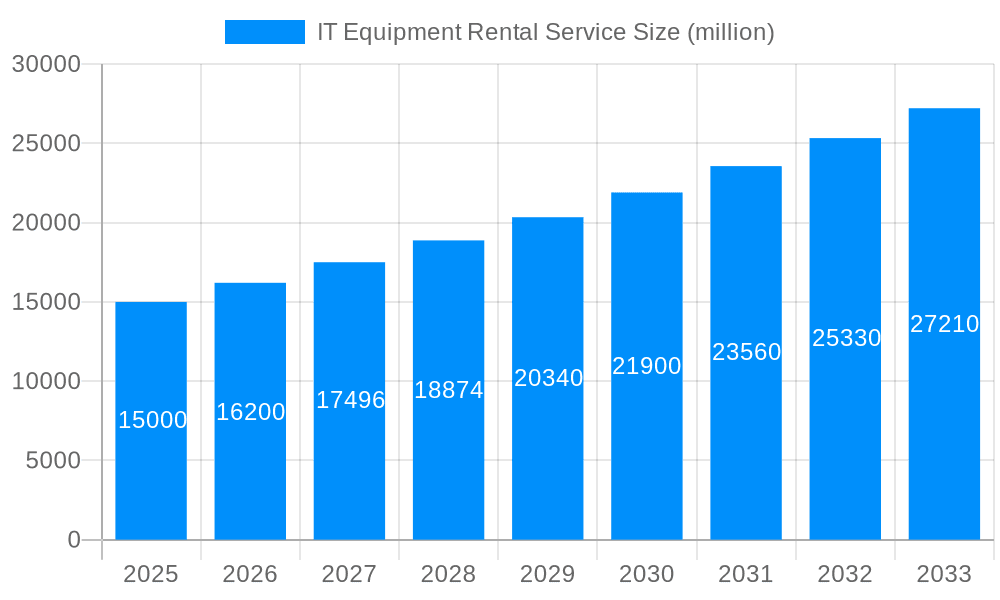

1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Equipment Rental Service?

The projected CAGR is approximately 3.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IT Equipment Rental Service

IT Equipment Rental ServiceIT Equipment Rental Service by Type (Servers, Switches, Laptops and Desktops, Printers and Scanners, Projectors, Keyboard and Mouse, Screens, Others), by Application (Personal Leasing, Business Leasing), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The IT Equipment Rental Service market is poised for significant expansion, driven by the increasing adoption of flexible IT solutions and a strategic shift from capital expenditure (CAPEX) to operational expenditure (OPEX) models. The market is projected to reach a size of $5.7 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.9% between 2025 and 2033. This growth is underpinned by businesses, particularly SMEs, seeking cost-effective access to advanced technology, eliminating substantial upfront investments and enabling swift adaptation to evolving IT needs. Rental agreements offer unparalleled scalability, allowing organizations to precisely match IT infrastructure to fluctuating demands and mitigate risks associated with technological obsolescence. The proliferation of cloud computing and hybrid IT environments further stimulates demand for temporary equipment to support projects and augment existing infrastructure. Key growth drivers include rental demand for servers, networking equipment, and laptops/desktops, serving both personal and business leasing requirements. Emerging economies with expanding IT sectors are also contributing to global market growth.

