1. What is the projected Compound Annual Growth Rate (CAGR) of the Loan Origination Solution?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Loan Origination Solution

Loan Origination SolutionLoan Origination Solution by Application (/> Banks, Credit Unions, Mortgage Lenders & Brokers, Others), by Type (/> On-demand (Cloud), On-premise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

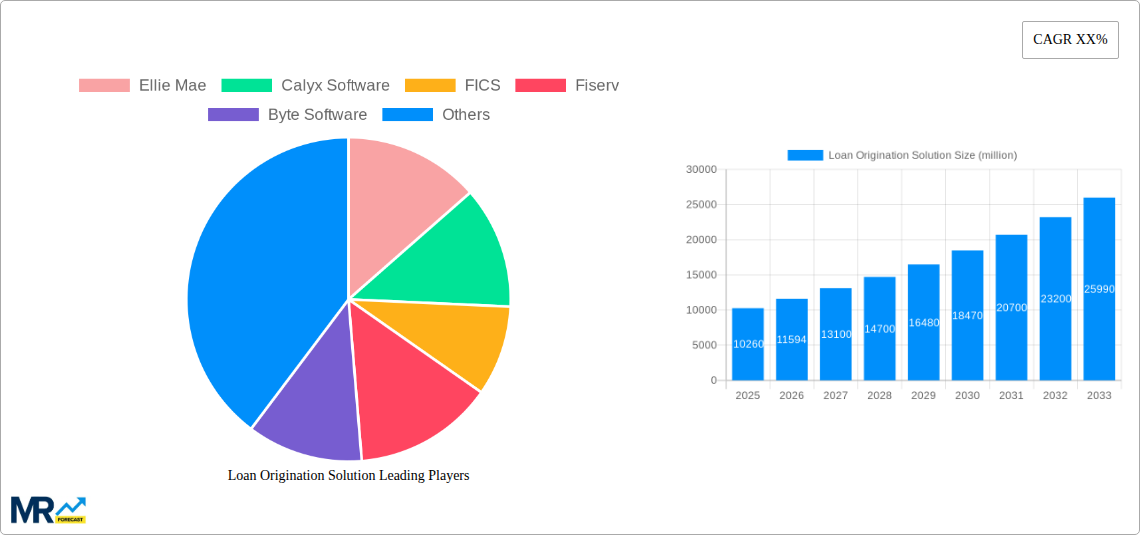

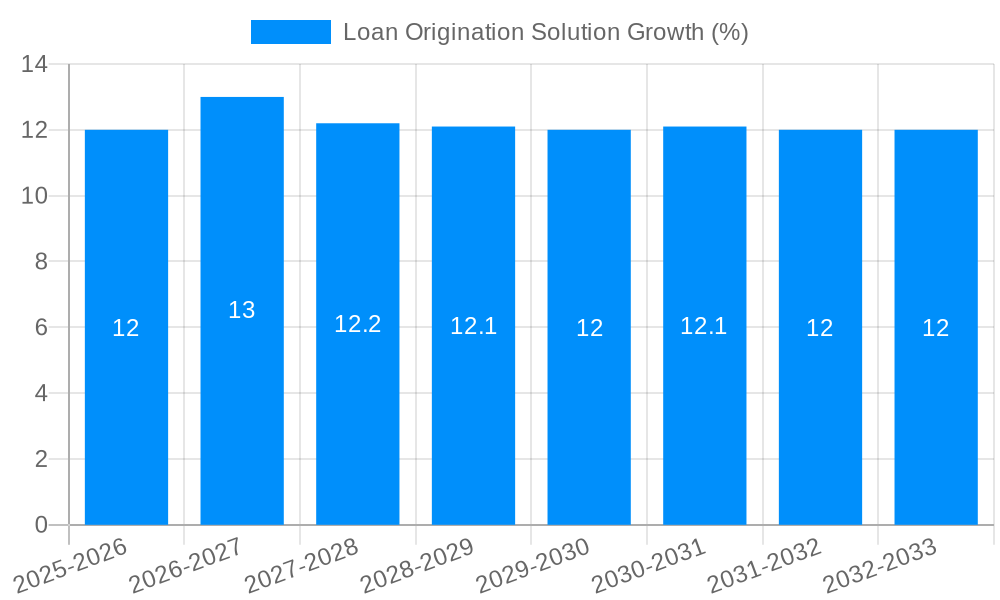

The global Loan Origination Solution market is poised for significant expansion, with an estimated market size of USD 10,260 million in the base year 2025. This growth is propelled by a confluence of factors including escalating demand for streamlined mortgage lending processes, increasing adoption of digital transformation initiatives across financial institutions, and the persistent need for enhanced regulatory compliance in loan processing. Key drivers such as the rise of fintech innovations, the growing preference for cloud-based solutions offering scalability and cost-efficiency, and the imperative to reduce operational costs are fueling this market surge. Furthermore, evolving customer expectations for faster loan approvals and seamless digital experiences are compelling lenders to invest in advanced loan origination technologies. The market is witnessing a robust Compound Annual Growth Rate (CAGR) of approximately 12-15% over the forecast period (2025-2033), indicating a dynamic and expanding landscape.

