1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Equipment Long-term Rental Service?

The projected CAGR is approximately XX%.

Medical Equipment Long-term Rental Service

Medical Equipment Long-term Rental ServiceMedical Equipment Long-term Rental Service by Type (Financial Leasing Direct Leasing Model, Manufacturer's Financial Leasing Model, Sale and Leaseback Model), by Application (Medical Institutions, Individual Consumer), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

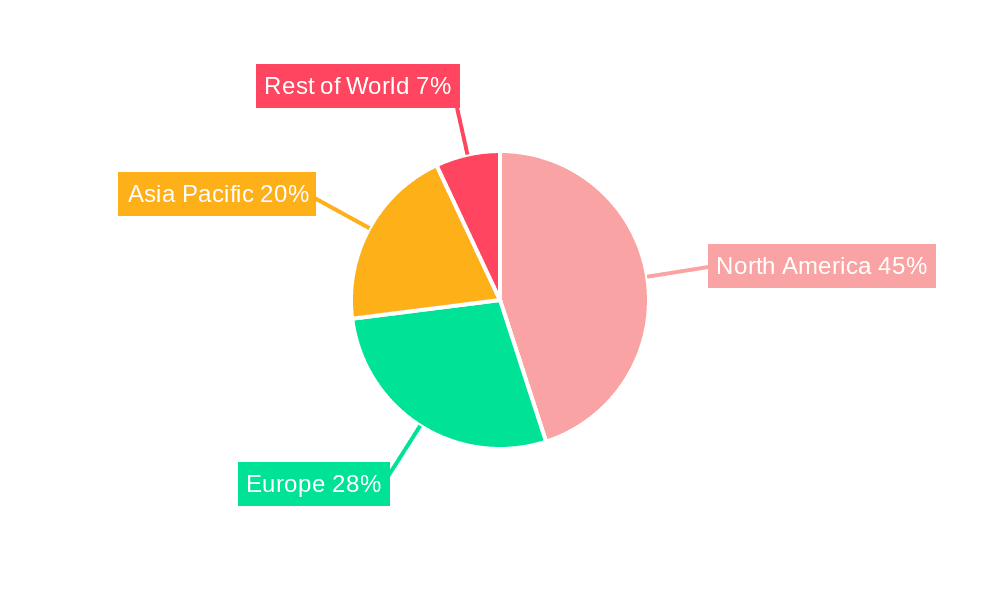

The medical equipment long-term rental service market is experiencing robust growth, driven by increasing healthcare expenditure, a preference for cost-effective solutions among healthcare providers and individual consumers, and technological advancements leading to more sophisticated and specialized equipment. The market's expansion is fueled by the rising prevalence of chronic diseases necessitating long-term medical device use, coupled with the desire to avoid high upfront capital expenditures for medical technology. Several market segments are contributing to this growth, including financial leasing models (direct leasing, manufacturer financing, and sale and leaseback), catering to various customer types like medical institutions and individual consumers. The North American market currently holds a significant share due to high healthcare spending and advanced medical infrastructure; however, growth in other regions, particularly Asia-Pacific, is projected to be substantial due to rising disposable incomes and increasing healthcare awareness. Competition is diverse, encompassing both large multinational corporations and specialized regional providers. The market faces challenges such as stringent regulatory requirements, potential obsolescence of equipment, and managing logistical complexities associated with device maintenance and repair. However, these challenges are being addressed through technological solutions and improved service models focusing on equipment management and maintenance contracts. The market is expected to continue its upward trajectory, driven by consistent healthcare investment and an evolving patient care landscape.

