1. What is the projected Compound Annual Growth Rate (CAGR) of the Off-Road Vehicle Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Off-Road Vehicle Insurance

Off-Road Vehicle InsuranceOff-Road Vehicle Insurance by Type (Third Party Insurance, Third Party, Fire and Theft Insurance, Comprehensive Insurance), by Application (Individual, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

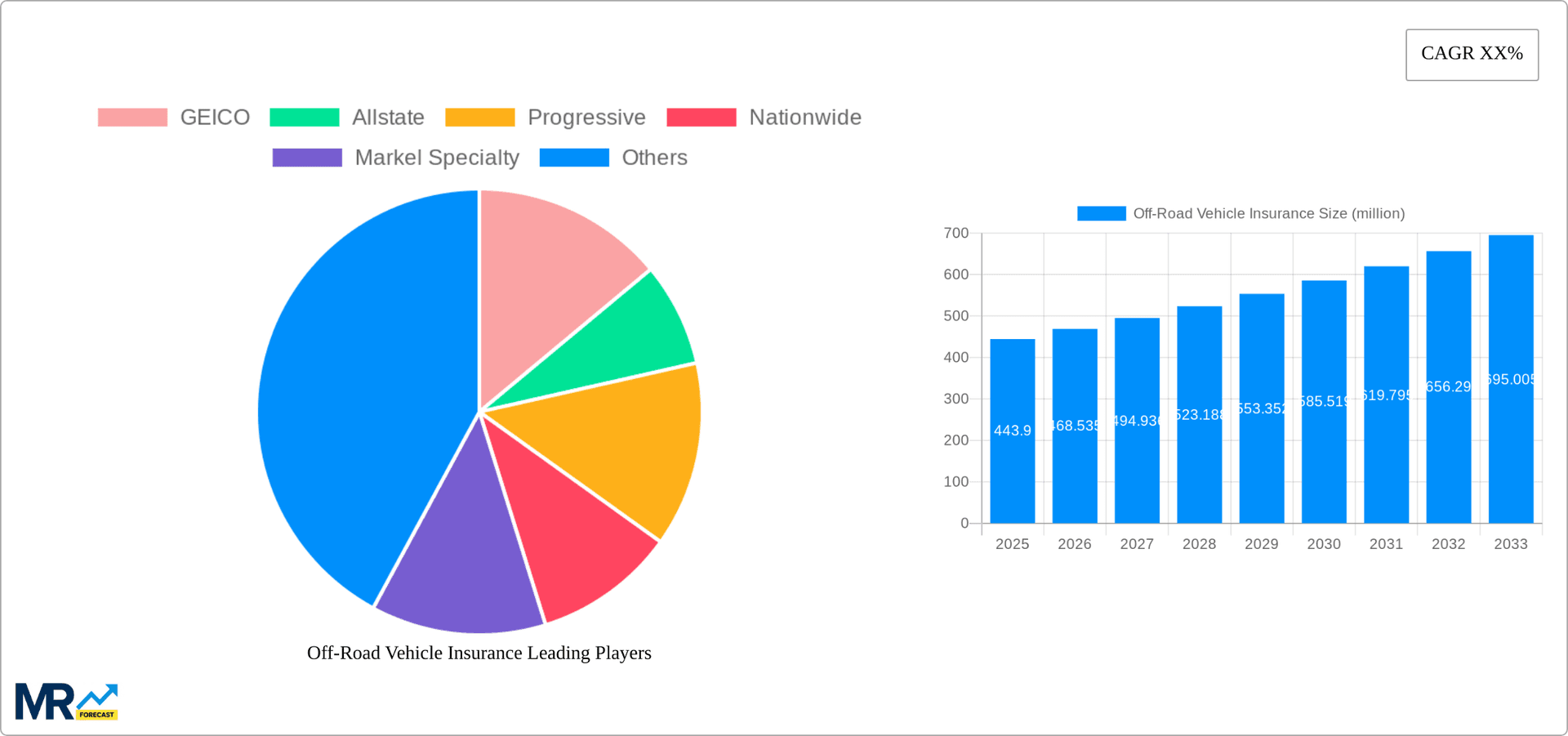

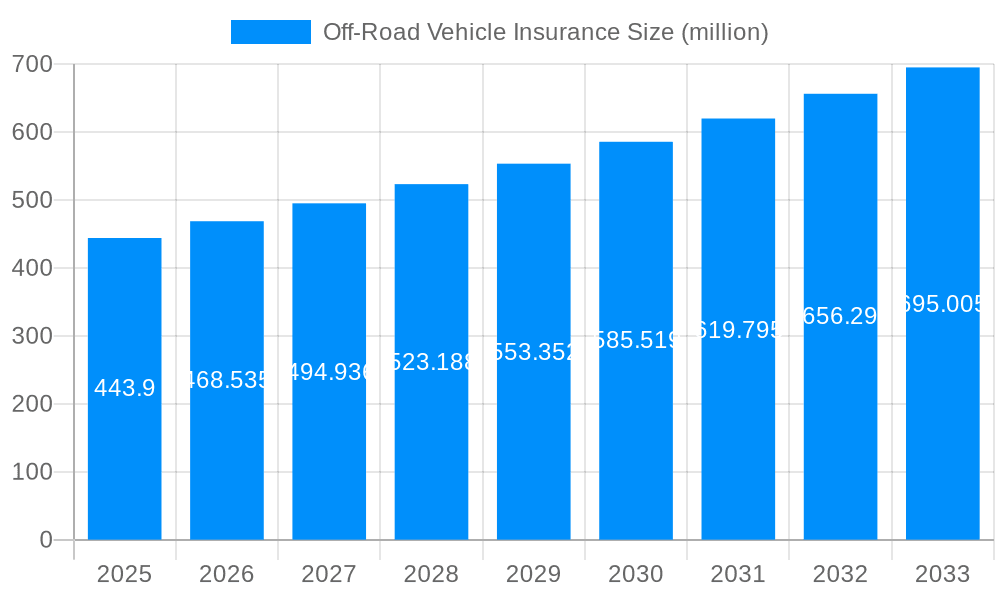

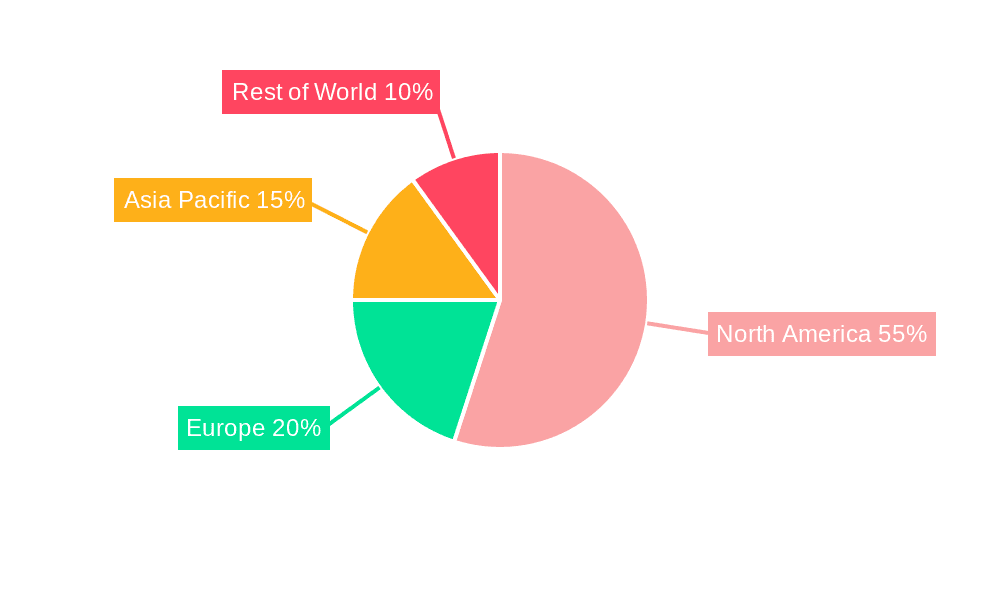

The off-road vehicle (ORV) insurance market, valued at $443.9 million in 2025, is poised for substantial growth. Driven by increasing ORV ownership, particularly among younger demographics and enthusiasts of activities like ATV riding and motocross, the market demonstrates strong potential. Expanding adventure tourism and off-road recreational parks further fuel this demand. The market is segmented by insurance type (third-party, fire and theft, comprehensive) and application (individual, commercial), reflecting diverse consumer needs and risk profiles. While comprehensive coverage offers the most protection, third-party liability insurance remains a crucial component, particularly for commercial operators. Major players like GEICO, Allstate, Progressive, and State Farm are actively shaping this landscape, competing with specialized insurers like Markel Specialty and Polaris. Regional variations in ORV usage and regulatory environments influence market penetration. North America, particularly the United States, is expected to hold a significant