1. What is the projected Compound Annual Growth Rate (CAGR) of the Mainframe Identity Management?

The projected CAGR is approximately 2.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Mainframe Identity Management

Mainframe Identity ManagementMainframe Identity Management by Type (/> On-premises, Cloud Based), by Application (/> Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

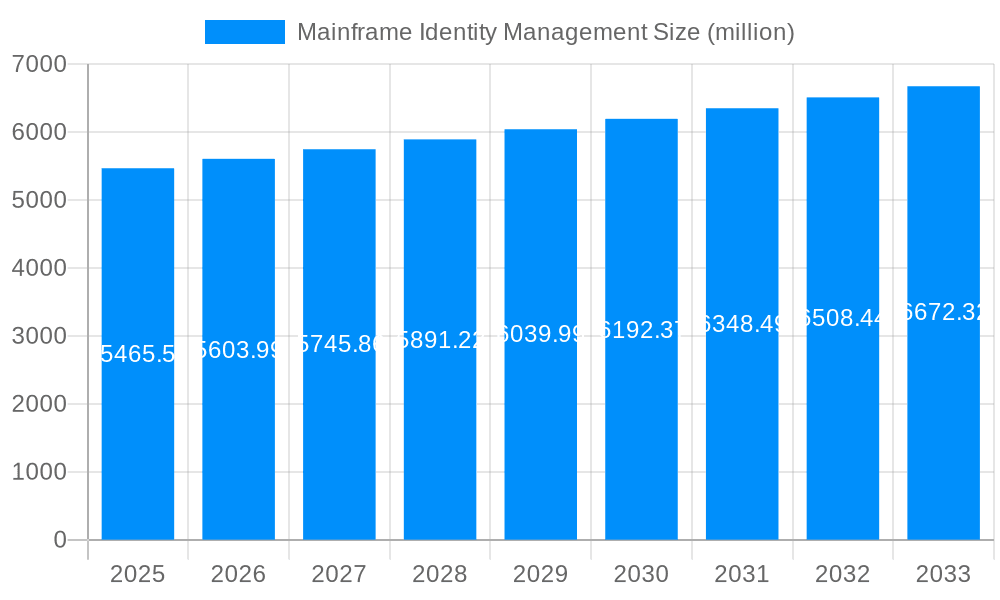

The Mainframe Identity Management market is projected to reach approximately $5,465.5 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 2.6% throughout the forecast period of 2025-2033. This sustained growth underscores the continued importance of robust identity and access management (IAM) solutions for legacy mainframe systems, which remain critical infrastructure for many large enterprises. The primary drivers for this market expansion include the increasing need for enhanced security to combat evolving cyber threats, regulatory compliance mandates such as GDPR and SOX, and the imperative to streamline user access and lifecycle management on these complex platforms. As organizations continue to modernize their IT landscapes, integrating mainframe IAM with broader enterprise-wide solutions becomes paramount for maintaining a unified security posture and ensuring operational efficiency.

The market is characterized by a bifurcation in deployment models, with both on-premises and cloud-based solutions catering to distinct enterprise needs and legacy system architectures. Large enterprises, due to the scale and sensitivity of their mainframe operations, often lean towards comprehensive on-premises solutions, while Small and Medium-sized Enterprises (SMEs) are increasingly exploring cloud-based options for greater flexibility and scalability. Key trends shaping the market include the adoption of Privileged Access Management (PAM) to secure high-risk accounts, the integration of AI and machine learning for anomaly detection and predictive security, and the growing demand for automated provisioning and deprovisioning of user identities. Despite the robust demand, certain restraints such as the high cost of implementing and maintaining mainframe IAM solutions and the scarcity of skilled professionals with mainframe expertise can pose challenges to market penetration. Major players like Broadcom, IBM, and Oracle are actively investing in innovation to address these challenges and capitalize on the ongoing demand for secure and efficient mainframe identity management.

