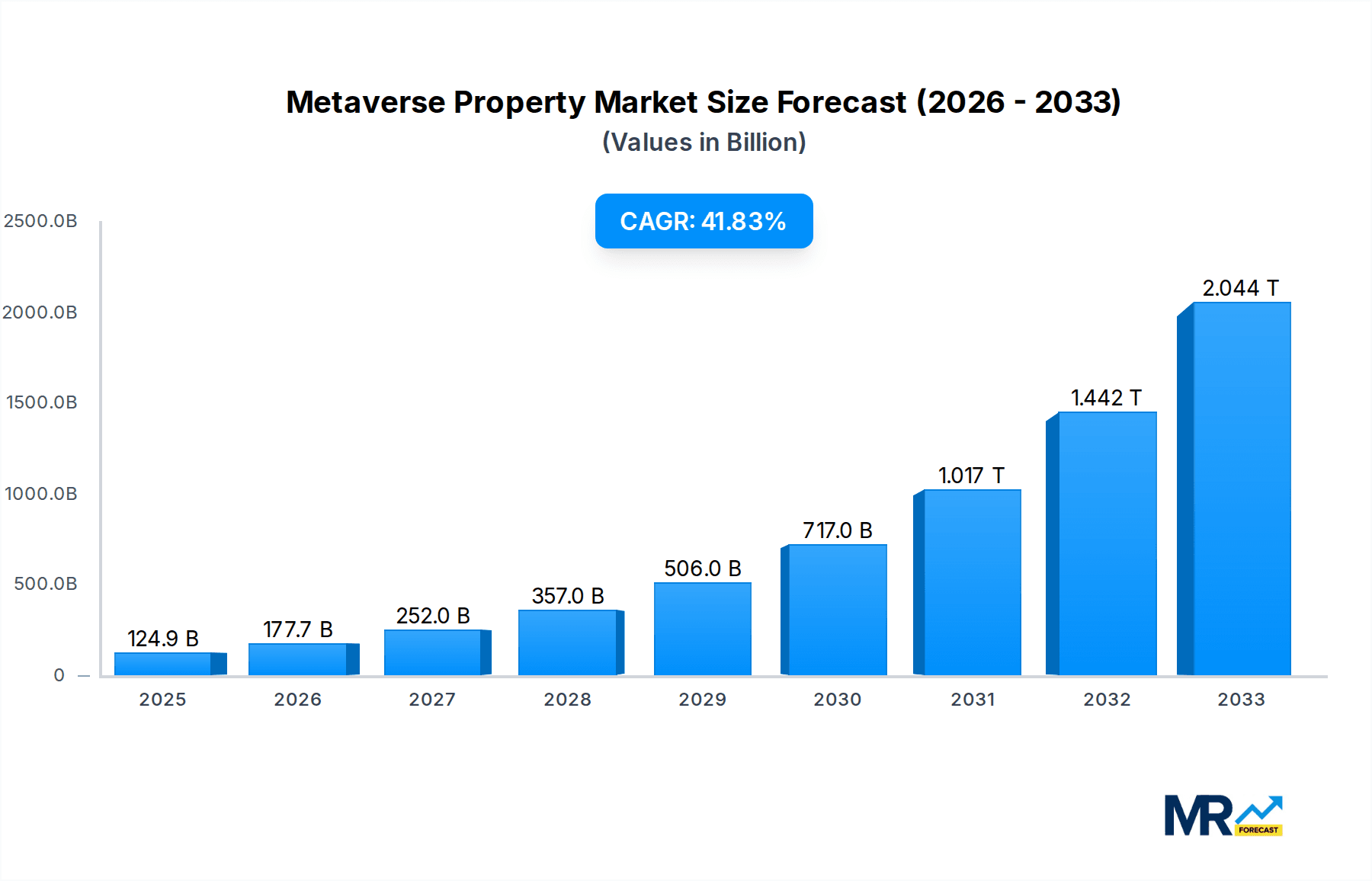

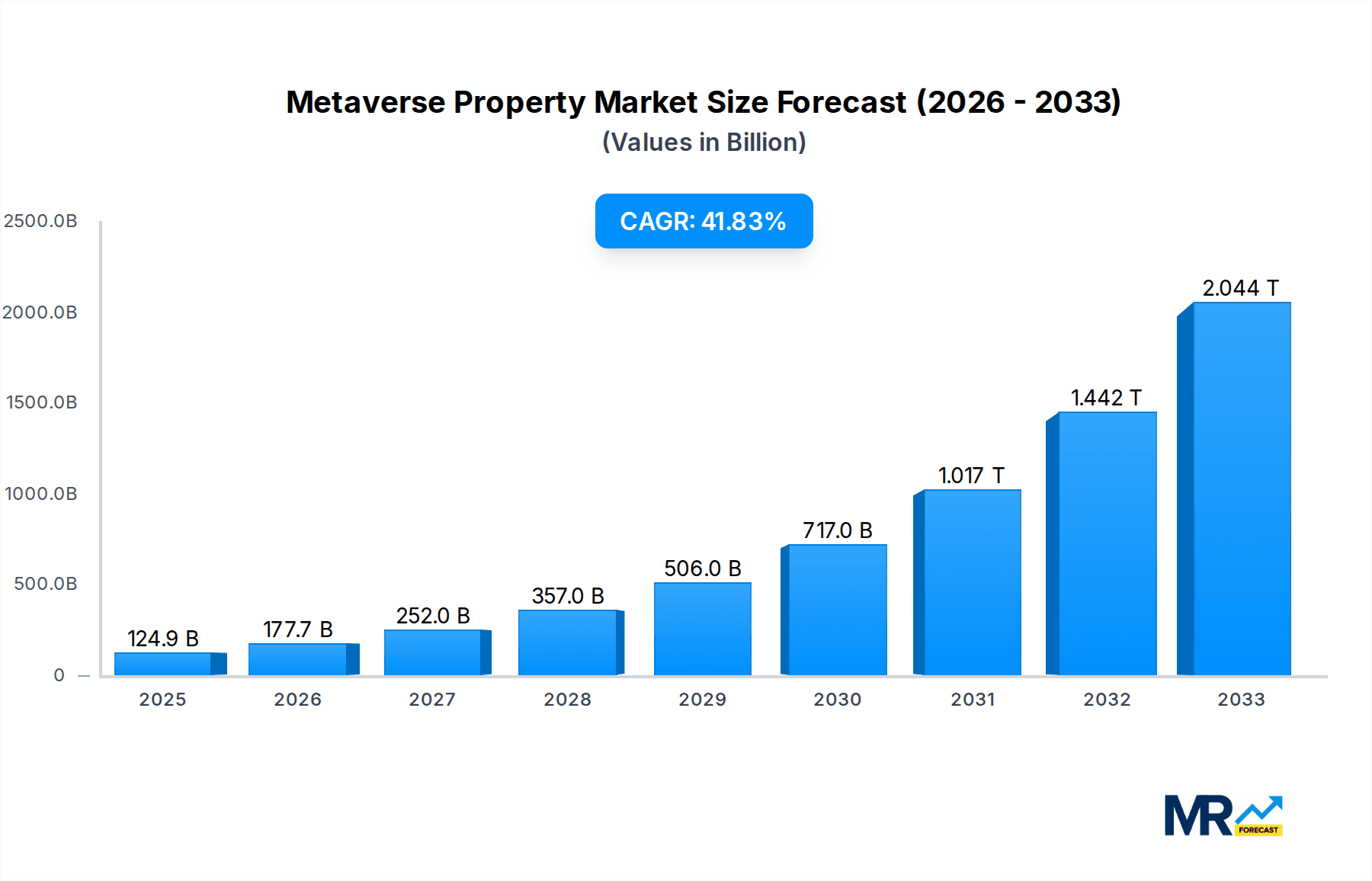

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metaverse Property?

The projected CAGR is approximately 42.78%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Metaverse Property

Metaverse PropertyMetaverse Property by Type (With Blockchain, Without Blockchain), by Application (Direct Selling, Auction), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Metaverse Property market is poised for an explosive growth trajectory, projected to reach a substantial $124.87 billion by 2033. This phenomenal expansion is driven by an impressive Compound Annual Growth Rate (CAGR) of 42.78%, indicating a rapid adoption and investment surge in virtual real estate. The primary catalysts for this surge are the increasing institutional investments and venture capital funding flowing into metaverse development, coupled with the growing mainstream appeal of immersive digital experiences. Furthermore, the burgeoning demand for unique digital assets and the desire for virtual land ownership for diverse applications, from gaming and social interaction to commerce and brand presence, are significant drivers. The integration of blockchain technology is a pivotal trend, enhancing transparency, security, and ownership within these virtual marketplaces, thereby fostering greater trust and encouraging widespread participation.