share due to its established ORV culture and large consumer base. However, emerging markets in Asia-Pacific and South America also exhibit promising growth opportunities as these regions witness increasing disposable income and a rise in adventure tourism. While precise CAGR is unavailable, a conservative estimate of 5-7% annual growth is reasonable considering overall insurance sector trends and the projected rise in ORV adoption across various regions. Market restraints could include the complexities of risk assessment and claims handling related to off-road accidents and the potential for higher premiums compared to standard vehicle insurance.

The competitive landscape involves both large established insurers adapting their offerings to this specialized market and niche insurers specializing in ORV insurance. Successful players will need to offer competitive pricing, comprehensive coverage options tailored to different ORV types and user needs, efficient claims processing, and effective risk management strategies. Strong distribution networks, including online channels, are crucial for reaching target customers. Furthermore, effective marketing focusing on the unique risks and benefits of ORV insurance will prove essential for sustained growth in this dynamic and expanding sector.

The off-road vehicle (ORV) insurance market is experiencing significant growth, projected to reach multi-million unit premiums by 2033. The historical period (2019-2024) saw a steady increase driven by rising ORV ownership, particularly among younger demographics and enthusiasts. This trend is expected to continue throughout the forecast period (2025-2033), fueled by increasing disposable incomes and a growing interest in outdoor recreational activities. The estimated market value for 2025 (base year) is substantial, showcasing the sector's maturity and potential. Several key factors contribute to this growth. Firstly, the increasing popularity of various off-road vehicles, such as ATVs, UTVs, and dirt bikes, directly correlates with the demand for insurance coverage. Secondly, stricter regulations and safety standards imposed by governing bodies are driving consumers towards ensuring adequate insurance protection. This trend is further accelerated by the rising awareness of potential liabilities and risks associated with operating ORVs, including accidents, injuries, and property damage. Consequently, the insurance sector is witnessing a diversification of product offerings, encompassing comprehensive packages tailored to the specific needs and risk profiles of individual ORV owners and commercial operators. This includes specialized coverages for specific activities and terrains, further contributing to market expansion. Finally, technological advancements in risk assessment and claims processing are streamlining operations, leading to improved efficiency and affordability, making ORV insurance more accessible to a wider customer base. The market is expected to see a significant expansion in the coming years, reaching figures in the tens or even hundreds of millions of units, depending on market penetration and pricing strategies.

