1. What is the projected Compound Annual Growth Rate (CAGR) of the LINUX Server?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

LINUX Server

LINUX ServerLINUX Server by Type (CentOS System, Ubuntu System, Red Hat Linux System, Others, World LINUX Server Production ), by Application (Web Server, File Server, Mail Server, Proxy Server, DNS Server, Others, World LINUX Server Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

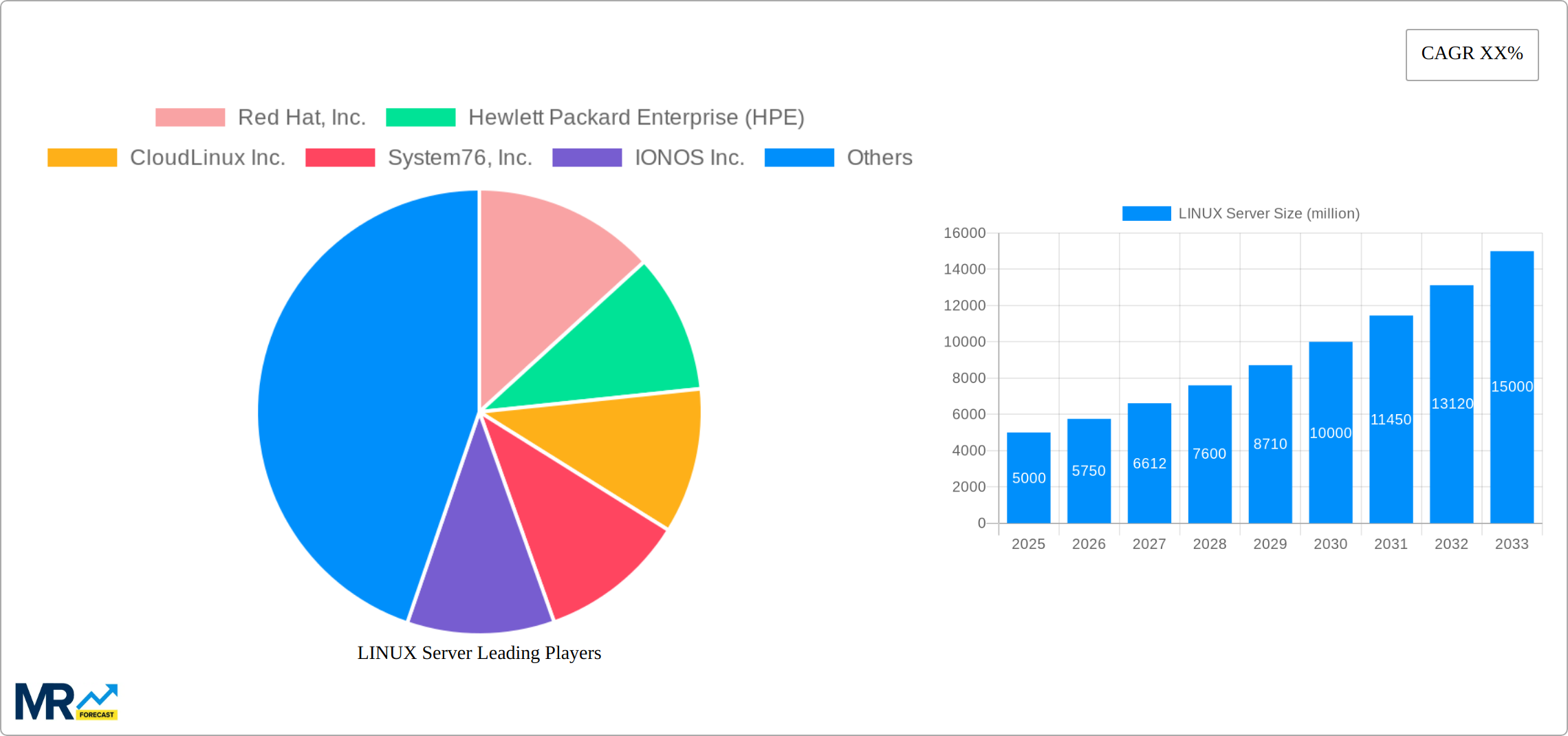

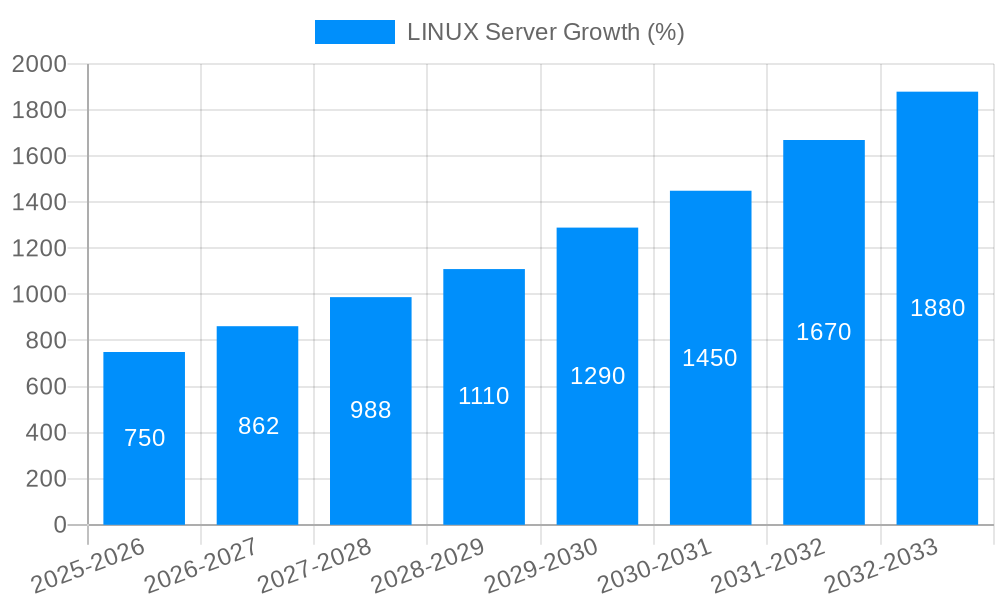

The Linux server market is experiencing robust growth, driven by increasing demand for open-source solutions, enhanced security features, and cost-effectiveness compared to proprietary alternatives. The market's Compound Annual Growth Rate (CAGR) is estimated to be around 15% during the forecast period (2025-2033), indicating significant expansion opportunities. Key drivers include the rising adoption of cloud computing, the need for scalable and flexible IT infrastructure, and the growing preference for containerization technologies like Docker and Kubernetes, which frequently rely on Linux. Major players like Red Hat, IBM, and Canonical are leading the market, constantly innovating with new features and expanding their service offerings. This competitive landscape fuels further innovation and market expansion.

The market segmentation reveals a strong preference for specific Linux distributions tailored to particular enterprise needs. We can anticipate continued growth in specialized segments catering to specific industry verticals such as finance, healthcare, and telecommunications. While challenges exist, such as the need for skilled Linux administrators and the complexities of managing large-scale deployments, these are being mitigated by improved training resources and automation tools. Geographic expansion is also a major factor, with regions like Asia-Pacific showing particularly promising growth potential due to increasing digital transformation initiatives and rising IT infrastructure investments. Restraints include competition from other operating systems and the need for continuous security updates. However, the ongoing development of robust security features and community support within the Linux ecosystem will help overcome these challenges and support sustained market growth.

