1. What is the projected Compound Annual Growth Rate (CAGR) of the NFT Online Trading?

The projected CAGR is approximately 32.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

NFT Online Trading

NFT Online TradingNFT Online Trading by Type (Comprehensive Platform, Art Platform, Other), by Application (Permissionless, Semi-Curated, Fully-Curated), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

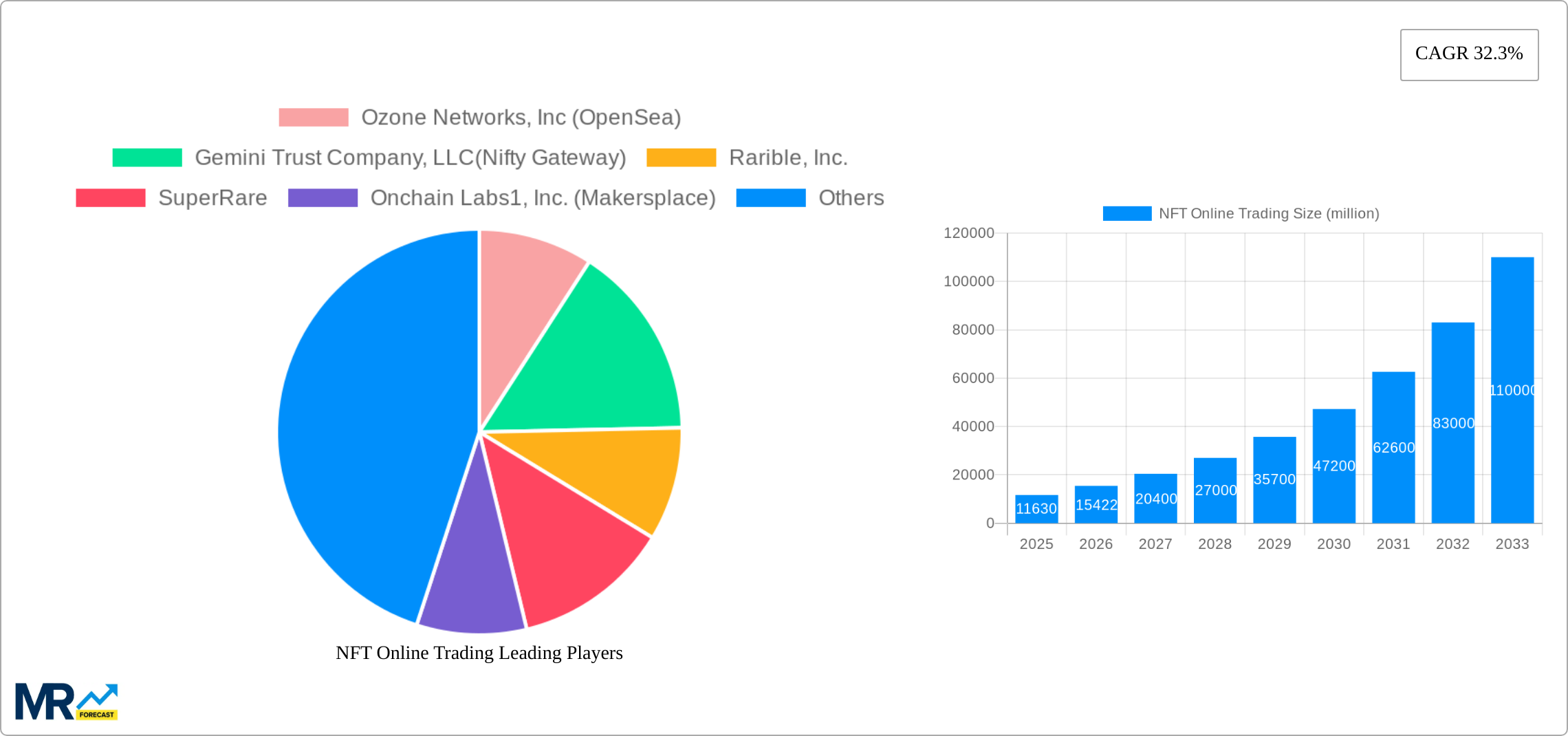

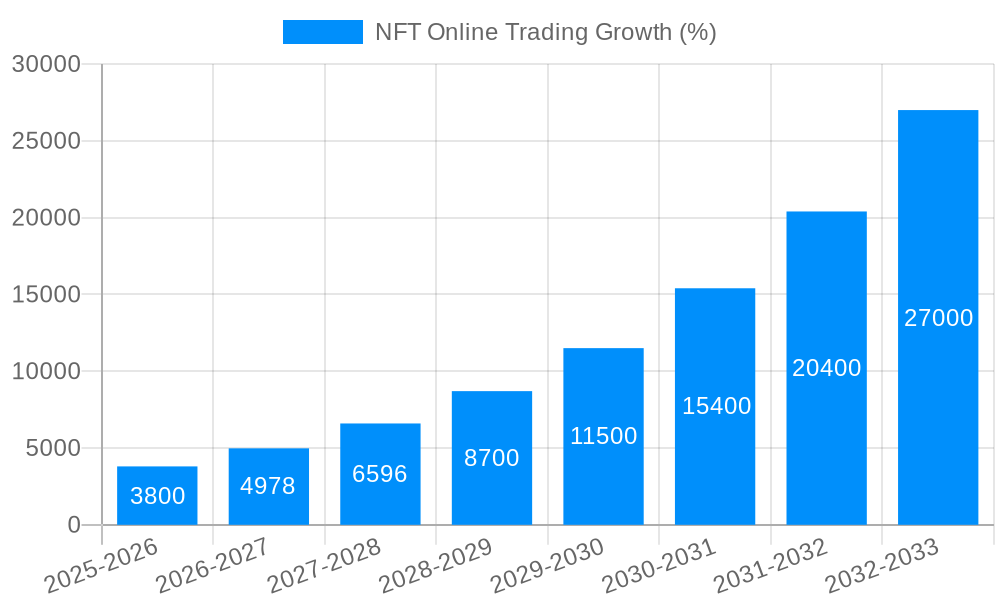

The NFT online trading market is experiencing explosive growth, projected to reach $11.63 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 32.3%. This surge is fueled by several key factors. Firstly, increasing mainstream adoption of cryptocurrencies and blockchain technology is making NFTs more accessible to a wider audience. Secondly, the burgeoning metaverse and the growing demand for digital assets, including virtual real estate, collectibles, and in-game items, are significantly boosting the market. Thirdly, the innovative business models adopted by platforms like OpenSea, Nifty Gateway, and Rarible, focusing on user-friendly interfaces and diverse NFT offerings, are driving user engagement and transaction volume. Finally, the rise of influencer marketing and celebrity endorsements within the NFT space has broadened the appeal and created hype, attracting new investors and collectors.