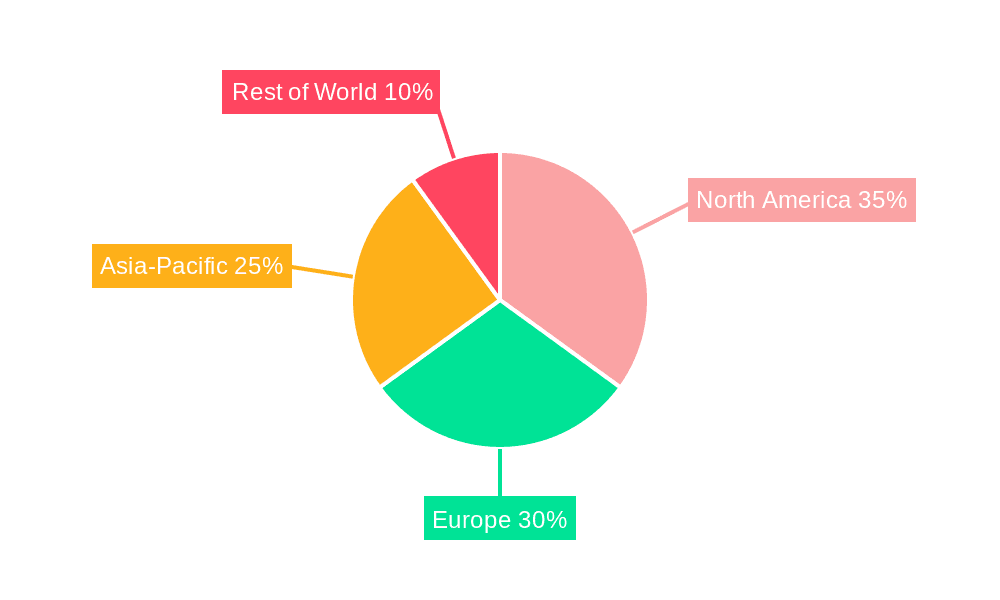

Despite robust growth, the market faces challenges including intense competition among diverse providers, leading to price pressures and margin erosion. Maintaining superior service levels, optimizing logistics and equipment upkeep, and effectively managing risks of damage or obsolescence are paramount for market participants. Innovations such as specialized equipment rentals (e.g., VR/AR devices) and subscription-based models are opening new growth avenues. While North America currently leads in market share due to high cloud adoption, the Asia-Pacific region is anticipated to exhibit strong growth, propelled by rapid digitalization and economic development in key nations like India and China. The sustained expansion of the global IT sector and an ongoing emphasis on agility and cost optimization underscore a promising future for the IT Equipment Rental Service market.

The IT equipment rental service market is experiencing robust growth, projected to reach multi-million unit figures by 2033. The study period (2019-2033), encompassing a historical period (2019-2024), base year (2025), and forecast period (2025-2033), reveals a consistent upward trajectory. Several factors contribute to this expansion. Firstly, the increasing adoption of flexible working models and remote work arrangements has fueled demand for short-term rental options, especially for laptops, desktops, and peripherals. Businesses are increasingly opting for rental solutions to avoid large capital expenditures, particularly in the face of fluctuating economic conditions. This trend is further amplified by the rapid technological advancements in the IT sector, necessitating frequent upgrades and necessitating a shift away from long-term ownership models. The surge in cloud computing and data center expansion has also significantly boosted the rental market for servers and networking equipment. Companies can easily scale their IT infrastructure up or down based on their immediate needs, eliminating the risk of over-investment in hardware. Finally, the rising emphasis on sustainability and reducing e-waste is driving more companies to consider renting IT equipment as a more environmentally friendly alternative to purchasing. The estimated market value for 2025 signifies a significant milestone in this ongoing growth, reflecting the increasing acceptance and adoption of rental services as a viable solution across various industries and user segments. The market is seeing millions of units rented annually, a number expected to increase significantly by the end of the forecast period.

Several key drivers are propelling the growth of the IT equipment rental service market. The escalating costs associated with purchasing and maintaining IT equipment, particularly for smaller businesses and startups, are forcing many to consider rental alternatives. Rental offers predictable and manageable monthly expenses, eliminating the need for large upfront investments and reducing the burden of unexpected repair costs. The rapid pace of technological advancements makes owning IT hardware a potentially expensive commitment, as equipment becomes obsolete quickly. Renting allows businesses to access the latest technology without being locked into long-term contracts for outdated equipment. The increasing demand for scalability and flexibility is another significant driver. Rental services offer the ability to easily adjust IT infrastructure based on changing business needs, facilitating expansion or contraction as required without major capital outlay. Furthermore, the growing awareness of environmental concerns is pushing businesses toward more sustainable practices, and renting IT equipment reduces e-waste by extending the lifespan of existing hardware and minimizing the need for constant replacements. The convenience and ease of access offered by rental services, alongside robust maintenance and support agreements, are further contributing to the market's expansion.

Despite the significant growth potential, the IT equipment rental service market faces certain challenges. Competition among established players and emerging rental providers can be fierce, requiring companies to constantly innovate and improve their offerings. Maintaining and managing a large inventory of diverse IT equipment can be complex and costly, requiring significant logistical expertise and investment in warehousing and distribution infrastructure. Ensuring the security and integrity of rented equipment, particularly sensitive data storage devices, is paramount; robust security protocols and strict data protection measures are crucial to mitigate any risks. The risk of equipment damage or loss during the rental period is another challenge, requiring clear contractual agreements and appropriate insurance coverage to protect both the provider and the renter. Finally, managing equipment obsolescence presents a significant challenge. The need to regularly upgrade the rental inventory to meet the ever-changing technological demands requires substantial capital investment and efficient asset management strategies.

