1. What is the projected Compound Annual Growth Rate (CAGR) of the Microfinance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Microfinance

MicrofinanceMicrofinance by Type (Below $3000, $3000-$10000, $10000-25000$, Above 25000$), by Application (Personal, SME), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

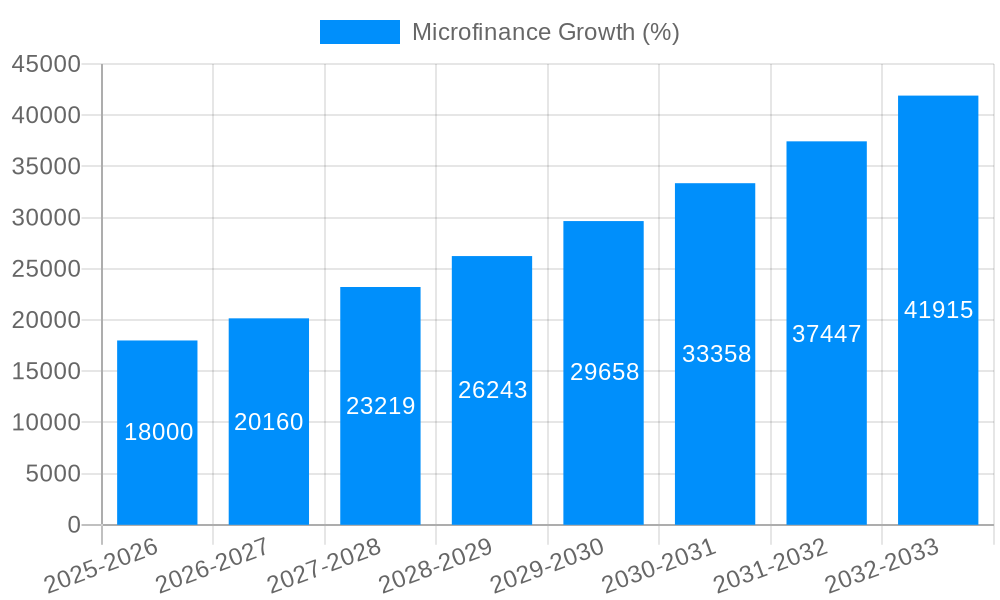

The global microfinance market is experiencing robust growth, driven by increasing financial inclusion initiatives, rising entrepreneurial activity, particularly among women and in underserved communities, and the expanding reach of digital financial services. The market, segmented by loan amount (Below $3000, $3000-$10000, $10000-$25000, Above $25000) and application (Personal, SME), shows a significant preference for smaller loans for personal use, reflecting the needs of the target demographic. While the precise market size in 2025 is unavailable, a reasonable estimate, considering a typical CAGR in the microfinance sector (let's assume 10-15% based on industry trends) and the current market conditions, places it somewhere between $500 billion and $700 billion. This growth is fueled by both increasing demand and the innovative approaches adopted by microfinance institutions (MFIs), such as leveraging technology for loan disbursement and management. However, challenges remain, including high operational costs, regulatory hurdles in some regions, and the inherent risks associated with lending to vulnerable populations. Effective risk management strategies, combined with technological advancements, are key to sustaining the market's positive trajectory.

