1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Action and Adventure Games?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Action and Adventure Games

Online Action and Adventure GamesOnline Action and Adventure Games by Type (/> PC Games, Mobile Games), by Application (/> Male, Female), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

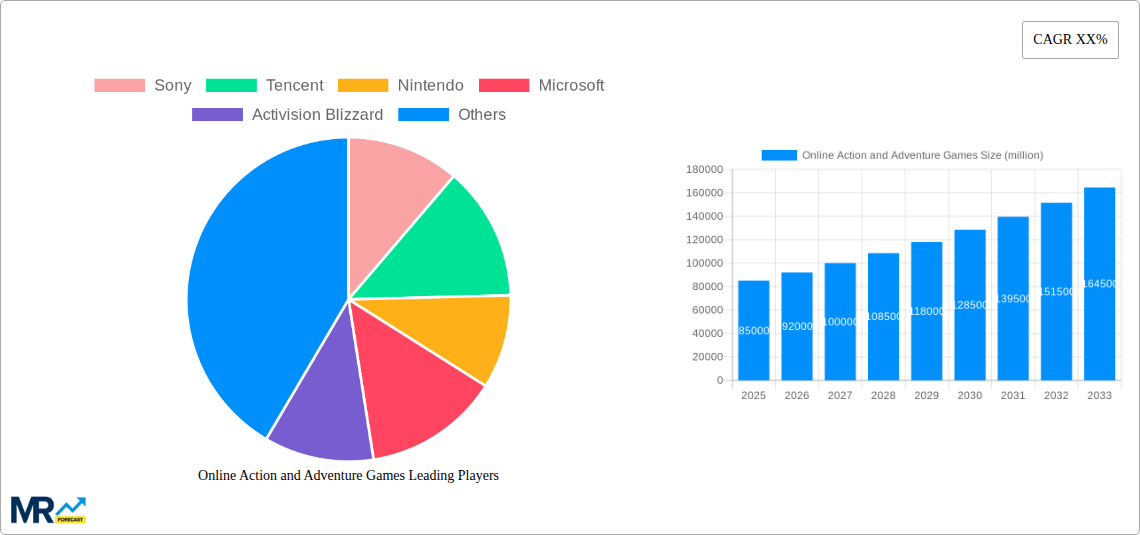

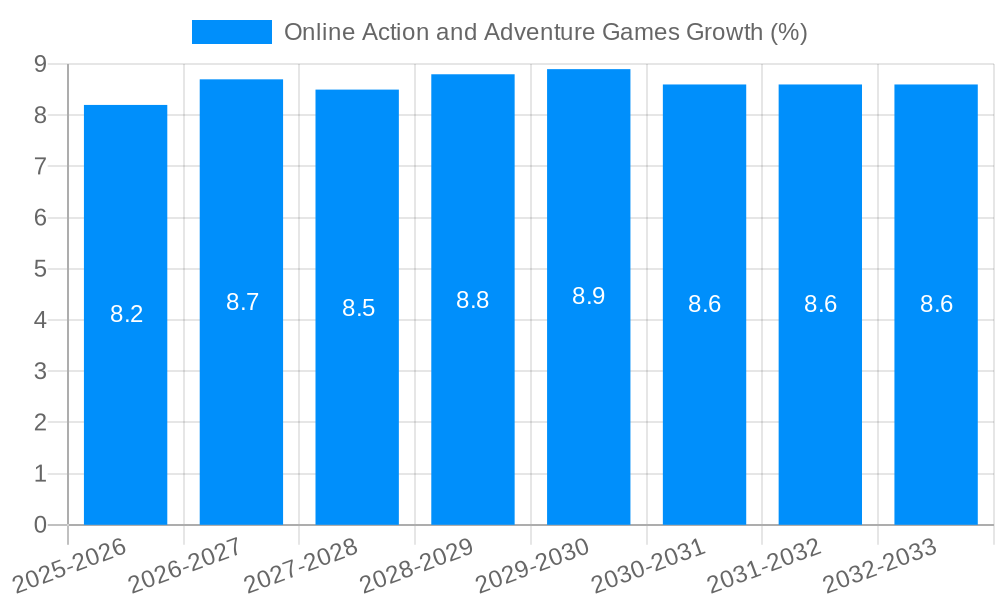

The global online action and adventure games market is poised for significant expansion, projected to reach approximately USD XXXX million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. This impressive trajectory is primarily fueled by the increasing penetration of high-speed internet and mobile devices worldwide, making immersive gaming experiences more accessible than ever. The burgeoning popularity of esports, coupled with the continuous innovation in game development, including the integration of advanced graphics, virtual reality (VR), and augmented reality (AR) technologies, are key drivers propelling market growth. Furthermore, the social aspect of online gaming, allowing players to connect and compete with others globally, fosters sustained engagement and contributes to the market's upward momentum.

The market is segmented into PC games and mobile games, with mobile gaming expected to command a dominant share due to the widespread adoption of smartphones and the availability of a vast array of free-to-play and microtransaction-based titles. On the application front, both male and female demographics are showing increasing engagement, with a growing number of female players participating in action and adventure titles, driven by more diverse narratives and accessible gameplay mechanics. Key players such as Sony, Tencent, Nintendo, Microsoft, and Activision Blizzard are heavily investing in R&D and strategic partnerships to capture a larger market share. Restraints, such as concerns over addiction and the high cost of developing AAA titles, are being addressed through responsible gaming initiatives and the exploration of alternative monetization models. Emerging trends include the rise of cloud gaming, cross-platform play, and the metaverse, which promise to redefine the gaming landscape and offer new avenues for growth.

