1. What is the projected Compound Annual Growth Rate (CAGR) of the Offshore Company Registration?

The projected CAGR is approximately 15%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Offshore Company Registration

Offshore Company RegistrationOffshore Company Registration by Application (Cross-border E-commerce, Foreign Trade Company), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

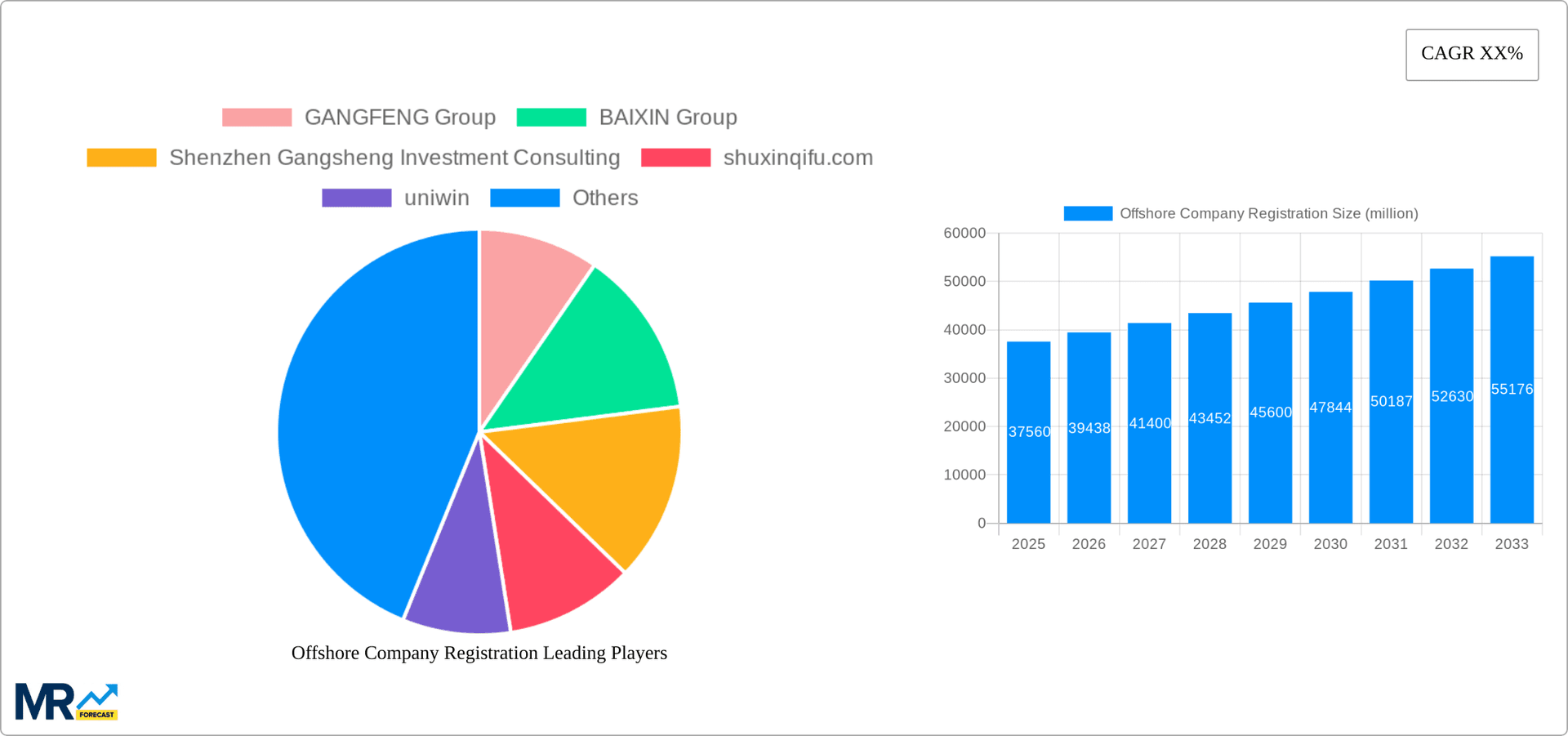

The offshore company registration market, valued at $24,770 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.1% from 2025 to 2033. This growth is fueled by several key drivers. Increasing globalization and the need for businesses to expand internationally are prominent factors. Furthermore, favorable tax regulations and streamlined business incorporation processes in certain offshore jurisdictions attract numerous entrepreneurs and multinational corporations seeking to optimize their financial structures and minimize tax liabilities. The rising popularity of e-commerce and cross-border transactions further bolsters demand for offshore company registration services. While specific restraints are not detailed, potential challenges could include regulatory changes in various jurisdictions, evolving anti-money laundering (AML) and know-your-customer (KYC) regulations, and increasing competition among service providers. The market is segmented by application (cross-border e-commerce and foreign trade companies) indicating a strong dependence on international trade activities. Leading players like Gangfeng Group and Baixin Group are shaping the market landscape, signifying a competitive yet dynamic market environment.

