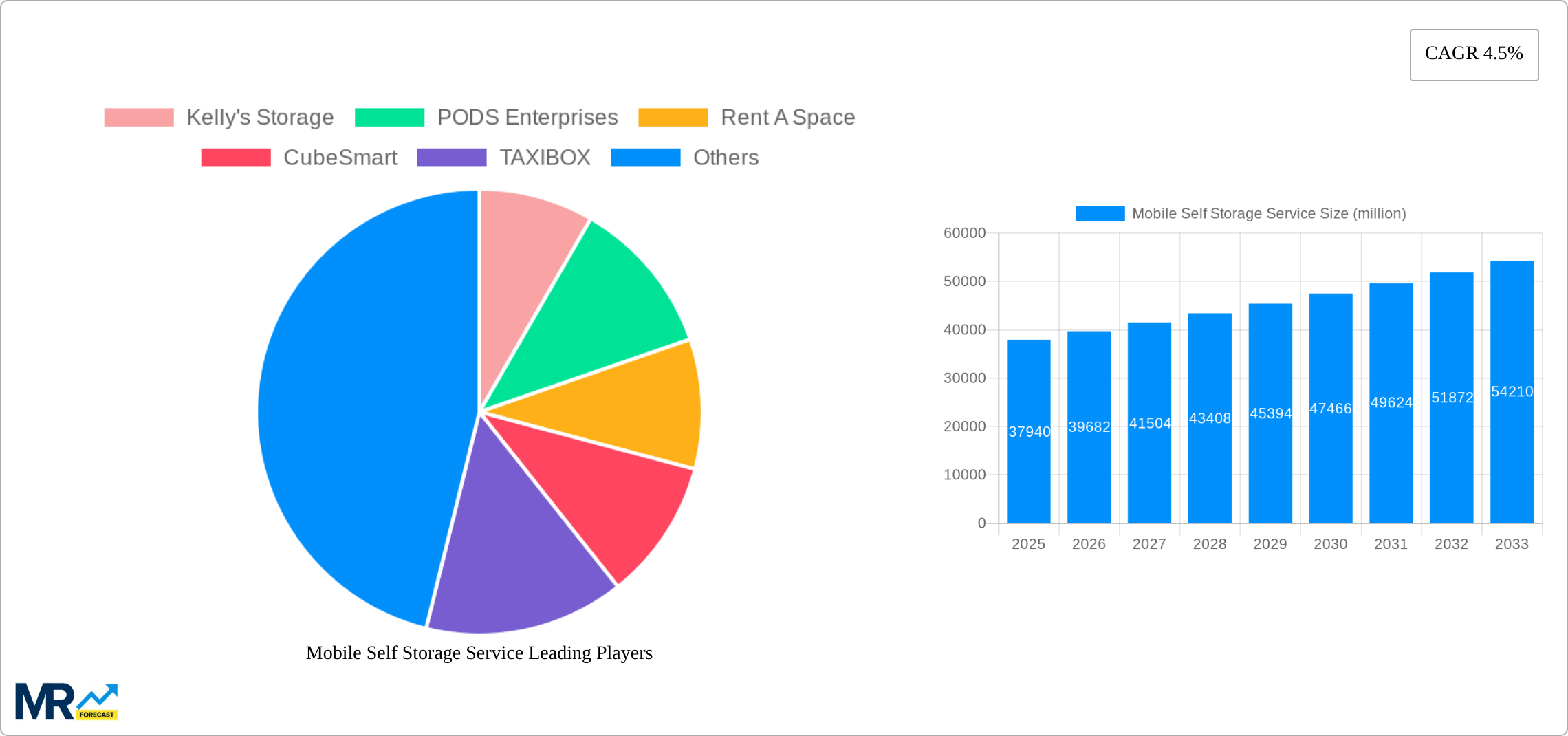

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Self Storage Service?

