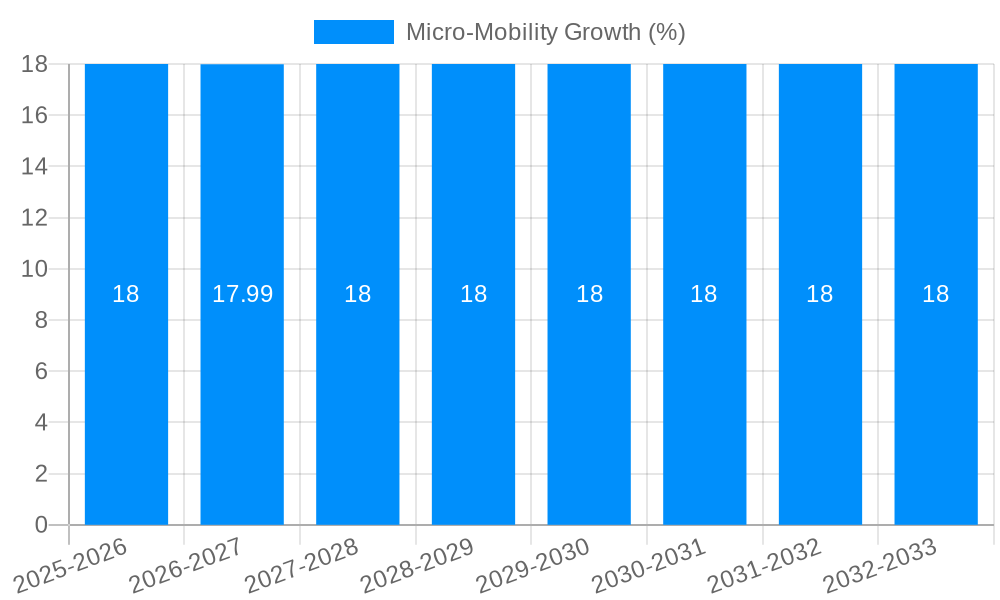

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro-Mobility?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Micro-Mobility

Micro-MobilityMicro-Mobility by Type (Bicycle, Electric Bike, Electric Scooter), by Application (Age 18-24, Age 25-34, Age 35-44, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

