1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Publishing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Music Publishing

Music PublishingMusic Publishing by Application (Commercial, Commonweal, Other), by Type (Performance, Digital, Synchronization, Mechanical, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

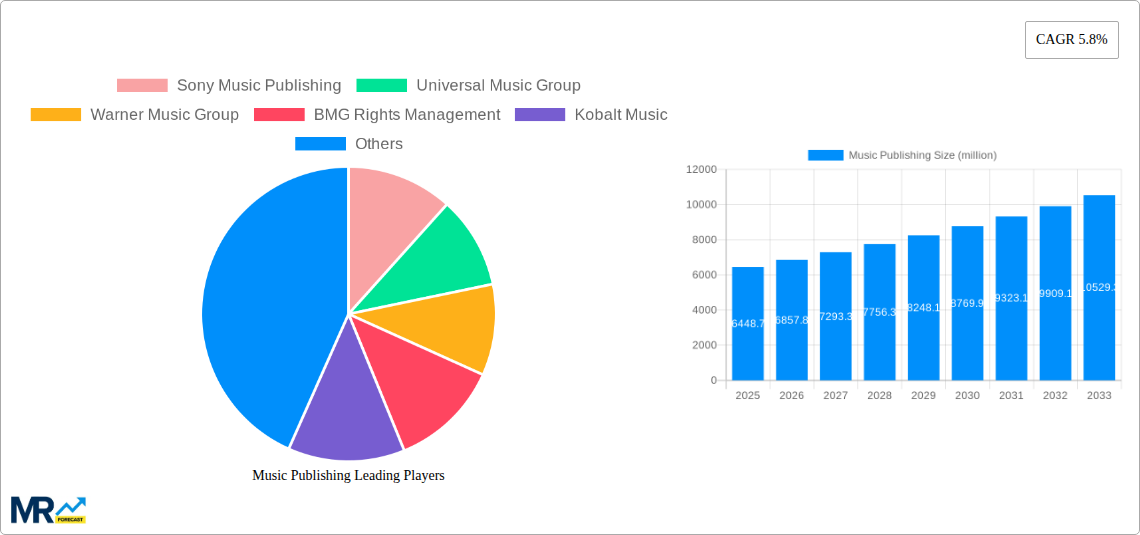

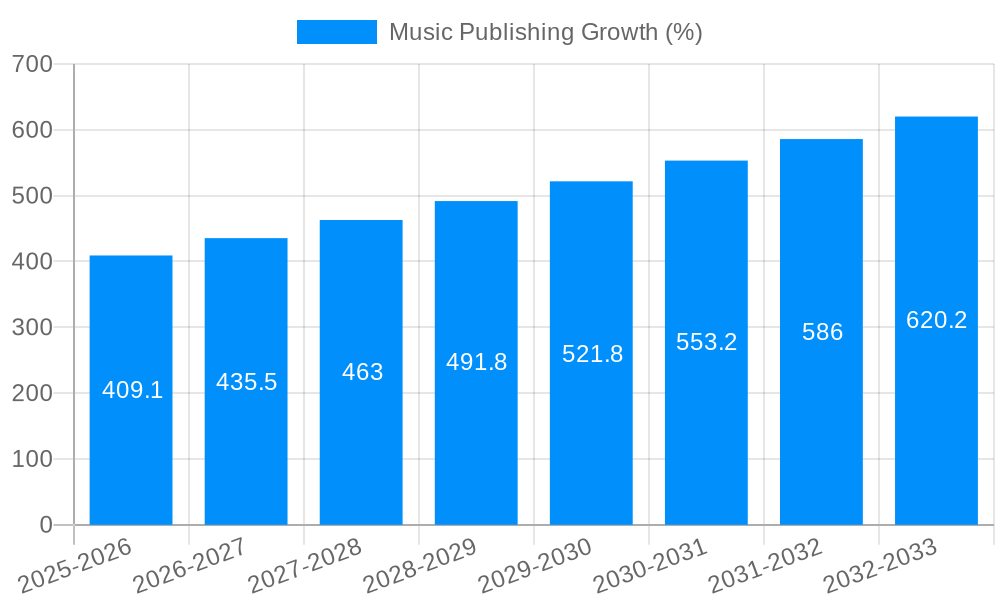

The global music publishing market, valued at $9,593.1 million in 2025, is poised for significant growth. While the exact CAGR is unavailable, considering the robust expansion driven by streaming services, digital distribution channels, and increasing music consumption globally, a conservative estimate would place it between 7-10% annually through 2033. Key drivers include the rising popularity of streaming platforms like Spotify and Apple Music, which generate substantial licensing revenue for publishers. Furthermore, the expansion into emerging markets, particularly in Asia-Pacific, fueled by a burgeoning middle class and increasing smartphone penetration, contributes significantly to market expansion. The increasing use of music in film, television, advertising, and gaming also fuels growth. Segmentation reveals a strong demand across various applications (commercial, commonweal, and other) and types (performance, digital, synchronization, and mechanical rights). Major players such as Sony Music Publishing, Universal Music Group, and Warner Music Group dominate the landscape, leveraging their vast catalogs and established