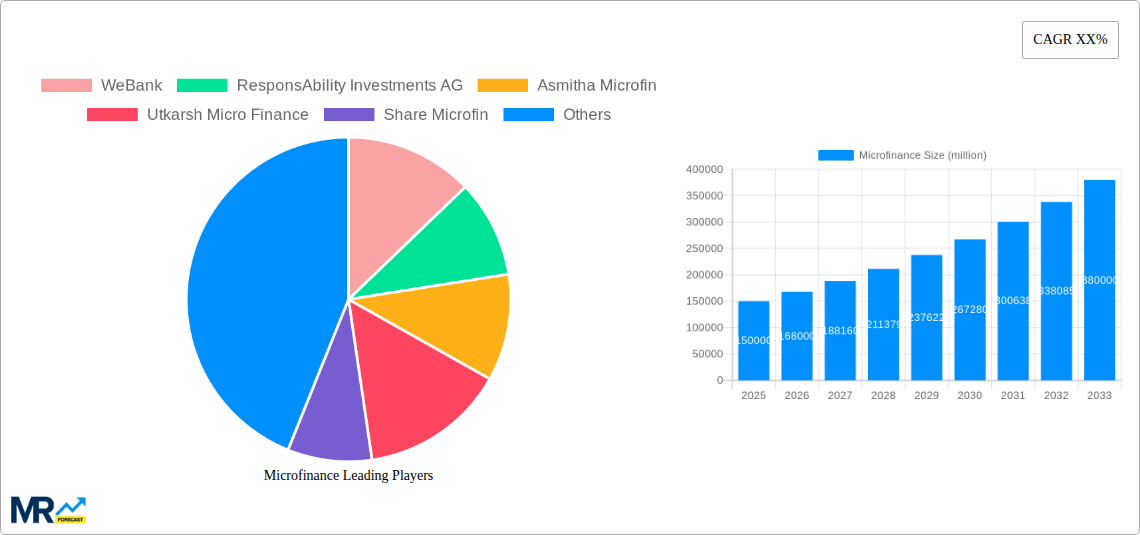

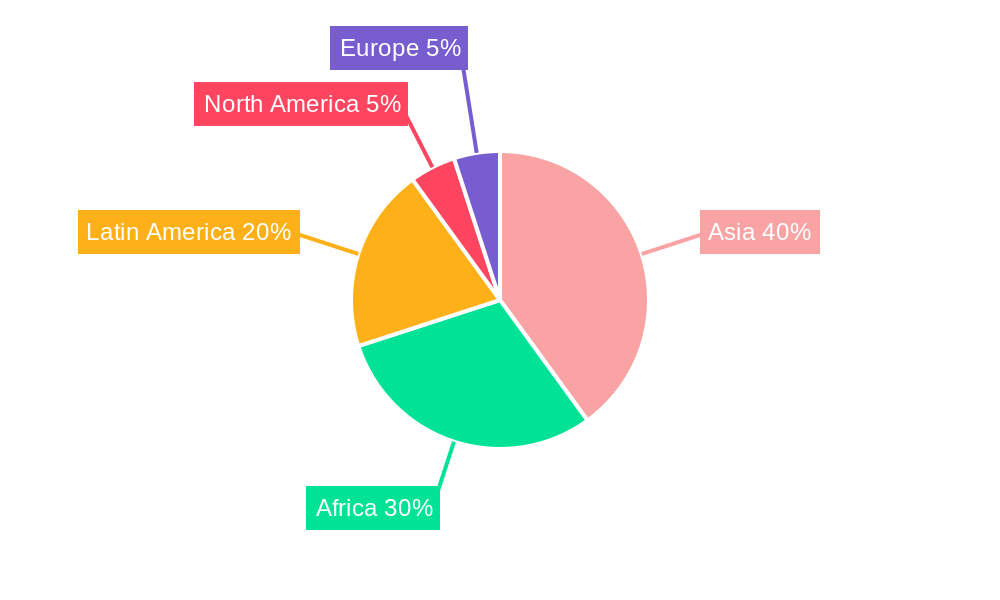

The major players in this dynamic market, such as WeBank, ResponsAbility Investments AG, and Ujjivan Financial Services, are constantly adapting their strategies to navigate these complexities. Geographical expansion, particularly in developing economies with high unbanked populations, remains a key growth driver. North America and Europe represent significant markets, but the strongest growth potential lies within Asia-Pacific and sub-Saharan Africa, where the need for microfinance is most acute. Further market segmentation, tailored product offerings based on specific needs, and strong partnerships with governments and NGOs are crucial for future success in this sector. The continued focus on financial literacy and responsible lending practices will be key to mitigating risks and ensuring the sustainable growth of the microfinance industry.

The global microfinance market is experiencing robust growth, projected to reach XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The base year for this analysis is 2025, with historical data spanning 2019-2024. Key market insights reveal a shift towards digitalization, with fintech companies like WeBank playing a crucial role in expanding access to credit through innovative mobile lending platforms. This digital transformation has lowered transaction costs and increased efficiency, significantly impacting market dynamics. Furthermore, the increasing adoption of micro-insurance products bundled with microloans has mitigated risk for both borrowers and lenders, leading to enhanced financial inclusion. The study shows a significant preference for smaller loan amounts (below $3000) amongst borrowers, primarily for personal consumption and small-scale business ventures. However, the growth of SMEs is driving demand for larger loans in the $3000-$10000 range, indicating a diversification in the market's target audience. Regulatory frameworks are also evolving, with a focus on responsible lending practices and client protection. This regulatory oversight, while creating initial challenges, ultimately enhances market stability and investor confidence. The market shows regional variations, with developing economies in Asia and Africa experiencing the most dynamic growth. The integration of microfinance with broader financial ecosystems, leveraging partnerships with commercial banks and other financial institutions, is a defining trend. Finally, the rising awareness of the socio-economic impact of microfinance initiatives is attracting significant investment from both public and private sectors, fueling market expansion.

