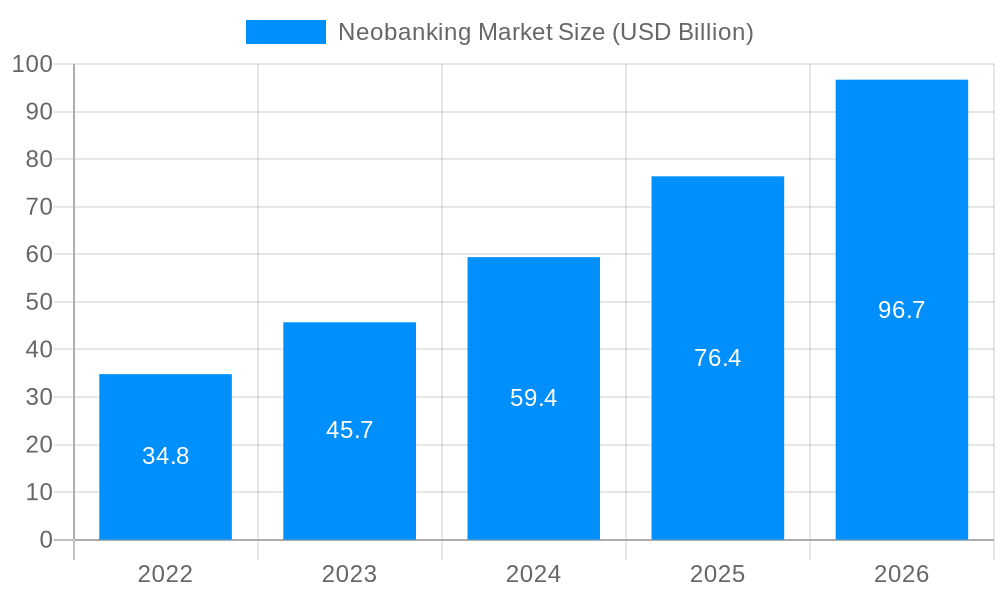

1. What is the projected Compound Annual Growth Rate (CAGR) of the Neobanking Market?

The projected CAGR is approximately 48.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Neobanking Market

Neobanking MarketNeobanking Market by Account Type (Personal, Business), by Service (Savings/Checking Accounts, Payments & Money Transfers, Mobile Banking, Loans/Insurance/Investments, Others), by By Account Type (Personal, Business), by South America (Brazil, Argentina, Rest of South America), by Europe (U.K., Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of the Middle East & Africa), by Asia Pacific (China, Japan, India, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Neobanking Market size was valued at USD 98.40 USD Billion in 2023 and is projected to reach USD 1574.44 USD Billion by 2032, exhibiting a CAGR of 48.6 % during the forecast period. The Neobanking Market refers to online banking services by digital-based fintech startups, that don't have physical managers pointed out. They supply various financial possibilities without physical branches. Neobanks form an exclusive and convenient niche, being completely online and accessible through easy-to-use mobile apps and web platforms. They bring different services on board, ie, saving accounts, payment processes, loans, and budgeting tools, targeting tech-savvy tech-native customers mainly. The main trends in the industry can be summarized as the geographic expansion of neobanks beyond borders, the association of neobanks with traditional banks from offering their products, and the use of technologies, such as artificial intelligence, or blockchain, for improved interaction with the customers. With the increasing demand for digital banking among consumers, the Neobanking Market keeps growing by challenging and replacing conventional banking systems and stimulating innovative approaches in financial services.

This report provides a comprehensive and in-depth analysis of the neobanking market, encompassing:

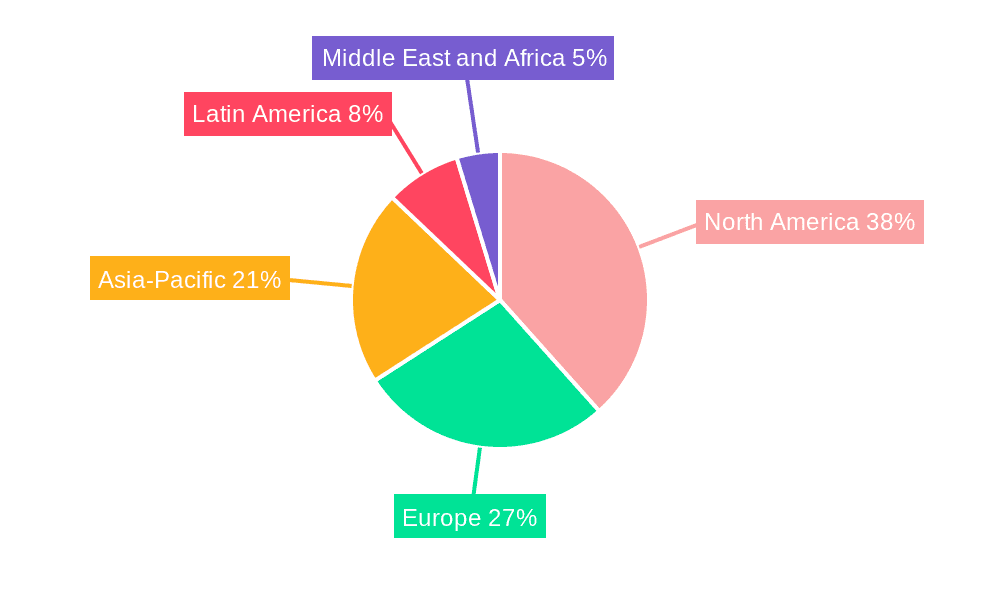

The neobanking market exhibits significant regional variations. North America and Europe represent mature markets with high levels of digital banking adoption, while Asia-Pacific is experiencing explosive growth, driven by expanding internet penetration, increasing smartphone usage, and a large underserved population. Latin America and the Middle East & Africa also present substantial growth potential, albeit with unique market dynamics and regulatory landscapes. The report provides a detailed regional breakdown, highlighting specific market characteristics and growth opportunities for each region.

