1. What is the projected Compound Annual Growth Rate (CAGR) of the Mortgage-Backed Security?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mortgage-Backed Security

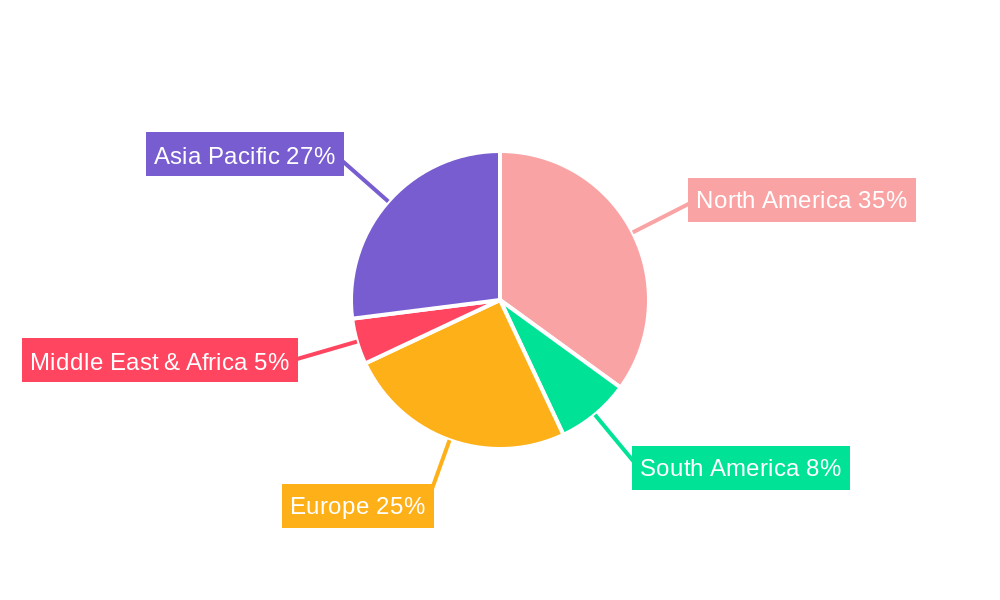

Mortgage-Backed SecurityMortgage-Backed Security by Type (Commercial MBS, Residental MBS), by Application (Commercial Banks, Real Estate Enterprises, Trust Plan), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