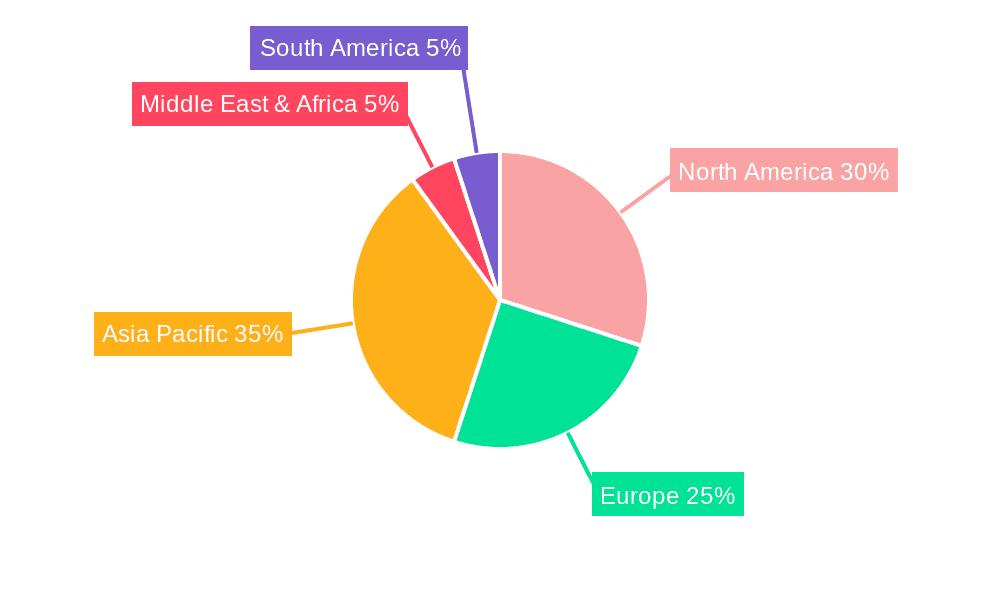

The regional distribution of the market is expected to reflect existing global trade patterns, with North America, Europe, and Asia-Pacific representing significant market segments. The continued growth in emerging economies will likely drive substantial future growth within the Asia-Pacific region. The forecast period of 2025-2033 is projected to witness a considerable expansion in the market size, driven by the aforementioned factors. The historical period (2019-2024) likely saw a steady growth trajectory, laying the foundation for the robust expansion anticipated in the coming years. A thorough understanding of the regulatory landscape in different jurisdictions, coupled with proactive adaptation to evolving international business practices, will be crucial for sustained success within this market. Companies offering comprehensive and compliant services will be best positioned to capitalize on the market's growth potential.

The offshore company registration market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to reach $YY million by 2033. This signifies a Compound Annual Growth Rate (CAGR) of ZZ% during the forecast period (2025-2033). Analysis of historical data (2019-2024) reveals a steady upward trajectory, accelerated in recent years by several key factors. The increasing complexity of global trade regulations and the desire for tax optimization are major drivers. Businesses, particularly those engaged in cross-border e-commerce and foreign trade, are increasingly seeking offshore jurisdictions to streamline operations and reduce their tax burden. This trend is further fueled by the expansion of digital economies and the rise of multinational corporations seeking efficient international structures. The market demonstrates a clear preference for regions offering robust legal frameworks, political stability, and attractive tax incentives. Competition among offshore jurisdictions is intense, leading to a continuous refinement of services and a focus on attracting high-value clients. The market is further segmented by company size and industry, with larger enterprises and technology companies driving a significant portion of the growth. The emergence of specialized service providers offering comprehensive registration and compliance solutions is also shaping the market landscape. The study period (2019-2033) highlights a clear shift towards greater sophistication and demand for specialized services within the offshore company registration sector. Market players are responding by investing in technology and expanding their service offerings to meet evolving client needs.

