. Furthermore, government initiatives focused on promoting sustainable transportation systems are creating a favorable environment for the adoption of car-hailing platforms, especially those incorporating electric and hybrid vehicles.

This report provides a comprehensive overview of the online car-hailing platform market, covering its current state, future trends, and key players. It offers in-depth analysis of market segments, regional variations, driving forces, challenges, and growth catalysts. The detailed market forecast allows stakeholders to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Uber Technologies, Lyft, ANI Technologies, Gojek, Wingz, Easy Taxi, Free Now, GrabTaxi, Curb, Junoride, FastGo, Didi Chuxing, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Car-Hailing Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Car-Hailing Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.