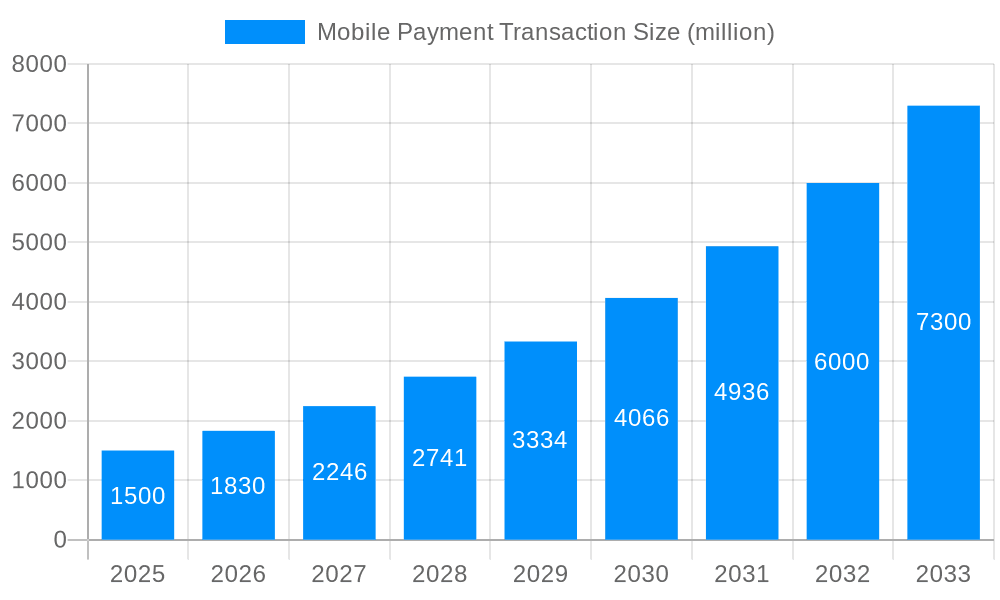

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Payment Transaction?

The projected CAGR is approximately 22%.

Mobile Payment Transaction

Mobile Payment TransactionMobile Payment Transaction by Application (Travel and Ticketing, Banking, Merchandise, Food and Beverages, Airtime, Others), by Type (Near Field Communication (NFC), Direct, WAP, SMS, USSD, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The mobile payment transaction market is experiencing explosive growth, projected to reach a substantial market size driven by the increasing adoption of smartphones, the expansion of e-commerce, and a global shift towards cashless transactions. The Compound Annual Growth Rate (CAGR) of 22% from 2019 to 2024 indicates a significant upward trajectory. This robust growth is fueled by several key factors: Firstly, the convenience and speed offered by mobile payment solutions are highly attractive to consumers and businesses alike. Secondly, enhanced security features and robust fraud prevention measures are building consumer trust and encouraging wider adoption. Thirdly, the integration of mobile payments with various loyalty programs and rewards systems incentivizes users and further expands market penetration. Finally, the continuous development and improvement of mobile payment technologies, including advancements in biometric authentication and near-field communication (NFC) technology, are paving the way for seamless and secure transactions.