The projected CAGR is approximately 4.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mobile Self Storage Service

Mobile Self Storage ServiceMobile Self Storage Service by Type (Short-Term Storage, Long-Term Storage), by Application (Commercial Use, Residential Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

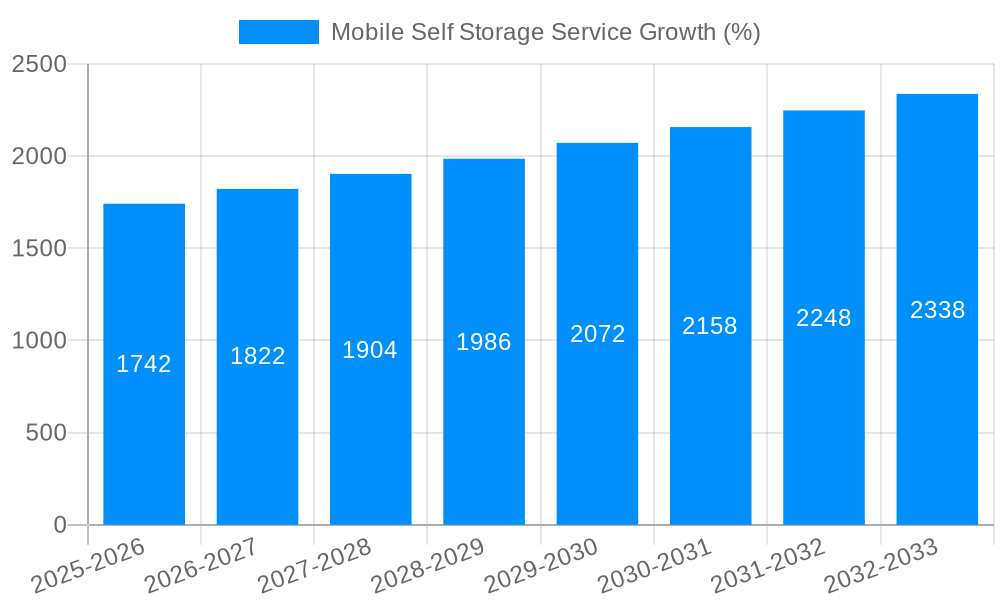

The mobile self-storage market, currently valued at $37.94 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing urbanization and population density in major metropolitan areas lead to a higher demand for flexible and convenient storage solutions. The rise of e-commerce and the associated need for efficient inventory management also contributes significantly to market growth. Furthermore, the convenience and cost-effectiveness of mobile storage compared to traditional self-storage facilities, particularly for short-term needs such as relocation or home renovations, are major factors driving adoption. The market is segmented by storage duration (short-term and long-term) and user type (commercial and residential), with both segments exhibiting significant growth potential. The residential segment benefits from increased home renovations and population mobility, while the commercial segment thrives on the fluctuating demands of businesses, especially those with inventory management needs. Competition is moderate, with established players like PODS Enterprises and CubeSmart competing alongside smaller, regionally focused companies. Future market growth will likely be influenced by technological advancements in mobile storage unit design, improved logistics and delivery services, and further refinement of pricing models to accommodate diverse user needs.