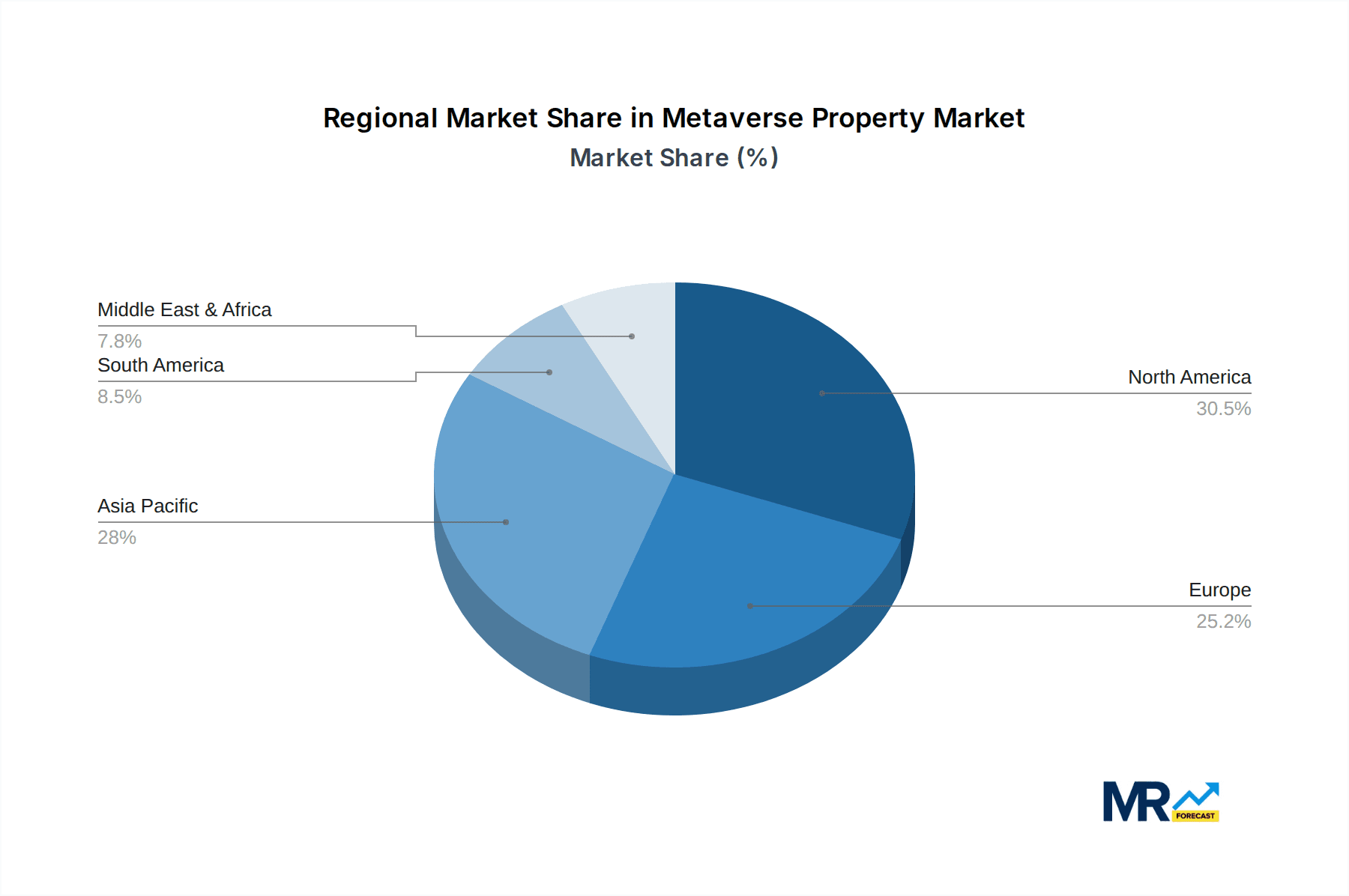

The market is segmented into properties with and without blockchain integration, with blockchain-enabled properties likely to command a premium due to their verifiable ownership and interoperability. Applications for metaverse property are diverse, spanning direct selling, auctions, and virtual event hosting. Major players like Decentraland, The Sandbox, and Metaverse Group are at the forefront of shaping this nascent industry, developing innovative platforms and fostering vibrant virtual economies. While the growth is robust, potential restraints such as regulatory uncertainties, scalability challenges of underlying blockchain technologies, and the need for greater user accessibility could temper the pace of expansion. Nonetheless, the overarching trend indicates a transformative shift where digital real estate will become an increasingly integral part of the global economy, with significant opportunities emerging across all major regions, particularly in North America and Asia Pacific, which are expected to lead adoption and investment.