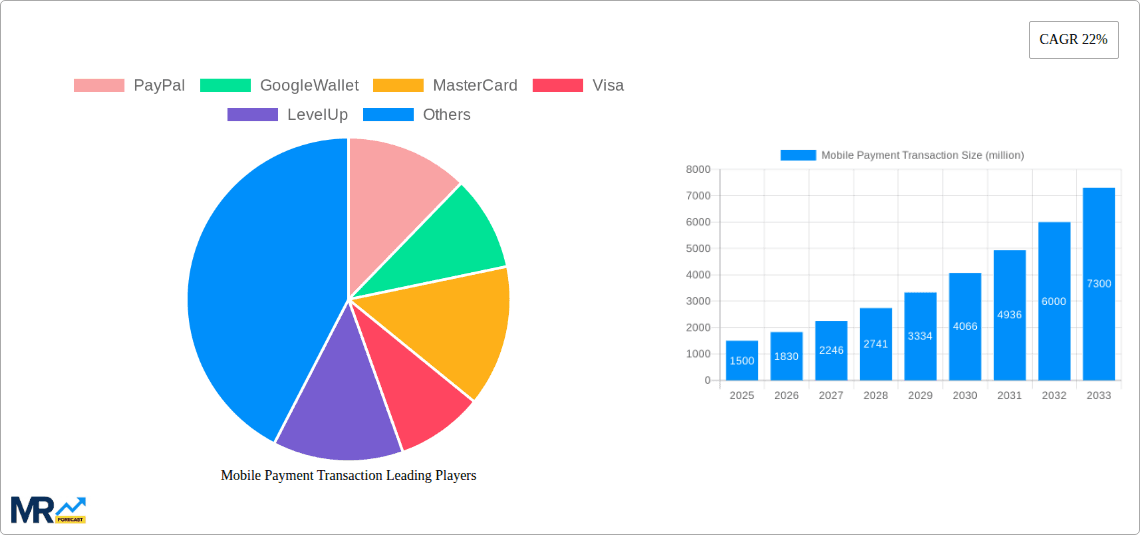

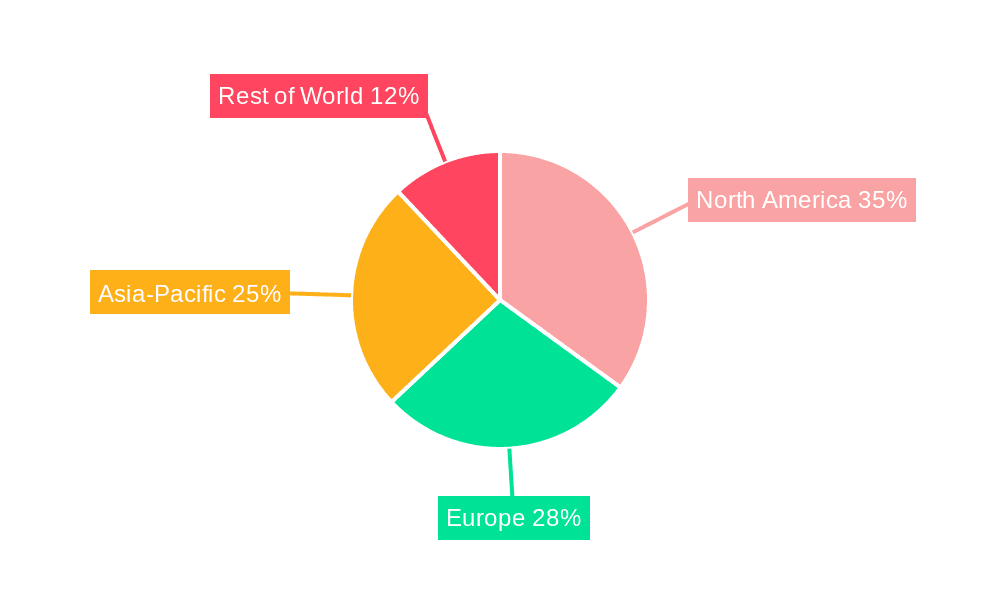

Looking ahead, several trends will shape the future of the mobile payment landscape. The rise of contactless payments is expected to accelerate, particularly in the wake of increased hygiene concerns. Furthermore, the increasing popularity of Buy Now, Pay Later (BNPL) options and the integration of mobile wallets with other financial services are reshaping consumer behavior. However, the market also faces challenges, such as security concerns and the need for greater financial literacy among consumers in some regions. Nevertheless, the overall market outlook remains overwhelmingly positive, with continued growth expected throughout the forecast period (2025-2033). Major players like PayPal, Google Wallet, Mastercard, and Visa are expected to continue to dominate the market, while smaller fintech companies will focus on niche applications and innovative solutions. The geographical distribution of market share will vary significantly, with developed markets in North America and Europe likely maintaining a significant lead, though rapid growth is anticipated in emerging markets in Asia and Africa.

The global mobile payment transaction market is experiencing explosive growth, projected to reach hundreds of billions of dollars by 2033. The study period (2019-2033), encompassing a historical period (2019-2024), a base year (2025), and an estimated and forecast period (2025-2033), reveals a consistent upward trajectory. Key market insights indicate a shift away from traditional payment methods towards the convenience and accessibility offered by mobile solutions. This trend is driven by increasing smartphone penetration, particularly in developing economies, coupled with the rising adoption of e-commerce and digital services. The estimated value for 2025 points to a significant market capitalization, showcasing the sector's maturity and substantial investment. Furthermore, the increasing integration of mobile payment systems with other financial technologies, such as digital wallets and banking apps, fuels further growth. The rising preference for contactless transactions, fueled by concerns over hygiene and the need for speed, adds another layer to this upward trend. The market isn't homogenous; significant variations exist across regions and demographics, with some exhibiting faster adoption rates than others. This necessitates a nuanced approach to market analysis, considering factors like infrastructure development, digital literacy levels, and consumer behavior patterns. Competition among established players and the emergence of innovative fintech startups further contribute to the dynamic nature of this market, driving both innovation and consolidation. The report offers a granular analysis of these factors, providing valuable insights for stakeholders across the value chain.

