1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Monitoring Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IT Monitoring Software

IT Monitoring SoftwareIT Monitoring Software by Application (Large Enterprises, SMEs), by Type (On-premises, Cloud Based), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

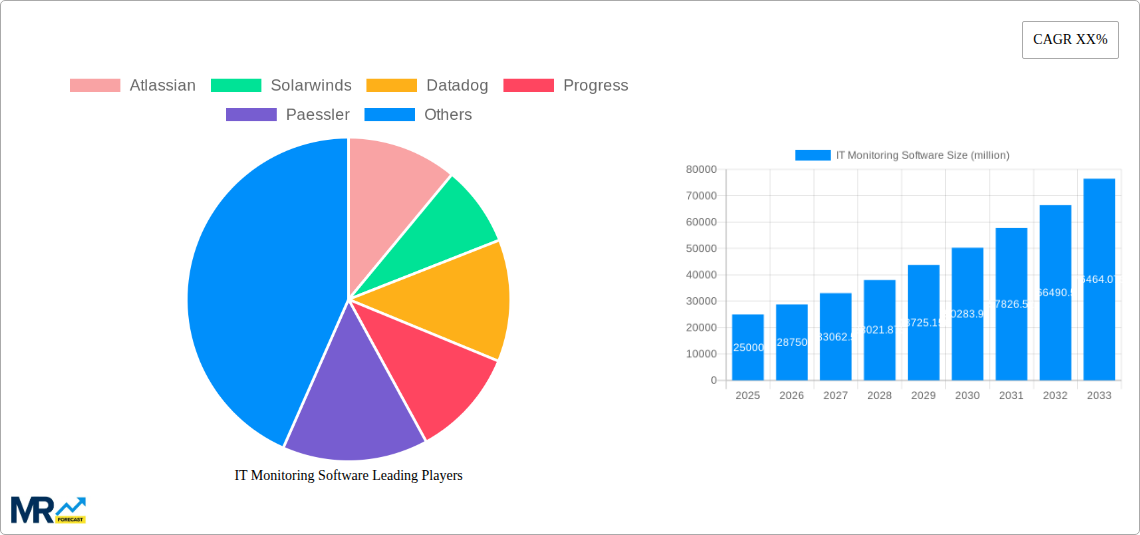

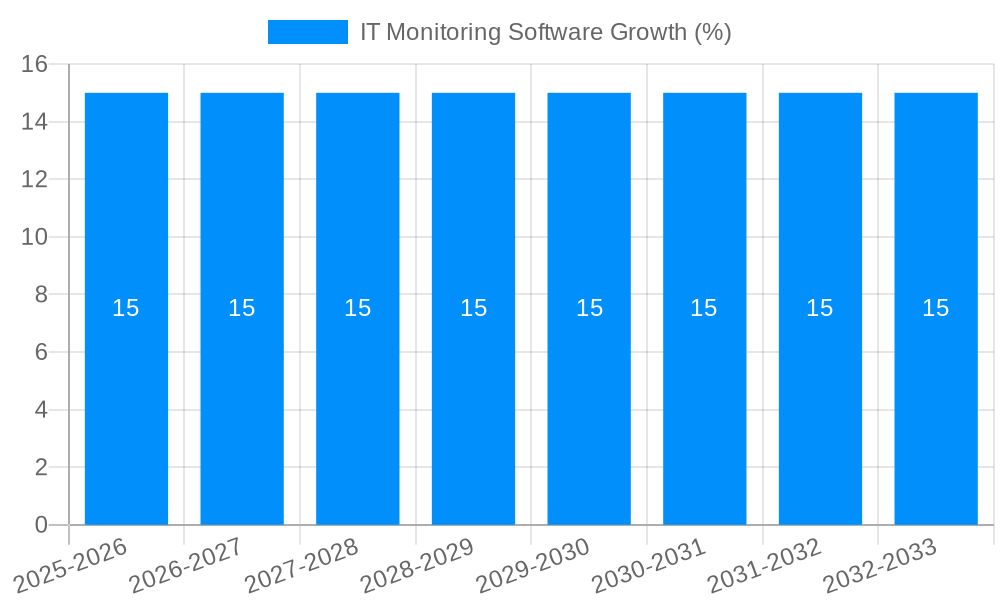

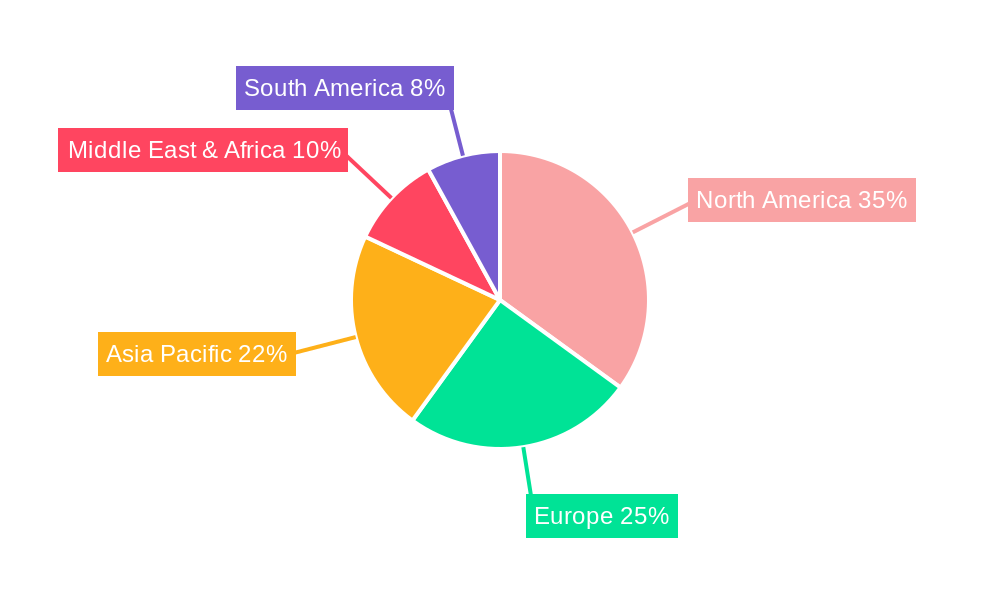

The IT Monitoring Software market is experiencing robust growth, driven by the increasing adoption of cloud-based infrastructure, the rise of DevOps practices, and the escalating need for proactive IT management to minimize downtime and enhance operational efficiency. The market, estimated at $15 billion in 2025, is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 12% from 2025 to 2033, reaching approximately $45 billion by 2033. This expansion is fueled by several key factors. Firstly, the shift towards hybrid and multi-cloud environments necessitates sophisticated monitoring solutions capable of managing complex IT landscapes. Secondly, the growing emphasis on digital transformation across various industries compels organizations to prioritize application performance and user experience, leading to increased demand for comprehensive monitoring tools. Thirdly, advancements in Artificial Intelligence (AI) and Machine Learning (ML) are integrating into IT monitoring software, enhancing capabilities such as predictive analytics and automated incident response. The market is segmented by deployment (on-premises and cloud-based) and application (large enterprises and SMEs), with the cloud-based segment witnessing faster growth due to its scalability, flexibility, and cost-effectiveness. Competitive landscape is characterized by established players like Atlassian, SolarWinds, and Datadog, alongside emerging niche providers. Geographic expansion is also a prominent trend, with North America and Europe currently holding the largest market shares, while the Asia-Pacific region exhibits significant growth potential.

Despite this promising outlook, the market faces certain challenges. High initial investment costs for comprehensive solutions can hinder adoption among SMEs, necessitating the development of cost-effective, scalable solutions. Moreover, the complexity of integrating monitoring tools across diverse IT environments, and the need for skilled personnel to manage and interpret monitoring data, present hurdles for