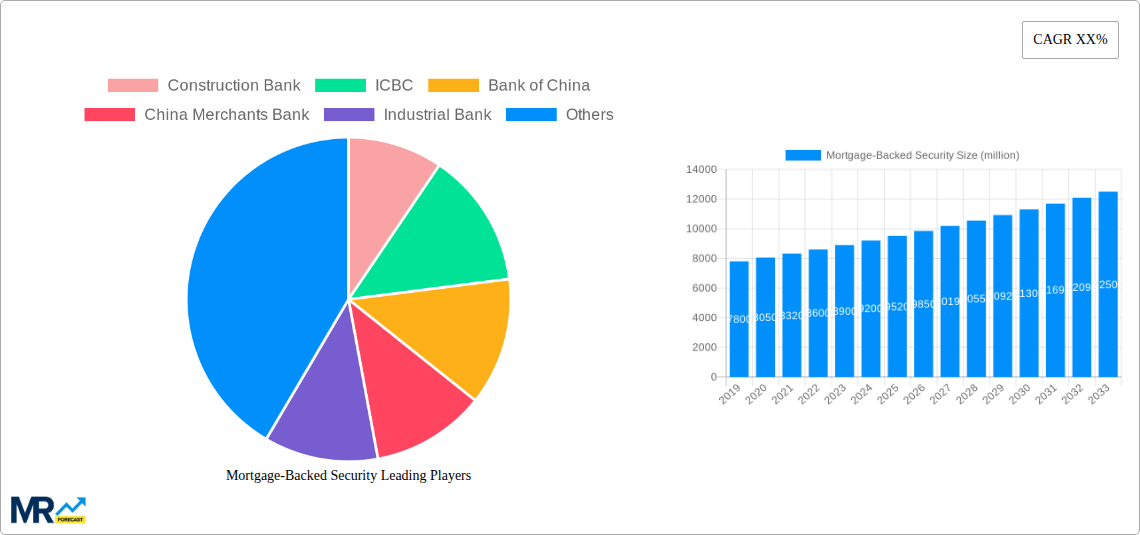

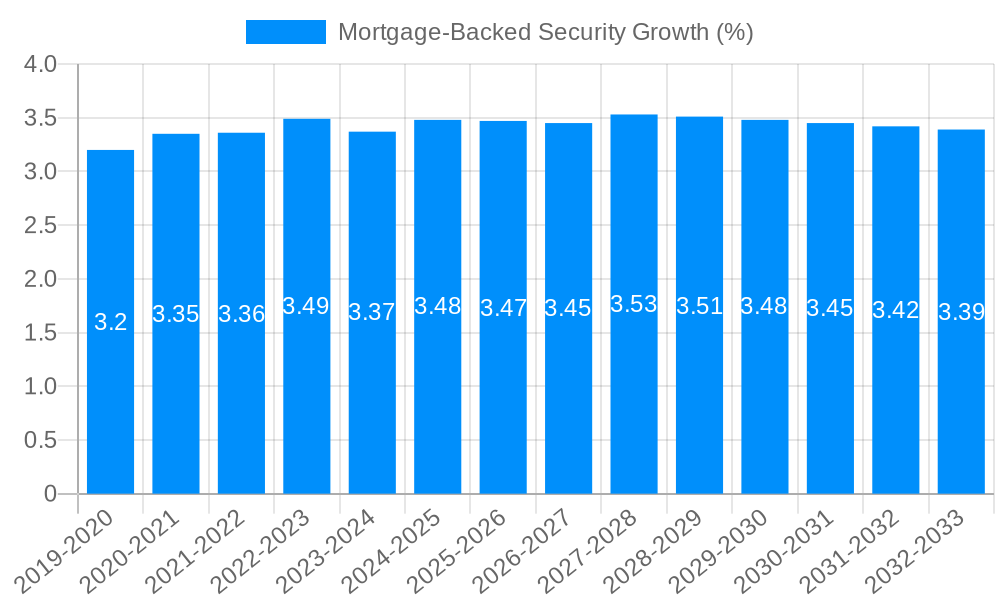

The global Mortgage-Backed Security (MBS) market is poised for significant expansion, projected to reach approximately $10.5 trillion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 5.5% over the forecast period (2025-2033). This robust growth trajectory is primarily fueled by a confluence of factors, including sustained demand for housing across key regions, increasing investor appetite for diversified fixed-income products, and supportive governmental policies aimed at stimulating the real estate sector. The residential MBS segment is expected to continue dominating the market, driven by the persistent need for affordable housing solutions and the securitization of vast residential mortgage portfolios. Simultaneously, the commercial MBS segment is also witnessing steady growth, propelled by expanding commercial real estate development and the financial institutions' drive to manage their balance sheets more efficiently. This dynamic market is characterized by technological advancements, such as the adoption of blockchain for enhanced transparency and efficiency in MBS issuance and trading, and a growing emphasis on sustainable and ESG-compliant MBS to attract environmentally conscious investors.

However, the market's growth is not without its challenges. Rising interest rates, though a natural part of economic cycles, can lead to prepayment risk and potentially impact the yields of MBS, acting as a restraint. Geopolitical uncertainties and regulatory shifts in different regions also introduce an element of risk, demanding careful navigation by market participants. The competitive landscape is dominated by a consortium of major construction and commercial banks, alongside prominent securities firms, all vying for market share. These entities are increasingly focusing on product innovation, risk management strategies, and leveraging data analytics to gain a competitive edge. The Asia Pacific region, particularly China, is emerging as a critical growth engine, owing to rapid urbanization and a burgeoning middle class driving housing demand. North America and Europe remain substantial markets, with established regulatory frameworks and sophisticated financial ecosystems. The market is segmented by type into Commercial MBS and Residential MBS, and by application into Commercial Banks, Real Estate Enterprises, and Trust Plans, reflecting the diverse financial instruments and institutional players involved.

Here is a unique report description for Mortgage-Backed Securities, incorporating your specified elements:

The global Mortgage-Backed Security (MBS) market is poised for significant evolution and expansion throughout the study period of 2019-2033, with a strong focus on the base year of 2025, projected to see substantial activity within the estimated year of 2025 and carrying through the forecast period of 2025-2033, building upon the foundation laid in the historical period of 2019-2024. XXX, a key market insight, indicates a growing appetite for securitized debt as a diversified investment avenue, particularly in light of fluctuating interest rate environments. The historical period witnessed the gradual recovery and adaptation of MBS markets post-global financial crises, with increasing regulatory oversight and a renewed emphasis on risk management. As we move into the base year of 2025, the market is characterized by a maturing understanding of MBS products, leading to more sophisticated structuring and pricing mechanisms. Commercial MBS, in particular, is expected to see steady growth as businesses seek flexible financing solutions for their real estate assets, and Real Residential MBS will continue to be a cornerstone of housing finance, albeit with evolving consumer preferences and regulatory landscapes impacting origination standards.