relationships with artists and licensees. However, challenges include copyright infringement and the ongoing debate over fair compensation for artists and rights holders in the digital realm. This requires ongoing adaptation and strategic investment in technology and legal expertise to protect intellectual property and manage licensing agreements effectively. The industry's future success hinges on navigating these challenges and capitalizing on emerging opportunities within the metaverse and other technological advancements impacting music consumption and distribution.

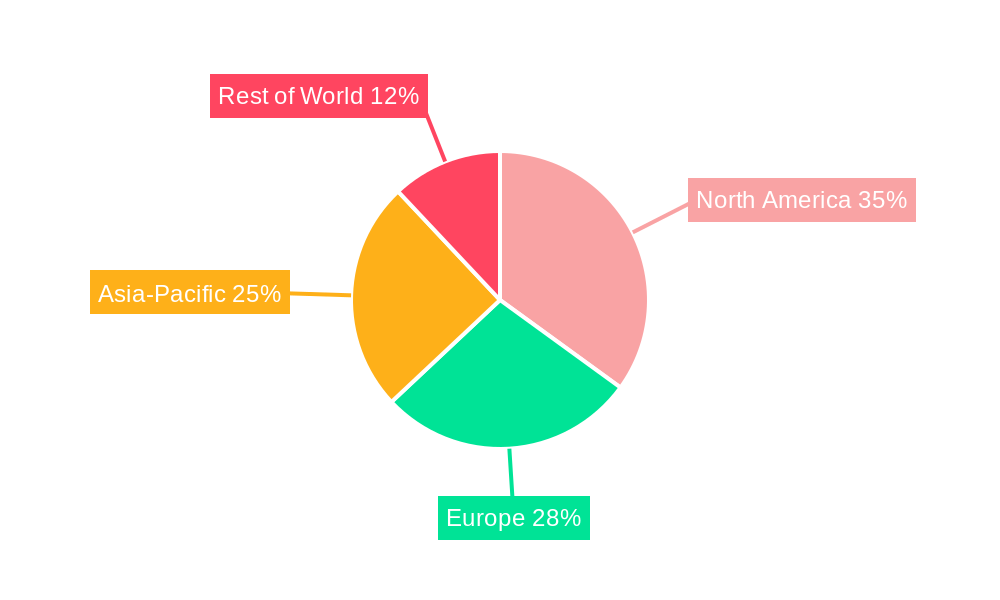

The market's regional distribution reflects established industry players' strongholds in North America and Europe, but growth potential is most pronounced in the Asia-Pacific region. The presence of established and emerging players within each region shapes the competitive dynamics. The ongoing evolution of music consumption habits, including short-form video platforms like TikTok and the increasing adoption of AI-driven music creation tools, will significantly influence market growth. Strategic mergers and acquisitions, technological innovation, and the exploration of new revenue streams (such as NFTs and immersive experiences) will be critical for companies aiming to thrive in this dynamic environment. Ultimately, the music publishing industry will continue its evolution, shaped by technological disruption, evolving consumer preferences, and the ongoing negotiation of fair value for intellectual property in the digital age.

