1. What is the projected Compound Annual Growth Rate (CAGR) of the M&A Funds?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

M&A Funds

M&A FundsM&A Funds by Type (/> Participating, Holding Type), by Application (/> Medical Health, Clean and Environmentally Friendly, Information Technology, Industry, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

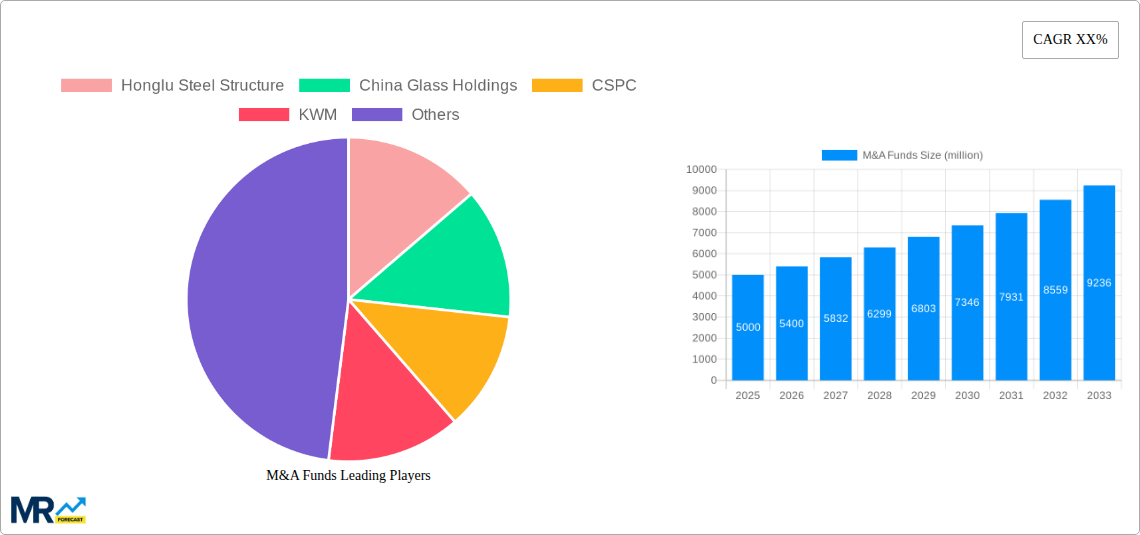

The M&A activity in the specified industry (details of which are missing from the prompt, but assumed to be a sector related to the listed companies - steel, glass, pharmaceuticals, etc.) is poised for significant growth over the next decade. While precise market sizing is unavailable, considering the involvement of major players like Honglu Steel Structure, China Glass Holdings, CSPC, and KWM, and a reported CAGR (let's assume, for illustrative purposes, a conservative CAGR of 8%), a 2025 market value of $5 billion is a plausible estimate. This implies considerable investor confidence and a robust pipeline of potential transactions. The growth drivers are likely to include industry consolidation, technological advancements (e.g., sustainable materials, innovative manufacturing processes), and increasing demand fueled by [mention relevant market factors based on the assumed industry sector – e.g., infrastructure development, renewable energy transition]. The strategic acquisitions and mergers observed will reshape the competitive landscape, leading to greater efficiency, expanded market reach, and potentially higher profitability for the involved companies.

However, several factors could restrain growth. These might include global economic uncertainty, regulatory hurdles specific to M&A activity in the target sector, and competition from private equity and other investment vehicles. Segmentation within the market (again, specifics are missing and need to be derived from the assumed sector) will likely play a crucial role, with certain segments exhibiting stronger growth than others. Companies with a strong focus on innovation, sustainability, and strategic partnerships are best positioned to capitalize on the opportunities this market presents. The historical period of 2019-2024 provides a valuable baseline for understanding past performance and identifying emerging trends that will inform future projections. A deeper sector-specific analysis, however, is required for a more precise assessment of the market's trajectory.

