1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile App Distribution?

The projected CAGR is approximately 15.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mobile App Distribution

Mobile App DistributionMobile App Distribution by Type (/> iOS, Android, Other), by Application (/> Mobile Phone, Smart TV, Smart Watches, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

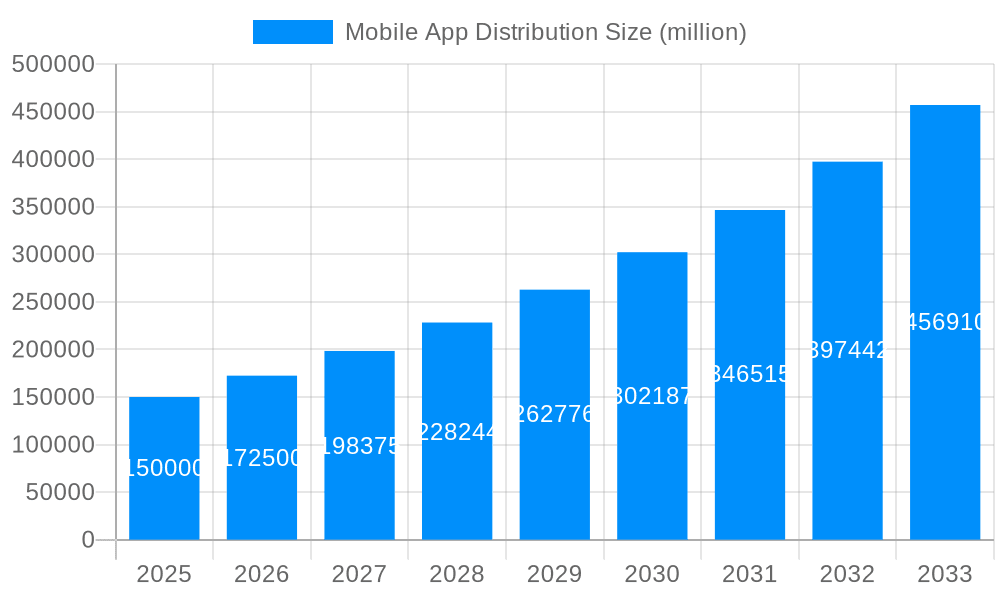

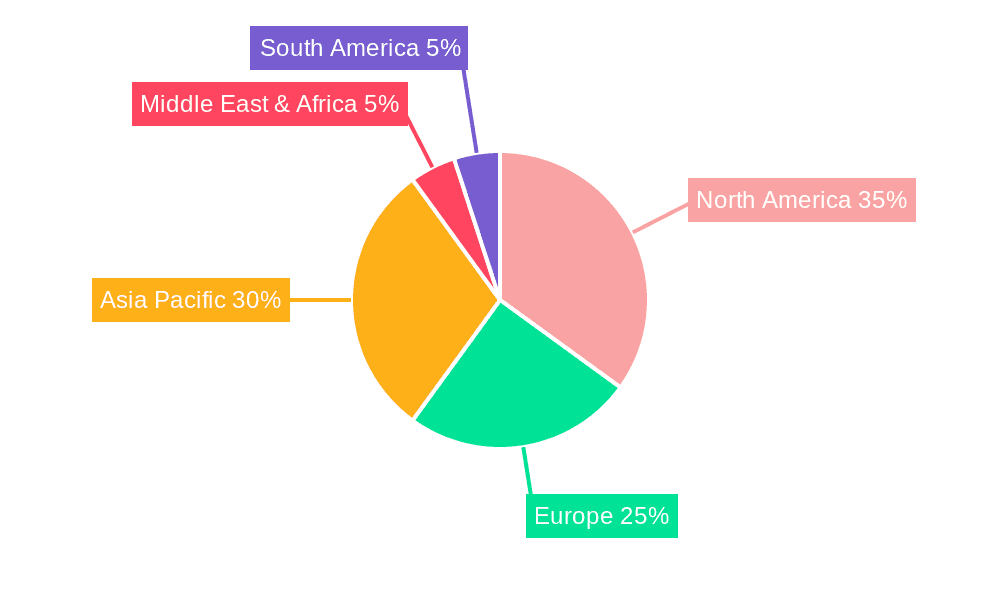

The global mobile app distribution market is poised for significant expansion, propelled by widespread smartphone adoption, enhanced internet accessibility, and the pervasive integration of mobile applications across industries. The market, valued at $284 billion in 2025, is forecast to achieve a Compound Annual Growth Rate (CAGR) of 15.5% between 2025 and 2033. This robust growth trajectory is attributed to burgeoning demand in mobile gaming, essential mobile-first services like e-commerce and fintech, and advancements in app development technologies such as augmented reality (AR) and artificial intelligence (AI). Android leads in market share, followed by iOS, with emerging platforms contributing to growth in the "Other" OS category. While mobile phones are the primary distribution channel, smart TVs and smartwatches are gaining momentum. North America and Asia Pacific are key growth regions, driven by high smartphone penetration and strong digital economies. Emerging markets in Africa and South America offer substantial untapped potential as smartphone usage escalates.

