1. What is the projected Compound Annual Growth Rate (CAGR) of the Jewelry Valuation Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Jewelry Valuation Service

Jewelry Valuation ServiceJewelry Valuation Service by Type (Diamond, Gemstone, Others), by Application (Jewelry Trading, Jewelry Auction, Insurance, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

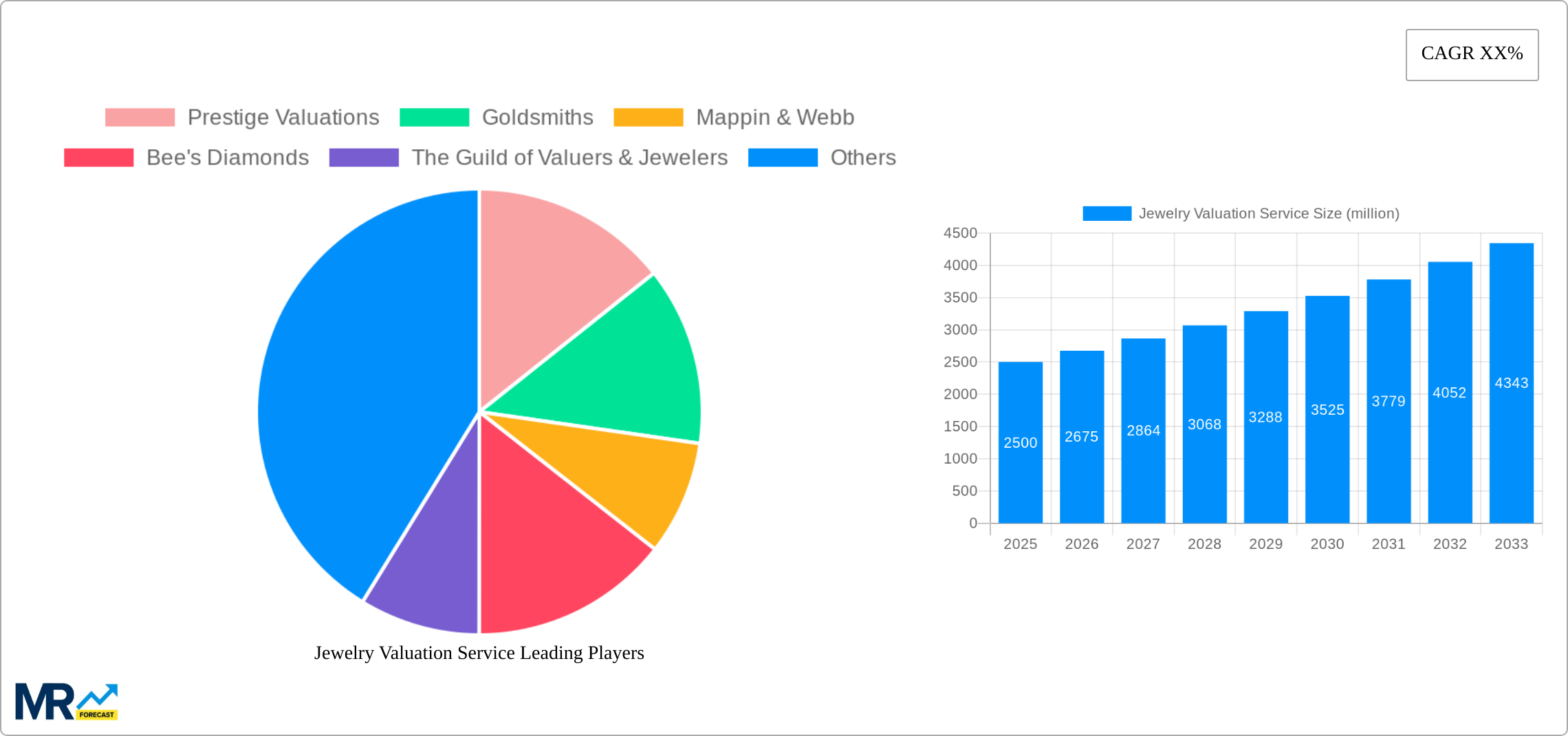

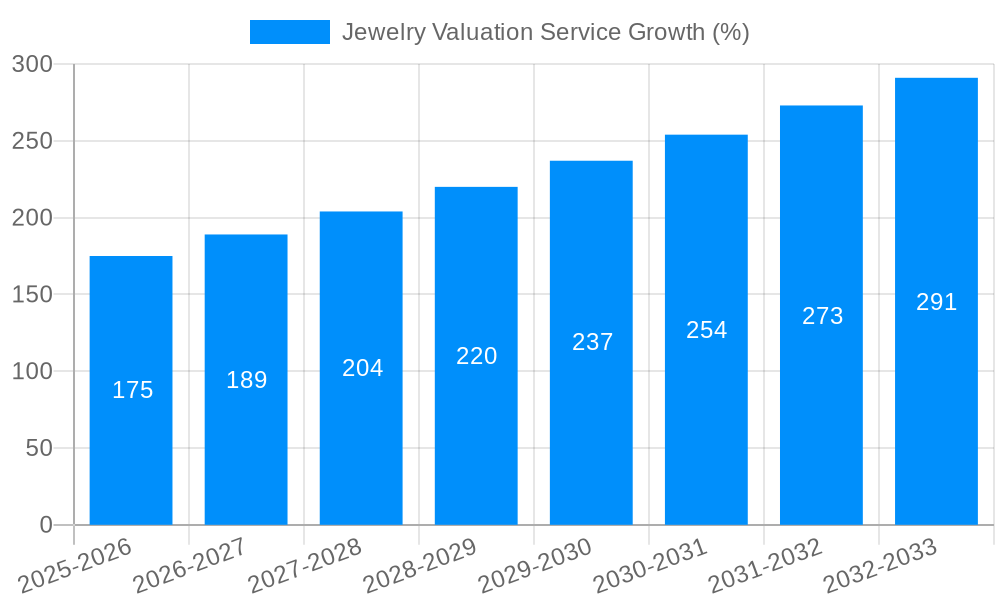

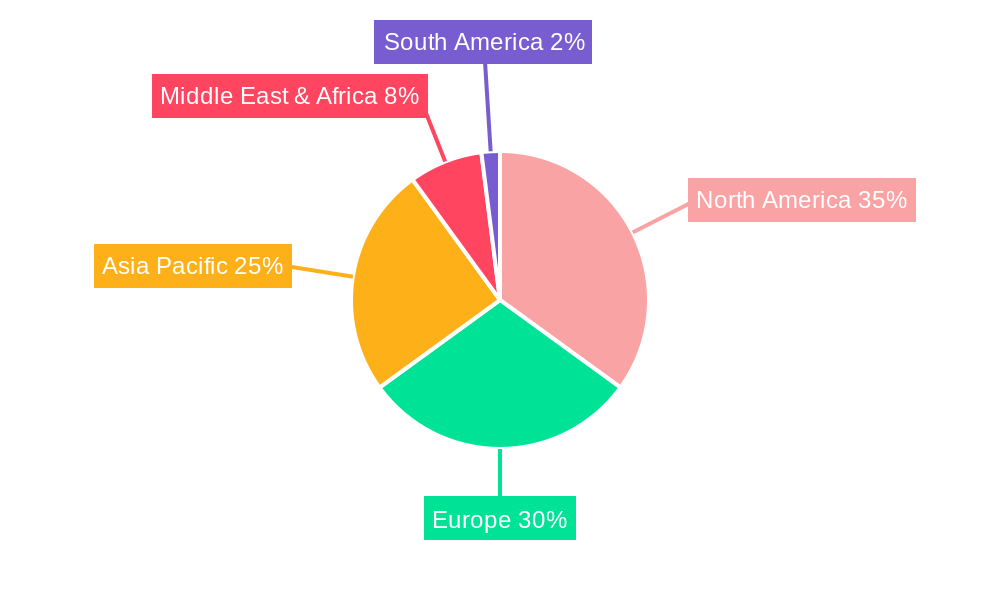

The global jewelry valuation services market is experiencing robust growth, driven by increasing demand for accurate assessments in insurance, trading, and auctions. The market, estimated at $2.5 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033, reaching approximately $4.2 billion by 2033. Several factors contribute to this expansion. The rising value of precious jewelry and gemstones necessitates professional valuation for accurate insurance coverage and secure transactions. Furthermore, the growth of online jewelry trading platforms and auction houses fuels demand for reliable valuation services to mitigate risk and ensure fair pricing. The increasing sophistication of counterfeit jewelry further emphasizes the need for expert appraisal. Segmentation within the market reveals significant activity in jewelry trading and insurance, followed by auctions and other specialized applications like estate planning. Key players such as Prestige Valuations, Goldsmiths, and Bonhams are leading the market, leveraging their expertise and brand recognition. Geographic distribution shows strong presence in North America and Europe, with significant growth potential in Asia-Pacific due to rising disposable incomes and a burgeoning luxury goods market.

