1. What is the projected Compound Annual Growth Rate (CAGR) of the Life Reinsurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Life Reinsurance

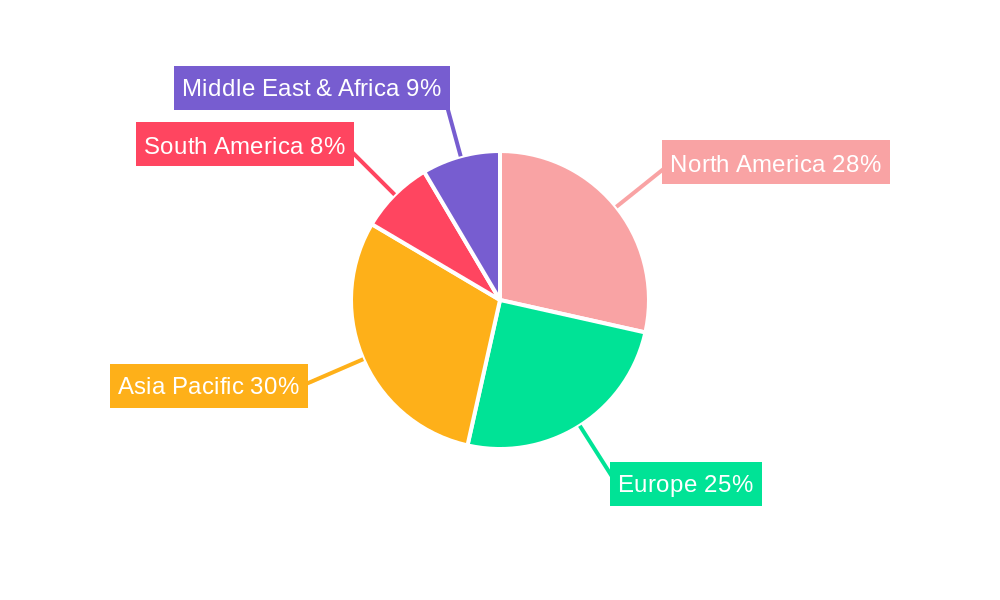

Life ReinsuranceLife Reinsurance by Type (/> Participating, Non-participating), by Application (/> Children, Adults, Senior Citizens), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