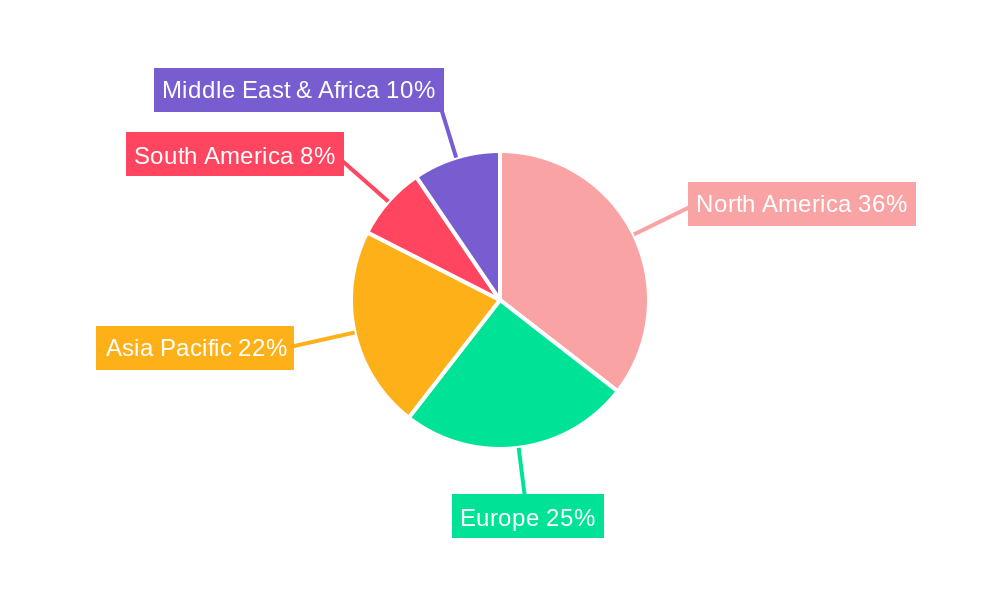

The market is segmented across various applications, with Banks, Credit Unions, and Mortgage Lenders & Brokers representing the dominant segments due to their core business operations. The "Others" category, encompassing alternative lenders and peer-to-peer platforms, is also showing considerable growth as the financial ecosystem diversifies. In terms of deployment type, the On-demand (Cloud) segment is rapidly gaining traction over the traditional On-premise solutions, owing to its inherent flexibility, lower upfront investment, and enhanced accessibility. Geographically, North America is anticipated to lead the market, driven by the mature financial sector and early adoption of technological advancements. Asia Pacific is projected to exhibit the highest growth rate, fueled by rapid digitalization, a burgeoning middle class with increasing access to credit, and supportive government initiatives promoting financial inclusion. Emerging trends like the integration of Artificial Intelligence (AI) and Machine Learning (ML) for credit scoring and fraud detection, and the increasing focus on data analytics for personalized loan offerings, will further shape the trajectory of the loan origination solution market.