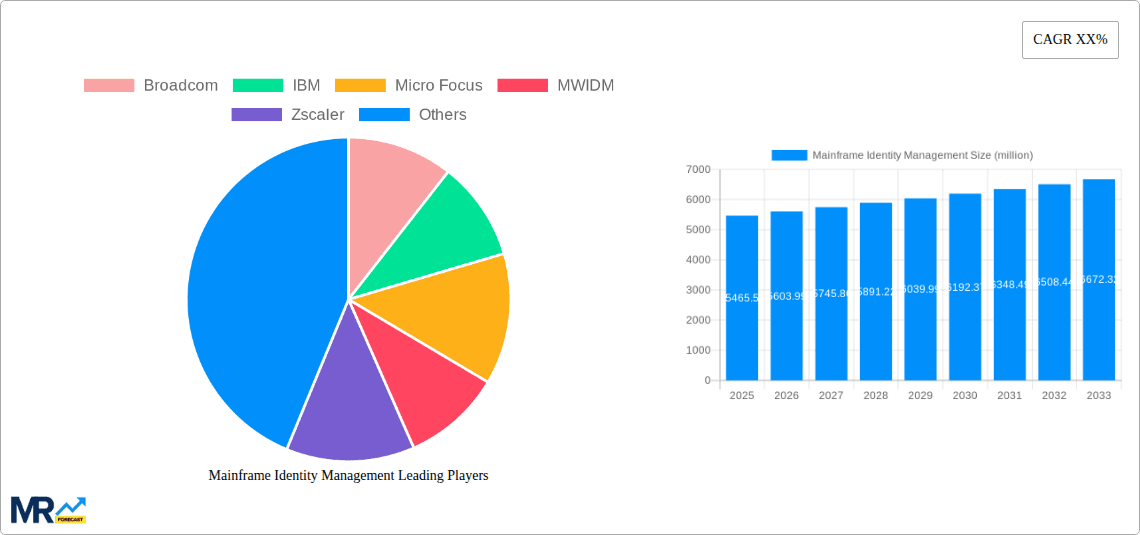

This report offers an in-depth analysis of the Mainframe Identity Management market, projecting a robust growth trajectory. We delve into the intricate landscape of securing legacy systems, a critical task for organizations worldwide. The study encompasses a significant Study Period of 2019-2033, with a Base Year of 2025 and an Estimated Year also of 2025, providing a clear snapshot of the current market dynamics and future potential. The Forecast Period spans from 2025 to 2033, during which we anticipate substantial market expansion. Our analysis is grounded in a thorough review of the Historical Period from 2019-2024, capturing past trends and foundational shifts. The market is segmented by deployment type (On-premises and Cloud Based) and application scope (Large Enterprises and SMEs), offering granular insights into diverse adoption patterns. Furthermore, we examine industry developments and the strategic plays of key vendors like Broadcom, IBM, Micro Focus, MWIDM, Zscaler, Software Diversified Services, Oracle, and One Identity. The report's value is underscored by its projection of a market size reaching several hundred million dollars by the end of the forecast period, driven by evolving security imperatives and digital transformation initiatives.