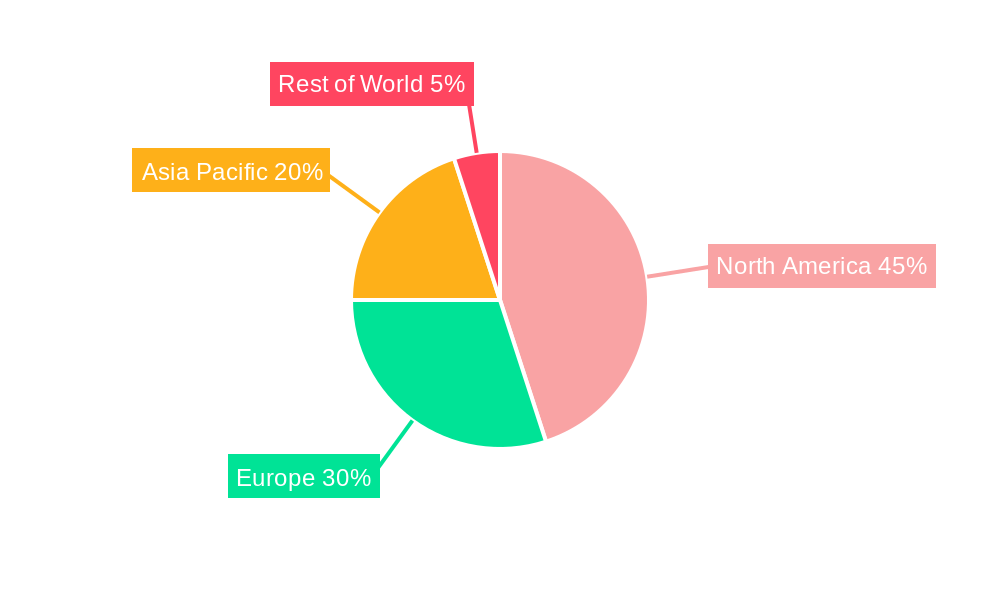

Despite the rapid expansion, challenges remain. Regulatory uncertainty surrounding NFTs and their underlying blockchain technology poses a potential risk. The market is also prone to volatility, impacted by factors such as speculative trading and market sentiment. Furthermore, the inherent risks associated with digital asset security and scams need to be addressed to build trust and foster sustainable growth. Segmentation analysis reveals strong interest across different platforms (comprehensive, art-focused, others) and curation models (permissionless, semi-curated, fully-curated), indicating a diversified market with varying user preferences and needs. Geographic distribution shows a strong presence across North America, Europe, and Asia-Pacific, with further expansion anticipated in emerging markets. The forecast period (2025-2033) promises continued growth, however, understanding and mitigating the associated risks will be crucial for achieving sustained and responsible expansion within the NFT online trading ecosystem.

The NFT online trading market experienced explosive growth during the historical period (2019-2024), transitioning from a niche activity to a multi-billion dollar industry. The base year (2025) estimates place the market value in the hundreds of millions, with projections indicating a substantial surge during the forecast period (2025-2033). This remarkable expansion is fueled by several key factors. The increasing adoption of blockchain technology and cryptocurrencies has laid a robust foundation for NFT transactions. The rise of decentralized marketplaces like OpenSea and Rarible has streamlined the buying and selling process, making NFTs more accessible to a wider audience. Moreover, the integration of NFTs into diverse sectors, ranging from digital art and collectibles to gaming and virtual real estate, has broadened the market's appeal and generated significant demand. The market's evolution has also seen a shift towards more sophisticated trading strategies and financial instruments, including fractional ownership and NFT lending platforms. This diversification continues to fuel investment and broaden the market's overall value. The influx of institutional investors and the emergence of specialized investment funds specifically targeting the NFT space are further indicators of the market’s maturation and long-term potential. The increasing popularity of the metaverse and the integration of NFTs within these digital worlds represent another significant driver, adding a new layer of utility and value to digital assets. However, volatility remains a key characteristic, and regulatory uncertainty represents a significant challenge to the sector’s continued, stable growth. The projected growth figures for 2033 are substantial, indicating a market size in the billions, reflecting a significant expansion beyond the current levels.

Several powerful forces are propelling the rapid expansion of the NFT online trading market. Firstly, the burgeoning popularity of blockchain technology and cryptocurrencies provides the fundamental infrastructure for secure and transparent NFT transactions. Secondly, the increasing mainstream acceptance of NFTs, driven by high-profile sales and celebrity endorsements, has dramatically increased awareness and demand. This is further amplified by the growing integration of NFTs into various sectors, creating new use cases and attracting investors from diverse backgrounds. The creative community is finding new avenues for monetizing their work, further boosting the market. The emergence of innovative platforms and tools for creating, trading, and managing NFTs has significantly reduced the barriers to entry for both creators and collectors. The development of secondary markets with robust liquidity further encourages participation, while also driving the price discovery mechanisms integral to establishing long-term values. The growth of the metaverse and the increasing convergence of physical and digital worlds through NFT integration represents a huge potential source of long-term growth. Furthermore, the rise of fractional ownership of high-value NFTs is democratizing access and fostering participation from a broader range of investors. As the underlying technology continues to mature and the regulatory landscape evolves, these driving forces are expected to continue to propel the market to new heights.