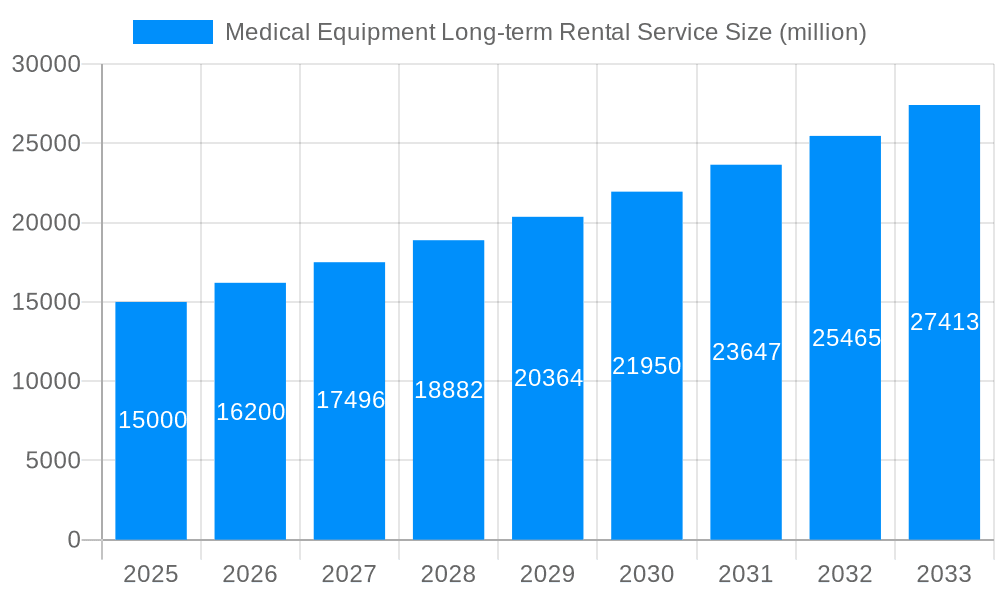

The forecast period (2025-2033) anticipates consistent growth in the medical equipment long-term rental service market, with a projected Compound Annual Growth Rate (CAGR) of approximately 8%. This growth will be propelled by continued technological innovation, the expansion of telehealth services, and increasing demand for specialized equipment in emerging markets. While the North American market will remain dominant, significant opportunities exist within the Asia-Pacific and European regions, reflecting their rising healthcare spending and growing populations. Key players will need to adapt to changing market dynamics by focusing on customer service excellence, building robust supply chains, and developing strategic partnerships to secure their market position. The market will witness increased consolidation as larger players acquire smaller companies to expand their reach and service offerings. This competitive landscape will drive innovation in rental models, pricing strategies, and service packages to cater to diverse customer needs and preferences.

The global medical equipment long-term rental service market is experiencing robust growth, projected to reach several billion USD by 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases globally necessitates advanced medical equipment, making rental a financially viable option for both healthcare institutions and individual consumers. The high capital costs associated with purchasing sophisticated medical technology, such as MRI machines or dialysis equipment, act as a significant barrier to entry for many. Rental services effectively circumvent this, enabling access to cutting-edge technology without the upfront financial burden. Furthermore, the increasing preference for flexible payment options and reduced operational expenditure is driving market expansion. Rental agreements offer customized terms, allowing institutions to adapt to changing needs and budgetary constraints. Technological advancements in medical equipment also contribute, as newer, more sophisticated devices enter the market, creating increased demand for rental services. This trend is particularly prominent in emerging economies where healthcare infrastructure is rapidly developing but budget limitations remain significant. The market is witnessing a shift towards specialized rental services catering to specific medical equipment types, reflecting a growing sophistication in service offerings. Lastly, the growing emphasis on efficient resource management and reduced waste within the healthcare sector further strengthens the appeal of long-term rental, allowing institutions to optimize their equipment utilization without the complexities of ownership. The market is segmented by rental type (financial leasing, direct leasing, manufacturer's financial leasing, sale and leaseback) and application (medical institutions, individual consumers), each segment contributing uniquely to the overall growth trajectory. The total market value, while fluctuating within the forecast period (2025-2033) due to global economic factors and healthcare spending patterns, maintains a consistent upward trend, presenting a significant opportunity for market players. The historical period (2019-2024) indicates a steady rise in adoption, laying a solid foundation for future growth.

The escalating demand for advanced medical technology combined with the high initial investment costs associated with purchasing new equipment is a primary driver of the medical equipment long-term rental service market. Healthcare providers, particularly smaller clinics and private practices, find it financially advantageous to rent rather than purchase expensive equipment, ensuring access to the latest technologies without straining their budgets. The flexibility inherent in rental agreements—allowing for adjustments to equipment needs based on patient volume or evolving treatment protocols—is another significant impetus. This is especially crucial in rapidly changing healthcare environments. Furthermore, the increasing focus on reducing capital expenditure and optimizing operational efficiency within healthcare organizations further fuels the market’s growth. Rental services streamline maintenance, repairs, and upgrades, reducing the burden on internal resources. Government initiatives and insurance policies that encourage the adoption of advanced medical technologies by providing financial incentives or reimbursement models indirectly support the rental market. This is particularly impactful in countries with robust healthcare systems and a strong emphasis on preventative healthcare and chronic disease management. Finally, the rise of telehealth and remote patient monitoring necessitates the use of specialized equipment; the rental model provides efficient access to such devices, particularly for individual patients undergoing home healthcare. The convenience and cost-effectiveness of long-term rental are transforming the healthcare landscape, making it an increasingly preferred choice for both providers and patients.

