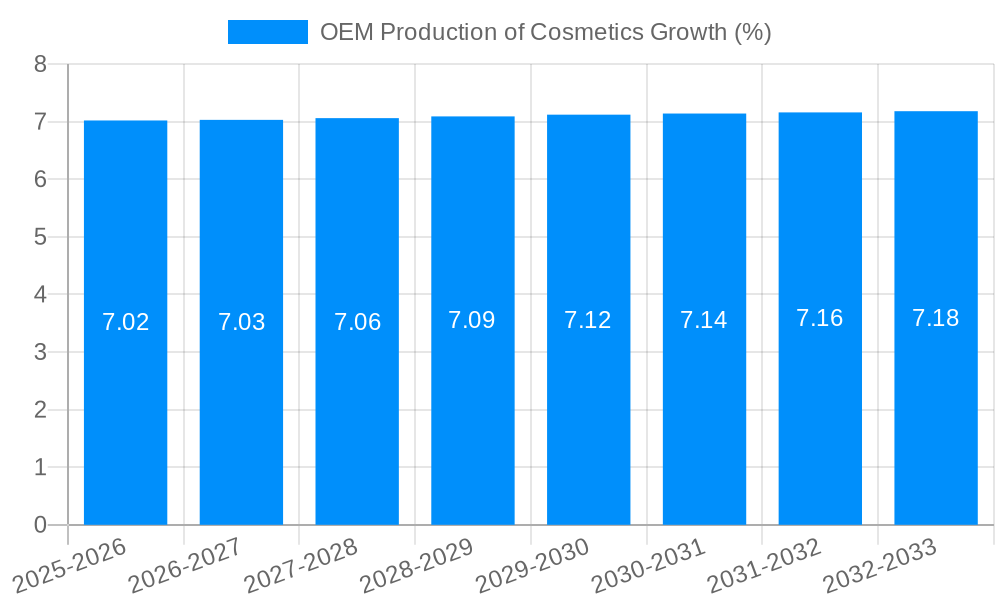

1. What is the projected Compound Annual Growth Rate (CAGR) of the OEM Production of Cosmetics?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

OEM Production of Cosmetics

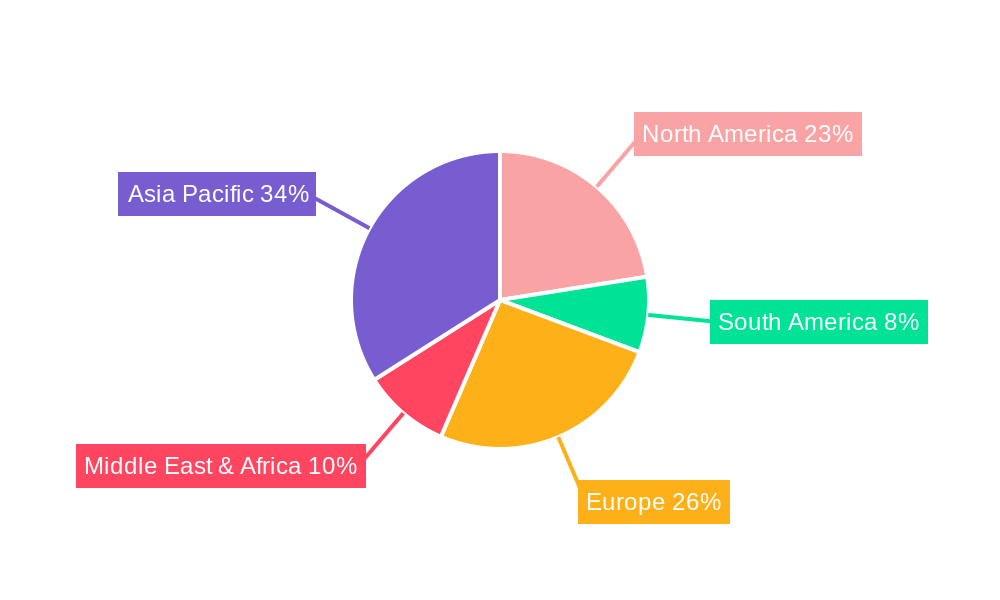

OEM Production of CosmeticsOEM Production of Cosmetics by Type (/> Skin Care, Makeup, Personal Care, Other), by Application (/> ODM, OEM, OBM), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global OEM production of cosmetics is a dynamic and rapidly expanding market. While precise figures for market size and CAGR are unavailable, leveraging industry knowledge and typical growth patterns in the cosmetics sector, we can project substantial growth. Considering the increasing demand for personalized cosmetics, the rise of direct-to-consumer brands relying on contract manufacturing, and the expanding e-commerce channels, the market is poised for continued expansion. Key drivers include the growing preference for customized beauty products, the rising popularity of natural and organic cosmetics, and a significant increase in outsourcing by major cosmetics brands to streamline operations and reduce costs. Furthermore, technological advancements in formulation, packaging, and manufacturing processes contribute to market growth. Challenges, however, include stringent regulatory environments, fluctuations in raw material costs, and increasing competition among OEM providers.