Several factors are propelling the expansion of the microfinance market. Firstly, the increasing penetration of mobile technology and internet connectivity in underserved regions is enabling wider access to financial services. Digital platforms are simplifying loan application processes, reducing bureaucratic hurdles, and reaching previously unbanked populations. Secondly, government initiatives focused on financial inclusion are providing crucial support through subsidies, favourable regulatory environments, and awareness campaigns. This regulatory support fosters investor confidence and encourages the development of sustainable microfinance institutions (MFIs). Thirdly, the growing recognition of the positive socio-economic impact of microfinance, empowering individuals and communities, is attracting significant philanthropic funding and corporate social responsibility initiatives. These investments are bolstering the capacity of MFIs and expanding their reach. Finally, the rise of innovative financial products tailored to the specific needs of micro-entrepreneurs, including bundled insurance and savings products, has enhanced the overall appeal and effectiveness of microfinance services.

Despite the positive trends, the microfinance industry faces significant challenges. High operational costs, particularly in remote areas, remain a constraint. The need for robust credit scoring mechanisms to effectively manage risk and prevent over-indebtedness is critical. Furthermore, maintaining profitability while adhering to responsible lending practices and client protection regulations presents a delicate balancing act for many MFIs. The vulnerability of borrowers to external shocks such as natural disasters and economic downturns necessitates robust risk mitigation strategies. Regulatory inconsistencies across different regions can create complexities for MFIs operating in multiple jurisdictions. Lastly, the need for effective financial literacy programs to empower borrowers to make informed financial decisions is vital for long-term sustainability and preventing potential financial distress.

Dominant Segment: The segment of loans below $3000 for personal use shows significant market dominance due to its high volume of transactions and accessibility to a large, underserved population. This segment benefits from the widespread adoption of mobile lending platforms and the increasing penetration of mobile technology.

Key Regions: Asia and Africa are projected to dominate the microfinance market due to their large populations, high rates of unbanked individuals, and significant government initiatives promoting financial inclusion. Within these regions, specific countries with strong governmental support for microfinance and a rapidly expanding mobile money ecosystem will experience disproportionately higher growth.

The high demand for smaller loans stems from the inherent needs of individuals and micro-entrepreneurs within these regions. These borrowers often require relatively small amounts of capital to meet immediate personal or business needs, such as purchasing essential goods, paying for education, or acquiring small-scale equipment. The readily available smaller loan amounts offered via mobile and digital platforms caters to this requirement. The continued increase in mobile phone and internet penetration in these regions is a key factor facilitating access and ensuring that the microfinance industry continues its growth trajectory within the identified segment. This segment’s growth will also be bolstered by ongoing government support in various forms, including regulatory frameworks, financial literacy programs, and direct investments in MFIs.

The microfinance industry's growth is catalyzed by the convergence of technological advancements (mobile lending platforms), favorable regulatory environments fostering financial inclusion, and growing recognition of microfinance's positive socio-economic impact, leading to increased investments from both public and private sectors.

This report provides a comprehensive overview of the microfinance market, analyzing historical trends, current market dynamics, and future growth projections. It identifies key players, examines significant developments, and highlights the driving forces and challenges shaping the industry. This detailed analysis offers valuable insights for investors, stakeholders, and policymakers seeking to understand and navigate this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include WeBank, ResponsAbility Investments AG, Asmitha Microfin, Utkarsh Micro Finance, Share Microfin, Ujjivan, Spandana Sphoorty Financial, Bhartiya Samruddhi Finance Limited(BSFL), GFSPL, Suning, Grameen America, LiftFund, Opportunity Fund, Accion, Justine Petersen, Malayan Banking Berhad, GC Business Finance, Adie, DMI, Microfinance Ireland, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Microfinance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Microfinance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.