Several factors are driving the rapid expansion of the mobile payment transaction market. Firstly, the ubiquitous nature of smartphones and increased internet penetration, especially in emerging markets, has created a fertile ground for mobile payment adoption. Consumers are increasingly comfortable managing their finances digitally. Secondly, the enhanced security features offered by many mobile payment platforms, including biometric authentication and encryption, are reassuring consumers concerned about fraud. Thirdly, the convenience and speed of mobile payments compared to traditional methods are undeniable advantages. Consumers appreciate the ease of making payments without carrying cash or physical cards. Moreover, the integration of mobile payments into various applications and services, such as ride-hailing apps, food delivery platforms, and e-commerce websites, creates a seamless user experience. The expansion of contactless payment technologies further accelerates the transition, enabling quick and hygienic transactions. Furthermore, government initiatives and regulatory changes in many countries are promoting the adoption of digital payments, reducing reliance on cash and fostering financial inclusion. This combined effect of technological advancements, user convenience, improved security, and supportive regulatory frameworks is propelling the remarkable growth observed in the mobile payment transaction market.

Despite the impressive growth, the mobile payment transaction market faces several challenges and restraints. Security concerns remain a significant hurdle, with the potential for data breaches and fraudulent activities deterring some consumers. Maintaining the security of sensitive financial data is crucial for gaining and maintaining consumer trust. Another challenge is the uneven distribution of mobile infrastructure and digital literacy across different regions and demographics. In some areas, limited internet access or a lack of understanding about how to use mobile payment systems hinders wider adoption. Furthermore, the complexities of integrating mobile payment systems with existing banking infrastructure can be challenging and costly for businesses. Regulatory compliance also presents a significant challenge, with varying regulations across different countries creating complexities for businesses operating internationally. Finally, the intense competition among existing players and emerging fintech startups creates a dynamic and unpredictable market environment. Navigating this competitive landscape requires agility and innovation. Addressing these challenges effectively is crucial to unlocking the full potential of the mobile payment transaction market.

The mobile payment transaction market exhibits significant regional variations. North America and Europe currently hold substantial market share due to high smartphone penetration and established digital payment infrastructure. However, Asia-Pacific is predicted to experience the fastest growth, fueled by increasing smartphone adoption and a burgeoning e-commerce sector. Within segments, contactless payments using near-field communication (NFC) technology are expected to dominate, driven by their ease of use and hygiene benefits. Peer-to-peer (P2P) payments also show strong growth potential, as consumers increasingly utilize mobile apps to send and receive money to friends and family.

The paragraph above highlights the key regional and segmental drivers of market growth, supported by a deeper dive into individual regions and segments throughout the full report.

The mobile payment transaction industry's growth is fueled by several key catalysts. The convergence of enhanced smartphone technology, robust digital infrastructures, and the rising popularity of e-commerce provides a fertile ground for rapid expansion. Government initiatives aimed at promoting financial inclusion and reducing cash dependency are further accelerating adoption. The increasing integration of mobile payments into everyday life, from online shopping to transportation and utility payments, fosters further convenience and user familiarity. This confluence of factors promises continued exponential growth in the coming years.

This report offers a comprehensive overview of the mobile payment transaction market, providing in-depth analysis of market trends, driving forces, challenges, key players, and future growth prospects. It combines detailed quantitative data with qualitative insights, providing stakeholders with a complete picture of this dynamic industry. The detailed regional and segmental breakdown offers a granular understanding of the market landscape, enabling informed decision-making. The forecast period extends to 2033, providing long-term insights for strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 22%.

Key companies in the market include PayPal, GoogleWallet, MasterCard, Visa, LevelUp, Brain Tree, MoneyBokkers, Worlpay, Clinkle, Single Point, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Mobile Payment Transaction," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mobile Payment Transaction, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.