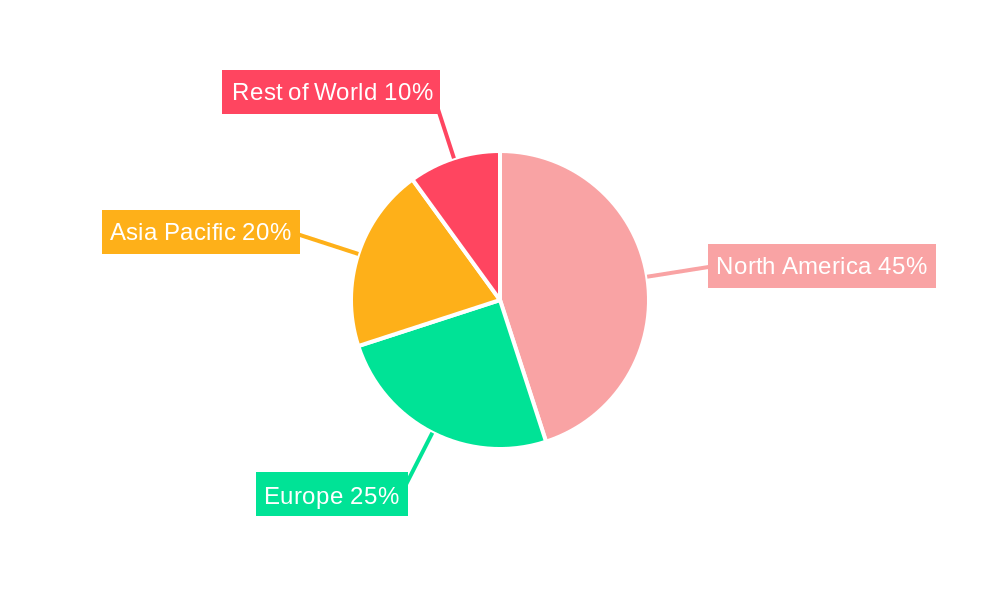

Geographic distribution reveals a substantial market presence across North America, driven by high population density and developed infrastructure supporting logistics. Europe and Asia Pacific also contribute significantly, reflecting growing urbanization and expanding e-commerce sectors. However, the market in developing regions of South America, Africa, and parts of Asia holds significant untapped potential as economic growth and infrastructure development facilitate increased demand for flexible storage solutions. While challenges remain, including managing transportation costs and regulatory hurdles in certain regions, the overall outlook for the mobile self-storage market remains positive, with continued growth expected throughout the forecast period. The inherent flexibility and convenience of this storage solution are well-positioned to capitalize on future trends in urbanization, e-commerce, and shifting consumer preferences.

The mobile self-storage service market is experiencing robust growth, projected to reach multi-million-unit volumes by 2033. The study period, encompassing 2019-2033, reveals a consistent upward trajectory, with significant acceleration anticipated during the forecast period (2025-2033). Key market insights indicate a shift towards greater consumer preference for flexible and convenient storage solutions. The increasing urbanization in many regions globally is a major driver, as individuals and businesses face challenges finding adequate traditional storage space. The rise of e-commerce and the gig economy have further fueled demand, with individuals needing temporary storage for inventory, equipment, or personal belongings during relocation or transitions. The market's dynamism is fueled by technological advancements, including improved mobile apps for booking and management, GPS tracking for enhanced security and efficiency, and the incorporation of smart features for climate control and access management. This innovation caters to the rising expectation of seamless user experiences, a critical aspect for sustained market expansion. Furthermore, the adaptability of mobile storage units to diverse needs, from short-term residential use to long-term commercial applications, ensures broad market appeal. Competition among numerous established and emerging players is driving innovation and service enhancements, ultimately benefiting consumers with greater choice and value propositions. Analysis of the historical period (2019-2024) demonstrates a consistent growth pattern, setting the stage for even more substantial expansion in the coming years. The estimated year 2025 serves as a critical benchmark for understanding the market's current state and predicting its future trajectory based on established trends.

Several factors contribute to the remarkable growth of the mobile self-storage service market. The convenience offered by on-demand, door-to-door storage solutions stands out as a significant driver. Unlike traditional storage facilities requiring transportation of belongings, mobile storage units are delivered directly to the customer's location, eliminating the hassle and expense of moving items. This convenience is particularly appealing to busy individuals, families undergoing relocation, and businesses with fluctuating storage needs. The flexibility inherent in mobile storage is another key factor. Customers can rent units for short or long durations, tailoring their storage needs to their specific circumstances. This contrasts sharply with traditional storage contracts which often entail long-term commitments. Moreover, the increasing adoption of technology, as mentioned above, significantly enhances the user experience, making the process of renting, managing, and accessing storage units simpler and more efficient. This technological integration reflects a broader market trend toward seamless, on-demand services across various industries. Finally, the growing awareness among businesses and residential consumers of the value proposition of mobile self-storage, in terms of cost-effectiveness, convenience, and flexibility, continues to stimulate market expansion.