This comprehensive report delves into the dynamic landscape of Loan Origination Solutions (LOS), charting its evolution from the historical period of 2019-2024 through to an estimated market valuation of $15.75 million in the base year of 2025 and projecting a robust growth trajectory up to 2033. The study period spans from 2019 to 2033, with a specific focus on the forecast period of 2025-2033. Our analysis encompasses key market insights, driving forces, prevailing challenges, regional and segment-specific dominance, critical growth catalysts, leading industry players, and significant sector developments.

XXX The loan origination solution market is undergoing a profound transformation, driven by an escalating demand for efficiency, compliance, and enhanced customer experiences throughout the lending lifecycle. Historically, the market has been characterized by fragmented solutions and manual processes. However, the period from 2019 to 2024 witnessed a significant shift towards digitization and automation. This era saw increased adoption of cloud-based LOS, enabling greater scalability and accessibility for a wider range of financial institutions. The rise of open banking and the increasing emphasis on personalized financial services have further amplified the need for sophisticated LOS that can seamlessly integrate with various third-party applications and data sources. Artificial intelligence (AI) and machine learning (ML) are emerging as pivotal trends, revolutionizing risk assessment, fraud detection, and underwriting processes, thereby accelerating loan approvals and reducing operational costs. The market is also seeing a growing focus on digital customer onboarding, with solutions offering intuitive interfaces and mobile accessibility to cater to the evolving preferences of borrowers. Furthermore, regulatory compliance remains a paramount concern, pushing LOS providers to continually update their platforms to adhere to stringent financial regulations and data privacy laws. The pandemic further accelerated the adoption of remote work and digital servicing, underscoring the criticality of robust, cloud-native LOS solutions that can support distributed teams and enable contactless lending. Looking ahead, the integration of blockchain technology for enhanced security and transparency, alongside the further maturation of AI-driven predictive analytics for personalized loan offerings, are expected to shape the future of the loan origination solution market, driving greater operational efficiencies and improving overall borrower satisfaction. The sheer volume of loan applications processed annually, projected to reach billions, underscores the critical role these solutions play in the global financial ecosystem, making continuous innovation and adaptation essential for market participants.

Several powerful forces are collectively propelling the loan origination solution market forward. The insatiable demand for streamlined and efficient lending processes stands as a primary driver. Financial institutions are under immense pressure to reduce operational costs and accelerate loan turnaround times to remain competitive. This necessitates the adoption of LOS that can automate manual tasks, from application intake to final disbursement, thereby freeing up human resources for more value-added activities. The ever-evolving regulatory landscape also plays a significant role. With an increasing number of compliance requirements and stringent data privacy laws, institutions require robust LOS that can ensure adherence and mitigate risks. This is particularly true in an era where data security and ethical lending practices are under intense scrutiny. Furthermore, the relentless pursuit of enhanced customer experience is a crucial catalyst. Borrowers today expect a seamless, intuitive, and fast digital journey for all their financial needs, including loan applications. LOS that offer user-friendly interfaces, mobile accessibility, and personalized offerings are therefore in high demand. The increasing penetration of digital technologies across all industries has normalized digital interactions, and the financial sector is no exception. This technological advancement, coupled with the growing adoption of cloud computing, has made sophisticated LOS more accessible and affordable for a wider range of institutions, from large banks to smaller credit unions and mortgage brokers. The sheer volume of financial transactions and the continuous need for capital infusion across various sectors ensures a perpetual demand for efficient loan origination capabilities.

Despite the robust growth, the loan origination solution market is not without its hurdles. A significant challenge lies in the integration complexity with existing legacy systems. Many financial institutions operate with outdated core banking systems, making it difficult and costly to seamlessly integrate new LOS platforms. This often requires substantial IT investment and a prolonged implementation period, which can deter adoption. Data security and privacy concerns remain paramount. As LOS handle sensitive borrower information, ensuring the utmost security against cyber threats and compliance with data protection regulations like GDPR and CCPA is a constant challenge for both providers and users. The cost of implementation and maintenance can also be a restraint, especially for smaller institutions with limited budgets. While cloud-based solutions are becoming more affordable, the initial setup, customization, and ongoing subscription fees can still represent a substantial financial commitment. Resistance to change within organizations is another factor. Employees accustomed to traditional, manual processes may be hesitant to adopt new technologies, requiring comprehensive training and change management strategies. Furthermore, the fragmented nature of the market with numerous vendors offering diverse functionalities can make it challenging for institutions to identify the most suitable LOS that meets their specific needs. Finally, the ongoing need for regulatory compliance updates demands continuous investment and adaptation from LOS providers, adding to the overall cost and complexity of the solutions.