Neobanks are subject to financial regulations, including anti-money laundering and consumer protection laws. Regulations vary by country and can impact neobanks' operations and growth strategies.

The report provides an analysis of patents filed in the neobanking space, identifying key technological innovations and trends.

The analyst's comment section provides insights and perspectives on the market's future growth and challenges.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 48.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 48.6%.

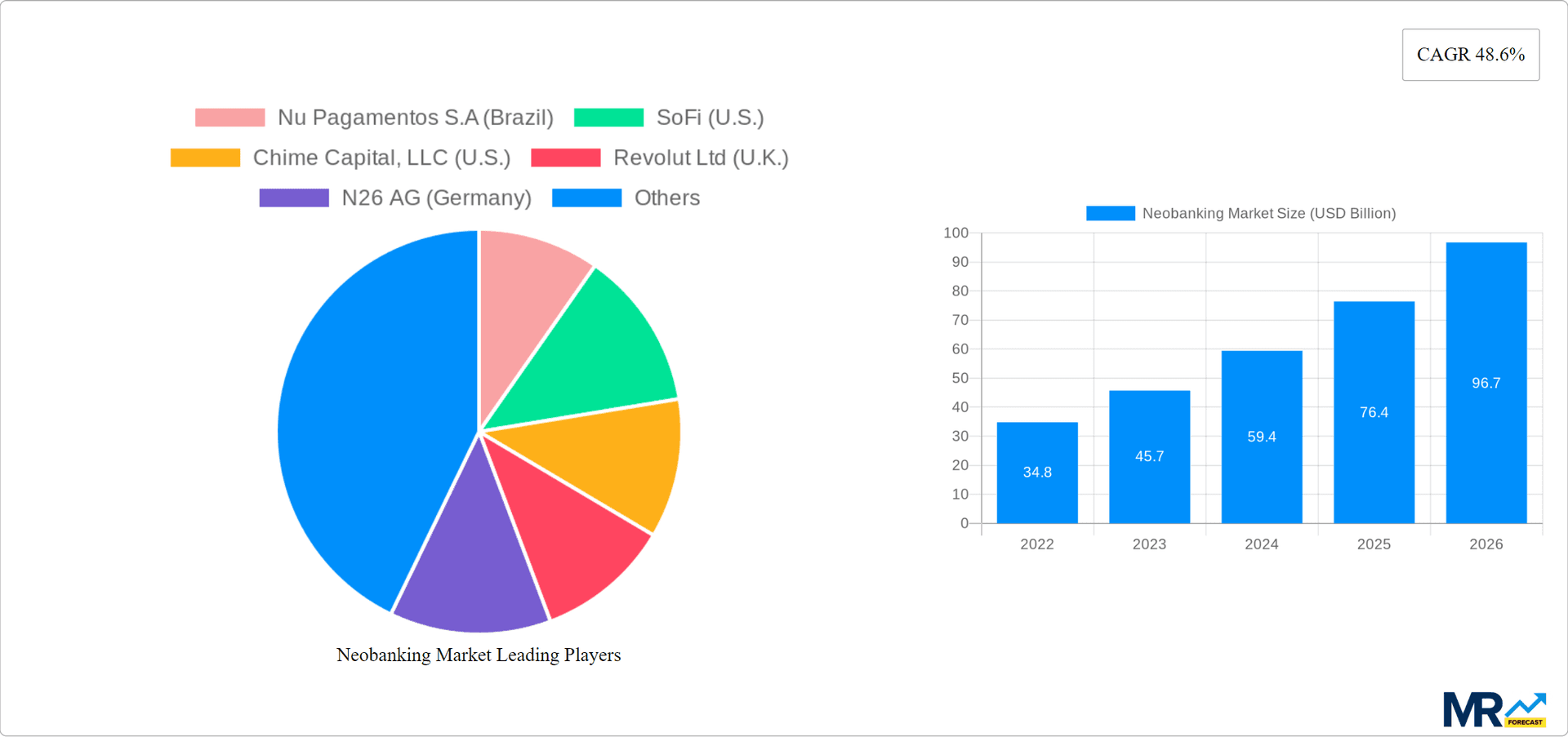

Key companies in the market include Nu Pagamentos S.A (Brazil), SoFi (U.S.), Chime Capital, LLC (U.S.), Revolut Ltd (U.K.), N26 AG (Germany), Monzo Bank Limited (U.K.), Varo Bank (U.K.), Starling Bank (U.K.), Atom bank plc (U.K.), Upgrade (U.S.).

The market segments include Account Type, Service.

The market size is estimated to be USD 98.40 USD Billion as of 2022.

Rapid Adoption of Neobanking Platforms among MSMEs. Micro and Small Businesses to Drive Market Growth.

Rising Integration of Cryptocurrencies and Blockchain Technology in Neobanking Platforms to Bolster Market Growth.

Data Privacy and Compliance with Various Regulations Issues to Impede Market Growth.

January 2024: Nu Mexico partnered with Felix Pago to launch the option to receive money from the U.S. The partnership simplified the process of sending money from the U.S. to Mexico and transformed the process of cross-border money transfers.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4850, USD 5850, and USD 6850 respectively.

The market size is provided in terms of value, measured in USD Billion.

Yes, the market keyword associated with the report is "Neobanking Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.