This report provides an in-depth analysis of the global Online Action and Adventure Games market, encompassing a comprehensive study of trends, driving forces, challenges, and regional dynamics from the historical period of 2019-2024 to the estimated future of 2025 and extending through the forecast period of 2025-2033. The market is segmented by Type into PC Games and Mobile Games, and by Application into Male and Female demographics. Key industry developments and growth catalysts shaping this dynamic sector are meticulously examined.

XXX The global online action and adventure games market is experiencing an unprecedented surge in engagement and revenue, projected to reach a valuation exceeding 150 million units by 2025, with a robust trajectory expected throughout the forecast period of 2025-2033. This growth is fueled by a confluence of technological advancements, evolving player preferences, and the increasing accessibility of gaming platforms. The PC Games segment continues to be a cornerstone of the market, driven by the demand for high-fidelity graphics and immersive gameplay experiences, attracting an estimated 75 million PC players by the base year of 2025. Simultaneously, the Mobile Games segment is witnessing exponential expansion, projected to encompass over 80 million mobile players by 2025, owing to the widespread adoption of smartphones and tablets, coupled with increasingly sophisticated mobile gaming infrastructure. The Male demographic currently leads in market penetration, estimated at 90 million players in 2025, but the Female demographic is rapidly closing the gap, showing significant growth potential and expected to reach 65 million players by the same year. Innovations in gameplay mechanics, the rise of free-to-play models with lucrative in-app purchase opportunities, and the continuous release of new, compelling titles are key indicators of the market's robust health. Furthermore, the integration of cloud gaming technologies is set to democratize access to high-end gaming experiences, further broadening the player base and driving market expansion. The study period of 2019-2033 will witness a significant shift in how players interact with these games, moving towards more persistent online worlds, cooperative play, and user-generated content, all contributing to sustained growth and evolving revenue streams. The estimated year of 2025 serves as a crucial inflection point, with significant investments in R&D and content creation expected to solidify market dominance for leading players.

