1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Banking?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mobile Banking

Mobile BankingMobile Banking by Type (Neo Bank, Challenger Bank), by Application (Business, Personal), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

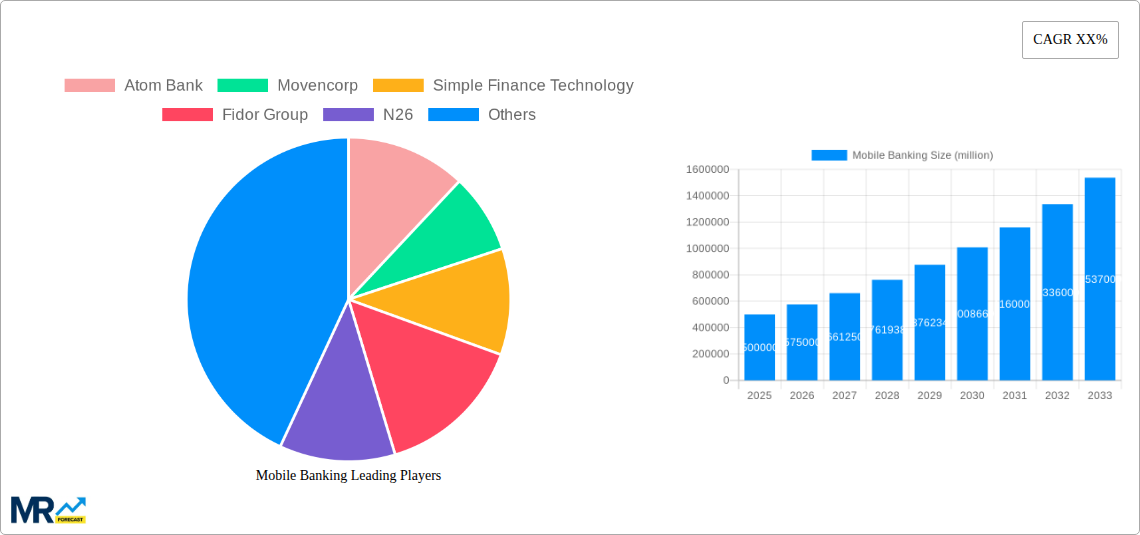

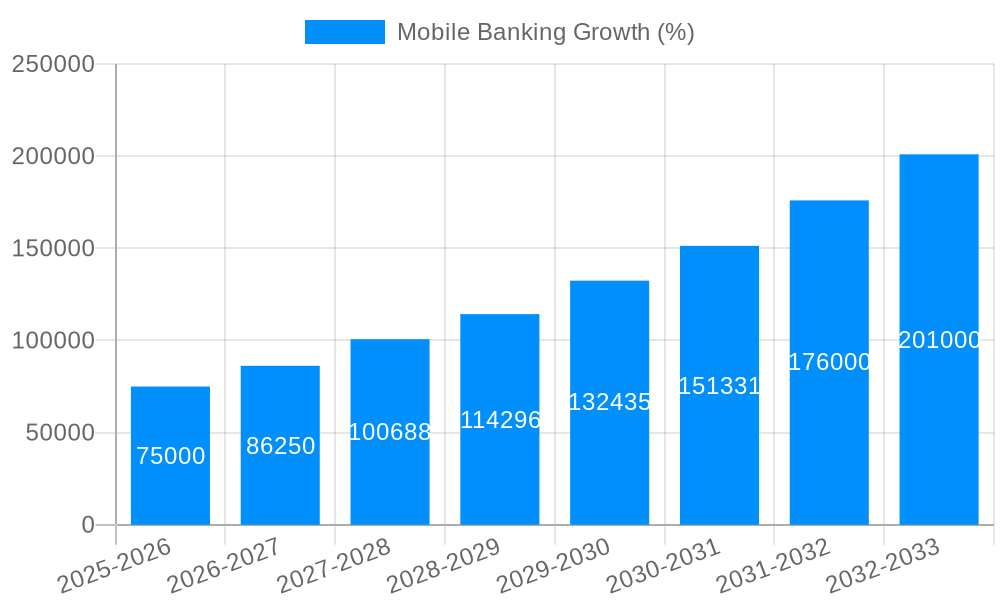

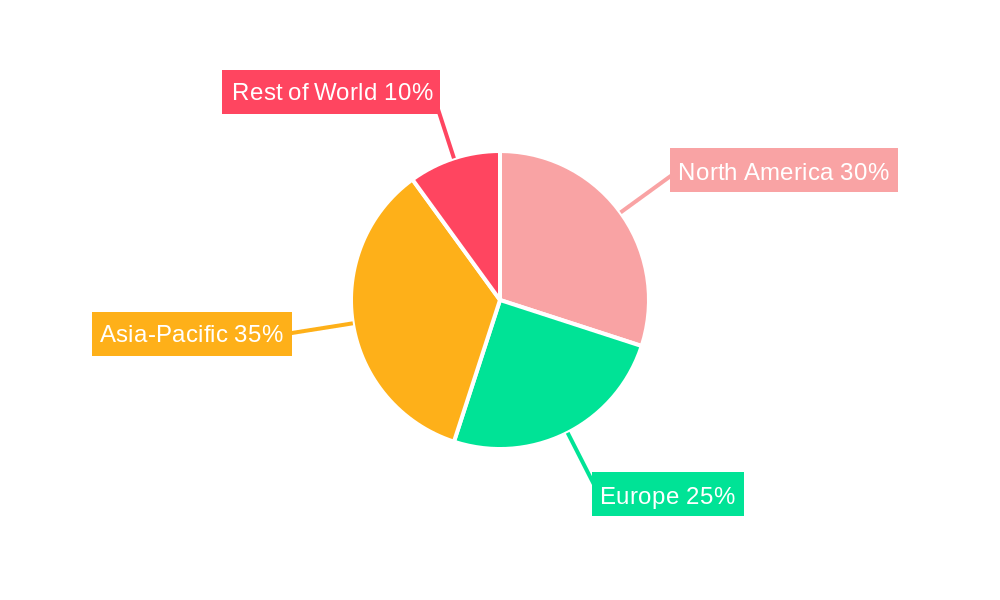

The global mobile banking market is experiencing robust growth, driven by the increasing adoption of smartphones, rising internet penetration, and the convenience offered by digital financial services. The market, estimated at $500 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $1.5 trillion by 2033. This surge is fueled by several key factors. Firstly, the emergence of neo-banks and challenger banks, offering innovative, user-friendly mobile-first banking experiences, is disrupting traditional banking models and attracting a large customer base, particularly among younger demographics. Secondly, the increasing demand for personalized financial management tools and services within mobile banking apps is driving engagement and attracting new users. Furthermore, advancements in mobile security technologies and regulatory support for open banking are fostering trust and confidence in mobile banking platforms. The market is segmented by bank type (neo-banks, challenger banks, and traditional banks integrating mobile features) and application (personal and business banking). Geographic growth is uneven, with North America and Europe currently holding significant market shares due to high smartphone penetration and established digital infrastructure. However, rapid digitalization in Asia-Pacific is poised to fuel substantial growth in this region over the forecast period. The continued expansion of mobile payment systems and the integration of AI and machine learning capabilities into mobile banking apps will further propel market growth.

Despite the considerable opportunities, the mobile banking market faces certain restraints. Concerns regarding data security and privacy remain a significant challenge, particularly given the increase in sophisticated cyber threats. Regulatory compliance and the need to adapt to evolving technological landscapes pose additional hurdles for market players. Furthermore, the digital divide, characterized by uneven access to technology and internet connectivity across different