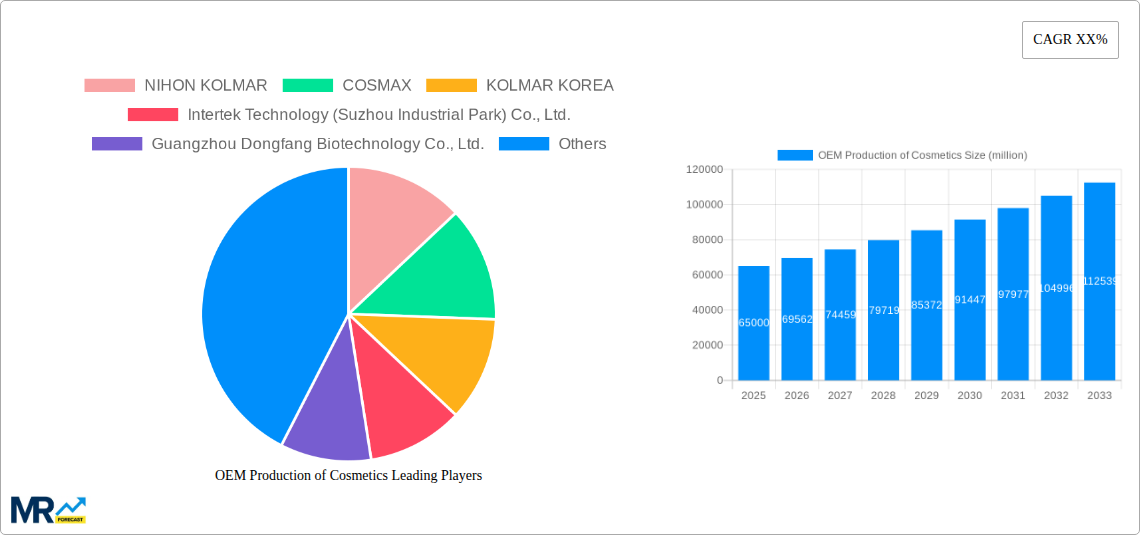

The substantial number of companies listed – including both large multinational corporations like Nihon Kolmar and Cosmax, and numerous smaller regional players – highlights the market's competitiveness. Geographic diversification is also a factor, with representation from China and other Asian markets suggesting a significant regional concentration. This underscores the need for OEMs to differentiate themselves through specialized services, innovative formulations, or cost-effective production methods. Future growth will likely be influenced by continued technological advancements, the rise of sustainable and ethical sourcing practices, and evolving consumer preferences towards personalized and inclusive beauty products. The forecast period (2025-2033) promises significant opportunities for established players and new entrants alike, though success will depend on adapting to changing market dynamics and consumer expectations.

The global OEM (Original Equipment Manufacturer) production of cosmetics experienced robust growth during the historical period (2019-2024), driven by increasing demand for personalized and private-label cosmetic products. The market witnessed a surge in the adoption of innovative formulations and packaging solutions, catering to the evolving consumer preferences for natural, organic, and sustainable cosmetics. This trend is expected to continue throughout the forecast period (2025-2033), with an estimated market value exceeding several billion dollars by 2033. The rise of e-commerce and direct-to-consumer (DTC) brands significantly contributed to the growth of the OEM sector, as these brands often outsource production to specialize in marketing and branding. Smaller companies, particularly those launching new brands, increasingly rely on OEMs to handle manufacturing, quality control, and regulatory compliance, allowing them to focus on their core competencies. This trend is particularly evident in regions with a burgeoning cosmetics market and a robust manufacturing infrastructure. The year 2025 serves as a pivotal point, reflecting the culmination of previous trends and the acceleration of new market dynamics. The estimated production volume for 2025 is projected to be in the hundreds of millions of units, a testament to the sector's ongoing expansion. Further analysis reveals significant regional variations, with certain areas demonstrating considerably faster growth rates than others, largely due to factors such as economic development, consumer spending habits, and government regulations. The market's future trajectory is heavily influenced by evolving consumer preferences towards ethically sourced ingredients, eco-friendly packaging, and technologically advanced formulations. This requires OEMs to invest in research and development, constantly adapting to meet the demands of this dynamic market.