The North America region is projected to dominate the loan origination solution market, driven by its mature financial ecosystem, strong technological infrastructure, and a high degree of digital adoption among consumers and businesses. The United States, in particular, stands as a key contributor due to the presence of a vast number of financial institutions, including large national banks, regional banks, credit unions, and a significant mortgage lending industry. The regulatory environment in North America, while complex, often fosters innovation as institutions seek efficient solutions to ensure compliance and streamline operations. The emphasis on customer experience in this region further fuels the demand for sophisticated LOS that can offer seamless digital onboarding and application processes.

Within the market segments, Mortgage Lenders & Brokers are expected to be the leading adopters and drivers of growth for loan origination solutions. The mortgage industry is inherently complex, characterized by a high volume of applications, intricate underwriting processes, and stringent regulatory requirements. LOS are critical for these entities to manage the entire lifecycle of a mortgage, from initial borrower contact and application submission to underwriting, appraisal, closing, and post-closing activities. The ability of LOS to automate repetitive tasks, ensure data accuracy, and maintain compliance with various federal and state regulations makes them indispensable for mortgage lenders and brokers aiming to improve efficiency and reduce risk. The increasing adoption of digital mortgages and the growing demand for faster closing times further amplify the need for advanced LOS within this segment.

The On-demand (Cloud) deployment type is also poised to significantly lead the market. Cloud-based LOS offer several compelling advantages:

While Banks and Credit Unions are significant segments, their adoption of cloud-based LOS is rapidly accelerating as they strive to compete with agile fintech lenders and improve their digital offerings to retain and attract customers. The "Others" segment, encompassing various specialized lenders and fintech companies, is also showing strong growth, often being early adopters of cutting-edge LOS technologies. However, the sheer volume and established infrastructure within the mortgage sector, combined with the clear advantages of cloud deployment, positions them as the dominant forces in shaping the trajectory of the loan origination solution market.

Several key factors are acting as significant growth catalysts for the loan origination solution industry. The relentless pursuit of operational efficiency and cost reduction within financial institutions is paramount. As loan volumes continue to rise, the need to automate manual processes, minimize errors, and accelerate turnaround times becomes critical. Furthermore, the increasing complexity of regulatory compliance across different jurisdictions necessitates sophisticated LOS that can ensure adherence and mitigate risks. The growing demand for personalized borrower experiences, driven by evolving customer expectations and the rise of fintech, is pushing institutions to adopt LOS that can offer seamless digital journeys and tailored product offerings.

This report offers a 360-degree view of the loan origination solution market, meticulously analyzing its current state and future trajectory. From the historical context of 2019-2024 to the projected market landscape up to 2033, our analysis delves into key trends, the driving forces behind market expansion, and the inherent challenges that shape the industry. We provide in-depth insights into the regions and segments poised for dominance, alongside an exploration of the critical growth catalysts that are fueling innovation and adoption. A comprehensive overview of the leading players, their offerings, and significant industry developments further equips stakeholders with the knowledge needed to navigate this evolving market. The report’s coverage ensures a thorough understanding of the technological advancements, regulatory influences, and customer-centric shifts that are redefining the loan origination process.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ellie Mae, Calyx Software, FICS, Fiserv, Byte Software, PCLender, LLC, Mortgage Builder Software, Mortgage Cadence (Accenture), Wipro, Tavant Tech, DH Corp, Lending QB, Black Knight, ISGN Corp, Pegasystems, Juris Technologies, SPARK, Axcess Consulting Group, Turnkey Lender, VSC.

The market segments include Application, Type.

The market size is estimated to be USD 10260 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Loan Origination Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Loan Origination Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.