1. What is the projected Compound Annual Growth Rate (CAGR) of the Office Sharing?

The projected CAGR is approximately 8.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Office Sharing

Office SharingOffice Sharing by Type (Flexible Lease, Long Lease), by Application (Start-up, Small Business, Interim of Companies, Project-based Company, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

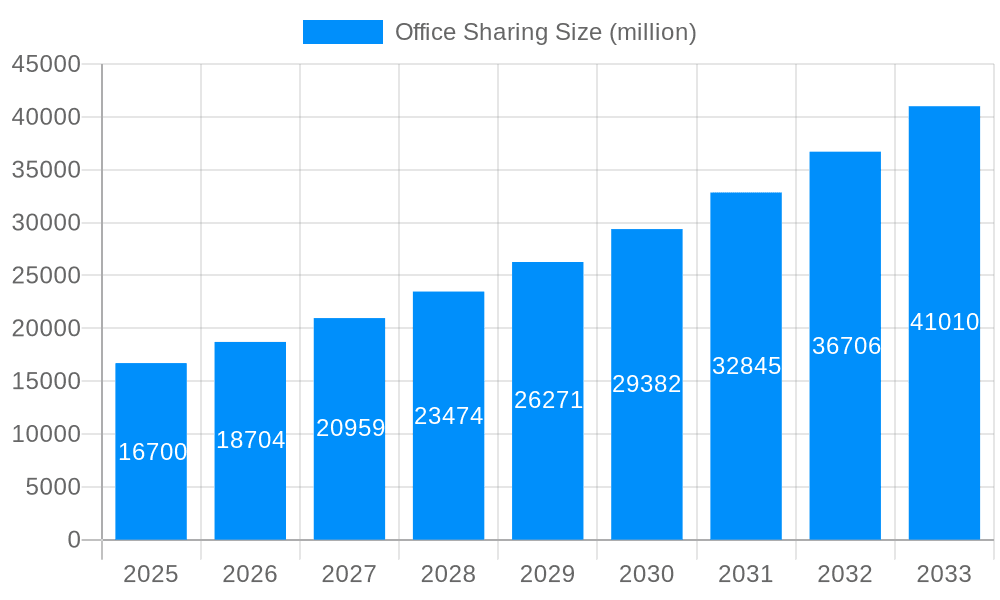

The global office sharing market, valued at $39.18 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.2% from 2025 to 2033. This surge is driven by several key factors. The increasing prevalence of remote work and hybrid work models necessitates flexible office solutions, fueling demand for short-term leases and co-working spaces. Furthermore, startups and small businesses, often lacking the capital for long-term leases, find office sharing cost-effective and conducive to collaboration. The expansion of the gig economy also contributes significantly, as freelancers and independent contractors seek professional yet affordable work environments. Technological advancements, such as improved booking platforms and virtual office solutions, further enhance market accessibility and convenience. Geographic expansion, particularly in developing economies with burgeoning entrepreneurial sectors, is another significant driver. However, challenges remain, including economic downturns which can impact demand, competition from traditional office spaces adapting to modern needs, and concerns about data security and privacy within shared workspaces. The market segmentation reveals a strong preference for flexible lease agreements, with significant demand coming from startups and small businesses.