However, several factors restrain market growth. The high cost of professional jewelry valuation services can be a barrier for some individuals and smaller businesses. Additionally, a lack of standardization across valuation methodologies and the need for highly specialized expertise can pose challenges. Competition from independent appraisers and the emergence of online valuation tools also impact the market. Future growth will depend on technological advancements enhancing valuation accuracy and efficiency, coupled with greater regulatory clarity and standardization in the industry. The increasing use of technology such as advanced imaging techniques and online platforms will help to streamline the process and improve accessibility. The focus will continue to be on delivering accurate and reliable valuations, building trust and ensuring the integrity of the jewelry market.

The global jewelry valuation service market is experiencing robust growth, projected to reach a valuation exceeding $XXX million by 2033. This expansion is fueled by a confluence of factors, including the burgeoning luxury goods market, increased demand for insurance appraisals, and the rising popularity of online jewelry trading platforms. The historical period (2019-2024) witnessed a steady climb in market size, driven primarily by the insurance sector's need for accurate valuations to mitigate risk. The estimated year (2025) marks a significant inflection point, reflecting the integration of advanced technologies like AI-powered grading and valuation tools. This technological leap is streamlining the valuation process, reducing turnaround times, and enhancing accuracy. The forecast period (2025-2033) anticipates continued growth, with a particular emphasis on the expansion of services into emerging markets and the diversification of valuation applications beyond traditional insurance and trading. Growth will be further spurred by increased consumer awareness of the importance of accurate jewelry valuation, particularly with high-value pieces. The rising number