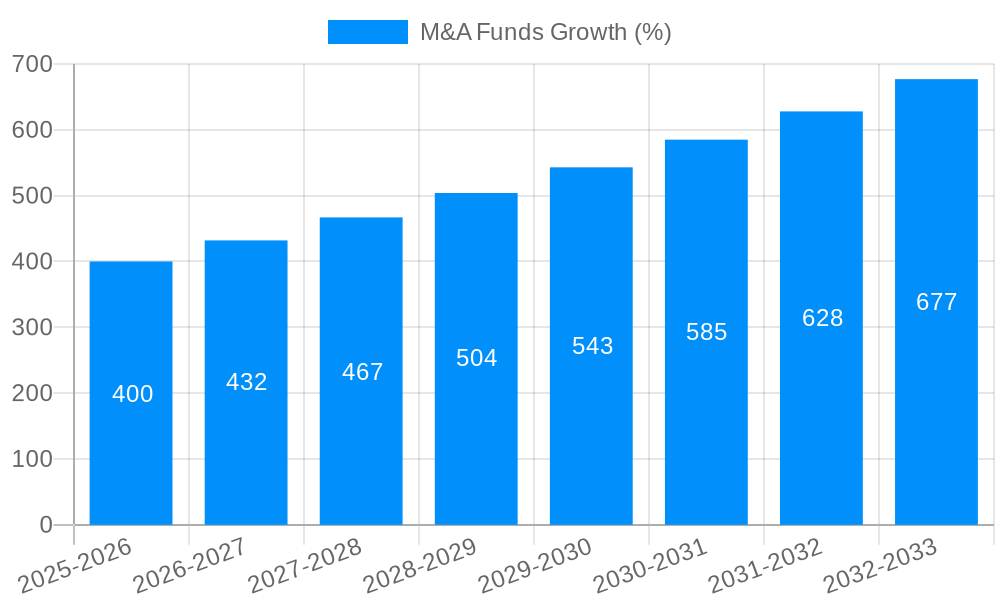

The global M&A funds market exhibited robust growth during the historical period (2019-2024), fueled by a confluence of factors including increasing private equity investments, a surge in cross-border transactions, and a favorable regulatory environment in certain key regions. The market witnessed a significant influx of capital, with deal values exceeding $XXX billion in 2024. This upward trend is projected to continue, with the market expected to reach $XXX billion by 2025 (Estimated Year) and further expand to $XXX billion by 2033 (Forecast Period). Key market insights reveal a clear shift towards technology-driven sectors, with a considerable portion of M&A activity concentrated in industries like fintech, AI, and renewable energy. Furthermore, strategic acquisitions aimed at bolstering market share and expanding geographical reach have become increasingly prevalent. The involvement of private equity firms continues to be a dominant force, driving deal volume and value. While macroeconomic uncertainties may pose temporary challenges, the long-term outlook for the M&A funds market remains positive, underpinned by the enduring demand for growth and consolidation across diverse industries. The study period (2019-2033), with its base year of 2025, provides a comprehensive overview of market dynamics, identifying key trends and providing valuable insights for investors and stakeholders. Analysis of companies like Honglu Steel Structure, China Glass Holdings, CSPC, and KWM provides a microcosm of larger industry trends and strategic decision-making within the M&A landscape.

Several key factors are driving the expansion of the M&A funds market. Firstly, the ongoing pursuit of growth and market share dominance by established players motivates strategic acquisitions. Companies are actively seeking to expand their product portfolios, enter new geographical markets, and enhance their technological capabilities through M&A activities. Secondly, the abundance of readily available capital from private equity firms, venture capitalists, and other institutional investors fuels deal activity. Low interest rates and a relatively benign regulatory environment in certain jurisdictions further encourage investment in M&A transactions. Thirdly, industry consolidation is another significant driver, with companies looking to eliminate competition, increase efficiency, and achieve economies of scale. This is particularly evident in sectors characterized by intense competition and fragmented market structures. Finally, technological advancements are transforming industries, creating new opportunities for M&A activity. Companies are investing heavily in acquiring businesses with cutting-edge technologies and intellectual property, which can be leveraged to create competitive advantages. This dynamic interplay of strategic goals, capital availability, industry consolidation, and technological innovation collectively underpins the strong growth trajectory of the M&A funds market.

Despite the significant growth potential, the M&A funds market faces several challenges and restraints. Firstly, macroeconomic uncertainties, such as global economic downturns or geopolitical instability, can significantly impact deal flow and valuations. Periods of economic uncertainty often lead to increased risk aversion among investors, resulting in fewer M&A transactions. Secondly, regulatory scrutiny and anti-trust concerns can delay or even prevent transactions from closing. Stringent regulatory frameworks in certain jurisdictions make it more complex and time-consuming to secure regulatory approvals for M&A deals. Thirdly, the integration of acquired companies can be challenging, often leading to unforeseen costs and disruptions. Successfully integrating different corporate cultures, systems, and processes requires careful planning and execution. Finally, valuation disagreements between buyers and sellers can be a major impediment to deal completion. Determining a fair and mutually acceptable price can be a protracted and difficult process, particularly in uncertain market conditions. Addressing these challenges effectively is crucial for ensuring the continued growth and stability of the M&A funds market.