some organizations. Nonetheless, the overarching trend of increased digitalization and the critical need for reliable IT infrastructure are expected to outweigh these limitations, driving continued expansion of the IT Monitoring Software market in the coming years. The market’s evolution will likely be shaped by further technological advancements, particularly in AI-powered anomaly detection and automated remediation, and strategic partnerships and acquisitions among key players.

The global IT monitoring software market is experiencing robust growth, projected to reach multi-million unit sales by 2033. The study period from 2019 to 2033 reveals a compelling trajectory, shaped by the increasing complexity of IT infrastructures and the escalating need for proactive system management. The base year of 2025 provides a snapshot of the market's current state, while the forecast period (2025-2033) indicates continued expansion driven by several factors detailed below. The historical period (2019-2024) demonstrates a steady upward trend, setting the stage for substantial future growth. Key market insights reveal a shift towards cloud-based solutions, driven by their scalability, cost-effectiveness, and ease of deployment. The demand for sophisticated application performance monitoring (APM) tools is also rising, reflecting the growing complexity of modern applications. Large enterprises are leading the adoption, but SMEs are increasingly recognizing the value proposition and are actively investing in these solutions to ensure business continuity and optimize IT operations. This market evolution necessitates a diverse range of monitoring capabilities, from basic network monitoring to advanced AI-powered predictive analytics. Furthermore, the increasing reliance on hybrid and multi-cloud environments is fuelling the demand for integrated and comprehensive monitoring platforms that can effectively manage the complexities of these diverse environments. The market's competitive landscape is characterized by both established players and emerging innovative companies, leading to continuous innovation and improved product offerings. The focus is on enhancing user experience through intuitive dashboards, comprehensive reporting capabilities, and effective alert management. Ultimately, the market's future growth hinges on the continuous evolution of technology and the ever-increasing need for organizations to manage their IT infrastructures effectively and efficiently.