Despite its phenomenal growth, the NFT online trading market faces several challenges and restraints. Firstly, the inherent volatility of cryptocurrency markets directly impacts NFT prices, creating uncertainty and risk for investors. Regulatory uncertainty represents a significant hurdle, with governments worldwide grappling with how to classify and regulate NFTs. This ambiguity can deter institutional investors and hinder market expansion. The prevalence of scams and fraudulent activities within the NFT space undermines investor confidence and discourages participation. The lack of standardization and interoperability across different NFT platforms can create fragmentation and hinder the seamless exchange of assets. Scalability issues with blockchain networks can lead to high transaction fees and slow processing times, especially during periods of high trading volume. Furthermore, the environmental impact of certain blockchain technologies used to create and trade NFTs is a growing concern, potentially leading to increased scrutiny and regulation. Finally, the speculative nature of the market, driven by hype and trends, contributes to significant price fluctuations and potential for market crashes. Overcoming these challenges is crucial for the sustainable and long-term growth of the NFT online trading market.

The NFT online trading market is geographically diverse, with significant participation from various regions. However, during the forecast period (2025-2033), North America and East Asia are projected to be the dominant regions due to high levels of cryptocurrency adoption, strong technological infrastructure, and a substantial concentration of early adopters. Within these regions, specific countries like the United States, Japan, and South Korea are expected to be key players.

In terms of market segments, the Comprehensive Platform segment is poised for significant growth, driven by platforms like OpenSea, providing a centralized marketplace for a wide array of NFTs across different sectors. These platforms are attractive due to their user-friendly interfaces and broad selection.

Comprehensive Platforms: These platforms offer a wide range of NFTs, encompassing digital art, collectibles, gaming assets, and more. Their all-encompassing nature attracts a broader audience, driving market expansion. The leading players in this segment are expected to dominate market share.

Art Platforms: These platforms focus specifically on digital art, fostering a community of artists and collectors. They often incorporate curation mechanisms, enhancing the quality and value of the artwork. While the segment's potential is undeniable, the broader appeal of comprehensive platforms might lead to a smaller market share compared to the comprehensive segment.

Other: This broad segment includes niche marketplaces focusing on specialized assets or applications of NFTs. The diversity within this segment means it likely shows fragmented growth, with no single sub-segment definitively dominating.

Application: Regarding application, the Permissionless segment holds a significant advantage because of its open access nature, attracting many creators and collectors. The fully curated model, on the other hand, may attract a higher average price per NFT but reach a smaller audience. The semi-curated approach is positioned as a medium ground, balancing freedom with quality control.

The Permissionless model facilitates rapid innovation and wider participation, leading to greater market volume. However, Fully Curated segments offer higher-quality assets and might attract higher average transaction values.

The Comprehensive Platform segment combined with a Permissionless application model is poised for significant market dominance. This combination provides the most accessible and versatile entry point for both creators and investors, fostering broader participation and driving considerable market volume.

Several factors will accelerate the growth of the NFT online trading industry. Technological advancements, such as improved scalability and interoperability of blockchain networks, will enhance the user experience and attract more participants. Continued mainstream adoption of cryptocurrencies and broader acceptance of NFTs in various sectors will expand the market significantly. Strategic partnerships between NFT marketplaces and established brands will legitimize the market, increase investor confidence, and drive further adoption. Finally, regulatory clarity and the establishment of robust legal frameworks to govern NFT trading will significantly reduce risk and attract institutional investments, fueling market expansion.

This report provides a comprehensive analysis of the NFT online trading market, covering historical trends, current market dynamics, and future growth projections. It offers valuable insights into market drivers, challenges, and growth opportunities, allowing businesses and investors to make informed decisions. The report also provides detailed profiles of key players in the industry, covering their market share, strategies, and competitive landscape. This analysis helps to understand the current market dynamics and foresee future growth prospects of the NFT online trading sector within the specified time frame (2019-2033).

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 32.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 32.3%.

Key companies in the market include Ozone Networks, Inc (OpenSea), Gemini Trust Company, LLC(Nifty Gateway), Rarible, Inc., SuperRare, Onchain Labs1, Inc. (Makersplace), VIV3, APENFT, Zora Labs, Blockparty, Axie Marketplace, Larva Labs, NBA Top Shot, Rarible, .

The market segments include Type, Application.

The market size is estimated to be USD 11630 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "NFT Online Trading," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the NFT Online Trading, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.