The Linux server market, valued at over $20 million in 2024, is poised for substantial growth, projected to surpass $100 million by 2033. This expansion is fueled by several key factors. The increasing adoption of cloud computing and virtualization technologies significantly contributes to this growth. Organizations are migrating their IT infrastructure to the cloud to leverage scalability, cost-effectiveness, and enhanced flexibility. Linux, with its open-source nature and robust security features, is a preferred choice for cloud deployments. Furthermore, the rising demand for big data analytics and artificial intelligence (AI) applications is driving the need for powerful and versatile servers. Linux servers excel in handling the complex computational demands of these applications, further boosting market expansion. The preference for open-source solutions also minimizes licensing costs, a significant advantage for businesses, particularly smaller ones and startups. The continuous development and improvement of Linux distributions, focusing on enhanced security, performance, and compatibility, enhance its appeal. This continuous evolution ensures Linux servers remain at the forefront of technological advancements, making it a reliable and future-proof choice for a broad range of industries. Finally, the growing adoption of hybrid cloud models, combining on-premise and cloud infrastructure, necessitates robust server solutions. Linux servers seamlessly integrate within such hybrid environments, facilitating efficient management and data flow. The combination of these factors contributes to the impressive and sustained growth trajectory predicted for the Linux server market throughout the forecast period (2025-2033).

Several powerful forces are driving the phenomenal growth of the Linux server market. The inherent cost-effectiveness of Linux, being open-source, is a major attraction. Organizations can significantly reduce software licensing fees compared to proprietary alternatives. This is particularly impactful for small and medium-sized businesses (SMBs) with tighter budgets. Furthermore, the vast and active community supporting Linux ensures continuous improvement and readily available support, fostering rapid problem resolution and innovation. The enhanced security features offered by Linux, coupled with the ability to customize security measures based on specific needs, contribute to increased adoption by businesses prioritizing data protection. Linux's scalability and flexibility allow businesses to adapt their server infrastructure to meet evolving requirements, avoiding the limitations of proprietary systems. The ability to run diverse applications and integrate with various hardware platforms makes Linux a highly adaptable solution for a wide range of enterprise needs. Finally, the growing adoption of DevOps methodologies emphasizes automation and efficiency in software development and deployment. Linux's inherent compatibility with DevOps tools and workflows makes it the preferred choice for many organizations embracing these modern software development practices. These factors, combined, create a powerful synergy driving the sustained expansion of the Linux server market.

Despite its strong growth trajectory, the Linux server market faces certain challenges. The complexity involved in configuring and managing Linux systems can present a barrier for organizations lacking experienced personnel. This skill gap necessitates investment in training and recruitment of qualified Linux administrators. Furthermore, the open-source nature of Linux, while a strength, also presents challenges in terms of maintaining consistent security and support across diverse distributions. Ensuring compatibility across different Linux versions and applications requires careful planning and testing. The lack of a unified support structure, unlike proprietary systems with centralized support teams, can sometimes lead to fragmentation and difficulty in obtaining timely assistance. Competition from other operating systems, including Windows Server and other open-source alternatives, continues to exert pressure on market share. Maintaining a competitive edge requires continuous innovation and adaptation to meet evolving market demands. Finally, while the open-source nature reduces licensing costs, the need for ongoing maintenance and support can still represent a significant operational expense. Addressing these challenges strategically is crucial for sustaining the healthy growth of the Linux server market.

