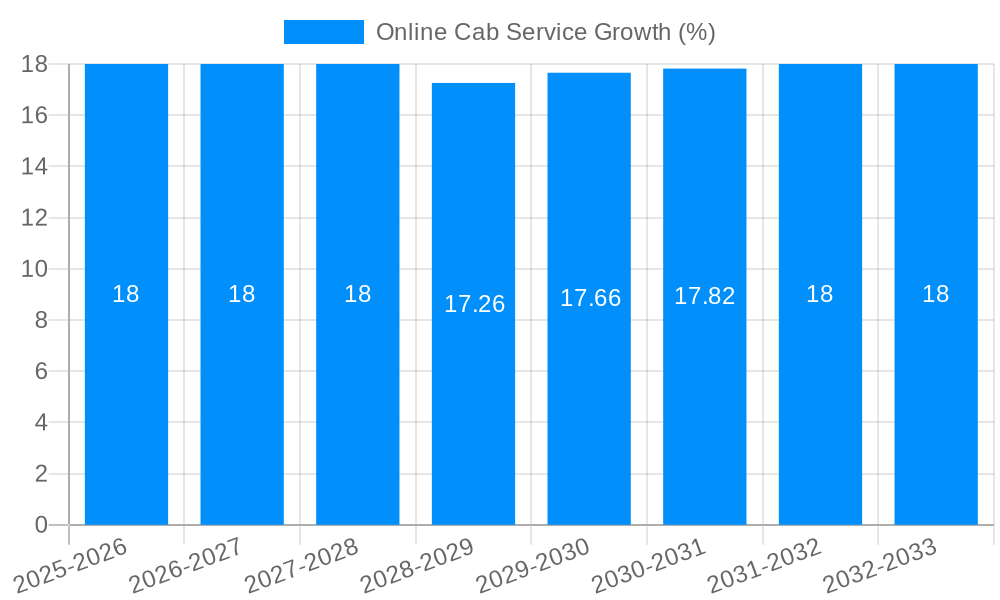

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Cab Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Cab Service

Online Cab ServiceOnline Cab Service by Type (E-Hailing, Car Rentals, Radio Cabs), by Application (Business, Entertainment, Advertising, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

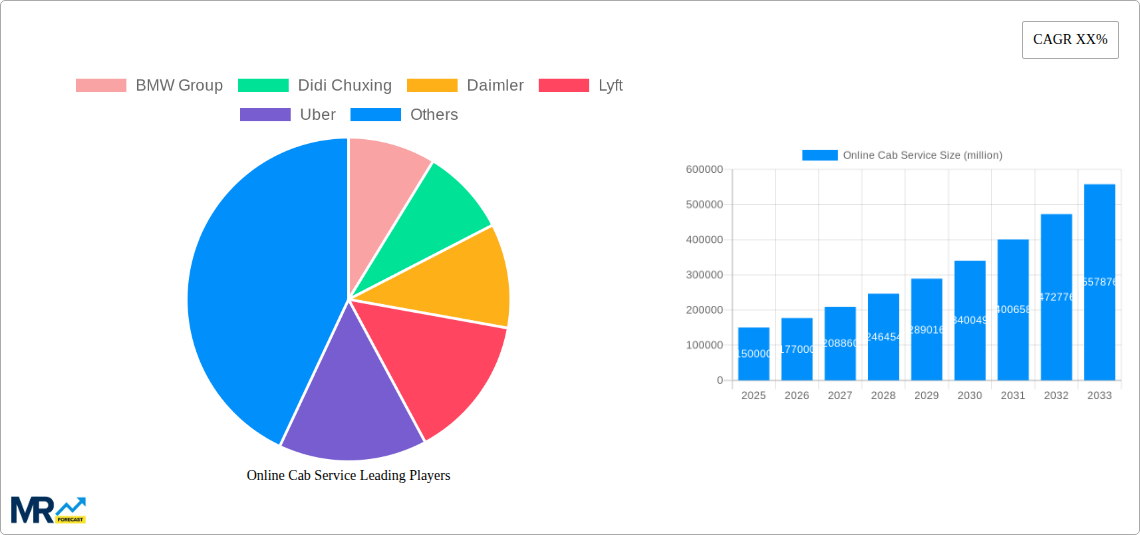

The global online cab service market is experiencing robust growth, driven by increasing smartphone penetration, urbanization, and a rising preference for convenient and affordable transportation options. The market, segmented by service type (e-hailing, car rentals, radio cabs) and application (business, entertainment, advertising, others), showcases a diverse landscape with significant potential. Major players like Uber, Lyft, Didi Chuxing, and Grab dominate the market, leveraging technological advancements and strategic partnerships to expand their reach and service offerings. While the exact market size for 2025 is not provided, considering a plausible CAGR of 15% (a conservative estimate given the sector's historical growth) and assuming a 2019 market size of $150 billion (a reasonable estimation based on industry reports), the 2025 market size would be approximately $300 billion. This substantial valuation reflects the market's maturity and the continuous expansion into new geographical regions. The market's growth is influenced by factors such as increasing disposable incomes in developing economies, the integration of advanced technologies like AI and machine learning for better route optimization and surge pricing, and the rising adoption of ride-sharing services for both personal and business purposes.

