1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Chocolate?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Chocolate

Luxury ChocolateLuxury Chocolate by Type (Dark Cholocate, White and Milk Premium Chocolate), by Application (Supermarkets and Hypermarkets, Independent Retailers, Convenience Stores, Specialist Retailers, Online Retailers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

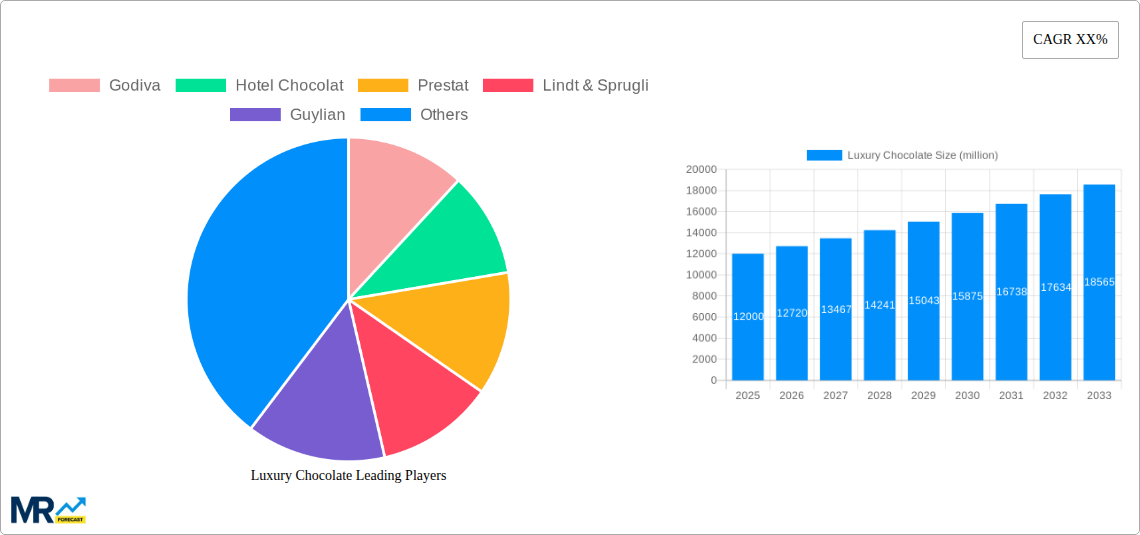

The luxury chocolate market, characterized by high-quality ingredients, sophisticated packaging, and premium pricing, is experiencing robust growth. Driven by increasing disposable incomes, particularly in emerging economies, and a growing preference for premium and artisanal products, the market is projected to expand significantly over the next decade. Consumers are increasingly seeking out unique flavor profiles and ethically sourced chocolate, fueling demand for innovative products and brands that resonate with their values. The segment is also benefiting from the expansion of online retail channels, which offer convenient access to a wider range of luxury chocolate brands and cater to a growing preference for direct-to-consumer experiences. While price sensitivity remains a factor, particularly during economic downturns, the resilience of the luxury goods market suggests that the premium chocolate sector will continue to exhibit strong performance. The dominance of established brands like Godiva and Lindt & Sprugli is being challenged by the rise of smaller, artisan chocolatiers who are emphasizing unique flavor combinations, sustainable sourcing, and personalized customer experiences.

