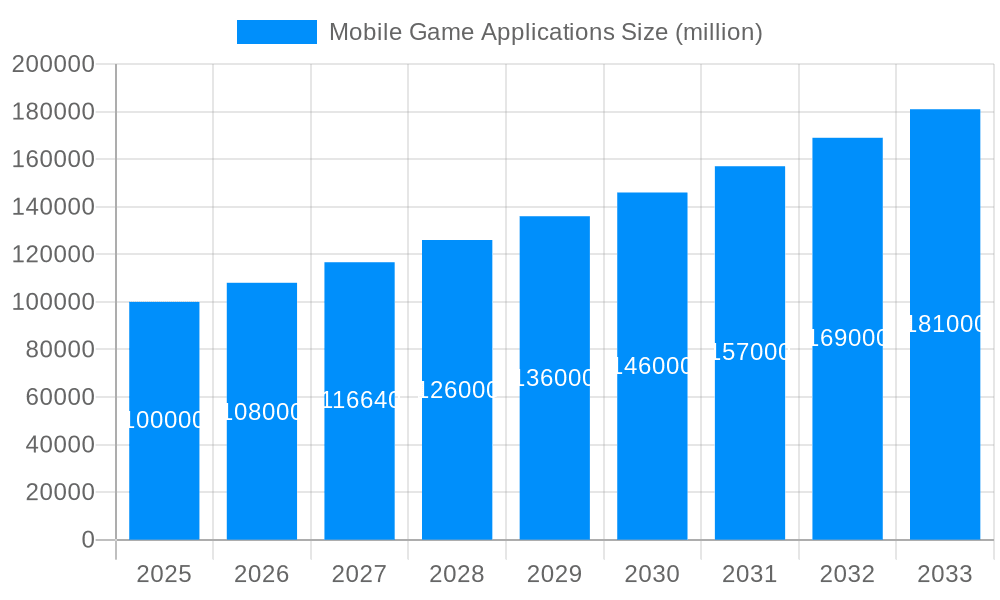

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Game Applications?

The projected CAGR is approximately 7.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mobile Game Applications

Mobile Game ApplicationsMobile Game Applications by Type (/> Entertainment, Education, Electronic Sports, Others), by Application (/> Android, IOS, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The mobile gaming applications market is a dynamic and rapidly expanding sector, projected to experience significant growth over the next decade. While precise market size figures are not provided, considering the involvement of major players like Tencent, Nintendo, and Activision Blizzard, a conservative estimate for the 2025 market size would be around $100 billion USD, considering the substantial revenue generated by these companies in the mobile gaming space. This market is fueled by several key drivers, including the proliferation of smartphones with advanced processing capabilities, the increasing accessibility of high-speed internet, and the growing popularity of casual and competitive mobile games. Further driving growth is the continuous innovation in game mechanics, graphics, and monetization strategies, creating engaging and lucrative experiences for players. Trends such as the increasing adoption of cloud gaming, the rise of esports on mobile platforms, and the growing popularity of hypercasual games contribute to the market's expansive potential.

However, market expansion isn't without its challenges. Competition is fierce, with numerous established and emerging developers vying for market share. Maintaining player engagement and preventing churn requires continuous investment in content updates, marketing, and community building. Furthermore, regulatory hurdles related to in-app purchases, data privacy concerns, and regional market variations also present obstacles to consistent growth. The market is segmented by game genre (e.g., puzzle, strategy, action, RPG), monetization model (free-to-play, paid), and geographic region. The competitive landscape is intensely competitive, with established industry giants and smaller, innovative developers constantly innovating and adapting to market trends. The long-term forecast suggests a continued upward trajectory, driven by ongoing technological advancements and evolving player preferences.