The estimated year of 2025 is anticipated to be a pivotal point where innovative MBS structures, potentially incorporating elements of sustainable finance and green bonds, begin to gain traction. This will be driven by investor demand for socially responsible investments and a growing awareness of environmental, social, and governance (ESG) factors. The forecast period from 2025-2033 is projected to witness a sustained upward trajectory, fueled by economic recovery, demographic shifts, and technological advancements in financial services. The report will delve into the nuances of how various applications, such as Commercial Banks, Real Estate Enterprises, and Trust Plans, are leveraging MBS for balance sheet management, capital raising, and risk transfer. Furthermore, the integration of advanced data analytics and artificial intelligence is expected to revolutionize the underwriting, servicing, and trading of MBS, leading to enhanced efficiency and reduced operational risks. The overarching trend points towards a more resilient, diversified, and technologically integrated MBS market, capable of meeting the evolving needs of both issuers and investors across the globe.

The mortgage-backed security market is experiencing a robust surge propelled by a confluence of favorable economic conditions and evolving investor strategies. Low interest rate environments, historically prevalent and projected to remain a significant factor in the coming years, incentivize both borrowers to refinance existing mortgages and investors to seek higher yields in the MBS market. This environment creates a continuous pipeline of high-quality securitizable mortgages. Furthermore, the growing global demand for diversified investment portfolios is a critical driver. Institutional investors, including pension funds, insurance companies, and asset managers, are increasingly allocating capital to MBS to achieve diversification away from traditional asset classes like equities and government bonds, seeking attractive risk-adjusted returns. The perceived stability and income-generating potential of MBS, particularly those backed by prime residential mortgages, appeal to these large-scale investors.

The increasing sophistication of financial engineering and product innovation within the MBS sector also plays a vital role. As market participants become more adept at structuring and understanding the complexities of MBS, new types of securities are emerging, catering to a wider range of investor risk appetites and return expectations. This includes the development of more specialized MBS products that can address specific market needs, such as those related to commercial real estate or emerging housing trends. Moreover, supportive regulatory frameworks in certain regions, aimed at stimulating housing markets and financial sector stability, can further boost the issuance and trading of MBS. The continuous development of robust secondary markets and improved trading platforms facilitates liquidity and price discovery, making MBS a more accessible and attractive investment.

Despite the optimistic outlook, the mortgage-backed security market grapples with several inherent challenges and restraints that can temper its growth trajectory. Foremost among these is the persistent concern over interest rate volatility. Rapid and unexpected shifts in interest rates can significantly impact the value of existing MBS, leading to prepayment risk for investors when rates fall (as borrowers refinance at lower rates) and extension risk when rates rise (as borrowers are less likely to refinance). This uncertainty can deter risk-averse investors. Regulatory scrutiny remains a significant factor, with ongoing efforts to strengthen prudential requirements and consumer protection standards for MBS origination and securitization. While aimed at market stability, these regulations can increase compliance costs and potentially limit the volume of securitizable assets, especially for certain types of mortgages or borrowers.

Furthermore, the inherent credit risk associated with underlying mortgages cannot be entirely eliminated. Economic downturns, rising unemployment, and localized housing market corrections can lead to increased mortgage defaults, directly impacting the performance and value of MBS. This necessitates rigorous due diligence and robust credit enhancement mechanisms, which can add complexity and cost to the securitization process. The perception of complexity and opacity, particularly for more intricate MBS structures, can also act as a restraint. Investors may require extensive education and sophisticated analytical tools to fully comprehend the risks and returns, limiting broader market participation. Geopolitical instability and broader economic uncertainties can also lead to periods of reduced investor confidence, impacting liquidity and pricing for MBS.

