1. What is the projected Compound Annual Growth Rate (CAGR) of the Modular Integrated Construction?

The projected CAGR is approximately 8.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Modular Integrated Construction

Modular Integrated ConstructionModular Integrated Construction by Type (Steel, Wood, Others, World Modular Integrated Construction Production ), by Application (Residential, Commercial, Healthcare, Others, World Modular Integrated Construction Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

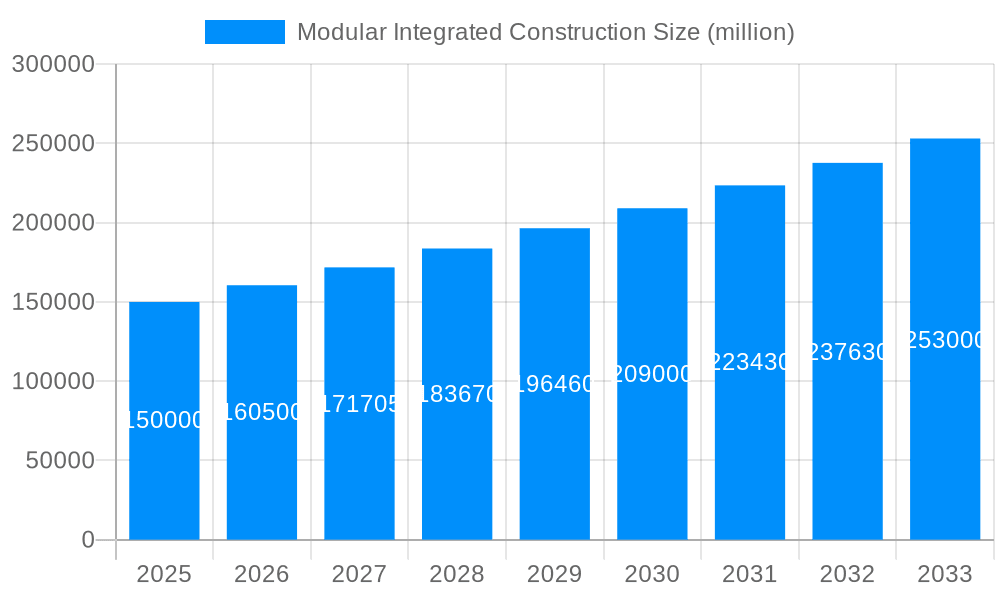

The global Modular Integrated Construction (MIC) market is experiencing substantial expansion, propelled by the escalating demand for expedited, efficient, and sustainable construction methodologies. Key growth drivers include accelerated urbanization, rising building expenses, and the imperative to shorten project delivery times. Innovations in prefabrication, advanced design software, and sophisticated modular construction techniques are further catalyzing market advancement. The widespread integration of MIC across residential, commercial, and infrastructure sectors significantly contributes to this upward trajectory. Despite persistent challenges like regulatory complexities and evolving public perception, the inherent benefits of MIC – such as waste reduction, superior quality assurance, and enhanced site safety – are effectively addressing these concerns. The market size was valued at $111.07 billion in the base year of 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.2%. This indicates significant market value growth by 2033.