Despite the impressive growth trajectory, the mobile self-storage service industry faces several challenges. High initial investment costs associated with purchasing and maintaining a fleet of mobile storage units can be a significant barrier to entry for new players. Competition from established players with extensive resources and infrastructure poses a considerable hurdle. Furthermore, logistical complexities, including managing efficient delivery and pick-up schedules, traffic congestion, and potential damage during transportation, pose operational challenges. Regulatory hurdles vary across different regions, adding to the operational complexities. Security concerns, such as theft or damage during transit or storage, necessitate robust security measures and insurance provisions. These measures increase operational costs and can affect pricing strategies. The fluctuating fuel prices also directly impact operational costs, making pricing adjustments necessary to maintain profitability. Finally, the need for robust customer service and efficient complaint resolution is crucial for maintaining customer satisfaction and brand reputation in a competitive market.

The residential use segment is poised for substantial growth within the mobile self-storage market. This is primarily driven by increased urbanization, population mobility, and the need for flexible storage solutions during home renovations, relocations, and temporary storage needs while traveling.

North America: This region consistently exhibits strong demand owing to its high population density in urban centers, a large and active real estate market, frequent relocations, and a strong preference for convenience and on-demand services.

Europe: Several European countries are also witnessing significant growth, driven by similar factors to North America, though at a potentially slower pace due to existing infrastructure and differing cultural norms.

Asia-Pacific: This region presents a high-growth potential, particularly in rapidly developing economies with expanding urban populations and increasing disposable income. However, market penetration may be slower due to varied infrastructure and regulatory landscapes.

The short-term storage segment is also experiencing rapid growth, as consumers increasingly prefer flexible options for temporary storage needs. This segment is directly fueled by the rise of the gig economy, the increasing frequency of relocations, and home renovation projects. The convenience of short-term rentals makes this a particularly attractive option for those seeking storage for specific events or projects. Commercial use, while growing, lags behind residential and short-term segments.

In summary: The combination of residential applications and short-term rentals represents the most dynamic and rapidly growing segment within the mobile self-storage market across key regions globally. North America maintains a leading position due to established infrastructure and consumer preferences. However, Asia-Pacific and specific European markets present significant untapped potential for future growth.

Several factors are propelling the expansion of the mobile self-storage industry. Technological advancements, especially in mobile applications and GPS tracking, are significantly enhancing user experience and operational efficiency. The increasing preference for flexible and convenient storage solutions among both residential and commercial customers is driving demand. Finally, the expansion into new geographic markets, particularly in rapidly developing economies, presents significant untapped potential for growth.

This report provides a comprehensive overview of the mobile self-storage service market, covering key trends, drivers, challenges, and opportunities. It offers valuable insights into market segmentation, competitive dynamics, and future growth projections, based on extensive market research and analysis conducted during the study period (2019-2033). The report is essential for industry stakeholders seeking to understand and capitalize on the evolving dynamics of this rapidly expanding sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.5%.

Key companies in the market include Kelly's Storage, PODS Enterprises, Rent A Space, CubeSmart, TAXIBOX, Ward North American, YoYo Box Pty Ltd, Super Easy Storage, SMARTBOX Solutions, Blox Mobile Storage, Britannia Movers International, Zippy Shell Incorporated, MyWay Mobile Storage, Mobile Attic, Stomo Mobile Self Storage, Masons Moving Group, Flexistore, Grace Worldwide, .

The market segments include Type, Application.

The market size is estimated to be USD 37940 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Mobile Self Storage Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mobile Self Storage Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.