The Mortgage-Backed Security market is characterized by a dynamic interplay of regions and segments, with certain areas and product types demonstrating a pronounced propensity to dominate. In terms of geographic dominance, China is emerging as a powerhouse within the global MBS landscape during the study period of 2019-2033. The country's vast population, rapid urbanization, and robust economic growth have fueled an unprecedented demand for housing, creating a fertile ground for mortgage origination and, consequently, MBS issuance. The governmental push towards financial liberalization and the development of a more sophisticated capital market infrastructure further solidify China's position. Initiatives aimed at deleveraging the financial system and promoting market-based financing mechanisms have seen a concerted effort to bolster the securitization market.

Within China, the Commercial Banks segment, including giants like Construction Bank, ICBC, Bank of China, China Merchants Bank, Industrial Bank, Agricultural Bank of China, CITIC Bank, Bank of Communications, and Postal Savings Bank, will be instrumental in driving MBS growth. These institutions are the primary originators of mortgages and possess the balance sheet capacity and expertise to structure and invest in MBS. Hangzhou Bank, as a significant regional player, also contributes to this ecosystem. The extensive branch networks and deep customer relationships held by these commercial banks provide them with a constant influx of mortgage assets ripe for securitization. Their strategic alignment with national housing policies and their role in facilitating economic development make them central to the expansion of the MBS market.

Furthermore, the application of MBS by Real Estate Enterprises will also play a crucial role in shaping market dominance. These enterprises rely heavily on securitized financing to fund their development projects and manage their capital. The availability of a liquid MBS market allows them to access a broader investor base and reduce their reliance on traditional bank lending, thereby accelerating their growth and contributing to the overall vibrancy of the real estate sector.

Considering the product types, Residential MBS is expected to continue its strong performance, driven by the fundamental need for housing finance. However, the report will also highlight a significant and growing dominance of Commercial MBS. As businesses expand and require sophisticated financing for commercial properties, from office buildings to retail complexes and industrial facilities, Commercial MBS offers a tailored solution. The complexities involved in underwriting and structuring Commercial MBS, often requiring specialized expertise, are being increasingly addressed by leading financial institutions and securities firms. Companies like China Merchants Securities, CITIC Securities, China Securities, CICC, Everbright Securities, Guotai Junan Securities, BOCI Securities, and Huatai Securities, alongside their banking counterparts, are actively involved in the origination, underwriting, and distribution of both Residential and Commercial MBS. The increasing focus on sophisticated financial instruments and the need for efficient capital allocation within the real estate and corporate sectors will see Commercial MBS carve out a significant and growing market share, potentially rivaling or even surpassing Residential MBS in certain periods within the forecast horizon. The Trust Plan application also adds another layer of complexity and opportunity, with trust companies playing a role in structuring and managing various securitized products, further diversifying the MBS landscape and contributing to its overall market dominance.

Several key factors are acting as powerful catalysts for the growth of the Mortgage-Backed Security industry. The ongoing pursuit of yield by institutional investors seeking to diversify portfolios and achieve attractive risk-adjusted returns remains a primary driver. Furthermore, government initiatives and regulatory reforms designed to promote financial market development and stimulate economic activity often include measures to support the securitization market. Technological advancements in data analytics and artificial intelligence are also enhancing the efficiency of risk assessment, pricing, and servicing of MBS, making them more accessible and attractive.

This comprehensive report provides an in-depth analysis of the global Mortgage-Backed Security market, spanning the historical period of 2019-2024 and projecting trends through the forecast period of 2025-2033, with 2025 serving as both the base and estimated year. It delves into the intricate workings of the market, dissecting its growth catalysts, inherent challenges, and the driving forces propelling its expansion. The report offers detailed insights into the key regions and segments poised for dominance, with a particular focus on the burgeoning Chinese market and the pivotal roles of Commercial Banks and Real Estate Enterprises, alongside the growing significance of Commercial MBS and Residential MBS. Leading players in the industry are identified, and significant developments and market shifts are meticulously chronicled. This report is designed to equip stakeholders with the strategic intelligence needed to navigate this complex and evolving financial landscape, understanding market dynamics, identifying opportunities, and mitigating risks effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Construction Bank, ICBC, Bank of China, China Merchants Bank, Industrial Bank, Agricultural Bank of China, CITIC Bank, Bank of Communications, Postal Savings Bank, Hangzhou Bank, China Merchants Securities, CITIC Securities, China Securities, CICC, Everbright Securities, Guotai Junan Securities, BOCI Securities, Huatai Securities, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Mortgage-Backed Security," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mortgage-Backed Security, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.