of high-net-worth individuals and the increasing prevalence of inheritance and estate planning are also key drivers of market expansion. Furthermore, the emergence of specialized valuation services catering to specific gemstone types, such as rare diamonds or coloured gemstones, is adding complexity and driving revenue within niche segments. The market is witnessing consolidation amongst larger players, with many seeking to acquire smaller, specialized firms to broaden their service offerings and geographical reach. This consolidation further shapes the market landscape and influences the overall growth trajectory.

Several factors are accelerating the growth of the jewelry valuation service market. Firstly, the ever-increasing value of jewelry holdings globally necessitates professional valuation services. The rise in disposable income in several emerging economies is leading to higher jewelry purchases, directly impacting the demand for valuation services. Simultaneously, the insurance industry's stringent requirements for accurate valuations are driving demand, as insurers rely on these appraisals to accurately assess risk and determine coverage amounts. Moreover, the increasing sophistication of jewelry fraud has heightened the need for independent, reliable valuations to prevent disputes and financial losses. The growing preference for online jewelry trading necessitates robust and trusted valuation methods to ensure transparency and prevent disputes in transactions. Furthermore, the expansion of jewelry auction houses and the rise in the number of private collectors fuel demand for accurate valuations to establish fair market prices and assess the authenticity of precious pieces. Finally, regulatory changes and increasing transparency requirements are pushing businesses to rely more heavily on professional valuation services, ensuring compliance and avoiding legal issues.