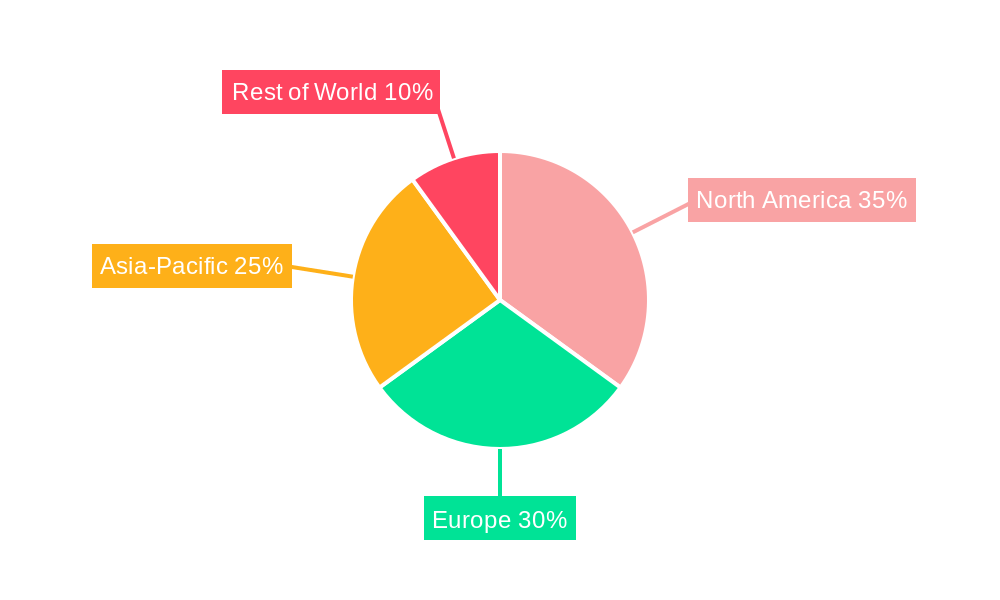

The market segmentation reveals diverse consumption patterns. Supermarkets and hypermarkets account for a substantial share, reflecting the convenience they offer to consumers. However, independent retailers and specialist chocolate shops are attracting discerning consumers willing to pay a premium for exceptional quality and personalized service. Online retail is a rapidly growing channel, offering wider product selection and convenient delivery directly to the consumer. Dark chocolate, followed by milk and white chocolate varieties, remain popular, although the market shows signs of increased demand for unique, flavor-infused premium options. Geographically, North America and Europe currently hold significant market share, but the Asia-Pacific region is demonstrating impressive growth potential, driven by the rising middle class and increasing consumption of premium food and beverage products. The continued expansion of the luxury chocolate market is anticipated to be steady, albeit with some fluctuations based on global economic conditions. Successful brands will need to effectively blend heritage and tradition with innovative product offerings to meet the demands of an evolving consumer base.

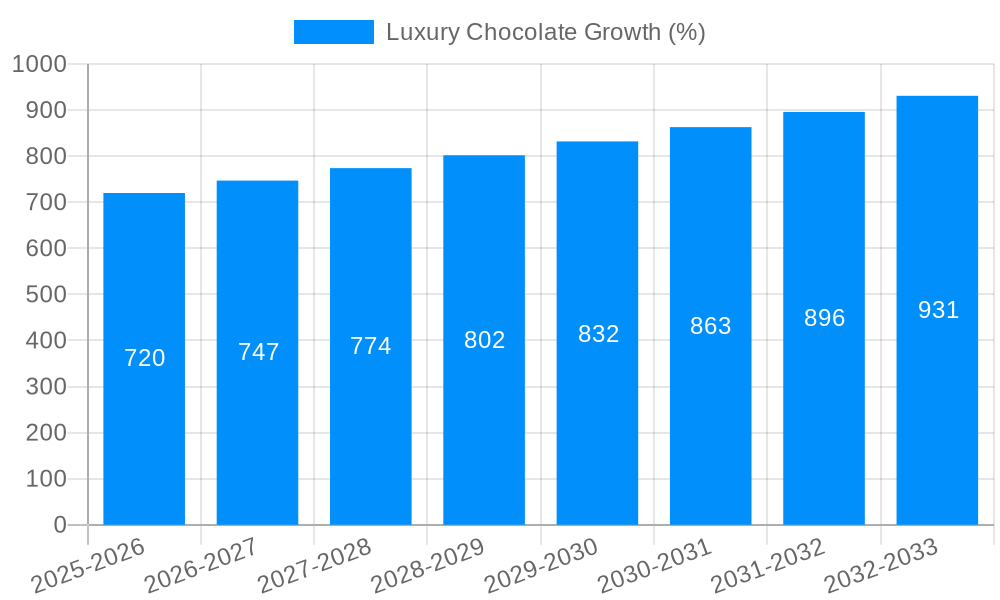

The luxury chocolate market, valued at over $XX billion in 2024, is experiencing a period of significant transformation driven by evolving consumer preferences and innovative product offerings. The historical period (2019-2024) witnessed a steady growth trajectory, primarily fueled by the increasing demand for premium, high-quality chocolate experiences. This trend is expected to continue into the forecast period (2025-2033), with projections indicating a compound annual growth rate (CAGR) of X% during this time. Key market insights reveal a strong preference for dark chocolate, owing to its perceived health benefits and intense flavor profiles. Consumers are increasingly discerning, seeking out ethically sourced cacao beans, sustainable production practices, and unique flavor combinations. The rise of online retail channels has also significantly impacted the market, offering brands new avenues for reaching affluent consumers. The estimated market value in 2025 stands at approximately $YY billion, demonstrating a substantial increase from previous years. This growth is further amplified by the expanding popularity of luxury chocolate gifting occasions, including holidays and special events, which drives sales and enhances brand recognition among high-net-worth individuals. Furthermore, the emergence of artisanal and handcrafted chocolate brands is challenging established players, appealing to consumers seeking unique and personalized experiences. The increasing demand for personalized and experience-driven consumption further contributes to the market growth. Companies are increasingly incorporating innovative packaging, offering exclusive experiences, and emphasizing the stories behind their products to connect with a discerning and experience-seeking clientele. This shift towards experiential luxury is reshaping the industry, driving premium pricing strategies and creating a highly competitive landscape. The competitive landscape includes both established multinational players and smaller, niche brands, each vying for a share of the growing market.