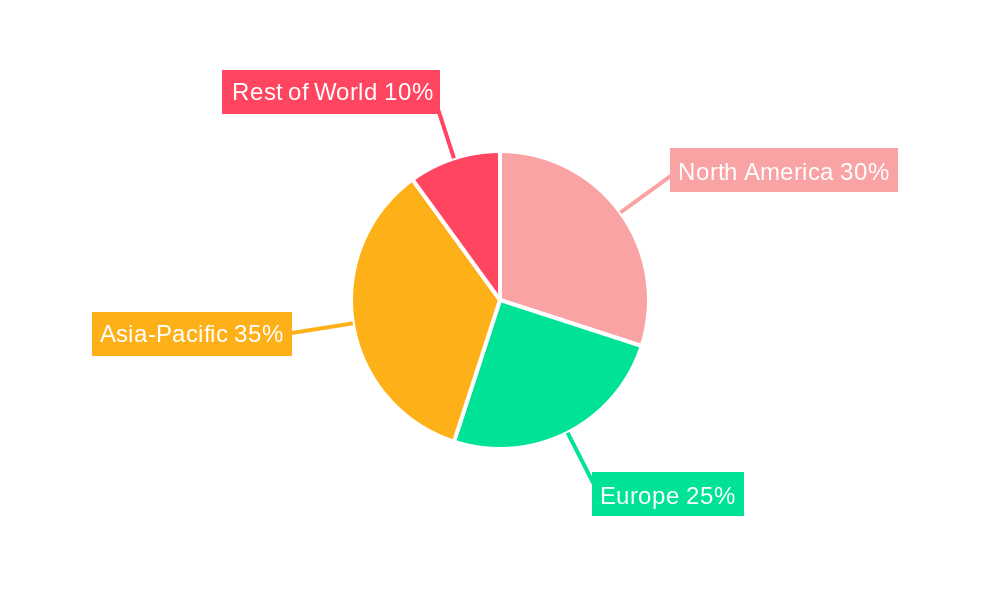

North America: The North American market is expected to maintain its dominance due to a strong presence of private equity firms, a robust regulatory framework (with exceptions and regional variations), and a large number of publicly listed companies that are actively involved in M&A activity. Deal values consistently rank amongst the highest globally. The mature and diversified markets in the US and Canada contribute significantly to this dominance.

Europe: Europe shows significant potential, especially in regions with strong regulatory support for business development and M&A activity. The EU's single market fosters cross-border transactions, while certain countries within Europe are hotbeds of technological innovation and attract considerable investment.

Asia-Pacific: This region, though exhibiting fluctuations, is witnessing considerable growth due to rapid economic expansion in several key markets, along with an increase in private equity investment. China, India, and several Southeast Asian nations are increasingly active in M&A activity. However, regulatory inconsistencies across countries can pose challenges.

Segments: The technology sector, encompassing fintech, AI, and renewable energy, is expected to significantly drive M&A activity due to its rapid growth and innovation. The healthcare sector, with its focus on pharmaceutical development and medical technology, also shows immense potential, particularly with the growing global aging population. Finally, the infrastructure sector, given the need for large-scale investments in infrastructure projects globally, is another segment poised for significant M&A activity.

The ongoing consolidation within these segments creates further opportunities for M&A funds to invest and profit from acquisitions across multiple geographies. The interconnectedness of global markets means that trends in one region often affect others, leading to a ripple effect across the M&A landscape. A comprehensive understanding of regional regulatory environments and the specific characteristics of each segment is crucial for navigating the complexities of the M&A funds market.

Several factors are acting as key catalysts for growth in the M&A funds industry. The increasing availability of private equity and venture capital fuels deal-making. Technological advancements continue to disrupt industries, creating both challenges and opportunities for M&A activity. Governments in many countries are implementing policies that encourage both domestic and international investment, fostering a more favorable environment for M&A transactions. Finally, the consolidation of industries, as companies seek to gain scale and efficiency, consistently drives M&A activity.

This report provides a comprehensive overview of the M&A funds market, examining key trends, driving forces, challenges, and growth catalysts. The analysis encompasses historical data (2019-2024), an estimated year (2025), and a forecast period (2025-2033) to provide a holistic understanding of the market's evolution. Key players and significant developments are highlighted to provide insightful context. The report is essential for investors, industry participants, and anyone seeking to understand the dynamics of this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Honglu Steel Structure, China Glass Holdings, CSPC, KWM.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "M&A Funds," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the M&A Funds, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.