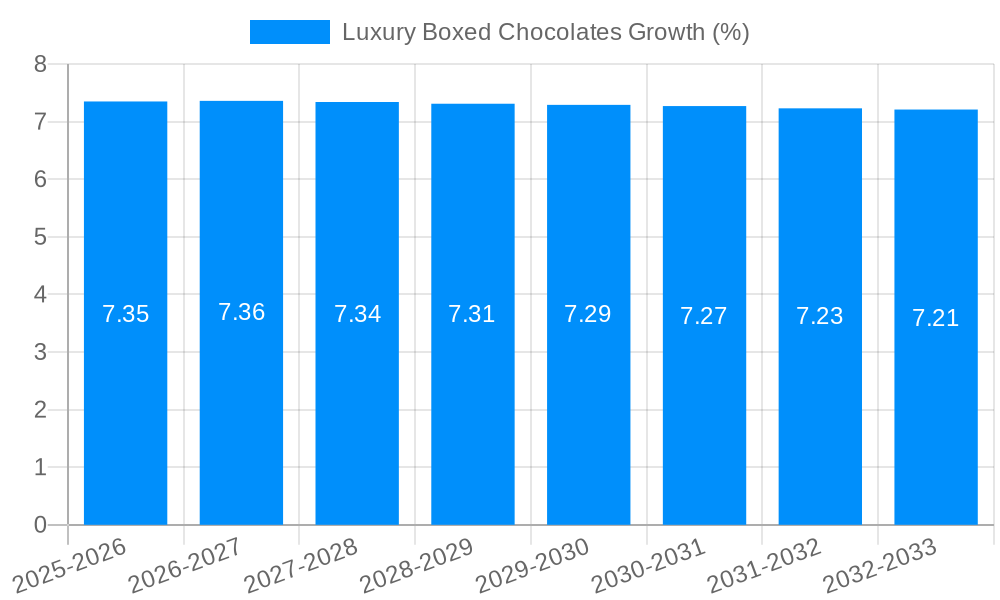

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Boxed Chocolates?

The projected CAGR is approximately 6.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Boxed Chocolates

Luxury Boxed ChocolatesLuxury Boxed Chocolates by Type (Dark Chocolate, White Chocolate), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