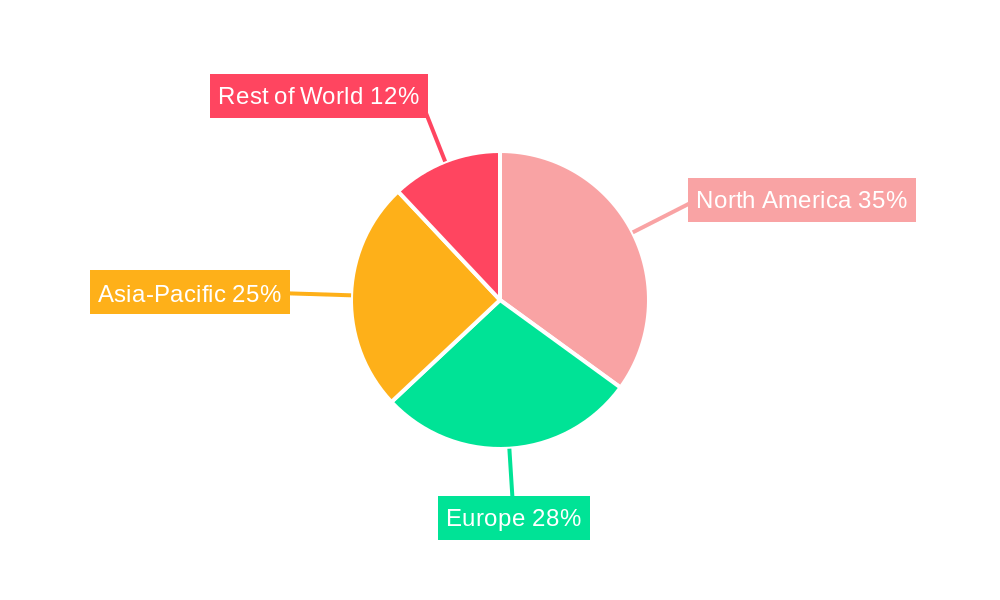

North America: This region is projected to hold a significant market share due to the high concentration of technology companies and early adoption of cloud technologies. The mature IT infrastructure and substantial investment in digital transformation initiatives contribute to high demand for Linux servers.

Europe: The increasing adoption of cloud computing and digitalization across various industries, particularly in countries like Germany and the UK, drives significant growth in this region. Government initiatives supporting digital transformation further stimulate market expansion.

Asia-Pacific: Rapid economic growth and increasing digitalization in countries like China, India, and Japan are propelling the demand for Linux servers. The booming e-commerce sector and the expansion of data centers fuel this growth.

Segments:

Cloud Computing: The largest and fastest-growing segment. Cloud providers rely heavily on Linux for its scalability, flexibility, and cost-effectiveness. The migration to the cloud is a key driver of this segment's growth.

High-Performance Computing (HPC): Linux servers are crucial for computationally intensive tasks in scientific research, financial modeling, and other demanding applications. The demand for increased processing power drives growth in this segment.

Big Data Analytics: The ever-growing volume of data necessitates powerful and reliable servers. Linux excels in handling big data workloads, enabling efficient data processing and analysis.

Enterprise Servers: Many large enterprises rely on Linux servers for their core infrastructure needs, benefiting from its stability, security, and customizability.

The confluence of robust regional demand and the accelerating adoption of cloud computing, HPC, and big data analytics within these regions ensures the Linux server market’s continued dominance. Millions of servers are deployed annually, with projections indicating sustained and significant growth throughout the forecast period. North America and Europe currently lead the market, but the Asia-Pacific region is experiencing rapid expansion, closing the gap. The dominance of the cloud computing segment underscores the profound impact of cloud adoption on the overall Linux server market.

The convergence of several factors fuels the Linux server market's impressive growth. The increasing demand for robust and secure cloud infrastructure, coupled with the cost-effectiveness and scalability of Linux, makes it a compelling choice for businesses of all sizes. Advances in containerization technologies and microservices architectures further enhance the deployment and management of Linux servers, creating greater efficiency and agility. Furthermore, the growing focus on DevOps and automation processes simplifies deployment, maintenance, and scalability, adding to the attractiveness of Linux in modern IT environments.

This report provides a detailed analysis of the Linux server market, encompassing market size, growth drivers, challenges, key players, and significant developments. It offers a comprehensive overview of the current market landscape and provides valuable insights for businesses operating in or considering entering this dynamic sector. The report's projections and forecasts offer strategic guidance for informed decision-making related to investments, partnerships, and technological advancements within the Linux server market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Red Hat, Inc., Hewlett Packard Enterprise (HPE), CloudLinux Inc., System76, Inc., IONOS Inc., SEASnet, RACKSPACE TECHNOLOGY, Sisense Inc., IBM Corporation, Canonical Group Limited, Zentyal Linux Server, OVH SAS, DigitalOcean, LLC., The Constant Company, LLC., Alibaba Cloud.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "LINUX Server," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the LINUX Server, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.