However, the market also faces challenges. Regulatory hurdles in different countries, concerns about driver safety and security, and competition from traditional taxi services and public transportation pose significant restraints. Furthermore, fluctuations in fuel prices and economic downturns can impact the overall market growth. Despite these challenges, the long-term outlook for the online cab service market remains positive, with continuous innovation and expansion anticipated in the coming years. The market's future will be shaped by companies' abilities to adapt to evolving consumer preferences, navigate regulatory landscapes, and leverage technological advancements to enhance efficiency and user experience. The focus on sustainable transportation options and the increasing adoption of electric vehicles within the fleet will also play a significant role in shaping the industry's future trajectory.

The online cab service market experienced explosive growth throughout the historical period (2019-2024), driven by increasing smartphone penetration, urbanization, and a growing preference for convenient and affordable transportation options. The market's value soared into the tens of billions of dollars, with key players like Uber and Didi Chuxing dominating significant regional markets. However, the COVID-19 pandemic caused a temporary downturn in 2020, impacting ridership and revenue. Despite this setback, the market demonstrated remarkable resilience, quickly rebounding as restrictions eased and consumer confidence returned. The base year (2025) reveals a market already surpassing previous highs, indicating a strong recovery and continued growth trajectory. The forecast period (2025-2033) anticipates sustained expansion, fueled by technological advancements, evolving consumer preferences, and the integration of online cab services into broader mobility ecosystems. This growth will likely be uneven across different segments, with e-hailing services expected to maintain their dominant position, while other segments like car rentals and radio cabs may experience more moderate growth. The focus on sustainability and the rise of electric vehicle fleets are expected to further reshape the market landscape in the coming years, driving demand for environmentally friendly transportation options. The increasing use of data analytics and AI-powered optimization tools by service providers is also expected to enhance operational efficiency and improve the user experience. Furthermore, the ongoing integration of online cab services with other transportation modes, such as public transit and bike-sharing, will create a more integrated and efficient urban transportation system, leading to the further expansion of the market. The market's success hinges on addressing challenges related to driver compensation, regulatory frameworks, and maintaining consistent service quality to sustain future growth.

Several factors are propelling the growth of the online cab service market. Firstly, the widespread adoption of smartphones and mobile internet access has made booking a cab incredibly convenient. Users can easily compare prices, track their ride in real-time, and make payments digitally. Secondly, urbanization and the increasing congestion in major cities are driving demand for efficient transportation alternatives. Online cab services offer a quicker and often more comfortable mode of transport compared to public transportation in many situations. Thirdly, the cost-effectiveness of online cab services, especially for short to medium distances, is a major attraction for many consumers. Dynamic pricing models may fluctuate, but generally, the overall cost competitiveness remains a driving factor. Fourthly, the emergence of innovative features such as ride-sharing, carpooling options, and premium service tiers caters to a wider range of user preferences and budgets. This differentiation allows providers to reach diverse customer segments. Finally, the continuous improvement in service technology, including AI-driven route optimization and improved safety features, enhances user experience and trust in the service. These factors combined contribute to the rapid growth and sustained popularity of online cab services globally.

Despite the significant growth, the online cab service market faces several challenges. One primary concern is regulatory uncertainty and varying legal frameworks across different regions. These inconsistencies can hinder operations and increase compliance costs for providers. Another challenge is the intense competition within the market, which puts pressure on pricing and profit margins. The need for continuous investment in technology and infrastructure to maintain a competitive edge also presents a significant financial burden. Furthermore, the safety and security of both passengers and drivers are ongoing concerns, requiring robust background checks, safety protocols, and emergency response systems. Driver compensation and working conditions remain a point of contention in many markets, leading to protests and regulatory scrutiny. Fluctuations in fuel prices significantly impact operational costs and can affect profitability. Finally, the dependence on technology also exposes the industry to cyber security threats and data breaches, requiring substantial investment in secure systems. Addressing these challenges will be crucial for sustainable growth and maintaining public trust in the online cab service industry.