The Mainframe Identity Management market is experiencing a significant evolution, driven by the persistent need to secure foundational IT infrastructure while embracing modernization. A key trend observed is the increasing adoption of cloud-based identity management solutions that integrate with existing mainframe environments. This hybrid approach allows organizations to leverage the scalability and agility of the cloud for identity governance and administration (IGA) functions, while maintaining the core sensitive data and applications on the mainframe. The market is also witnessing a surge in demand for Zero Trust architectures being applied to mainframe access. This paradigm shift moves away from traditional perimeter-based security, demanding continuous verification of every user and device attempting to access mainframe resources, regardless of their location. This is particularly crucial given the increasing sophistication of cyber threats targeting legacy systems. Furthermore, the report highlights the growing importance of automated provisioning and deprovisioning of access rights. Manual processes are no longer sustainable in today's dynamic threat landscape and for efficient IT operations. Organizations are actively seeking solutions that can automatically grant, modify, and revoke user access based on predefined policies and roles, significantly reducing the risk of unauthorized access and the burden on IT administrators. Another significant trend is the rise of modern authentication methods, such as Multi-Factor Authentication (MFA) and privileged access management (PAM) solutions, being extended to mainframe users. This enhances the security posture by requiring multiple forms of verification, thereby mitigating risks associated with compromised credentials. The increasing regulatory compliance pressures, such as GDPR, SOX, and industry-specific mandates, are also a strong driver for advanced identity management capabilities on mainframes, compelling organizations to implement robust audit trails and access controls. The market is also seeing innovation in API-driven identity management, enabling seamless integration between mainframe applications and modern identity platforms, facilitating a more unified approach to security across the entire IT estate. The continuous need for skilled mainframe professionals also influences the adoption of user-friendly and automated identity management tools, aiming to reduce the dependency on specialized knowledge for routine tasks.

Several compelling factors are propelling the growth of the Mainframe Identity Management market. Foremost among these is the ever-increasing cyber threat landscape. Mainframes, often housing the most critical and sensitive data for large enterprises, have become prime targets for cyberattacks. The potential financial and reputational damage from a mainframe breach is immense, compelling organizations to invest heavily in robust identity management solutions to secure these systems. Coupled with this is the relentless pressure of regulatory compliance. Various global and industry-specific regulations mandate stringent access controls, audit trails, and data protection measures for sensitive information. Mainframe identity management solutions are crucial for organizations to meet these compliance obligations and avoid significant penalties. Furthermore, the ongoing digital transformation initiatives within organizations, even those with significant mainframe investments, necessitate a more integrated and secure approach to identity. As enterprises strive to connect their mainframe systems with cloud-based applications and modern digital platforms, ensuring consistent and secure identity management across this hybrid environment becomes paramount. The aging workforce and the impending retirement of experienced mainframe professionals also play a role. This creates a need for more automated and user-friendly identity management solutions that can simplify access management and reduce reliance on highly specialized skills, thereby mitigating operational risks. Finally, the pursuit of operational efficiency and cost optimization is a significant driver. Streamlined identity management processes, including automated provisioning and deprovisioning, reduce manual effort, minimize errors, and free up IT resources for more strategic initiatives. This efficiency gain directly contributes to the bottom line, making it an attractive investment for businesses.

Despite the strong growth drivers, the Mainframe Identity Management market faces several significant challenges and restraints that can impede its full potential. A primary hurdle is the inherent complexity and legacy nature of mainframe systems. These systems are often decades old, with intricate configurations and proprietary technologies that can make integration with modern identity management solutions difficult and costly. The shortage of skilled mainframe professionals exacerbates this challenge. Organizations struggle to find individuals with the expertise required to implement, manage, and maintain complex mainframe identity management solutions, leading to implementation delays and increased operational burdens. The perceived high cost of modernization and integration is another significant restraint. Many organizations view the process of updating their mainframe security infrastructure as an expensive undertaking, which can deter investment, especially for Small and Medium-sized Enterprises (SMEs). The lack of standardized protocols and interoperability between different mainframe systems and modern identity platforms can create significant integration challenges, requiring custom development and extensive testing, which adds to the overall cost and time to deployment. Furthermore, the resistance to change within organizations can be a substantial obstacle. Some IT departments and business units may be hesitant to adopt new technologies and processes, preferring to stick with established, albeit less secure, methods. This organizational inertia can slow down the adoption of advanced mainframe identity management solutions. The fear of disrupting critical business operations during the implementation of new security measures is also a major concern. Organizations operate on the principle of "if it ain't broke, don't fix it," and the risk of even a temporary outage during a security upgrade can be unacceptable for mission-critical mainframe applications. Finally, the difficulty in accurately assessing the ROI of mainframe identity management investments can make it challenging to secure budget approval. The benefits are often intangible in terms of risk reduction and compliance, making it harder to justify the upfront expenditure compared to revenue-generating projects.