Despite its significant growth potential, the medical equipment long-term rental service market faces several challenges. One major hurdle is the complexity of managing a diverse range of equipment, requiring robust logistical networks, specialized maintenance expertise, and effective inventory control. The high initial investment in infrastructure and skilled personnel to support a successful rental operation can act as a barrier to entry for new players. Furthermore, the risk of equipment obsolescence presents a significant challenge; rapid technological advancements in the medical field can quickly render rented equipment outdated, affecting rental profitability and potentially requiring frequent replacements. Contractual complexities, including lease terms, maintenance responsibilities, and liability issues, can also create difficulties, potentially leading to disputes and financial losses. Competition from established medical equipment manufacturers offering their own financing and leasing options poses a substantial challenge to independent rental providers. Regulatory compliance and adherence to stringent safety and quality standards add another layer of complexity and cost to operations. Fluctuations in the global economy and healthcare spending patterns can also impact market growth, causing uncertainty for rental companies and influencing investment decisions. Finally, ensuring efficient and timely maintenance and repair services is critical for maintaining customer satisfaction and minimizing downtime, representing a continuous operational challenge.

The medical equipment long-term rental service market is witnessing significant growth across diverse regions, however, North America and Europe currently hold the largest market share. This dominance is attributable to several factors: advanced healthcare infrastructure, high healthcare expenditure per capita, and a significant prevalence of chronic diseases.

North America: The region's high adoption of advanced medical technologies, coupled with a well-established healthcare system, makes it a lucrative market for rental services. The presence of numerous large healthcare providers and a sizable population requiring advanced medical care creates significant demand.

Europe: Similar to North America, Europe has robust healthcare infrastructure and a relatively high healthcare expenditure. Stricter regulations regarding equipment safety and maintenance standards might influence the growth of reliable rental services in the region.

Dominant Segments:

Medical Institutions: This segment accounts for the largest portion of the market, driven by the cost-effectiveness of renting specialized and expensive equipment for hospitals, clinics, and diagnostic centers. Hospitals, in particular, require a wide array of advanced medical equipment, ranging from imaging systems to surgical instruments. The high initial cost of purchasing these devices makes leasing an attractive option. The need for flexibility and scalability in their equipment inventory also contributes to the high demand within this sector.

Financial Leasing Model: This model offers significant advantages in terms of tax benefits and financial structuring. It enables healthcare providers to leverage rental payments for tax deductions and optimize their cash flow. Financial institutions play a crucial role in providing tailored financing solutions for medical equipment acquisitions, supporting this model’s growth.

The paragraph below provides a further explanation of the key regional and segmental dominance:

The combination of developed healthcare infrastructure, strong economies, and increasing adoption of advanced medical technologies contribute to the dominance of North America and Europe in the market. However, emerging markets in Asia-Pacific and Latin America are expected to witness significant growth in the coming years, driven by increasing healthcare expenditure and a rising prevalence of chronic diseases. Within these regions, the medical institutions segment is experiencing the most rapid expansion, while the financial leasing model's prevalence is growing due to its financial advantages. However, growth projections need to account for regional disparities in healthcare spending, regulatory frameworks, and access to technology.

Several factors are accelerating growth within the medical equipment long-term rental service industry. Firstly, the increasing affordability of advanced medical equipment through rental schemes is making sophisticated technology accessible to a wider range of healthcare providers and patients. Secondly, flexible contract terms and reduced capital expenditure requirements are enhancing the appeal of rental services to financially constrained organizations. Thirdly, the trend towards outsourcing non-core functions, including equipment maintenance and management, is further bolstering the market's expansion. Finally, technological advancements are continuously driving innovation in medical equipment, creating a constant demand for updated rental options.