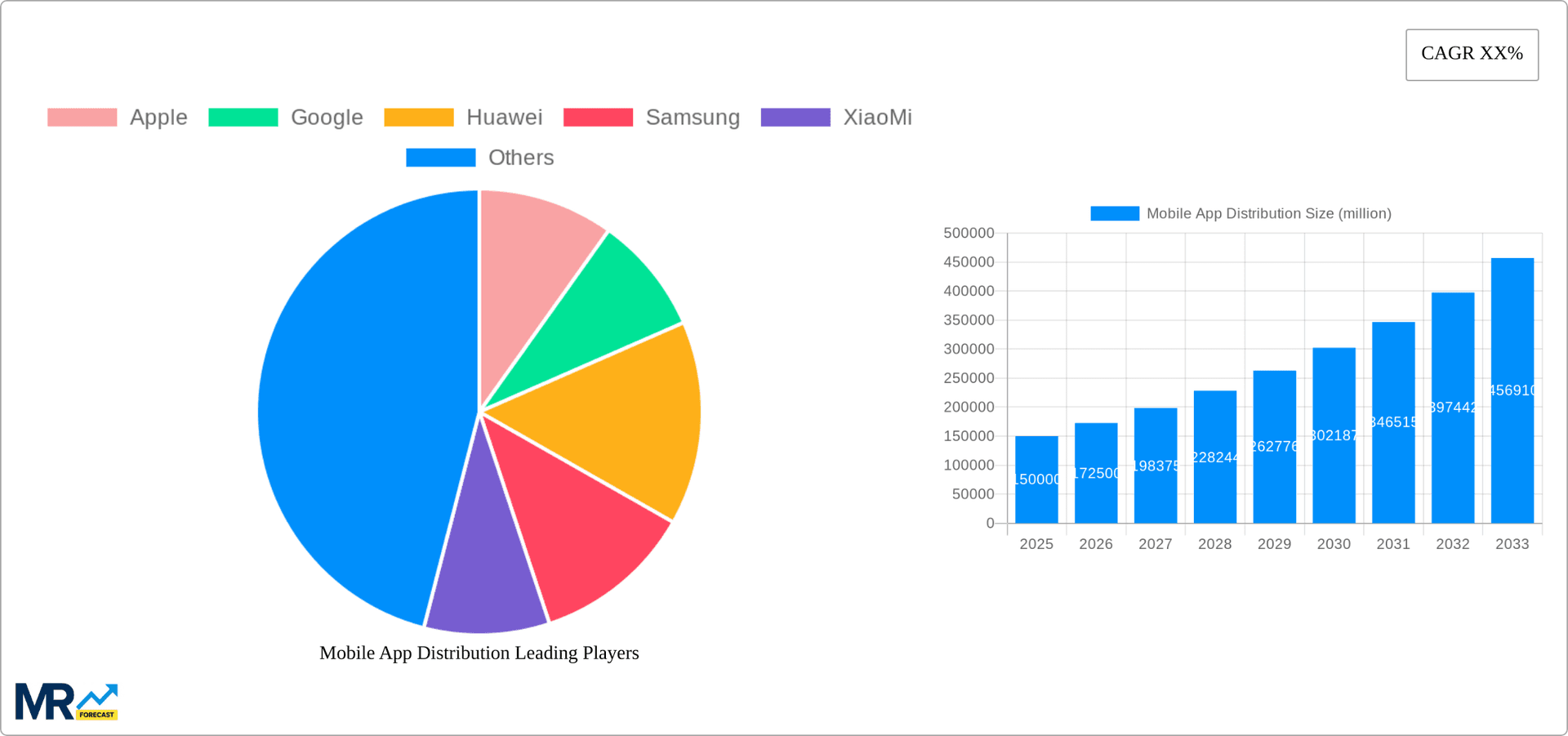

Key market restraints include persistent concerns regarding app security and user privacy, intense competition among developers, and the intricacies of app store optimization and user acquisition. The fragmented nature of the app ecosystem, with numerous distribution channels, also presents a challenge. To navigate these obstacles, developers are prioritizing personalized user experiences, employing data analytics for performance enhancement, and adopting innovative monetization strategies. Leading entities such as Apple, Google, and Samsung continually refine their app stores and distribution strategies to meet evolving user needs and maintain market dominance. The ongoing evolution of mobile technology and the sustained demand for mobile-centric solutions will ensure the mobile app distribution market remains a vibrant and competitive arena.

The global mobile app distribution market experienced phenomenal growth between 2019 and 2024, exceeding 100 million units in several key segments. This surge is attributed to several converging factors, including the proliferation of smartphones, the increasing adoption of smartwatches and smart TVs, and the continuous evolution of mobile app functionalities. The market's trajectory reveals a clear shift towards mobile-first strategies, with businesses heavily investing in app development and distribution to reach a wider audience. This trend is particularly pronounced in regions with high smartphone penetration and robust internet infrastructure. While Android continues to dominate the market share in terms of unit shipments, iOS maintains a strong presence among high-value users, leading to a diverse ecosystem of apps catering to varied preferences and spending habits. The historical period (2019-2024) showcased significant regional variations, with Asia-Pacific leading in terms of app downloads and active users, followed by North America and Europe. However, the emerging markets in Africa and Latin America are showing significant potential for future growth, driven by increasing