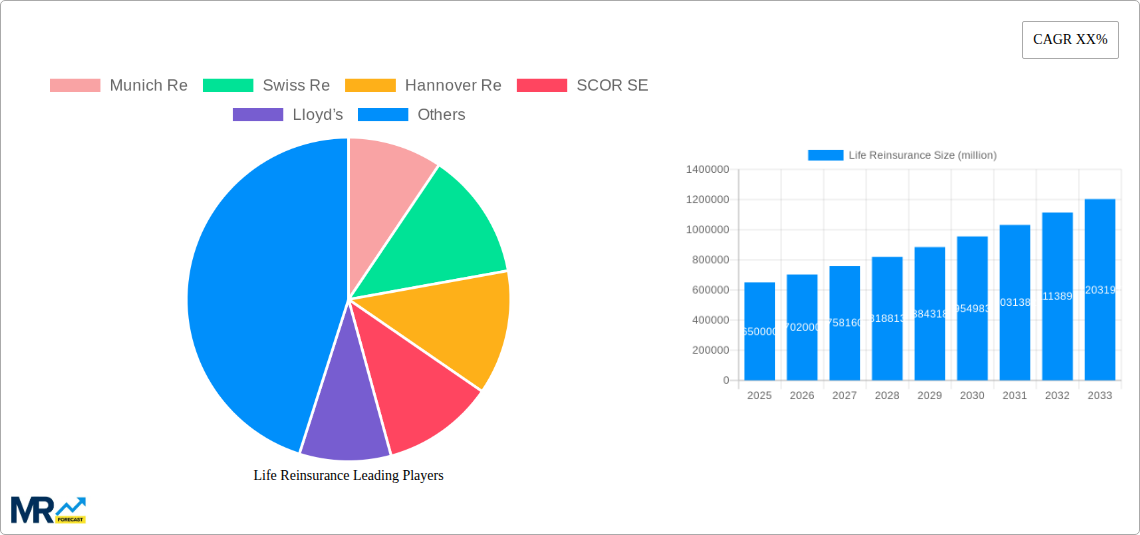

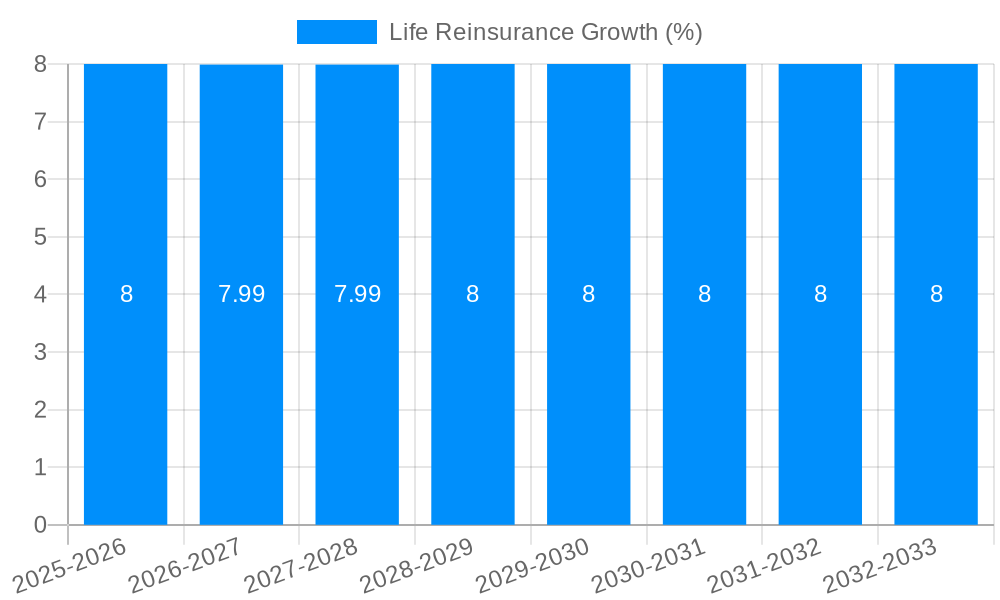

The global Life Reinsurance market is poised for robust expansion, projected to reach an estimated market size of $650 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of approximately 8% over the forecast period ending in 2033. This significant growth is fueled by a confluence of factors, primarily the increasing demand for life insurance products globally, driven by heightened awareness of financial security and mortality risks, particularly in emerging economies. The aging global population is a substantial driver, as it necessitates more comprehensive life insurance and annuity solutions, thereby increasing the need for reinsurers to underwrite these liabilities. Furthermore, the evolving regulatory landscape, which often encourages insurers to cede risk to manage their solvency and capital adequacy, plays a crucial role. Technological advancements in data analytics and underwriting are also empowering reinsurers to offer more tailored and efficient solutions, expanding their reach and profitability. The market is seeing a significant shift towards participating life reinsurance products, driven by their ability to offer policyholders potential dividends while providing insurers with a mechanism to manage capital efficiently.

The market's trajectory is also shaped by a complex interplay of trends and restraints. Key trends include the growing adoption of advanced analytics and AI for underwriting and risk assessment, leading to more accurate pricing and product development. There's also a notable expansion of life reinsurance services to cater to the specific needs of different demographics, with a particular focus on the growing senior citizen segment and their complex healthcare and retirement planning requirements. However, restraints such as the persistent low-interest-rate environment in some major economies can impact investment yields for reinsurers, potentially affecting profitability. Geopolitical uncertainties and increasing climate-related events also pose challenges, demanding sophisticated risk modeling and capital management strategies. Despite these headwinds, the fundamental drivers of population growth, increasing life expectancy, and the expanding middle class in developing nations are expected to sustain a healthy growth trajectory for the life reinsurance sector.