This report offers an in-depth exploration of the burgeoning Metaverse Property market, a segment poised for exponential growth within the digital economy. Analyzing the period from 2019 to 2033, with a particular focus on the Base Year of 2025 and the Forecast Period of 2025-2033, this study delves into the intricate dynamics of digital land ownership and development. We will examine key industry players, technological advancements, and the driving forces shaping this revolutionary market. The projected market size, estimated to reach billions by 2025 and further expand exponentially within the forecast period, underscores the immense potential of this evolving sector.

The Metaverse Property market is witnessing a dynamic evolution, characterized by a rapid influx of investment and innovation. In the Historical Period (2019-2024), the market was largely nascent, primarily driven by early adopters and speculative interest in decentralized platforms. The emergence of platforms like Decentraland and The Sandbox in the Base Year (2025) has solidified the concept of digital real estate as a tangible asset class, with land parcels transacting in the billions. The primary trend observed is the increasing institutionalization of this market, moving beyond individual enthusiasts to large corporations and investment firms recognizing the long-term value. The Forecast Period (2025-2033) is expected to see a diversification of property types, from virtual storefronts and entertainment venues to educational campuses and residential spaces, each commanding unique valuations based on utility and accessibility.

Furthermore, the integration of blockchain technology remains a pivotal trend, providing transparency, security, and verifiable ownership for metaverse properties. This has led to a clear segmentation within the market: properties With Blockchain (primarily on decentralized platforms) and those Without Blockchain (often on centralized, proprietary metaverses). While blockchain-based properties currently lead in terms of value and speculative interest, the growth of closed-ecosystem metaverses presents a parallel, albeit different, market dynamic. The application of metaverse property is also diversifying, with Direct Selling of land remaining a core transaction method, complemented by an increasing prevalence of Auctions for prime digital real estate and unique digital assets. Industry developments are rapidly pushing the boundaries of what is possible, with advancements in AR/VR technology and the development of sophisticated in-world creation tools further enhancing the appeal and utility of metaverse properties. The overall market sentiment is one of robust growth and increasing maturity, with projections indicating a sustained upward trajectory for digital real estate values throughout the study period.

The explosive growth of the metaverse property market is underpinned by several powerful driving forces that are fundamentally reshaping digital ownership and interaction. A primary catalyst is the increasing adoption and accessibility of immersive technologies, such as virtual reality (VR) and augmented reality (AR). As these technologies become more affordable and user-friendly, more individuals and businesses are entering the metaverse, creating a greater demand for digital real estate to house their virtual experiences and operations. This increased user base directly translates into higher demand for land parcels, virtual storefronts, and event spaces.

Secondly, the growing recognition of the metaverse as a significant economic frontier by major corporations is a critical driver. Companies across various sectors, including retail, entertainment, and advertising, are investing heavily in establishing a virtual presence, acquiring land, and developing experiences within the metaverse. This influx of corporate investment not only validates the market but also significantly increases transaction volumes and property values, pushing the market size into the billions. The potential for new revenue streams through virtual commerce, advertising, and branded experiences is a compelling incentive for businesses to secure prime digital real estate.

Finally, the advancements in blockchain technology and the proliferation of decentralized platforms have provided the essential infrastructure for secure and transparent digital property ownership. This has fostered trust and confidence among investors, enabling the seamless transfer of digital assets and the creation of verifiable ownership records. The decentralized nature of many metaverse platforms allows for greater user control and the potential for true digital asset ownership, attracting a new wave of digital natives and investors seeking to participate in the ownership economy.

Despite the immense growth potential, the metaverse property market faces several significant challenges and restraints that could temper its rapid ascent. A primary concern is the inherent volatility and speculative nature of the market. As a relatively new asset class, metaverse property values can be highly susceptible to trends, hype, and the overall sentiment of the cryptocurrency market, leading to significant price fluctuations. This volatility can deter institutional investors seeking stable returns and pose risks for individual buyers who may experience substantial losses.

Another considerable challenge is the lack of widespread standardization and interoperability across different metaverse platforms. The current landscape is fragmented, with each metaverse operating as a distinct ecosystem. This means that digital land and assets purchased in one metaverse cannot easily be transferred or utilized in another, creating walled gardens and limiting the overall utility and value proposition of digital real estate. This fragmentation can hinder broader adoption and create uncertainty for long-term investment.

Furthermore, regulatory uncertainty and legal frameworks surrounding digital property rights and ownership are still in their nascent stages. Governments and regulatory bodies are grappling with how to define, tax, and protect digital assets and transactions within the metaverse. This lack of clear regulatory guidance can create apprehension for both businesses and individuals, potentially slowing down investment and development. The nascent nature of these regulations could lead to future complications and unforeseen liabilities for market participants.