smartphone affordability and improving internet connectivity. The forecast period (2025-2033) suggests sustained growth, particularly driven by innovations like 5G technology, advancements in AR/VR integration, and the rise of the metaverse, which are expected to create new opportunities and expand the addressable market. The estimated year 2025 will be a critical benchmark, demonstrating the impact of recent technological leaps and market consolidation. The study period (2019-2033) offers a complete picture of the evolution of the mobile app distribution landscape, highlighting both the challenges and opportunities that lie ahead.

Several key factors are driving the explosive growth of the mobile app distribution market. Firstly, the relentless increase in smartphone penetration globally is a major contributor. Billions of individuals worldwide now own smartphones, creating an enormous potential user base for mobile applications. Secondly, the continuous improvement in internet infrastructure, including the widespread rollout of 4G and the emergence of 5G networks, provides users with faster and more reliable access to apps. This improved connectivity enhances the user experience, encouraging greater adoption and engagement. Thirdly, the increasing sophistication of mobile apps themselves is a driving force. Apps are becoming more feature-rich, personalized, and integrated with other aspects of users' lives, creating greater stickiness and user loyalty. Furthermore, the growing adoption of smartwatches and smart TVs is expanding the range of devices on which apps can be distributed, thereby creating new revenue streams and opportunities for developers. The rise of in-app purchases and subscriptions further bolsters market expansion, generating considerable revenue for both app developers and distribution platforms. Finally, the constant innovation in app development tools and frameworks, together with a thriving developer community, ensures a steady stream of new and exciting applications are continuously being released, catering to evolving user demands.