Several key factors are driving the expansion of the off-road vehicle insurance market. The escalating popularity of off-road vehicles themselves, driven by increasing leisure time and disposable incomes, forms a crucial cornerstone. Consumers are increasingly seeking thrilling outdoor experiences, leading to a surge in ORV ownership across various demographics. This heightened demand directly translates into a greater need for insurance coverage, protecting both the vehicles themselves and the individuals operating them from potential financial repercussions. Furthermore, stringent governmental regulations concerning safety standards and liability are actively fostering market growth. Governments are increasingly implementing stricter rules mandating insurance for ORV operation, leading to a mandatory uptake of insurance policies. The increasing awareness among consumers regarding potential risks, such as accidents, injuries, and environmental damage, contributes significantly to this trend. Finally, technological improvements in risk assessment and insurance product design are making insurance more targeted and affordable. Insurers are leveraging data analytics and sophisticated modeling techniques to better understand risk profiles, allowing them to offer more competitive and tailored insurance packages, thus further expanding the market's reach and penetration. This confluence of factors positions the off-road vehicle insurance sector for sustained and substantial growth in the coming years.

Despite the significant growth potential, the off-road vehicle insurance market faces certain challenges. Accurate risk assessment remains a hurdle. The diverse nature of off-road environments and the varying skill levels of operators make it difficult to accurately assess and price risk. This can lead to either underinsurance, leaving operators vulnerable, or overinsurance, making premiums excessively high and limiting market access. Another challenge lies in claims management. Off-road accidents can be complex and expensive to investigate and resolve, particularly in remote locations. Furthermore, fraudulent claims can also inflate costs and affect the overall market stability. Regulatory complexities across different jurisdictions present additional difficulties. The varying regulations and licensing requirements across states and countries create operational challenges for insurers and hinder the standardization of insurance products. Finally, the limited data availability, especially regarding historical accident statistics in specific off-road environments, can pose challenges for accurate actuarial modeling and risk prediction. This lack of data can affect the accuracy of pricing and the overall market stability. Addressing these challenges requires collaboration between insurers, regulatory bodies, and technology providers to develop more sophisticated risk assessment models and efficient claims management processes.

The Individual segment within the off-road vehicle insurance market is poised for significant dominance. This segment's growth is intrinsically linked to the rising popularity of recreational ORV use among individuals. The increasing disposable incomes coupled with a growing preference for outdoor leisure activities directly fuels this segment’s expansion.

The Comprehensive Insurance type is also anticipated to be a dominant force. Consumers are increasingly seeking comprehensive coverage to protect against a broader range of risks, including accidents, theft, and damage to both the vehicle and third-party property. This demonstrates a growing awareness of potential liabilities and a willingness to secure complete insurance protection.

The combination of the Individual application segment and the Comprehensive insurance type presents a powerful synergy. Individuals purchasing comprehensive insurance are better protected and this boosts the market's overall value significantly. The market’s growth will be propelled by individuals seeking all-encompassing protection for their ORVs and themselves. Millions of units are expected to be covered under this segment by the end of the forecast period.

Several factors are acting as catalysts for growth within the off-road vehicle insurance industry. The increasing awareness of liability risks associated with operating ORVs is pushing more owners towards acquiring insurance. Simultaneously, government regulations are increasingly mandating insurance coverage, creating a compulsory market expansion. Technological advancements in risk assessment, telematics, and claims processing are enabling insurers to create more efficient and cost-effective insurance products, making them more accessible to a wider population. This synergy of rising awareness, regulatory pressure, and technological innovation is fostering a robust and sustained increase in the adoption of ORV insurance.

The off-road vehicle insurance market is experiencing robust growth driven by a surge in ORV ownership and an increasing awareness of liability risks. This report provides an in-depth analysis of the market, projecting continued growth throughout the forecast period (2025-2033). The comprehensive analysis includes detailed insights into market trends, driving forces, challenges, key players, and significant developments, offering valuable insights for insurers, ORV manufacturers, and regulatory bodies. The report focuses on the dominance of the Individual segment purchasing Comprehensive Insurance, particularly within key regions like the United States, Canada and Australia. This detailed examination offers strategic insights into market opportunities and potential for future growth.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GEICO, Allstate, Progressive, Nationwide, Markel Specialty, Farmers Insurance Grou, TD Insurance, Liberty Mutual, Acuity, Dairyland, Polaris, State Farm.

The market segments include Type, Application.

The market size is estimated to be USD 443.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Off-Road Vehicle Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Off-Road Vehicle Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.