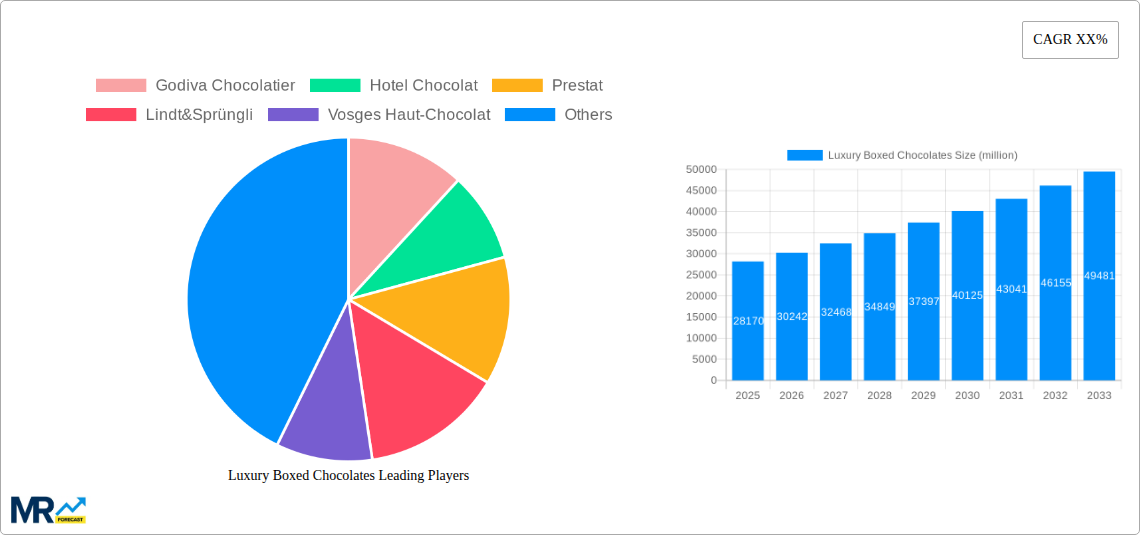

The luxury boxed chocolate market, valued at $18.01 billion in 2025, is projected to experience robust growth, driven by increasing consumer spending on premium confectionery and gifting occasions. A compound annual growth rate (CAGR) of 6.6% from 2025 to 2033 indicates a significant market expansion. The dark chocolate segment is anticipated to dominate due to its perceived health benefits and sophisticated flavor profile, while white chocolate caters to a growing preference for sweeter options. Online sales channels are experiencing rapid growth fueled by convenience and expanding e-commerce infrastructure. Key market players, including Godiva, Lindt, and Nestlé, are employing sophisticated branding and product innovation to maintain their competitive edge. Geographic expansion into emerging markets with rising disposable incomes, coupled with strategic partnerships and collaborations, represent major growth opportunities. However, challenges include fluctuating raw material prices, intense competition, and maintaining consistent quality across global supply chains. Premiumization continues as a key driver, with consumers showing increased willingness to pay a premium for high-quality ingredients, unique flavors, and artisanal craftsmanship. The market’s future depends on maintaining this focus on quality and innovation, adapting to evolving consumer preferences, and effectively leveraging digital marketing strategies.

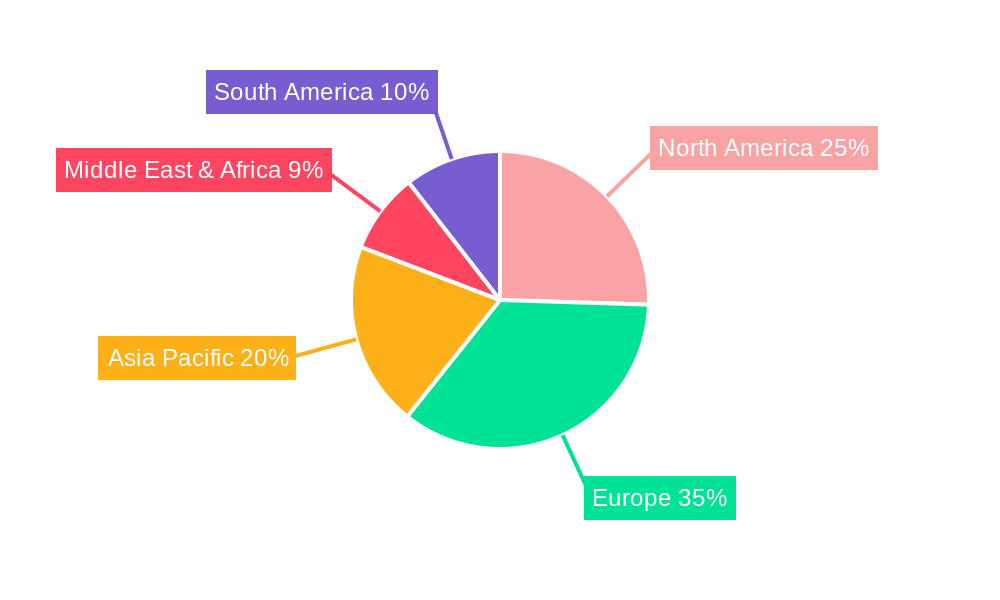

The market's segmentation reveals significant opportunities. Dark chocolate's dominance allows for further product diversification in flavors and origins. The online sales channel presents lucrative avenues for growth through targeted advertising and efficient delivery systems. Regional disparities exist, with North America and Europe currently holding the largest market shares; however, Asia-Pacific holds significant potential due to its rising middle class and increasing adoption of Western confectionery traditions. This untapped potential, coupled with strategic marketing initiatives focused on cultural relevance, promises substantial future growth. Maintaining a strong brand identity and fostering consumer loyalty through exceptional product quality and customer service remain paramount for continued market leadership.

The luxury boxed chocolates market, valued at several billion units in 2025, is experiencing significant growth, projected to reach tens of billions of units by 2033. This expansion is fueled by several key trends. Firstly, a rising affluent population globally, particularly in emerging economies, is driving demand for premium confectionery as a symbol of indulgence and gifting. Secondly, a growing awareness of ethical sourcing and sustainability is influencing consumer purchasing decisions, with increasing demand for chocolates made with high-quality, ethically sourced cocoa beans. This has led many luxury brands to emphasize transparency in their supply chains. Thirdly, the increasing popularity of online retail channels has provided luxury brands with new avenues to reach a wider consumer base, enhancing accessibility and convenience. The market is also witnessing a trend towards personalization and customization, with luxury brands offering bespoke gift boxes and tailored assortments. Consumers are increasingly seeking unique and memorable experiences, and luxury chocolates perfectly encapsulate this trend. Finally, the ongoing evolution of flavors and innovative product development is keeping the market dynamic. Luxury brands are constantly experimenting with unique flavor combinations, incorporating exotic ingredients, and creating visually stunning box designs to capture the attention of discerning consumers. This drive for innovation, combined with the enduring appeal of fine chocolate, positions the luxury boxed chocolates market for continued robust growth throughout the forecast period (2025-2033).