Despite the significant growth potential, several challenges hinder the seamless distribution of mobile apps. The intense competition among app developers is a major hurdle. The app stores, particularly Apple's App Store and Google Play Store, are saturated with millions of applications, making it difficult for new apps to gain visibility and traction. App store optimization (ASO) has become critical, requiring significant investment in marketing and promotion. Furthermore, fragmentation across different operating systems (iOS, Android, etc.) and device types poses a distribution challenge, necessitating developers to adapt their apps for various platforms. Security concerns and privacy issues remain critical challenges, with users becoming increasingly aware of data breaches and the potential misuse of personal information. This has led to stricter regulations and increased scrutiny of app developers, requiring them to invest more resources in security measures. Finally, monetization remains a challenge for many app developers, with only a small percentage of apps achieving significant revenue. The high cost of app development, marketing, and maintenance further intensifies these challenges, making profitability difficult to attain for many startups and small businesses. These issues significantly impact the overall growth trajectory of the mobile app distribution market.

Android's continued dominance: Android's open-source nature and broader device compatibility across price points contribute to its larger market share compared to iOS. This translates into a significantly larger number of app downloads and active users. While iOS enjoys higher ARPU (average revenue per user), Android's sheer volume of users makes it the key segment to dominate.

Asia-Pacific: A growth powerhouse: Countries in the Asia-Pacific region, including China, India, and Indonesia, boast rapidly expanding smartphone markets and internet penetration, leading to explosive growth in app downloads and usage. The sheer population size and rapidly growing middle class in this region present unparalleled opportunities for app developers and distributors.

Mobile Phones as the primary platform: While Smart TVs and Smartwatches are seeing growth, mobile phones remain the dominant platform for app distribution. The ubiquity of smartphones and their constant connectivity ensure their enduring role as the primary consumer device for accessing mobile apps. The massive user base, diverse app categories, and advanced functionalities continue to drive growth within the mobile phone segment.

Gaming and Social Media apps: These app categories remain the most popular and lucrative in the mobile app market. Their widespread adoption fuels a large volume of app downloads, in-app purchases, and advertising revenue, solidifying their position as key segments.

The sustained growth in mobile phone usage, coupled with the rise of 5G and increased data speeds, will further accelerate the dominance of this segment. Similarly, the Asia-Pacific region's demographic trends and economic growth will continue to fuel the market's expansion within that region. The continuous development of sophisticated mobile games and social media platforms reinforces the leadership position of these segments.

The mobile app distribution industry is experiencing significant growth fueled by several key factors. The widespread adoption of 5G technology promises faster download speeds and enhanced user experiences, driving further app usage and adoption. Innovations in augmented reality (AR) and virtual reality (VR) technologies are creating new immersive app experiences, expanding the market. The metaverse's emergence presents a novel platform for app distribution and engagement, offering unique opportunities for developers and distributors. Finally, the ongoing expansion of the Internet of Things (IoT) connects more devices to the internet, creating opportunities for app development beyond smartphones, including smart home appliances and wearables, further expanding the market potential.

This report provides a comprehensive overview of the mobile app distribution market, covering historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). It analyzes key trends, drivers, challenges, and leading players, providing valuable insights for businesses, investors, and developers in the mobile app ecosystem. The report delves into specific segments, like Android and iOS, regional breakdowns, and application categories, offering a granular view of the market's dynamic landscape. This detailed analysis allows stakeholders to make informed decisions and capitalize on emerging opportunities in this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.5%.

Key companies in the market include Apple, Google, Huawei, Samsung, XiaoMi, Tencent, Facebook, Microsoft, Amazon, BBK, Baidu, Yandex.

The market segments include Type, Application.

The market size is estimated to be USD 284 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Mobile App Distribution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mobile App Distribution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.