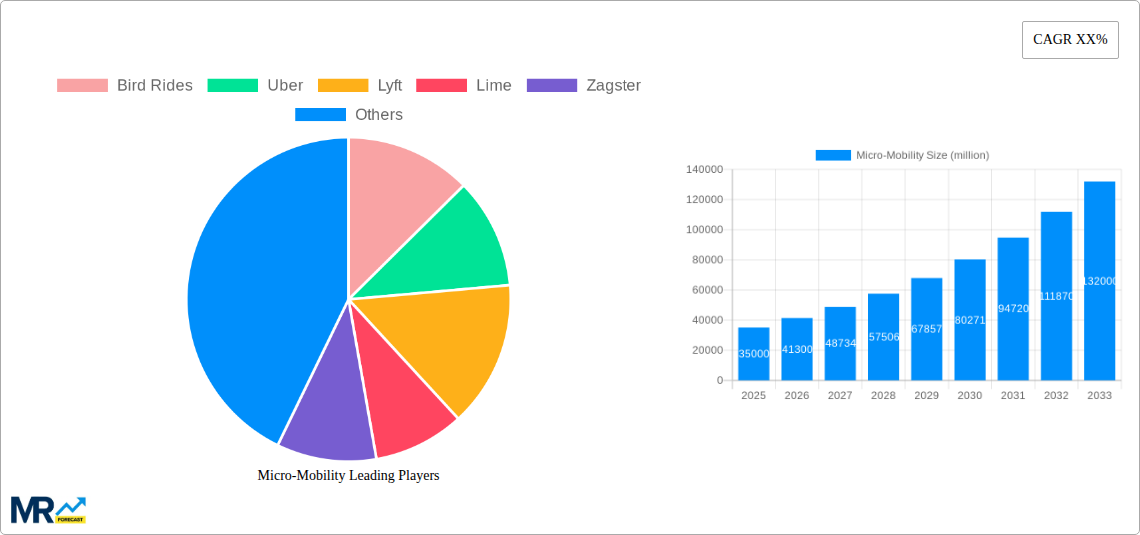

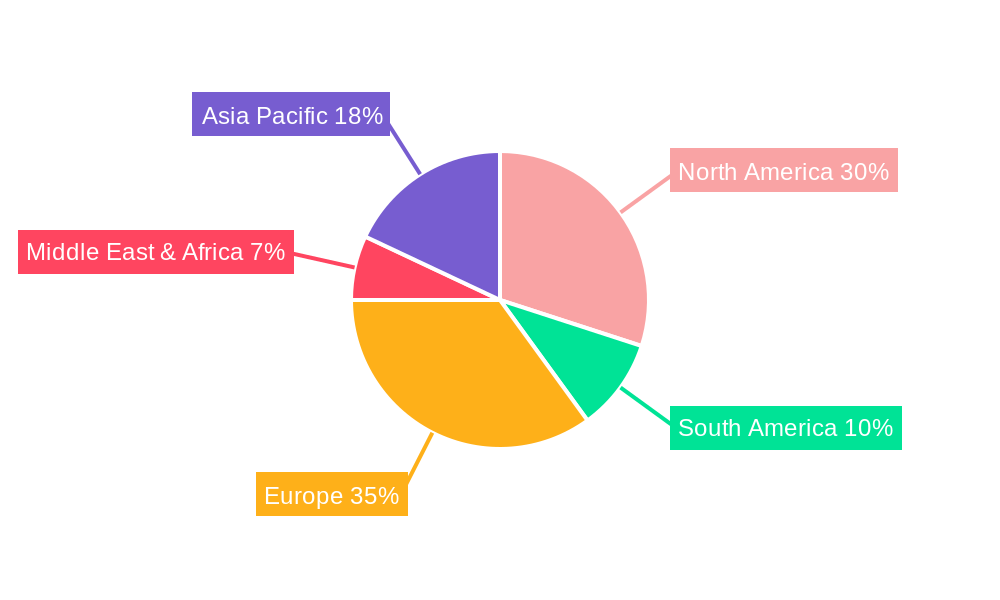

The micro-mobility market, encompassing bicycles, e-bikes, and e-scooters, is experiencing robust growth, driven by increasing urbanization, rising fuel costs, and a growing preference for eco-friendly and convenient transportation solutions. The market's appeal extends across various demographics, with significant adoption among young adults (18-34) for commuting and leisure activities. Technological advancements, such as improved battery technology and smart features, are further fueling market expansion. While regulatory hurdles and safety concerns pose challenges, ongoing infrastructure development, particularly dedicated bike lanes and charging stations, is mitigating these restraints. The competitive landscape is dynamic, with a mix of established players like Uber and Lyft alongside numerous startups innovating in shared micro-mobility services. This creates both opportunities and pressures for companies to adapt and offer differentiated services, such as subscription models and integrated payment systems. Geographical variations exist, with North America and Europe currently holding significant market shares, while Asia-Pacific is projected to experience substantial growth in the coming years due to increasing disposable incomes and government initiatives promoting sustainable transport. This growth is expected to continue, driven by factors mentioned above.

The forecast period (2025-2033) anticipates a sustained expansion, although the CAGR might moderate slightly as the market matures. Key strategic considerations for market participants include strategic partnerships, expansion into underserved regions, investment in technological innovation (especially battery life and safety features), and proactive engagement with local regulatory bodies. Companies will need to focus on optimizing operations, improving user experiences and leveraging data analytics to manage fleets efficiently. The success in this market hinges upon the ability to effectively address user needs, ensuring both convenience and safety within the existing regulatory environment. Future market growth will likely be shaped by the increasing integration of micro-mobility solutions with broader transportation networks, creating seamless travel options for users.

The micro-mobility market, encompassing bicycles, electric bikes, and electric scooters, experienced explosive growth during the historical period (2019-2024), reaching an estimated value of several million units in 2025. This surge is driven by a confluence of factors, including increasing urbanization, growing environmental concerns, and the appeal of convenient, affordable, and often faster-than-public-transit short-distance transportation options. The market is highly dynamic, with significant shifts in technology, business models, and regulatory landscapes observed. The rise of dockless sharing systems, initially spearheaded by companies like Bird Rides and Lime, revolutionized access to micro-mobility vehicles, while established players like Uber and Lyft quickly entered the space. Competition is fierce, leading to innovative pricing strategies, fleet management improvements, and a focus on user experience enhancements. The market also witnessed a diversification of vehicle types, with advancements in electric bike technology and the introduction of innovative scooter designs. Beyond the initial boom, the industry has faced challenges related to safety regulations, infrastructure limitations, and the environmental impact of discarded vehicles. However, continuous innovation and the ongoing evolution of regulations point to a period of consolidation and sustained, though possibly slower, growth in the forecast period (2025-2033). The market is expected to see increased integration with existing transportation networks and smarter fleet management systems leveraging data analytics and AI.