Several factors are converging to propel the growth of the luxury chocolate market. Firstly, the increasing disposable incomes, particularly in developing economies, are enabling a larger segment of the population to indulge in premium chocolate products. Secondly, a growing awareness of health and wellness is paradoxically driving demand for high-quality dark chocolate, perceived for its antioxidant properties and rich flavor. This trend is particularly visible amongst health-conscious millennials and Gen Z consumers who seek healthier alternatives within their indulgent treats. Thirdly, the rise of experiential consumption is a key driver. Consumers are increasingly seeking unique experiences associated with the products they purchase, and luxury chocolate brands are successfully capitalizing on this trend through innovative packaging, unique flavor combinations, and sophisticated marketing campaigns that highlight the craft and artistry of chocolate-making. Furthermore, the expansion of e-commerce and omnichannel retail strategies has provided luxury chocolate brands with increased access to a global consumer base, allowing them to circumvent traditional retail limitations and cater directly to individual preferences. Finally, the increasing demand for ethically sourced and sustainably produced chocolate is driving consumer choices, particularly among ethically-conscious consumers. Brands that can demonstrate commitment to sustainable practices are gaining a competitive advantage.

Despite the significant growth potential, the luxury chocolate market faces several challenges. Fluctuations in cocoa bean prices represent a major risk to profitability. The price volatility can impact production costs and ultimately affect the final retail price, which may impact sales volumes. Intense competition from both established players and emerging artisanal brands creates pressure to maintain product innovation and branding. Maintaining brand exclusivity and preventing counterfeiting are also significant concerns in the luxury market. Counterfeits undermine brand image and reduce consumer confidence. Additionally, economic downturns or recessions can negatively affect consumer spending on luxury goods, including premium chocolates. Health concerns, though paradoxically driving the demand for dark chocolate, could still create limitations depending on sugar content. Finally, stringent regulations surrounding food safety and labeling can impose compliance costs on manufacturers and affect profit margins. Successfully navigating these challenges requires strategic planning, brand diversification, effective supply chain management and a constant focus on consumer trends.

The luxury chocolate market exhibits diverse growth patterns across different regions and segments. While precise market share data varies from year to year, several key observations can be made:

Dark Chocolate Dominance: The dark chocolate segment consistently outperforms white and milk chocolate in terms of growth, driven by the health halo effect and growing consumer preference for intense flavors. The estimated market value for dark chocolate in 2025 is expected to reach $ZZ billion.

Specialist Retailers' Strong Position: Specialist retailers, including high-end chocolatiers and gourmet food stores, capture a significant share of luxury chocolate sales, primarily due to their ability to provide a curated shopping experience and offer expert advice. These retailers often host tasting events, showcase artisanal brands, and create an environment that aligns with the luxury chocolate experience. This segment is expected to continue to grow, exceeding $WW billion in 2025.

Online Retail Growth: While specialist retailers retain importance, online channels are rapidly expanding, offering convenience and access to a wider range of products. This segment is experiencing rapid growth and is poised to capture a significant share of the market in the coming years.

Western Europe and North America Lead: These regions traditionally represent the largest markets for luxury chocolate, due to high disposable incomes and established consumer preferences for premium chocolate products. However, growth in emerging markets like Asia and the Middle East is expected to accelerate, driven by increasing affluence and growing interest in premium food and beverages.

In terms of geographical dominance, Western Europe and North America will likely maintain their leading positions in the forecast period. This is due to high per capita chocolate consumption rates and the established presence of both international and local premium chocolate brands. However, Asia-Pacific and Middle East and African markets show substantial growth potential driven by rapid economic development and increasing disposable incomes.

Several factors will continue to fuel the growth of the luxury chocolate industry. Innovation in flavor profiles, ethical sourcing, and sustainable packaging will attract increasingly discerning consumers. The rise of online channels broadens market reach and allows for personalized experiences. The focus on experiential consumption, creating a luxury experience beyond just the product itself, will further enhance market growth. The expansion of brand collaborations with high-end fashion houses or other luxury brands further elevates brand perception and attracts new customer segments.

This report provides a detailed analysis of the luxury chocolate market, covering historical trends, current market dynamics, and future growth projections. It includes a comprehensive overview of key market segments, leading players, driving forces, and challenges. The report also offers valuable insights for businesses operating in or seeking to enter the luxury chocolate market, providing strategic recommendations for achieving success in this dynamic and competitive industry. The detailed analysis offered covers market sizing, segmentation, competitive landscape, and future opportunities. This enables businesses to make informed decisions, develop effective strategies, and capitalize on future market expansion.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Godiva, Hotel Chocolat, Prestat, Lindt & Sprugli, Guylian, Artisan du Chocolat, Montezuma, Bettys, Maison Pierre Marcolini, Fifth Dimension, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Chocolate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Chocolate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.