The global music publishing market, valued at $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a CAGR of X% during the forecast period (2025-2033). This growth is fueled by the increasing consumption of digital music, expansion of streaming platforms, and the rise of synchronization licensing in film, television, and advertising. The historical period (2019-2024) witnessed significant shifts in revenue streams, with digital rights gradually surpassing traditional mechanical licensing. This transition is further amplified by the growing importance of performance royalties, driven by the increasing popularity of online music services and live streaming events. The market is also seeing a consolidation trend, with major players like Sony Music Publishing and Universal Music Group making strategic acquisitions to expand their catalogs and market share. This increased concentration, however, also presents challenges for independent publishers and songwriters who may struggle to compete with the resources and negotiating power of these giants. Nevertheless, innovative business models, such as direct-to-fan platforms and collaborations with independent artists, are emerging, offering alternative pathways for growth and revenue generation for both publishers and creators alike. The geographical distribution of revenue also reflects evolving market dynamics, with North America and Europe still dominating, but Asia-Pacific showing considerable potential for future expansion given the growing middle class and increasing adoption of digital technologies. Overall, the music publishing industry is undergoing a period of transformation driven by technological advancements, changing consumer habits, and evolving business strategies.

The music publishing market's expansion is primarily driven by the exponential growth of digital music streaming. Platforms like Spotify, Apple Music, and Amazon Music have revolutionized music consumption, generating substantial performance royalties for publishers. The increasing demand for music in visual media, such as film, television, and video games, fuels the synchronization licensing segment. Moreover, the rise of social media platforms and user-generated content creates new avenues for music usage, generating micro-licensing opportunities. The globalization of music consumption, facilitated by online streaming, broadens the market's reach, exposing musical works to a wider audience and increasing revenue streams across geographical boundaries. Furthermore, the creative industry's growing reliance on music for advertising and branding campaigns significantly boosts synchronization licensing revenue. Finally, the evolving legal frameworks protecting intellectual property rights worldwide offer publishers greater security and control over their catalogs, fostering a more stable and predictable market environment.

Despite the positive outlook, several challenges hinder the music publishing industry's growth. The complex and fragmented nature of royalty collection and distribution presents significant logistical and administrative difficulties, often leading to delays and inaccuracies in payments. The rise of copyright infringement and piracy, particularly through illegal file-sharing and unauthorized streaming services, continues to pose a serious threat to publishers' revenue. Furthermore, negotiating fair licensing agreements with streaming services can be challenging, particularly for independent publishers lacking the bargaining power of larger companies. Fluctuations in exchange rates and currency values can also impact the financial performance of international music publishers. Finally, emerging technologies, like artificial intelligence-generated music, may present novel challenges to traditional copyright models and revenue streams in the long term, requiring adaptation and innovation within the industry to maintain profitability.

The Digital segment is poised to dominate the music publishing market throughout the forecast period. This is primarily due to the immense popularity of streaming services and the subsequent growth in digital rights revenue.

Specifically within the Digital segment:

The dominance of the Digital segment stems from its accessibility, convenience, and global reach, unlike traditional physical distribution methods. It caters to the evolving preferences of consumers, enabling them to access music libraries instantly and seamlessly across various devices. This technological shift has revolutionized how music is consumed and distributed, creating a significant upward trend in digital licensing and rights management. The rise of this segment also requires publishers to adapt and optimize their business models to effectively manage and monetize digital rights.

The music publishing industry's growth is propelled by several key factors, including the rising popularity of streaming services, the increasing use of music in advertising and media, and technological advancements that streamline copyright management and royalty distribution. Furthermore, the growing awareness and enforcement of copyright protections worldwide contribute to a more favorable market environment, enhancing publishers' revenue streams. The expansion of global music markets, particularly in emerging economies, provides additional growth opportunities.

This report provides a comprehensive analysis of the music publishing industry, covering market size, growth drivers, challenges, and key players. It offers a detailed segmentation analysis by application, type, and geography, providing valuable insights into market trends and future prospects. The report also includes an in-depth competitive landscape analysis, outlining the strategies and market positions of major players. The extensive forecast period allows stakeholders to make informed strategic decisions based on reliable projections of market evolution.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sony Music Publishing, Universal Music Group, Warner Music Group, BMG Rights Management, Kobalt Music, peermusic, Round Hill Music, Pulse Music Group, Downtown Music Services, .

The market segments include Application, Type.

The market size is estimated to be USD 9593.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Music Publishing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Music Publishing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.