The burgeoning success of online action and adventure games is propelled by a multifaceted array of driving forces. Foremost among these is the relentless evolution of technological advancements. High-speed internet connectivity, including the widespread adoption of 5G networks, has drastically reduced latency and enabled seamless multiplayer experiences, making online gaming more accessible and enjoyable than ever before. Simultaneously, graphical capabilities on both PC and mobile platforms have reached new heights, offering breathtaking visuals and immersive environments that captivate players. The increasing accessibility and affordability of gaming hardware, particularly smartphones which have become ubiquitous, have democratized gaming, bringing it to a much wider audience. Furthermore, the proliferation of free-to-play (F2P) business models, often coupled with lucrative in-app purchase options and battle passes, has significantly lowered the barrier to entry for new players, fostering massive user bases. The growing influence of esports and streaming platforms like Twitch and YouTube Gaming has also played a pivotal role, creating aspirational figures and fostering a sense of community, further driving engagement and sales. The constant release of high-quality, engaging content by major publishers and independent developers alike ensures a continuous stream of fresh experiences, keeping players invested and attracting new ones.

Despite its impressive growth trajectory, the online action and adventure games market is not without its significant challenges and restraints. One of the primary concerns is the increasing cost of game development. Producing visually stunning and technologically advanced titles requires substantial investment in research and development, talent acquisition, and marketing, which can be a substantial barrier for smaller studios. Intense market competition is another formidable hurdle, with a constant influx of new titles vying for player attention and disposable income. This saturation can lead to difficulties in achieving discoverability and retaining players. Furthermore, player churn and retention remain critical issues. Maintaining player engagement over extended periods requires continuous content updates, balance adjustments, and community management, which can be resource-intensive. Monetization strategies also present a delicate balancing act. While F2P models drive accessibility, aggressive or perceived "pay-to-win" mechanics can alienate players and damage a game's reputation, leading to negative word-of-mouth and decreased revenue. The ever-evolving landscape of cybersecurity threats, including hacking, cheating, and account theft, poses a constant risk to player trust and data integrity, necessitating robust security measures. Lastly, regulatory scrutiny and evolving content policies in various regions can impact game design, distribution, and monetization practices, requiring developers to adapt and comply.