Several powerful forces are propelling the growth of the luxury boxed chocolates market. The rising disposable incomes in developing economies, alongside a growing middle class in established markets, creates a larger consumer base capable of affording premium confectionery. This increased purchasing power is a primary driver of market expansion. Furthermore, the shift towards gifting experiences over material possessions is boosting sales, especially during holidays and special occasions. Luxury boxed chocolates represent a thoughtful and sophisticated gift, fostering demand. The market is also benefiting from evolving consumer preferences. The demand for healthier and more ethically sourced products is prompting luxury brands to adopt sustainable practices and transparency, appealing to increasingly conscious consumers. In addition, effective marketing and branding strategies by leading players are creating strong brand loyalty and driving sales. The skillful use of digital marketing and social media platforms further expands market reach and enhances brand visibility. Lastly, the continuous innovation in flavor profiles, packaging, and presentation adds an element of excitement and novelty, attracting repeat purchases and enticing new customers.

Despite the positive growth trajectory, the luxury boxed chocolates market faces certain challenges. Fluctuations in cocoa bean prices represent a significant risk, impacting production costs and potentially affecting profitability. Economic downturns can also reduce consumer spending on non-essential items like luxury chocolates, causing temporary dips in demand. Intense competition amongst established brands and emerging players necessitates continuous innovation and differentiation to maintain market share. Furthermore, maintaining ethical and sustainable sourcing practices while keeping costs manageable is a constant challenge for luxury brands. The increasing demand for healthier alternatives within the food industry puts pressure on luxury chocolate producers to adapt their product offerings to cater to consumer health concerns. Finally, counterfeit products and gray market sales pose a threat, impacting the revenue of legitimate brands and potentially damaging brand reputation. Addressing these challenges requires strategic planning, robust supply chain management, and a commitment to product quality and ethical sourcing.

The luxury boxed chocolate market exhibits regional variations in growth patterns. North America and Western Europe are expected to retain significant market shares due to the established presence of luxury brands and high consumer spending power in these regions. However, Asia-Pacific is predicted to witness the fastest growth rate, driven by a burgeoning affluent population and a growing preference for premium food and beverage products. Within segments, dark chocolate is expected to dominate the market due to its perceived health benefits (higher antioxidant content) and sophisticated appeal. Online sales are exhibiting high growth potential, leveraging the convenience and accessibility of e-commerce platforms to reach a broader customer base.

The combination of a growing preference for premium products in rapidly developing economies, coupled with the convenience offered by e-commerce, positions online sales of dark chocolate as a particularly lucrative segment. The perceived health benefits of dark chocolate, and the increasingly sophisticated marketing efforts of luxury brands targeting this specific segment, will contribute to the dominance and growth of this area within the luxury boxed chocolate market. The rise of dark chocolate specifically is further driven by consumer awareness of health and wellness trends, as consumers increasingly seek out foods perceived to offer health benefits beyond simply taste.

The luxury boxed chocolate industry's growth is further catalyzed by the increasing popularity of personalized and customized gifting options. Consumers are increasingly seeking unique and memorable experiences, and luxury chocolates provide a perfect avenue for this. The rising popularity of subscription boxes and online gifting services is also fueling market expansion. Consumers are embracing the convenience and surprise factor of receiving curated selections of chocolates on a regular basis. These factors, along with continued innovation and brand building, provide a strong foundation for ongoing industry expansion.

This report provides a detailed analysis of the luxury boxed chocolates market, covering market trends, driving forces, challenges, regional performance, key players, and significant developments. The comprehensive study offers valuable insights into the market dynamics and provides a forecast for the period 2025-2033, enabling stakeholders to make informed strategic decisions for growth and expansion within this lucrative sector. The study encompasses historical data from 2019-2024, offering a robust base for understanding market evolution and predicting future growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.6%.

Key companies in the market include Godiva Chocolatier, Hotel Chocolat, Prestat, Lindt&Sprüngli, Vosges Haut-Chocolat, The Hershey Company, Nestlé, Guylian, Ferrero Group, Pierre Marcolini, Fifth Dimension Chocolates, Patchi, Amedei, Valrhona, Artisan du Chocolat, Montezuma's, .

The market segments include Type, Application.

The market size is estimated to be USD 18010 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Boxed Chocolates," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Boxed Chocolates, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.