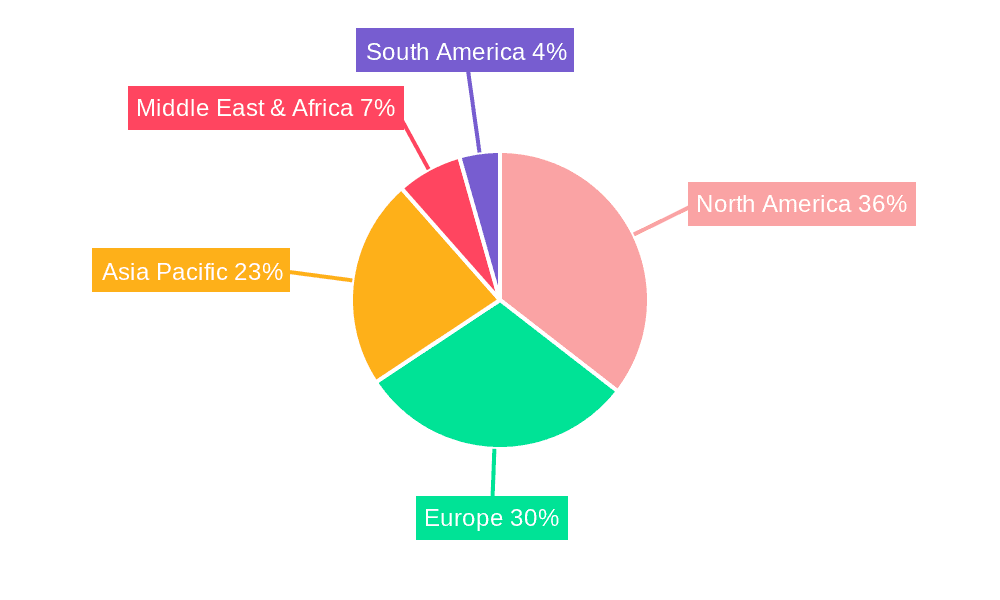

The market's regional distribution reflects global economic trends, with North America and Europe currently holding substantial market shares. However, Asia-Pacific is poised for significant growth driven by rapid urbanization and a burgeoning middle class fostering entrepreneurial activity. Key players in the market, including WeWork, Regus, and IWG, are constantly innovating to offer more sophisticated services and cater to the evolving needs of their diverse clientele, ranging from individual freelancers to large corporations seeking supplementary office space. The continuous adaptation to shifting work patterns, economic cycles, and technological advancements will be pivotal in determining the long-term trajectory of the office sharing market. Competition remains fierce, with ongoing mergers, acquisitions, and the introduction of new technologies likely shaping the landscape in the coming years.

The global office sharing market exhibited robust growth during the historical period (2019-2024), exceeding several million units in transactions. This expansion is projected to continue throughout the forecast period (2025-2033), with the estimated market size in 2025 reaching several million units and further substantial growth anticipated. Key market insights reveal a significant shift in workplace preferences, driven by the increasing adoption of flexible work models and a growing emphasis on cost-efficiency. The rise of startups and small businesses, coupled with the increasing demand for project-based workspaces, has fueled the demand for shared office spaces. The market is characterized by a diverse range of providers, from large multinational corporations like IWG Group and WeWork to smaller, localized operators catering to niche needs. This fragmentation presents both opportunities and challenges, with competition increasing as more players enter the market, while simultaneously creating a richer array of options for diverse business needs. The trend towards hybrid work models has also significantly impacted the market, with businesses seeking flexible solutions that accommodate both remote and in-office workforces. This has led to an increased demand for spaces that offer a blend of collaborative and private work areas, along with advanced technological infrastructure and amenities. The historical data indicates a clear upward trajectory, and this trend is expected to persist, driven by ongoing technological advancements, changing work dynamics, and the evolving needs of businesses across various sectors. The market is highly dynamic, influenced by economic conditions and evolving technological trends, further shaping the growth trajectory in the coming years. This report delves deeper into the factors driving this expansion, the challenges faced by market participants, and a detailed analysis of key market segments.

Several factors contribute to the booming office sharing market. The rise of the gig economy and the increasing prevalence of remote work have created a significant demand for flexible and cost-effective workspace solutions. Startups and small businesses, often operating with limited budgets, find shared offices a more attractive option than traditional long-term leases. The flexibility offered by these spaces allows businesses to scale up or down their workspace as needed, mitigating risks associated with long-term commitments. Furthermore, the collaborative environment fostered in shared offices promotes networking and innovation, providing businesses with opportunities to connect with other professionals and explore potential partnerships. Technological advancements, such as improved communication tools and cloud-based software, have also facilitated remote work and the adoption of flexible work arrangements. The growing awareness of environmental sustainability is also influencing the market, as shared offices often promote resource efficiency and reduce the environmental footprint compared to traditional office spaces. Cost savings on infrastructure, utilities, and administrative overhead are further key drivers attracting businesses to this model. Lastly, the ability to choose location-based offices provides advantages such as proximity to clients or a desired professional atmosphere.