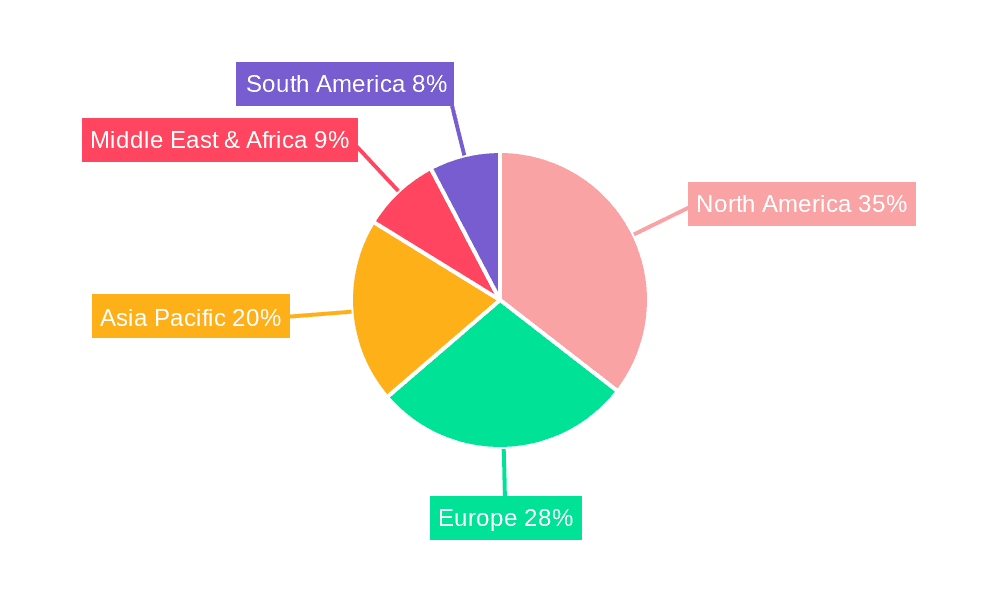

The Mainframe Identity Management market is poised for significant dominance in specific regions and segments due to a confluence of factors including high mainframe adoption, stringent regulatory environments, and robust cybersecurity investments.

Key Regions/Countries:

Dominant Segments:

The Mainframe Identity Management industry is experiencing significant growth due to several key catalysts. The escalating sophistication and frequency of cyber threats targeting legacy systems are a primary driver, forcing organizations to fortify their defenses. Stringent regulatory compliance mandates, such as GDPR and SOX, compel businesses to implement robust identity governance and access controls for sensitive mainframe data. Furthermore, the ongoing digital transformation efforts require seamless and secure integration of mainframe systems with modern cloud applications, thereby increasing the demand for unified identity management solutions. The increasing adoption of cloud-based IGA solutions that integrate with mainframes also contributes to market expansion, offering scalability and agility. Finally, the inherent need for operational efficiency by automating access provisioning and deprovisioning processes further fuels growth as organizations seek to reduce manual efforts and mitigate risks.

This report provides a holistic view of the Mainframe Identity Management market, meticulously analyzing its trends, drivers, challenges, and future prospects. We offer unparalleled insights into the competitive landscape, highlighting the strategies and innovations of leading vendors. The report delves into the intricacies of on-premises vs. cloud-based deployment models and the specific needs of Large Enterprises versus SMEs, providing a granular understanding of market segmentation. Our comprehensive analysis is underpinned by extensive market research and expert opinion, projecting the market to reach several hundred million dollars by 2033. This report is an indispensable resource for stakeholders seeking to navigate the evolving security demands of mainframe environments and capitalize on the significant growth opportunities within this critical sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.6%.

Key companies in the market include Broadcom, IBM, Micro Focus, MWIDM, Zscaler, Software Diversified Services, Oracle, One Identity, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Mainframe Identity Management," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Mainframe Identity Management, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.