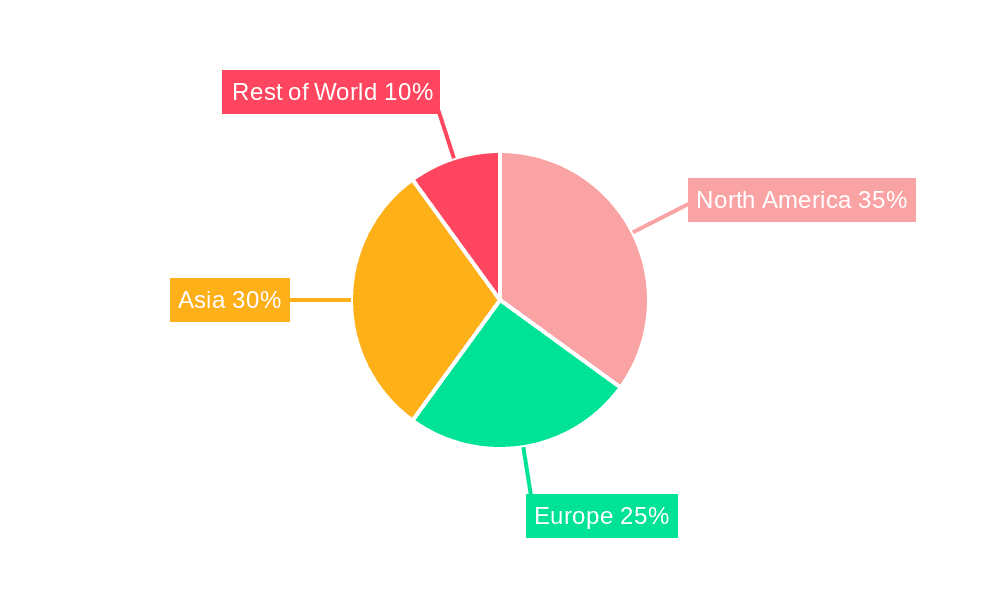

The mobile game application market experienced explosive growth throughout the historical period (2019-2024), exceeding expectations and establishing itself as a dominant force in the entertainment industry. The estimated market value in 2025 stands at a staggering $XXX million, fueled by a confluence of factors including increased smartphone penetration, improved mobile internet connectivity, and the consistent release of engaging and innovative games. This growth trajectory is projected to continue throughout the forecast period (2025-2033), with the market expected to reach $YYY million by 2033. Key market insights reveal a shift towards hyper-casual games, accessible to a wider audience, alongside the continued success of established genres like RPGs and strategy titles. The rise of esports and mobile gaming tournaments further bolsters the market's expansion, attracting both players and significant investment. Monetization strategies are also diversifying, with in-app purchases, subscriptions, and advertising all contributing to the revenue streams. The market's success hinges on factors such as continuous innovation in game design, sophisticated monetization models, and the adoption of advanced technologies like augmented reality (AR) and virtual reality (VR) to enhance the player experience. The competitive landscape remains fiercely contested, with established giants and emerging players vying for market share, leading to an environment of continuous innovation and improvement. The market's geographical distribution showcases a strong concentration in Asia, particularly China, driven by a large and engaged player base, while other regions, including North America and Europe, continue to demonstrate significant growth potential.

Several key factors propel the growth of the mobile game application market. The ubiquitous nature of smartphones and the widespread availability of high-speed internet access form the foundation of this expansion. This accessibility allows for a significantly larger potential player base compared to traditional gaming platforms. The continuous evolution of game design, encompassing innovative gameplay mechanics, captivating narratives, and visually stunning graphics, keeps players engaged and attracts new audiences. The rise of esports and competitive mobile gaming contributes significantly to market growth by fostering a sense of community and creating lucrative opportunities for both players and developers. Furthermore, the diversification of monetization strategies, including in-app purchases, subscriptions, and advertising, provides multiple revenue streams for developers. The integration of advanced technologies like AR and VR further enhances the gaming experience, captivating players and driving market expansion. Finally, the continuous influx of investment from venture capitalists and large corporations fuels the development of new games and technologies, driving the market forward. The increasing integration of social features within games also fosters a sense of community and encourages user retention and engagement.

Despite its impressive growth, the mobile game application market faces several challenges. Intense competition among developers, leading to a highly saturated market, requires continuous innovation and adaptation to maintain a competitive edge. The increasing cost of development and marketing can pose a significant hurdle for smaller studios, creating barriers to entry. Maintaining user engagement and preventing churn remains a crucial challenge, requiring developers to constantly update and improve their games to retain player interest. The monetization landscape is also dynamic, with changing app store policies and player sensitivities to in-app purchases necessitating strategic adjustments. Concerns regarding data privacy and security are paramount, requiring developers to implement robust measures to protect user information. Finally, the evolving preferences of players and the rapid pace of technological advancements necessitate continuous adaptation and innovation to stay relevant in the market. The fragmentation of the mobile gaming market across different operating systems (iOS and Android) and geographical regions further complicates distribution and marketing strategies.

Asia (Specifically China): This region consistently dominates the market due to a massive smartphone user base, high mobile internet penetration, and a strong gaming culture. The Chinese market alone accounts for a significant percentage of global mobile gaming revenue.

North America: This region exhibits substantial growth potential driven by high per-capita spending on mobile games and a significant player base accustomed to in-app purchases.

Europe: While exhibiting slower growth compared to Asia and North America, Europe represents a significant market due to its large and engaged player base.

Hyper-Casual Games: This segment is experiencing rapid growth due to its accessibility, ease of play, and broad appeal, attracting a wide range of players.

Role-Playing Games (RPGs): These games maintain significant popularity due to their immersive storylines, character customization options, and engaging gameplay.

Strategy Games: These games benefit from their complex gameplay and competitive elements, creating a dedicated and loyal player base.

Mobile Esports: The increasing popularity of competitive mobile gaming is driving growth by generating revenue through tournaments, sponsorships, and broadcasting rights. The convergence of casual and competitive gaming is also a significant contributor to this market expansion. The rise of influencer marketing within this sector is also worth noting; driving awareness, engagement, and revenue. The social aspects of mobile gaming—creating communities around specific games— also contribute to long-term engagement and growth. Further, improvements in mobile device technology and internet infrastructure will ensure continued expansion in these segments.

The mobile gaming industry's growth is further propelled by the increasing affordability of smartphones, particularly in developing nations. This expanded access to gaming unlocks a vast, untapped market. The continuous innovation in game development, encompassing immersive storylines and advanced graphics, contributes to higher player engagement and retention. Moreover, the proliferation of mobile esports and the emergence of professional mobile gaming leagues further fuels market growth through increased competition and viewership.

This report provides a comprehensive overview of the mobile game application market, covering trends, driving forces, challenges, and key players. It offers valuable insights into the market's dynamics, providing forecasts up to 2033. The report analyzes key segments and geographical regions, highlighting growth opportunities and potential risks. It is a valuable resource for businesses, investors, and stakeholders seeking to understand and navigate this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.9%.

Key companies in the market include Tencent, Nintendo, Activision Blizzard, Ubisoft, Electronic Arts Inc., Games Inc. (Take-two Interactive), Bethesda Softworks LLC, Zynga, Epic Games, Inc., NetEase, Inc., GungHo Online Entertainment Inc. ( SoftBank Group), Kabam Games Inc., Rovio Entertainment Corporation, Atari, Bandai Namco, FarSight Studios, Taito, Game Circus, Backbone Entertainment.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Mobile Game Applications," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mobile Game Applications, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.