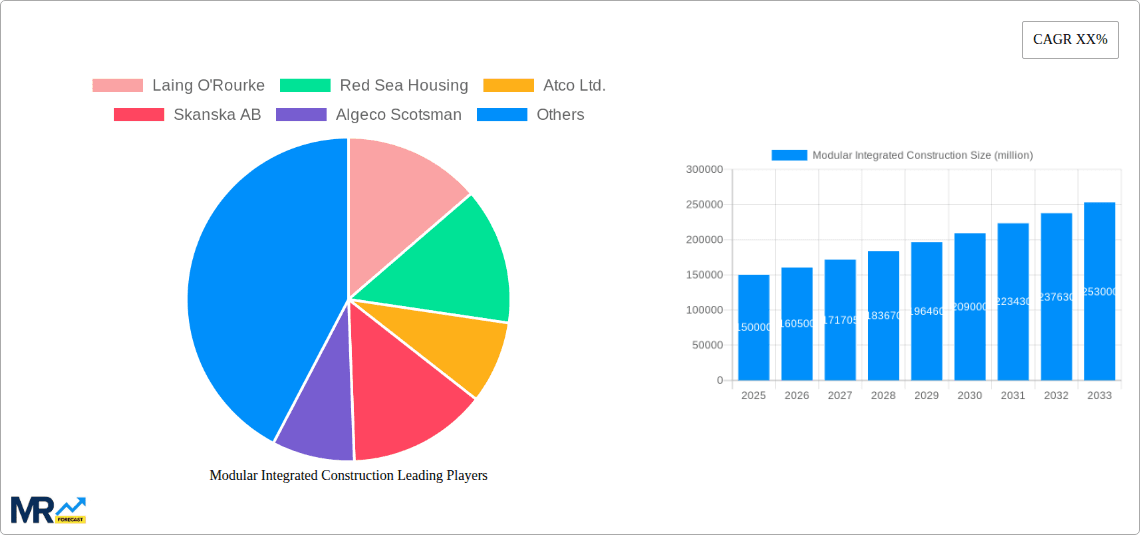

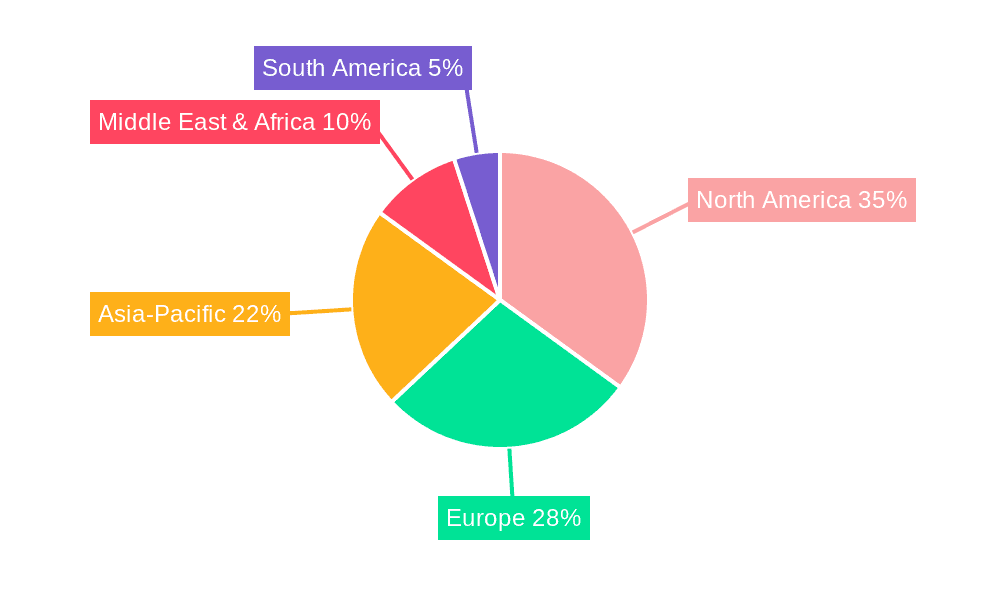

Growth is anticipated across diverse geographic regions, with North America and Europe currently dominating market share. However, emerging economies in the Asia-Pacific and Middle East regions present considerable future potential for MIC. Segment analysis highlights substantial opportunities within the residential and commercial construction sectors, while infrastructure projects represent a rapidly expanding segment. Leading industry participants, including Laing O'Rourke and Skanska AB, are strategically prioritizing research and development, scaling production capabilities, and pioneering innovative construction solutions to leverage increasing demand. The competitive environment is characterized by dynamic strategies, with both established entities and new entrants competing through technological innovation, strategic alliances, and global expansion. The adoption of eco-friendly materials and sustainable construction practices is expected to further bolster market growth.

The modular integrated construction (MIC) market is experiencing explosive growth, projected to reach several billion dollars by 2033. Key market insights reveal a significant shift towards off-site construction methodologies driven by several factors. The historical period (2019-2024) witnessed a steady rise in adoption, particularly within the residential and commercial sectors. The estimated market value in 2025 stands at approximately $XXX million, a substantial increase from previous years. This growth is fueled by increasing demand for faster project delivery, improved quality control, and reduced labor costs. Furthermore, advancements in technology, such as Building Information Modeling (BIM) and digital fabrication, are enhancing design efficiency and streamlining the manufacturing process. The forecast period (2025-2033) anticipates continued expansion, driven by rising urbanization, infrastructure development projects, and a growing preference for sustainable construction practices. MIC offers significant advantages in sustainability by minimizing waste and reducing on-site construction impacts. The increasing awareness of environmental concerns further strengthens the market's growth trajectory. The current market landscape is characterized by a diverse range of players, including large multinational corporations and specialized modular building manufacturers. Competition is intensifying, leading to innovation in design, materials, and construction techniques. This competitive environment is expected to accelerate the adoption of MIC across various sectors, including healthcare, education, and hospitality. The integration of advanced technologies is poised to further revolutionize the MIC industry, leading to improved efficiency, greater precision, and enhanced building performance. This includes the use of robotics, Artificial Intelligence (AI), and sophisticated software solutions that optimize the entire construction lifecycle. The convergence of these trends is expected to drive continued market expansion and innovation throughout the forecast period, leading to significant growth in market value exceeding $XXX million by 2033.

Several factors are driving the rapid expansion of the modular integrated construction (MIC) market. Firstly, the increasing demand for faster project delivery timelines is a major impetus. MIC significantly reduces construction time compared to traditional on-site methods, enabling quicker occupancy and return on investment. Secondly, the growing emphasis on improving construction quality and minimizing errors is another key driver. The controlled factory environment of MIC allows for greater precision and quality control, resulting in fewer defects and rework. This leads to significant cost savings and enhanced project outcomes. Thirdly, the persistent challenge of labor shortages within the construction industry is pushing the adoption of MIC. Off-site manufacturing minimizes the need for extensive on-site labor, addressing skill gaps and reducing reliance on a shrinking workforce. Fourthly, the rising awareness of sustainability and environmental concerns is promoting MIC. The reduced waste generation, lower carbon footprint, and optimized material usage associated with MIC align perfectly with the increasing demands for eco-friendly construction practices. Finally, technological advancements in design software, manufacturing techniques, and project management tools are enhancing efficiency and optimizing the entire MIC process. These advancements are making MIC increasingly cost-effective and attractive to developers and construction companies seeking to leverage the advantages of this innovative approach. The convergence of these factors is propelling the widespread adoption of MIC and solidifying its position as a transformative force in the construction industry.