Several key factors are driving the expansion of the micro-mobility market. Firstly, the increasing urbanization across the globe leads to congested roads and inadequate public transportation systems, making micro-mobility vehicles an attractive alternative for short-distance travel. Secondly, growing environmental awareness is pushing consumers towards more sustainable transportation options, with electric vehicles being a significant part of this shift. Micro-mobility's convenience and affordability are also major drivers; they often provide a quicker and cheaper alternative to taxis or private vehicles, particularly for younger demographics. Technological advancements, such as improved battery technology in electric vehicles and the development of more durable and user-friendly designs, enhance the overall appeal and performance of these vehicles. Furthermore, supportive government policies and initiatives, such as dedicated bike lanes and subsidies for electric vehicles in many cities, are stimulating market growth. Finally, the rise of innovative business models, especially dockless sharing, significantly lowered the barrier to entry for users and helped accelerate adoption. These converging factors have created a strong foundation for continued expansion.

Despite the significant growth, the micro-mobility sector faces notable challenges. Safety concerns remain paramount, with accidents involving electric scooters receiving considerable media attention. This has led to stricter regulations and safety mandates in many cities, potentially slowing down growth or increasing operating costs for companies. Infrastructure limitations, such as a lack of dedicated bike lanes and safe parking areas, pose significant obstacles to widespread adoption. The environmental impact of discarded or improperly managed vehicles is also an ongoing concern. Furthermore, the high initial investment required for fleet expansion, coupled with operational costs such as maintenance and repairs, presents a significant hurdle for many companies. Competition is intense, with established players and new entrants vying for market share, leading to price wars and margin pressure. Finally, the fluctuating demand and seasonality of the market present operational challenges for effective fleet management and financial planning.

The micro-mobility market shows significant regional variation in growth and adoption rates. While many cities globally have embraced micro-mobility, certain regions and segments stand out:

Electric Scooter Segment: This segment is anticipated to dominate the market during the forecast period (2025-2033), driven by its ease of use and affordability, especially among the 18-34 age group.

Age 18-24 Segment: This demographic represents a significant user base, characterized by a higher propensity to adopt new technologies and a greater reliance on shared mobility solutions. This group often prioritizes convenience and affordability.

Urban Centers in North America and Europe: Cities in these regions provide a conducive environment for micro-mobility due to their density, existing infrastructure (though sometimes incomplete), and higher disposable income among residents.

Asia-Pacific (specific cities): Certain metropolitan areas in the Asia-Pacific region, notably in China and India, are experiencing rapid growth in micro-mobility adoption, primarily due to high population density and increasing traffic congestion. However, regulatory frameworks and infrastructure vary significantly across this diverse region.

The paragraph emphasizes that although the global market is growing, success isn't uniform. Regulations, infrastructure, and cultural acceptance differ dramatically. Regions and segments with supportive environments, technological advancements, and strong consumer demand will see the most significant growth. While electric scooters are currently leading, the long-term dominance may shift based on technological innovation and evolving user preferences.

The continued growth of the micro-mobility industry will be fueled by several key catalysts. Technological innovations, particularly in battery technology and vehicle design, will lead to longer-range vehicles and improved safety features. Increased integration with public transportation systems, such as seamless payment options and better intermodal connections, will enhance user experience. Government initiatives promoting sustainable transportation and the development of dedicated infrastructure will create more favorable conditions for micro-mobility adoption. Finally, data-driven fleet management and optimized charging infrastructure will improve efficiency and sustainability, driving long-term profitability.

This report provides a detailed analysis of the micro-mobility market, covering market size and trends, growth drivers and challenges, key players, and significant industry developments. It offers a comprehensive view of the market's evolution from its initial boom to its current state and future projections, incorporating data and insights to help businesses and investors navigate this rapidly changing landscape. The report’s projections extend through 2033, offering a long-term perspective of market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bird Rides, Uber, Lyft, Lime, Zagster, Skip, Spin, Hellobike, Mobike, Citi Bike, Mobycy, Nextbike, Capital Bikeshare, Velib, Call a Bike, Santander Cycles, Bicing, YEGO, Wind Mobility, Beam, Tier Mobility, Voi Technology, Vogo, Bolt Mobility, Razor Share, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Micro-Mobility," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Micro-Mobility, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.