Several key factors are propelling the growth of the IT monitoring software market. The surge in digital transformation initiatives across industries is a primary driver, as organizations increasingly rely on IT systems for core business operations. This dependence necessitates robust monitoring to ensure system uptime, performance, and security. The adoption of cloud computing and virtualization is also significantly impacting the market. Cloud-based deployments require sophisticated monitoring tools to manage the complexities of distributed systems and ensure optimal performance. Furthermore, the rise of big data and the Internet of Things (IoT) is generating massive volumes of data that need to be effectively monitored and analyzed. This necessitates advanced analytics capabilities integrated into IT monitoring software. The increasing sophistication of cyber threats is another crucial driver. Proactive monitoring and threat detection are becoming critical for organizations to mitigate security risks and protect sensitive data. Finally, the growing emphasis on regulatory compliance is influencing the adoption of IT monitoring software. Many industries have stringent regulations related to data security and system uptime, requiring organizations to demonstrate compliance through comprehensive monitoring and reporting. These converging factors create a powerful synergy that is driving significant growth in the IT monitoring software market.

Despite the significant growth potential, the IT monitoring software market faces certain challenges and restraints. The complexity of modern IT infrastructures, particularly those incorporating hybrid and multi-cloud environments, can pose significant integration and management challenges. Integrating monitoring tools across disparate systems and platforms can be complex and resource-intensive. Cost is another significant factor. The implementation and maintenance of comprehensive monitoring solutions can be expensive, especially for smaller organizations with limited budgets. The need for specialized skills and expertise is another obstacle. Effectively deploying and managing sophisticated monitoring tools often requires specialized training and expertise, which can be a barrier to entry for some organizations. Furthermore, the sheer volume of data generated by modern IT systems can overwhelm monitoring tools, requiring advanced analytics capabilities and efficient data management strategies. Finally, vendor lock-in is a concern for some organizations, as switching from one monitoring platform to another can be disruptive and expensive. Addressing these challenges and restraints is crucial for ensuring the continued growth and adoption of IT monitoring software.

The cloud-based segment is poised to dominate the IT monitoring software market throughout the forecast period (2025-2033). Several factors contribute to this dominance:

Scalability and Flexibility: Cloud-based solutions offer unparalleled scalability and flexibility, adapting seamlessly to changing business needs and workload fluctuations. This eliminates the need for significant upfront investments in hardware and infrastructure, making them particularly attractive to organizations of all sizes.

Cost-Effectiveness: Cloud-based models generally offer a more cost-effective approach than on-premises deployments, reducing capital expenditure and simplifying IT management. Pay-as-you-go pricing models further enhance cost efficiency, allowing organizations to align spending directly with their actual usage.

Ease of Deployment and Management: Cloud-based solutions are typically easier to deploy and manage than their on-premises counterparts, simplifying the implementation process and reducing the need for specialized IT expertise. Automated updates and maintenance reduce operational overhead.

Accessibility and Collaboration: Cloud-based platforms offer enhanced accessibility, enabling authorized personnel to monitor and manage systems remotely from anywhere with an internet connection. Improved collaboration features enhance teamwork and response times.

While the large enterprise segment remains a significant driver, the growth of the SME segment is particularly noteworthy. SMEs are increasingly recognizing the value proposition of comprehensive IT monitoring, driven by the need to enhance operational efficiency, reduce downtime, and improve security. However, the specific geographic dominance will vary depending on factors such as digital adoption rates, economic growth, and government initiatives promoting digital transformation. Regions with strong digital infrastructure and high technological adoption are expected to witness higher growth rates.

The IT monitoring software market's growth is further accelerated by advancements in artificial intelligence (AI) and machine learning (ML). These technologies enable predictive analytics, proactive threat detection, and automated remediation, significantly improving operational efficiency and reducing downtime. The increasing integration of IoT devices and the rise of edge computing are also catalyzing growth, demanding sophisticated monitoring solutions capable of managing the complexities of decentralized systems and diverse data streams. The growing need for robust security measures to safeguard against cyber threats and compliance with stringent data protection regulations further drives demand for comprehensive and advanced IT monitoring tools.

This report provides a comprehensive overview of the IT monitoring software market, encompassing market size estimations, growth trends, key drivers and restraints, competitive landscape analysis, and future market projections. The report segments the market by application (large enterprises, SMEs), deployment type (on-premises, cloud-based), and geographic region, providing detailed insights into each segment's performance and growth prospects. Furthermore, it highlights key industry developments, including technological advancements, strategic partnerships, mergers and acquisitions, and regulatory changes that are shaping the market landscape. The report concludes with a detailed analysis of leading players in the market, their strengths and weaknesses, and their competitive strategies. This information is crucial for stakeholders seeking a deeper understanding of the IT monitoring software market and its future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Atlassian, Solarwinds, Datadog, Progress, Paessler, Site24x7, Zoho, Nagios, ITRS Group, BMC, New Relic, FusionReactor, Quest Software, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "IT Monitoring Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IT Monitoring Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.