regions and demographics, limits market penetration in some areas. Addressing these challenges requires a multi-faceted approach involving enhanced security measures, user education, and proactive regulatory frameworks that encourage innovation while ensuring consumer protection. The strategic partnerships between mobile network operators, fintech companies, and traditional banks are likely to play a crucial role in overcoming these obstacles and unlocking further market expansion.

The global mobile banking market is experiencing explosive growth, projected to reach tens of billions of dollars by 2033. The period between 2019 and 2024 (historical period) saw significant adoption, laying the groundwork for the even more dramatic expansion predicted for the forecast period (2025-2033). Key market insights reveal a shift towards neo and challenger banks, driven by their user-friendly interfaces, innovative features, and often lower fees compared to traditional institutions. The estimated market value in 2025 (base year and estimated year) reflects this trend, with a substantial portion attributable to the personal banking segment. Consumers are increasingly comfortable managing their finances entirely through mobile apps, leading to a decline in physical branch visits and a surge in mobile-based transactions. This trend is further fueled by advancements in mobile technology, including improved security measures, faster internet speeds, and the increasing prevalence of smartphones globally. The rise of open banking APIs is also significantly impacting the landscape, facilitating seamless data sharing and the development of personalized financial services. Competition is fierce, with established players adapting to the mobile-first environment and newer entrants disrupting the market with their technologically advanced offerings. Geographical variations exist, with regions boasting high smartphone penetration and internet access experiencing faster adoption rates. The market's evolution is characterized by continuous innovation, with new features and services constantly being introduced to meet evolving customer needs and preferences. The focus is on enhancing the user experience, offering personalized financial management tools, and leveraging data analytics to provide tailored financial advice. The increasing integration of mobile banking with other digital platforms and services further expands its reach and potential.