The e-hailing segment is poised to dominate the online cab service market throughout the forecast period (2025-2033). This segment's convenience and widespread adoption contribute to its leading position.

E-hailing's dominance: E-hailing services account for a substantial majority of the market share, benefiting from ease of use, real-time tracking, and mobile payment integration. This segment shows robust growth potential due to continuous technological enhancements and expanding geographic reach.

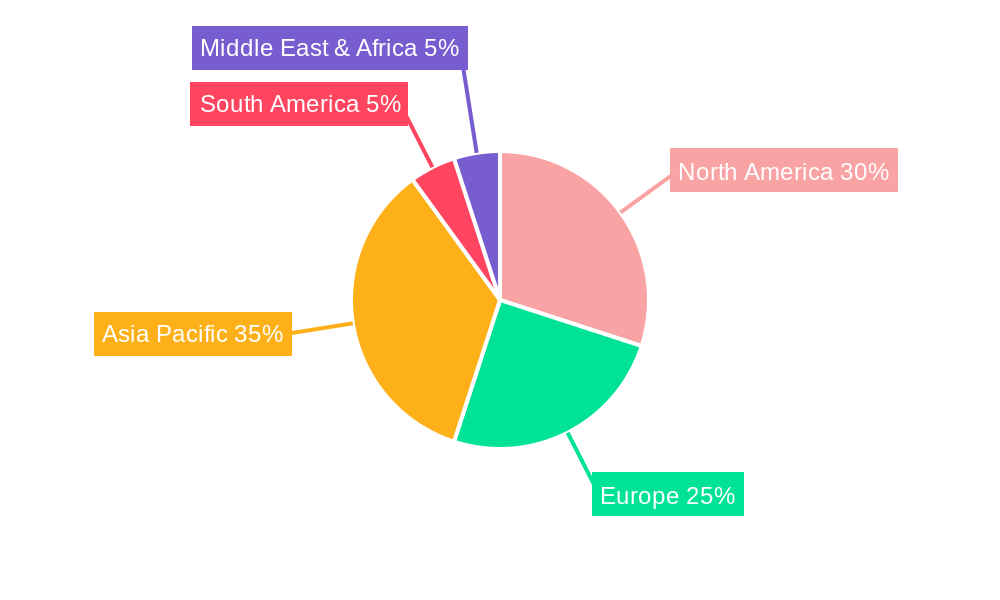

Geographic variations: While growth will be global, key regions are expected to lead the charge. Asia, particularly China and Southeast Asia, are predicted to remain major markets due to high population density and increasing urbanization. North America and Europe will also contribute significantly, but at a potentially slower rate compared to Asia's rapid growth.

Business Application: The business application of e-hailing services shows immense potential. Corporations and businesses increasingly utilize these services for employee transportation, client meetings, and other business-related travel needs. The forecast projects significant growth in this segment as businesses recognize the efficiency and cost-effectiveness benefits. The demand for corporate accounts and tailored business solutions will further fuel this growth.

Future Trends: The integration of e-hailing platforms with other modes of transportation (public transit, bike-sharing) will increase the segment's value and appeal. The expansion into new markets and regions, and the introduction of innovative pricing and service models, are set to further consolidate the e-hailing segment's position. The focus on sustainability, with electric and hybrid vehicles becoming more prevalent within fleets, will further enhance the appeal of e-hailing services to environmentally-conscious consumers and businesses.

The online cab service industry's growth is fueled by several factors, including technological advancements, such as AI-powered route optimization and predictive analytics improving efficiency and reducing costs. Increasing smartphone penetration and mobile internet connectivity expand the potential user base. The expansion into underserved markets and the development of innovative service models, such as ride-sharing and subscription services, also contribute significantly to market growth. Finally, the growing awareness of environmental concerns is creating demand for eco-friendly transportation solutions, including electric vehicle fleets.

This report provides a comprehensive analysis of the online cab service market, covering historical performance, current market dynamics, and future growth projections. The report examines key trends, driving forces, challenges, and opportunities, offering valuable insights for businesses, investors, and policymakers. The detailed segmentation analysis, regional breakdown, and competitive landscape analysis provide a complete overview of this dynamic sector. The report also identifies key growth catalysts and discusses the impact of technological advancements, regulatory changes, and evolving consumer preferences on market development.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BMW Group, Didi Chuxing, Daimler, Lyft, Uber, BiTaksi, Cabify, Grab, Gett, GoCatch, Ingogo, LeCab, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Cab Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Cab Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.