The market is witnessing significant growth across diverse regions, but North America and Western Europe currently dominate due to their robust economies, high technological adoption rates, and established IT infrastructure. Within specific segments, the demand for laptops and desktops for personal and business leasing is exceptionally high. The rapid expansion of remote work and the increasing number of freelance professionals significantly contribute to this segment's dominance.

Dominant Segments:

The business leasing segment overall outpaces personal leasing, reflecting the significant needs of corporations and enterprises across all equipment types.

Several factors are catalyzing the growth of the IT equipment rental service industry. The shift towards flexible work arrangements and the increasing adoption of hybrid work models are primary drivers, fueling demand for short-term rentals of laptops, desktops, and peripherals. The rising cost of IT equipment, combined with the rapid pace of technological innovation, is pushing businesses to favor rental solutions over direct purchases. This strategic shift allows companies to access the latest technology without the long-term financial commitment of ownership. Furthermore, the growing awareness of environmental sustainability and the desire to minimize e-waste are contributing to the increasing adoption of rental services as a responsible and cost-effective alternative.

This report provides a detailed analysis of the IT equipment rental service market, covering market size, growth trends, key drivers, challenges, and leading players. It offers a comprehensive overview of the industry, including a segment-wise analysis and regional market outlook, providing valuable insights for businesses operating in or seeking to enter this dynamic market. The report utilizes data spanning the study period (2019-2033), providing a robust historical perspective and reliable future projections. The report's key findings highlight the significant growth potential of the market, driven by factors like the shift to flexible work models, the rapid pace of technological advancements, and growing environmental concerns.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.9%.

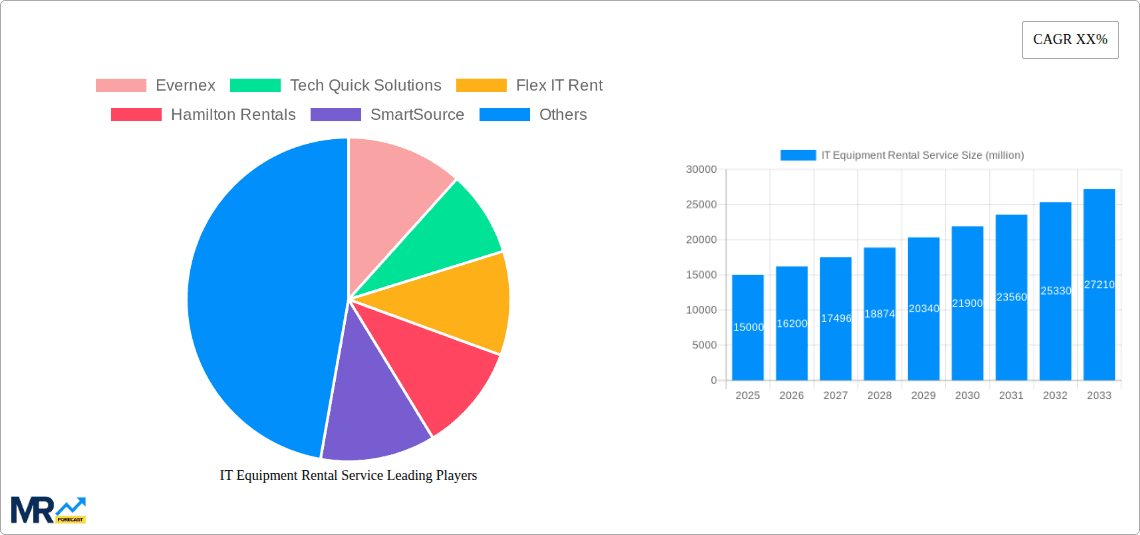

Key companies in the market include Evernex, Tech Quick Solutions, Flex IT Rent, Hamilton Rentals, SmartSource, Techbuyer, Micro Image International Corporation, RAC IT Solutions, Akesa IT Solutions, .

The market segments include Type, Application.

The market size is estimated to be USD 5.7 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "IT Equipment Rental Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IT Equipment Rental Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.