Several factors are driving the rapid expansion of the mobile banking sector. Firstly, the ubiquitous nature of smartphones and increased internet penetration, especially in developing economies, has made mobile banking accessible to a vastly wider population. This accessibility removes geographical barriers and allows financial inclusion for previously underserved demographics. Secondly, the convenience offered by mobile banking is undeniable. Users can access their accounts, transfer funds, pay bills, and invest anytime, anywhere. This 24/7 availability is a major draw for busy individuals and businesses. Thirdly, the innovative features offered by mobile banking apps are continually improving. Features like biometric authentication, personalized financial management tools, and AI-powered chatbots enhance security, convenience, and the overall user experience. The cost-effectiveness of mobile banking is another significant driver. Many mobile-only banks offer lower fees and more competitive interest rates compared to traditional banks, attracting price-sensitive consumers and businesses. Finally, the regulatory environment in many countries is becoming more supportive of fintech innovation, fostering a conducive environment for the growth of mobile banking. This includes the promotion of open banking initiatives, which enable greater data sharing and the development of innovative financial products.

Despite the significant growth, mobile banking faces several challenges. Security concerns remain a primary obstacle. The risk of cyberattacks, fraud, and data breaches is a constant threat, demanding robust security measures and user education. Maintaining customer trust is paramount to overcoming these concerns. Another challenge is the digital divide. Not everyone has access to smartphones or reliable internet connectivity, excluding a portion of the population from the benefits of mobile banking. Bridging this digital divide requires collaborative efforts from governments, telecom companies, and financial institutions. Furthermore, regulatory compliance can be complex and varies across different jurisdictions, creating hurdles for mobile banking providers operating internationally. Keeping up with evolving regulations and ensuring compliance across multiple markets is a significant operational challenge. Finally, competition is intense. Numerous players are vying for market share, forcing businesses to continuously innovate and improve their offerings to remain competitive. This competitive landscape necessitates significant investment in technology and customer service.

The Personal Banking segment is poised to dominate the market throughout the forecast period (2025-2033). This is primarily due to the widespread adoption of smartphones and the increasing comfort level of individuals managing their personal finances through mobile apps. The convenience and accessibility offered by mobile banking apps resonate strongly with the personal banking segment, driving significant growth.

Personal Banking Segment Dominance: The convenience of accessing accounts, transferring funds, paying bills, and making investments at any time and place is a major factor. This segment shows higher adoption rates globally compared to business banking.

Geographical Variations: Regions with high smartphone and internet penetration, such as North America, Europe, and parts of Asia, are leading the mobile banking adoption. Developing economies show immense potential, with growth driven by financial inclusion initiatives and rising smartphone usage.

Specifically, within the Personal banking segment:

Asia-Pacific Region: This region's vast population and rapidly increasing smartphone penetration present a massive growth opportunity for mobile banking. Countries like India and China are witnessing an unprecedented rise in mobile banking usage.

North America: Strong digital infrastructure and high levels of financial literacy contribute to the high adoption rates in this region.

Europe: The continent is witnessing a significant shift towards digital banking, with innovative mobile-only banks gaining traction among younger demographics.

The mobile banking industry's growth is fueled by several factors. Firstly, increasing smartphone penetration and improved internet connectivity are expanding the market's reach. Secondly, the development of innovative features such as biometric authentication and AI-powered chatbots enhances security and user experience. Thirdly, regulatory support for fintech and open banking initiatives creates a favorable environment for growth, while the cost-effectiveness of mobile banking compared to traditional methods attracts cost-conscious customers.

This report offers a comprehensive analysis of the mobile banking market, providing valuable insights into key trends, drivers, challenges, and growth opportunities. It covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and forecasts market performance until 2033. The report includes detailed market segmentation by type (Neo Bank, Challenger Bank), application (Business, Personal), and geography, providing granular data for informed strategic decision-making. The analysis includes profiles of leading market players and a discussion of significant industry developments. This report will be invaluable for businesses, investors, and policymakers seeking a deep understanding of this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Atom Bank, Movencorp, Simple Finance Technology, Fidor Group, N26, Pockit, Ubank, Monzo Bank, MyBank (Alibaba Group), Holvi Bank, WeBank (Tencent Holdings Limited), Hello Bank, Koho Bank, Rocket Bank, Soon Banque, Digibank, Timo, Jibun, Jenius, K Bank, Kakao Bank, Starling Bank, Tandem Bank, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Mobile Banking," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mobile Banking, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.