Finally, technical barriers to entry and user experience issues can also act as restraints. While VR/AR technology is improving, it can still be cumbersome and expensive for mainstream adoption. Similarly, the user interfaces and development tools for creating and interacting within metaverses can be complex, posing a barrier for less tech-savvy individuals. Ensuring a smooth and intuitive user experience is crucial for attracting and retaining a broader user base, which is essential for sustained property market growth.

The metaverse property market's dominance will likely be shaped by a confluence of key regions, countries, and specific market segments exhibiting strong growth potential.

Dominant Segments:

Type: With Blockchain: This segment is poised for substantial dominance due to the inherent trust, transparency, and decentralized ownership it offers. Properties within blockchain-enabled metaverses like Decentraland and The Sandbox are already commanding significant valuations, estimated to be in the billions by the Base Year of 2025. The ability to securely trade, monetize, and truly own digital land through NFTs (Non-Fungible Tokens) creates a robust economic foundation. The future forecast (2025-2033) indicates continued growth driven by smart contract functionalities that enable automated transactions, fractional ownership, and royalty payments, further solidifying its lead. This segment attracts both individual investors and institutional players looking for verifiable digital assets. The underlying blockchain technology provides a layer of security and provenance that is highly attractive in a nascent digital economy.

Application: Direct Selling: While auctions will continue to play a role, direct selling of metaverse property is expected to be the primary mode of transaction. This reflects the mature stage of the market where established marketplaces and direct listings facilitate straightforward acquisitions. The convenience and predictability of direct sales, especially for standardized land parcels and established virtual developments, will drive higher transaction volumes. This method allows for immediate acquisition and integration into existing metaverse strategies for businesses and individuals. The ease of negotiation and transaction completion will ensure its continued prominence throughout the forecast period.

Dominant Regions/Countries:

While the metaverse is inherently global, certain regions and countries are emerging as powerhouses in driving metaverse property adoption and investment:

North America (United States & Canada): These countries lead in terms of technological innovation, venture capital investment, and early adoption of cryptocurrencies and decentralized technologies. Major tech companies headquartered in the US are heavily investing in metaverse development, creating both demand for and supply of digital real estate. The presence of established blockchain and gaming communities further bolsters this region's dominance. The significant presence of early metaverse platforms like Decentraland and The Sandbox, largely developed with North American investment and user bases, further solidifies its position. The sheer volume of capital flowing into tech startups, many of which are metaverse-focused, directly impacts property acquisition and development.

Asia-Pacific (South Korea, Japan, Singapore): These nations are characterized by high internet penetration, a tech-savvy population, and a strong gaming culture. South Korea, in particular, has shown a keen interest in virtual worlds and digital economies, with significant government and corporate backing for metaverse initiatives. Japan's strong gaming heritage and its forward-thinking approach to technology adoption make it a fertile ground for metaverse property growth. Singapore's position as a global financial hub and its pro-innovation policies are attracting significant blockchain and metaverse-related investments, driving demand for digital real estate. The rapid digitalization of these economies and the increasing comfort with digital asset ownership are key contributors to their ascendant role.

The synergy between these dominant segments and regions will create a powerful engine for the global metaverse property market, pushing its valuation into the tens of billions and beyond within the study period.

Several key growth catalysts are propelling the metaverse property industry forward. The increasing mainstream adoption of VR/AR technologies is making immersive experiences more accessible and appealing, driving demand for digital real estate. Furthermore, significant investments from major corporations across various sectors are validating the metaverse as a lucrative economic frontier, leading to substantial capital inflow and property acquisitions. The continuous innovation in blockchain technology, enhancing security, transparency, and enabling true digital ownership, is also a critical catalyst, fostering trust and driving market participation. Finally, the development of user-friendly creation tools and platforms is lowering the barrier to entry for creators and businesses, accelerating the development and diversification of virtual environments.

This comprehensive report delves deep into the dynamic landscape of the metaverse property market, offering invaluable insights for investors, developers, and enthusiasts alike. It meticulously analyzes market trends, projecting growth into the billions by 2025 and beyond, and forecasts the trajectory of this burgeoning digital real estate sector. The report scrutinizes the driving forces behind this expansion, including technological advancements and corporate adoption, while also addressing the inherent challenges and restraints that market participants must navigate. With a focus on key regions and dominant market segments like blockchain-enabled properties and direct selling applications, this study provides a granular view of where the market is headed. Leading players and significant historical and projected developments are detailed, offering a holistic understanding of the current and future state of metaverse property.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 42.78% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 42.78%.

Key companies in the market include Decentraland, Sandbox, Metaverse Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Metaverse Property," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Metaverse Property, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.