This comprehensive report provides an in-depth analysis of the global life reinsurance market, examining its intricate dynamics, future trajectory, and the pivotal players shaping its landscape. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this research leverages historical data from 2019-2024 to deliver robust insights. The market is characterized by a significant volume of transactions, with key players managing substantial liabilities. For instance, the Gross Written Premiums (GWPs) within the life reinsurance sector are projected to reach figures in the hundreds of billions of US dollars by the end of the forecast period. This report delves into the evolving strategies of major reinsurers such as Munich Re, Swiss Re, Hannover Re, SCOR SE, Lloyd's, Berkshire Hathaway, Great-West Lifeco, RGA, China Re, Korean Re, PartnerRe, GIC Re, Mapfre, Alleghany, Everest Re, XL Catlin, Maiden Re, Fairfax, AXIS, Mitsui Sumitomo, Sompo, and Tokio Marine. It dissects the impact of various product types, including Participating and Non-participating life reinsurance, and the application across different demographics, such as Children, Adults, and Senior Citizens. Industry developments, regulatory shifts, and macroeconomic influences are meticulously analyzed to provide stakeholders with a holistic understanding of this vital segment of the insurance industry. The report aims to equip insurers, reinsurers, and investors with the foresight necessary to navigate market complexities and capitalize on emerging opportunities.

XXX The life reinsurance market is currently undergoing a significant transformation, driven by a confluence of demographic shifts, technological advancements, and evolving risk appetites. A prominent trend observed is the increasing demand for longevity risk solutions, particularly in developed economies with aging populations. Reinsurers are actively developing innovative products to manage the financial implications of longer life expectancies for pension funds and annuity providers, with the total value of longevity risk transfer deals expected to climb into the tens of billions of US dollars annually. Furthermore, the rise of emerging markets, particularly in Asia, is presenting substantial growth opportunities. As disposable incomes rise and awareness of life insurance products increases, so too does the demand for reinsurance capacity to support these expanding primary markets. China and India, for example, are anticipated to be key growth engines, contributing a significant portion to the overall market expansion. The increasing sophistication of data analytics and artificial intelligence is also revolutionizing underwriting and risk assessment processes. Reinsurers are leveraging these tools to gain deeper insights into mortality trends, policyholder behavior, and emerging health risks, leading to more accurate pricing and improved risk selection. This technological integration is expected to streamline operations and enhance profitability, potentially adding billions in efficiency gains across the industry. The market is also witnessing a growing interest in personalized insurance products, which necessitate flexible and tailored reinsurance solutions. This trend is pushing reinsurers to develop more modular and customizable offerings to meet the specific needs of primary insurers and their policyholders. The landscape of life reinsurance is therefore characterized by a dynamic interplay of demographic forces, technological innovation, and a strategic push towards greater customization and risk management sophistication, all contributing to a projected market growth trajectory of several percentage points annually. The volume of capital deployed in life reinsurance, both from traditional reinsurers and alternative capital providers, is substantial, with established players managing portfolios valued in the hundreds of billions. This sustained inflow of capital underscores the market's attractiveness and its critical role in the global financial ecosystem. The emphasis on data-driven decision-making and the proactive management of long-term liabilities are becoming paramount, shaping the strategies of virtually all market participants.

Several potent forces are propelling the life reinsurance market forward, underscoring its strategic importance in the global financial ecosystem. Primarily, the persistent low-interest-rate environment, though showing some signs of normalization, has compelled primary insurers to seek greater efficiency and risk mitigation to maintain profitability and solvency. Reinsurance offers a crucial avenue for capital optimization and risk transfer, allowing insurers to underwrite larger volumes of business and absorb unexpected mortality fluctuations without jeopardizing their financial stability. This is particularly relevant for annuity business, where long-term guarantees are offered. The growing global population, coupled with increasing wealth accumulation in emerging economies, is fundamentally expanding the addressable market for life insurance. As more individuals gain access to financial products, the demand for life cover and the associated need for reinsurance capacity rise in tandem. This demographic expansion translates into billions of dollars in potential new business for the reinsurance sector. Furthermore, the increasing complexity of life insurance products, including those with embedded savings and investment components, necessitates sophisticated risk management capabilities that reinsurers are uniquely positioned to provide. The advent of new health risks, such as pandemics, and the ongoing impact of climate change on mortality and morbidity patterns are also driving demand for specialized reinsurance solutions. Insurers are increasingly turning to reinsurers to share the burden of these emerging and systemic risks, leading to the development of innovative products and greater collaboration. The regulatory landscape also plays a crucial role; evolving solvency requirements and capital adequacy frameworks often incentivize insurers to cede risk to reinsurers, thereby optimizing their capital allocation and enhancing their resilience. This regulatory push is a significant driver of reinsurance demand, especially in regions with robust supervisory bodies.