Several key factors fuel the expansion of the OEM cosmetics production market. The rising demand for personalized and private-label cosmetics is a significant driver. Consumers are increasingly seeking customized products tailored to their specific skin type, concerns, and preferences. This trend empowers smaller brands and entrepreneurs to enter the market, relying on OEMs to produce their unique formulations. The cost-effectiveness of outsourcing production to OEMs also plays a vital role. It eliminates the need for significant upfront investments in manufacturing infrastructure, equipment, and personnel. This is especially advantageous for startups and smaller companies with limited capital. Additionally, OEMs often possess advanced technological capabilities and expertise in manufacturing, quality control, and regulatory compliance, enabling them to produce high-quality products efficiently. This expertise translates into cost savings for brands that choose to outsource their manufacturing. Finally, the growing popularity of e-commerce and DTC brands has further boosted the OEM sector. These online-focused brands frequently rely on OEMs for flexible and scalable production to meet fluctuating demand. This agility is crucial in the fast-paced and dynamic world of online cosmetics retail.

Despite the promising growth prospects, the OEM cosmetics production market faces several challenges. Maintaining consistent product quality across different OEMs is paramount. Variations in manufacturing processes and raw material sourcing can lead to inconsistencies in product quality, negatively impacting brand reputation. Ensuring strict adherence to regulatory compliance and safety standards across diverse global markets presents another significant hurdle. The constantly evolving regulatory landscape requires meticulous attention to detail and significant resources for compliance. Competition within the OEM sector is intense, with numerous players vying for contracts. This necessitates continuous innovation and the adoption of advanced technologies to maintain a competitive edge. Intellectual property (IP) protection is a major concern for brands that outsource production. OEMs must demonstrate their commitment to protecting their clients' formulations and brand identities. Finally, managing supply chain disruptions, particularly in the context of global economic uncertainty and geopolitical events, poses a considerable risk to OEMs and their clients.

The dominance of Asia-Pacific and, specifically, China, can be attributed to several factors: Lower labor costs, easier access to raw materials, and a rapidly expanding consumer base create a favorable environment for OEMs. The rising middle class in China is driving increased demand for cosmetic products, which fuels the growth of the OEM industry to meet this demand. However, the regulatory landscape in China is complex and evolving, presenting challenges for both domestic and international OEMs. The stringent regulatory requirements ensure product safety and quality but necessitate substantial investment in compliance. This competitive yet regulated environment fosters innovation and efficiency within the OEM industry.

The OEM cosmetics production industry is experiencing significant growth spurred by several key catalysts. The rising demand for personalized and private-label cosmetics, coupled with the cost-effectiveness and scalability of OEM manufacturing, creates a perfect storm for expansion. Technological advancements in formulation, packaging, and manufacturing processes further enhance efficiency and product quality, fueling growth. Finally, the growing popularity of e-commerce and direct-to-consumer brands creates an ever-expanding market for OEM services.

This report offers a comprehensive analysis of the OEM production of cosmetics market, covering historical data, current market trends, and future projections. It provides detailed insights into key market drivers, restraints, and growth opportunities, along with a thorough assessment of leading market players and their strategic initiatives. The report also includes regional breakdowns, segment analysis, and future outlook, making it an invaluable resource for industry stakeholders. The report covers critical aspects, from regulatory compliance and supply chain management to technological advancements and consumer preferences, providing a holistic understanding of the market's complex dynamics. The data presented allows for informed decision-making and strategic planning in this rapidly evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include NIHON KOLMAR, COSMAX, KOLMAR KOREA, Intertek Technology (Suzhou Industrial Park) Co., Ltd., Guangzhou Dongfang Biotechnology Co., Ltd., Guangdong Bawei Biotechnology Co., Ltd., Jiangsu Meiaisi Cosmetics Co., Ltd., Shanghai Zhenchen Cosmetics Co., Ltd., Shanghai Chuangyuan Cosmetics Company, Beijing Dongcai Daily Chemicals Co., Ltd., Guangdong Sanhao Technology Co., Ltd., Shanghai Paris Shidi Daily Chemical Co., Ltd., Liangguan Biochemical Technology Co., Ltd., North Bell Cosmetics Co., Ltd., BioTruly Company, Beihao Group.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "OEM Production of Cosmetics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the OEM Production of Cosmetics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.