Despite the considerable growth potential, several challenges impede the jewelry valuation service market. The primary challenge is ensuring consistent and unbiased valuations across different appraisers. Variations in methodologies and subjective assessments can lead to discrepancies in valuation, affecting client trust and potentially resulting in legal disputes. Another significant challenge is the need for ongoing professional development to keep pace with evolving market trends, technological advancements, and changes in gemstone grading standards. The high cost of acquiring and maintaining cutting-edge technology for gemstone analysis poses a significant barrier to entry for smaller firms, limiting competition and potentially driving up prices. Competition from informal or less qualified valuation providers threatens the integrity and credibility of the market. Furthermore, the inherent risks of handling high-value jewelry, including security concerns and the potential for loss or damage, pose logistical challenges and increase operational costs. The fluctuating prices of precious metals and gemstones create uncertainty in the market and necessitate continuous recalibration of valuation techniques.

The Insurance segment is poised to dominate the jewelry valuation service market in the coming years.

High Demand: The insurance sector’s reliance on accurate appraisals for risk assessment drives significant demand. Insurers require professional valuations to establish appropriate coverage amounts and settle claims efficiently.

Regulatory Compliance: Stringent regulatory requirements compel insurance companies to utilize qualified and certified appraisers, boosting demand for professional valuation services.

Growth in High-Value Insurance Policies: The increasing number of high-net-worth individuals necessitates the valuation of larger, more valuable jewelry collections, directly impacting the size of the insurance segment.

Geographic Distribution: This segment's strong demand is geographically widespread, with consistent growth expected across developed and emerging economies.

Technological Advancements: Technology adoption is transforming insurance practices; AI-driven valuation tools are streamlining the process, improving accuracy, and supporting the growth of this segment.

The Diamond segment also presents significant opportunities due to the inherent value and demand for diamonds in jewelry. The higher value of diamonds compared to other gemstones requires precise and sophisticated valuation expertise, supporting a premium pricing structure for the service.

Furthermore, key regions such as North America and Western Europe are expected to remain dominant due to higher per capita income, significant luxury goods consumption, and established insurance markets. However, growth in Asia-Pacific, particularly in rapidly developing economies like China and India, promises considerable market expansion driven by rising affluence and increasing demand for jewelry and insurance services.

The jewelry valuation service industry is experiencing significant growth fueled by the increasing demand for accurate and reliable valuations across various applications. Technological advancements, such as AI-powered valuation tools and advanced gemological equipment, are enhancing the speed and accuracy of the valuation process, attracting more clients. Simultaneously, rising consumer awareness of the importance of professional valuations is driving demand, particularly in the luxury goods sector and amongst high-net-worth individuals. This trend is further amplified by the growing emphasis on ethical sourcing and responsible investment in jewelry. Stricter regulatory frameworks are also prompting businesses to prioritize certified valuations for legal and financial compliance.

This report offers a detailed analysis of the global jewelry valuation service market, covering historical data, current market trends, and future projections. It provides comprehensive insights into market dynamics, including growth drivers, challenges, key players, and regional variations. The report also analyzes key segments such as diamond, gemstone, and other jewelry types, along with applications across insurance, trading, and auctions. The extensive research incorporates data from reputable sources and industry experts, providing stakeholders with a comprehensive understanding of this dynamic market and its potential for future growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Prestige Valuations, Goldsmiths, Mappin & Webb, Bee's Diamonds, The Guild of Valuers & Jewelers, Miltons Jewelers, Hamilton & Inches, Walsh Bros, SafeGuard, Insurance Valuation specialists, Bonhams, Forum Jewellers, Brisbane Valuation Service, Jewelry Appraisal Services, Deacons, CW Sellors, Knight Jewelers, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Jewelry Valuation Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Jewelry Valuation Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.