Despite its robust growth, the life reinsurance market faces a number of significant challenges and restraints that could temper its expansion. One of the most pervasive issues is the ongoing low-interest-rate environment, which continues to exert pressure on the investment income of reinsurers, impacting their profitability and the attractiveness of certain long-duration products. While interest rates are expected to rise, the pace and magnitude of this increase remain uncertain, creating a degree of volatility. The increasing frequency and severity of natural catastrophes, coupled with the growing impact of climate change on mortality and morbidity, pose a considerable challenge to the traditional underwriting models. This necessitates greater investment in sophisticated catastrophe modeling and risk management, potentially increasing operational costs. The ongoing evolution of the regulatory landscape, while sometimes a driver, can also act as a restraint. New or more stringent capital requirements and accounting standards can increase the compliance burden and capital costs for reinsurers, potentially leading to higher pricing for cedents. Cyber risks are also emerging as a significant concern. As the industry becomes more digitized, the threat of cyberattacks on sensitive policyholder data and critical infrastructure looms large, requiring substantial investment in cybersecurity measures and potentially leading to new forms of insurable risk that are complex to underwrite and reinsure. The intense competition within the reinsurance market, particularly from alternative capital providers such as insurance-linked securities (ILS) funds, can also lead to pricing pressure and margin erosion, especially for more commoditized lines of business. Furthermore, the inherent long-term nature of life reinsurance contracts means that reinsurers are exposed to significant latency risk, where unforeseen claims may emerge years or even decades after the initial underwriting. Accurately pricing and reserving for these long-tail liabilities requires robust actuarial expertise and a deep understanding of mortality trends, which can be challenging to maintain. The cost of acquiring and retaining talent with the specialized skills required in actuarial science, data analytics, and risk management is also a growing concern for many reinsurers.

The life reinsurance market exhibits distinct regional strengths and segment dominance, with several key areas poised to drive future growth and innovation.

Key Regions/Countries Dominating the Market:

Key Segments Dominating the Market:

Several factors are acting as powerful catalysts for growth in the life reinsurance industry. The primary driver remains the increasing global life expectancy, which, while a societal triumph, necessitates robust financial planning and risk management, thereby boosting demand for longevity-focused reinsurance products. Furthermore, the expanding middle class in emerging economies, particularly in Asia, is leading to a surge in life insurance penetration, directly translating into increased demand for reinsurance capacity. Technological advancements, including AI and big data analytics, are enabling more accurate risk assessment and product innovation, making reinsurance more accessible and attractive to primary insurers. Regulatory changes, such as updated solvency requirements in various jurisdictions, are also compelling insurers to cede more risk to optimize their capital positions. The growing awareness of financial planning and the need for protection against unforeseen events further fuels the demand for life insurance and, by extension, its reinsurance backbone.

The global life reinsurance market is characterized by the presence of several dominant and influential players who collectively manage a substantial portion of the world's life risk. These companies possess the financial strength, actuarial expertise, and global reach necessary to underwrite and manage complex reinsurance treaties.

This comprehensive report provides an unparalleled deep dive into the global life reinsurance market, offering critical insights for all stakeholders. It meticulously analyzes market trends, growth drivers, and the challenges that shape the industry's future. With a detailed examination of key regions and dominant segments, including the crucial role of adult life policies and non-participating products, the report equips readers with a nuanced understanding of market dynamics. We provide an exhaustive list of leading global reinsurers, enabling strategic competitive analysis. Furthermore, significant developments, cataloged by year and month, highlight the industry's evolution and technological advancements. The report's robust methodology, utilizing historical data from 2019-2024 and projecting forward to 2033 with a 2025 base year, ensures a reliable and forward-looking perspective. This publication is an indispensable tool for insurers, reinsurers, investors, and regulatory bodies seeking to navigate the complexities and capitalize on the opportunities within this vital sector, where billions in capital are managed annually.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Munich Re, Swiss Re, Hannover Re, SCOR SE, Lloyd’s, Berkshire Hathaway, Great-West Lifeco, RGA, China RE, Korean Re, PartnerRe, GIC Re, Mapfre, Alleghany, Everest Re, XL Catlin, Maiden Re, Fairfax, AXIS, Mitsui Sumitomo, Sompo, Tokio Marine.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Life Reinsurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Life Reinsurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.