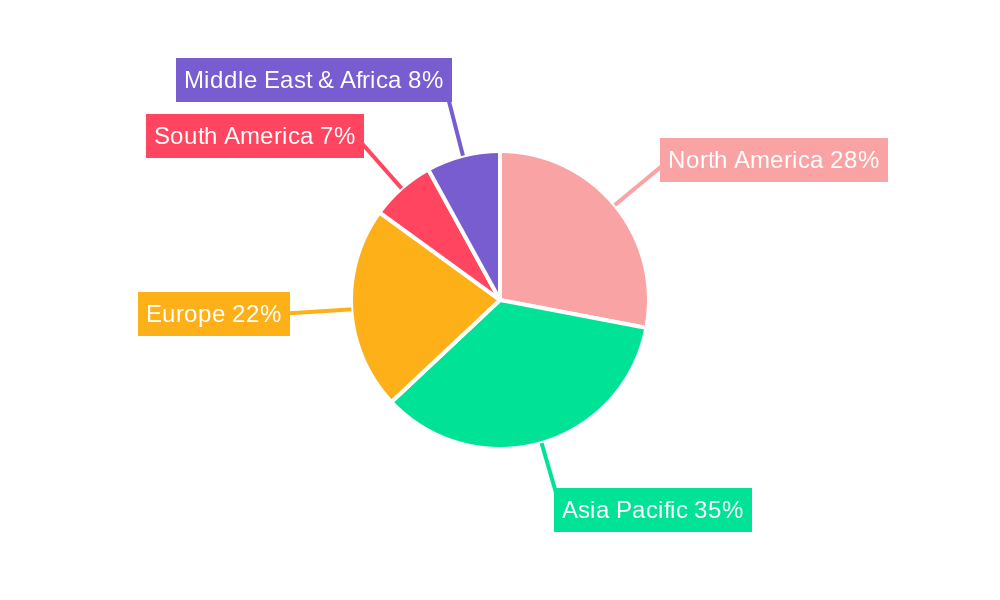

The online action and adventure games market is characterized by distinct regional dominance and segment-specific growth, with Asia-Pacific emerging as the undisputed leader, projected to hold a significant market share of over 40% by 2025. This dominance is primarily driven by the colossal player base in countries like China and India, where mobile gaming penetration is exceptionally high. The Mobile Games segment within Asia-Pacific is expected to be the most lucrative, fueled by the widespread availability of affordable smartphones and a culture that embraces mobile entertainment. The estimated number of mobile players in this region alone is projected to exceed 50 million by 2025. Within this segment, the Male demographic continues to be the primary consumer, accounting for an estimated 30 million players in 2025, attracted by the fast-paced action and competitive nature of many mobile titles. However, the Female demographic is showing remarkable growth, with an estimated 25 million players expected by 2025, driven by the increasing popularity of social gaming features and more diverse gameplay options.

Beyond Asia-Pacific, North America and Europe represent significant markets, with a strong preference for the PC Games segment. In North America, the PC market is estimated to reach 30 million players by 2025, driven by a long-standing gaming culture and the availability of high-end gaming PCs. Here, the Male demographic also leads, with an estimated 18 million players, though the Female demographic is rapidly expanding its presence, projected to reach 12 million players by 2025. Europe mirrors this trend, with a robust PC gaming ecosystem and an estimated 25 million PC players by 2025, predominantly Male (15 million players), with a growing Female player base (10 million players).

The Application segmentation reveals that while both Male and Female demographics are substantial, the sheer volume of male gamers in action and adventure genres, particularly in mobile gaming in Asia-Pacific, gives them a larger current share. However, the rapid growth rate within the Female demographic, especially in newer markets and on PC platforms in Western regions, indicates a significant future expansion opportunity. The continuous development of narrative-driven games, cooperative experiences, and community-focused features is actively broadening the appeal to a more diverse audience, ensuring sustained growth across all demographics and regions throughout the study period of 2019-2033.

Several key growth catalysts are propelling the online action and adventure games industry forward. The advancement in cloud gaming technologies is democratizing access to high-fidelity gaming experiences, allowing players to enjoy AAA titles on less powerful devices and reducing hardware costs. The increasing integration of Artificial Intelligence (AI) is leading to more dynamic and responsive gameplay, sophisticated NPC behavior, and personalized player experiences, enhancing immersion and replayability. The rise of the metaverse and persistent virtual worlds is creating new avenues for social interaction, exploration, and content creation within games, fostering deeper player engagement. Furthermore, the growing popularity of user-generated content (UGC) empowers players to become creators, fostering vibrant communities and extending the lifespan of games. The continuous innovation in monetization models, such as season passes and subscription services, offers diverse revenue streams that support ongoing development and content delivery.

This comprehensive report delves into the intricate workings of the online action and adventure games market, offering a detailed roadmap for stakeholders. Beyond the market size and forecast, it provides a granular analysis of the competitive landscape, dissecting the strategies of leading players such as Sony, Tencent, Nintendo, and Microsoft. The report meticulously examines the impact of technological innovations, from cloud gaming and AI integration to advancements in VR/AR, and their role in shaping future gameplay experiences. It also explores the evolving consumer preferences, with a particular focus on the growing influence of the female demographic and the increasing demand for diverse narratives and inclusive gameplay. Furthermore, the report sheds light on the regulatory environment and ethical considerations surrounding loot boxes, in-app purchases, and data privacy, offering insights into potential future shifts. By covering both the PC and mobile segments, and segmenting by demographic, this report provides a holistic view essential for strategic decision-making and identifying untapped opportunities within this dynamic and rapidly expanding industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sony, Tencent, Nintendo, Microsoft, Activision Blizzard, Electronic Arts, Epic Games, Take-Two Interactive, Sega Sammy, Bandai Namco, Apple, Sea (Garena), King, Ubisoft, Square Enix, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Action and Adventure Games," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Action and Adventure Games, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.