Despite its rapid growth, the office sharing market faces several challenges. Competition is fierce, with numerous providers vying for market share, particularly in major urban centers. Maintaining consistent occupancy rates can be difficult, especially during economic downturns. Security concerns related to shared spaces and data protection are also significant challenges. The reliance on technology for many aspects of managing a shared space also presents challenges in the form of technical issues and cyber security. Furthermore, ensuring a positive and productive working environment that caters to the diverse needs of multiple tenants requires careful management and effective communication. Finding suitable locations with adequate infrastructure and amenities is also a key challenge, particularly in areas with high demand. Lastly, managing the diverse requirements of individual users and businesses within a shared setting requires efficient operational management. These challenges necessitate innovative strategies and robust operational models to ensure sustainable growth and profitability in the office sharing market.

The Start-up segment is poised to dominate the office sharing market throughout the forecast period. This is due to the significant number of startups emerging globally, particularly in major technology hubs. Startups often prioritize flexibility, cost-effectiveness, and access to a collaborative environment, all of which are offered by shared office spaces. Furthermore, many shared office providers actively target startups with tailored services and amenities designed to support their growth. This strategy creates a symbiotic relationship where startups gain access to vital resources and support, while providers benefit from a steady stream of clients. Several key regions are expected to drive significant market growth:

North America: The US and Canada, particularly major metropolitan areas like New York, San Francisco, and Toronto, are expected to see strong growth due to the concentration of startups and a large pool of potential users seeking flexible workspaces.

Europe: Cities such as London, Paris, Berlin, and Amsterdam are key players, benefiting from established startup ecosystems and the increasing adoption of flexible work practices.

Asia-Pacific: The rapid economic growth in regions such as China, India, and Singapore, coupled with a rising number of startups and SMEs, fuels the demand for shared office spaces.

These regions present a combination of robust economic growth, a high density of businesses, and a supportive regulatory environment, contributing to the significant projected market expansion. The dominance of the start-up segment is further reinforced by the increasing trend toward hybrid work models, where even larger companies utilize flexible office spaces to supplement their primary office locations, allowing them to attract and retain top talent by offering work location flexibility.

The increasing adoption of flexible work models, coupled with the growing preference for cost-effective and collaborative work environments, are key growth catalysts for the office sharing industry. Technological advancements supporting remote work and facilitating seamless communication further enhance the appeal of shared spaces. The ongoing urbanization trend also contributes, with densely populated areas creating high demand for efficient and accessible workspace solutions. Finally, a rising awareness of sustainability and the environmental benefits of shared offices reinforces the positive trends driving market growth.

This report offers a comprehensive analysis of the office sharing market, covering historical data, current market trends, and future growth projections. It provides detailed insights into market segmentation, key players, driving forces, challenges, and regional trends. The report is invaluable for businesses seeking to understand and navigate the evolving landscape of the office sharing industry, offering crucial information for strategic decision-making and investment opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.2%.

Key companies in the market include WeWork Companies, Regus, Instant, Gorilla Property Solutions, OREGA MANAGEMENT, Prime Office Search, Servcorp, V•OFFICE, Compass Offices, Novel Coworking, Clockwise Offices, Office Freedom, KNOTEL, The Office Company, FlexOffice, Ecos Office, MAKEOFFICE, MITSUBISHI ESTATE, Startups, Coworker, CEO SUITE, Jumpstart, Spaces, JustCo, IWG Group, .

The market segments include Type, Application.

The market size is estimated to be USD 39180 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Office Sharing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Office Sharing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.