Despite its many advantages, the modular integrated construction (MIC) industry faces several challenges. One significant hurdle is the initial upfront investment required for establishing manufacturing facilities and acquiring specialized equipment. This can be a substantial barrier to entry for smaller companies, limiting the number of participants in the market. Secondly, the need for specialized skills and expertise in design, engineering, and manufacturing is another obstacle. Finding and retaining skilled workers with experience in MIC can be challenging, particularly in regions with limited exposure to this technology. Thirdly, transportation and logistics can pose significant challenges, especially for larger modules. Efficient and cost-effective transportation methods are crucial for ensuring timely project delivery and minimizing potential damage during transit. Fourthly, regulatory hurdles and building codes can vary significantly between regions, creating complexity and potentially hindering wider adoption. Harmonization of regulations and codes could streamline the MIC process and facilitate market expansion. Finally, the perception of MIC as less flexible or adaptable compared to traditional construction methods remains a concern. Addressing this perception through showcasing successful projects and highlighting the adaptability of modern MIC approaches is crucial for wider market acceptance. Overcoming these challenges will be essential for realizing the full potential of MIC and further accelerating its growth trajectory.

Several regions and segments are expected to dominate the Modular Integrated Construction (MIC) market.

North America: The United States and Canada are leading adopters due to a robust construction industry, significant infrastructure investment, and increasing awareness of sustainable building practices. The market is driven by the high demand for affordable housing and the need for efficient construction methods in these regions. The market size in millions will be significantly large.

Europe: Countries like Germany, the UK, and the Scandinavian nations are witnessing strong growth due to government support for sustainable construction and a mature construction sector open to innovative technologies. This region demonstrates high adaptability to newer methods.

Asia Pacific: Rapid urbanization and infrastructure development in countries like China, Japan, and India are fueling the growth of MIC. The large-scale projects coupled with a growing demand for cost-effective construction solutions are significant drivers here. Market size in millions will be high and increasing.

Residential Segment: The residential sector is a major driver, propelled by the increasing demand for affordable and rapidly constructed housing solutions in growing urban areas. The need for quicker project completion is also leading many developers to consider this technology.

Commercial Segment: Offices, hotels, and retail spaces are increasingly adopting MIC due to the benefits of faster construction, efficient space utilization, and improved quality control. Many companies prefer quicker turnaround time for projects.

Paragraph Summary: The MIC market is witnessing strong growth across multiple regions and segments. North America and Europe are leading the way due to mature construction sectors and government support, while the Asia Pacific region is experiencing a surge driven by rapid urbanization and infrastructure development. Within segments, residential and commercial construction are significantly contributing to market growth, driven by the need for faster construction, improved quality, and cost-effectiveness. The interplay of regional needs and sector-specific demands is shaping the trajectory of MIC adoption globally, resulting in a dynamic and rapidly expanding market with significant value in millions of dollars across all regions and segments.

Several factors are acting as catalysts for growth within the MIC industry. Firstly, increasing government initiatives and policies promoting sustainable and efficient construction are creating a supportive environment. Secondly, technological advancements, such as BIM and digital fabrication, are improving design efficiency and construction precision. Thirdly, the growing acceptance of off-site construction methodologies by architects and developers is expanding the market's reach. These factors combined are leading to significant and rapidly expanding market growth within the sector.

This report provides a comprehensive analysis of the Modular Integrated Construction market, covering historical data, current market trends, and future projections. It offers in-depth insights into key drivers, challenges, and opportunities within the industry. The report also profiles leading players, examines significant developments, and provides a detailed segmentation of the market by region and application. The analysis is based on rigorous research and data collection, providing valuable insights for stakeholders across the MIC value chain.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.2%.

Key companies in the market include Laing O'Rourke, Red Sea Housing, Atco Ltd., Skanska AB, Algeco Scotsman, Kleusberg GmbH, Katerra, Lendlease Corporation, Bechtel Corporation, Fluor Corporation, DuBox, Modulaire Group, Kwikspace, Guerdon Modular Buildings, Wernick Group, KOMA MODULAR, Elements Europe, FORM Homes, Bouygues Construction, Premier Modular, Starrco, Vinci SA, Turner Industries, DMDmodular, ALHO Construction, FullStack Modular, Plant Prefab, PT Blink, BuildWright, Blokable, .

The market segments include Type, Application.

The market size is estimated to be USD 111.07 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Modular Integrated Construction," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Modular Integrated Construction, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.