Several key factors are propelling the growth of the offshore company registration market. Firstly, the increasing globalization of businesses necessitates streamlined international operations. Offshore registration provides a strategic advantage by simplifying cross-border transactions, facilitating access to international markets, and protecting intellectual property. Secondly, tax optimization remains a major incentive. Many offshore jurisdictions offer attractive tax regimes, allowing companies to reduce their overall tax burden and enhance profitability. Thirdly, asset protection is a crucial driver. Offshore company structures can provide a layer of protection against legal liabilities and potential risks associated with international business operations. Finally, regulatory compliance, while complex, also contributes to the market’s growth. The need for expert guidance in navigating intricate regulations associated with offshore company setup drives demand for specialized services and professionals. The increasing sophistication of international tax laws further emphasizes this need, and companies are willing to invest in these services to avoid penalties and maintain compliance. The growth of cross-border e-commerce and foreign trade, coupled with the need for efficient and secure international business structures, is further accelerating this trend.

Despite the significant growth, the offshore company registration market faces several challenges and restraints. Firstly, the ever-evolving regulatory landscape presents complexities and compliance hurdles. International regulations, including those related to anti-money laundering (AML) and know-your-customer (KYC) initiatives, impose stringent requirements on offshore jurisdictions and registered companies. This necessitates continuous adaptation and investment in compliance measures. Secondly, reputational risks associated with certain offshore jurisdictions pose a significant challenge. Negative perceptions linked to tax evasion or lack of transparency can hinder growth and negatively affect client confidence. Thirdly, competition within the market is fierce, with numerous service providers vying for market share. This necessitates a focus on providing differentiated and high-quality services to retain clients and gain a competitive edge. Finally, geopolitical instability and economic fluctuations in certain regions can create uncertainty and negatively impact market growth. Companies must carefully assess the long-term stability and risks associated with different jurisdictions before choosing where to register their offshore entities. The increasing scrutiny from international organizations regarding tax avoidance further adds to the challenges faced by the industry.

The market for offshore company registration is geographically diverse, but certain regions and segments are showing particularly strong growth. Focusing on the Foreign Trade Company segment:

Asia-Pacific: This region is experiencing significant growth due to its expanding economies and increasing participation in global trade. Countries like Singapore, Hong Kong, and the British Virgin Islands are popular choices for foreign trade companies seeking offshore registration. The region's robust infrastructure and strategic location contribute to its appeal. The streamlined regulatory processes and business-friendly environment further enhance its attractiveness. Several countries within the Asia-Pacific region are actively promoting themselves as attractive locations for offshore company registration, resulting in considerable competition. The rising number of foreign trade companies seeking international expansion and tax optimization is fueling demand for registration services in this region. Growth within the Foreign Trade Company segment is likely to surpass other sectors, driven by an increasing need for efficient international trade structures.

Europe: While traditional European offshore centers maintain a presence, the focus is shifting towards compliance and transparency. Countries like the UK and Ireland, despite Brexit-related adjustments, are still attractive for their established legal frameworks and access to the European market. The European Union's focus on regulatory compliance requires careful navigation by companies seeking to register in these jurisdictions. The robust legal systems and efficient processes in certain European countries make them attractive for foreign trade companies despite the changing regulatory landscape.

Segment Dominance: The Foreign Trade Company segment is expected to dominate the market over the forecast period due to the increasing complexity and volume of international trade. Companies involved in foreign trade face numerous regulatory hurdles and require efficient structures to manage their cross-border operations. Offshore registration provides a strategic solution to simplify these operations, optimize tax implications, and mitigate potential risks. This segment is further driven by the rise of e-commerce and globalization of supply chains.

The offshore company registration industry is experiencing a surge in demand fueled by several key catalysts. The increasing globalization of businesses and the expansion of e-commerce are creating a significant need for efficient international structures. Tax optimization remains a primary driver, with businesses actively seeking jurisdictions offering favorable tax regimes. Furthermore, the need for robust asset protection and the desire to streamline international operations are contributing to the market's growth. The rising complexity of regulatory compliance further fuels demand for specialized services in this sector.

This report offers a comprehensive overview of the offshore company registration market, providing in-depth analysis of market trends, driving forces, challenges, key players, and future growth prospects. It identifies key regions and segments dominating the market and analyzes the impact of regulatory changes. The report utilizes historical data, market estimations, and future projections to provide valuable insights for businesses and stakeholders involved in the offshore company registration industry. The report's detailed analysis of the various market segments and leading players facilitates informed decision-making in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15%.

Key companies in the market include GANGFENG Group, BAIXIN Group, Shenzhen Gangsheng Investment Consulting, shuxinqifu.com, uniwin, OneStart, Shenzhen Wanqibang Technology Group, E-WANT Consultant, Shenzhen WSH Investment Consulting, .

The market segments include Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Offshore Company Registration," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Offshore Company Registration, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.