This report provides a detailed analysis of the medical equipment long-term rental service market, offering valuable insights into current trends, growth drivers, challenges, and key players. The report covers market segmentation by rental type and application, providing regional and global market forecasts. This in-depth study helps stakeholders, including companies and investors, make informed decisions based on current market conditions and future projections, contributing to a comprehensive understanding of the dynamic healthcare equipment rental landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

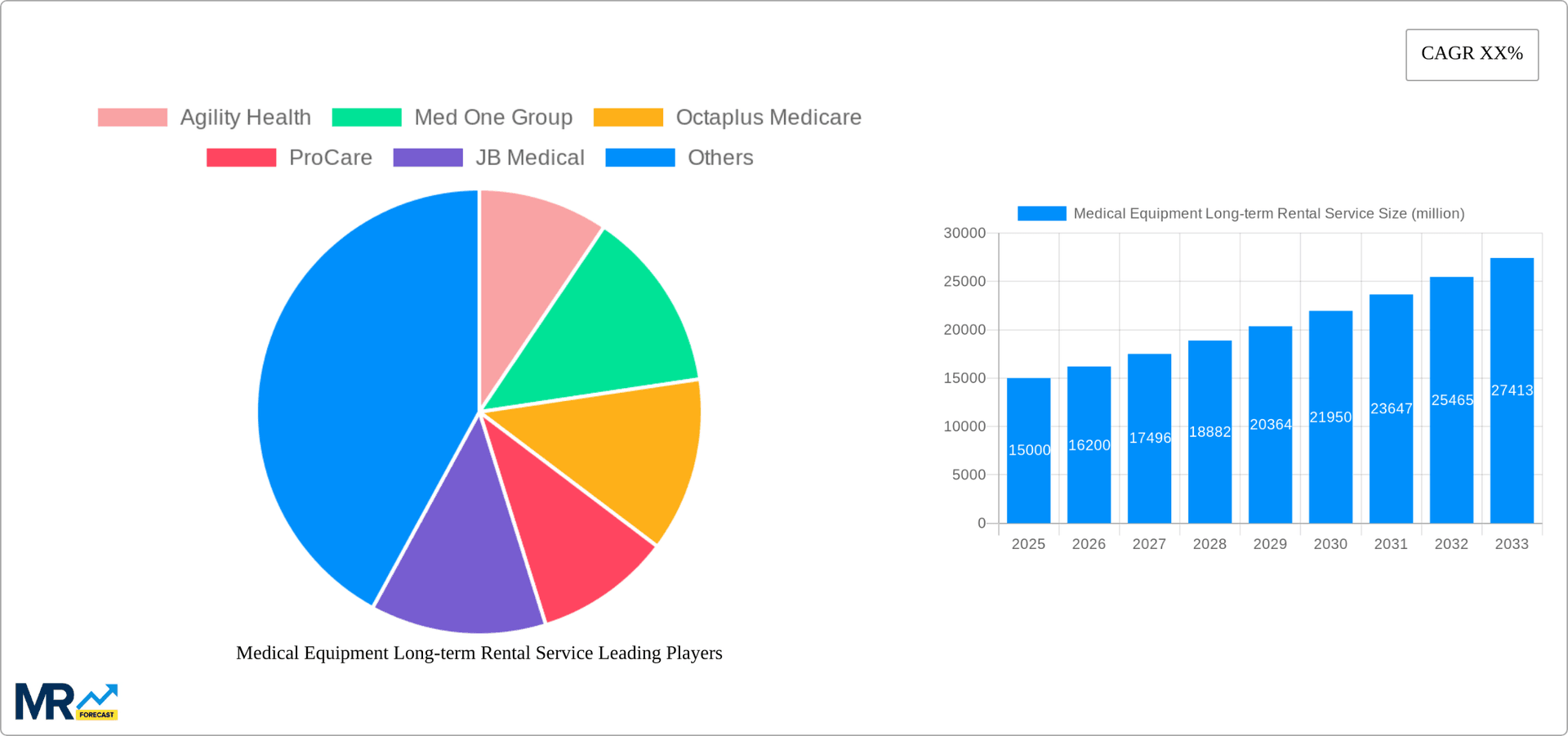

Key companies in the market include Agility Health, Med One Group, Octaplus Medicare, ProCare, JB Medical, CME Corp, USME, Family Rentals, Infiniti Medical Solutions, AGITO Medical, Able Durable Medical Equipment, State Medical Equipment, Heartland Medical, Health Aid Company, AdvaCare Systems, Arjo, Hillrom, Affordal Medical Supply, Access Medical Equipment, Price Rite Drug, Action Medical, Westmont Pharmacy, HaMed Halambalakis SA, Woodley Equipment, Aidacare, Sizewise, Ridgeview, Hill-Rom Services, American Medical & Equipment Supply, Comanche County Memorial Hospital, SpecialCare.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Medical Equipment Long-term Rental Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Equipment Long-term Rental Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.