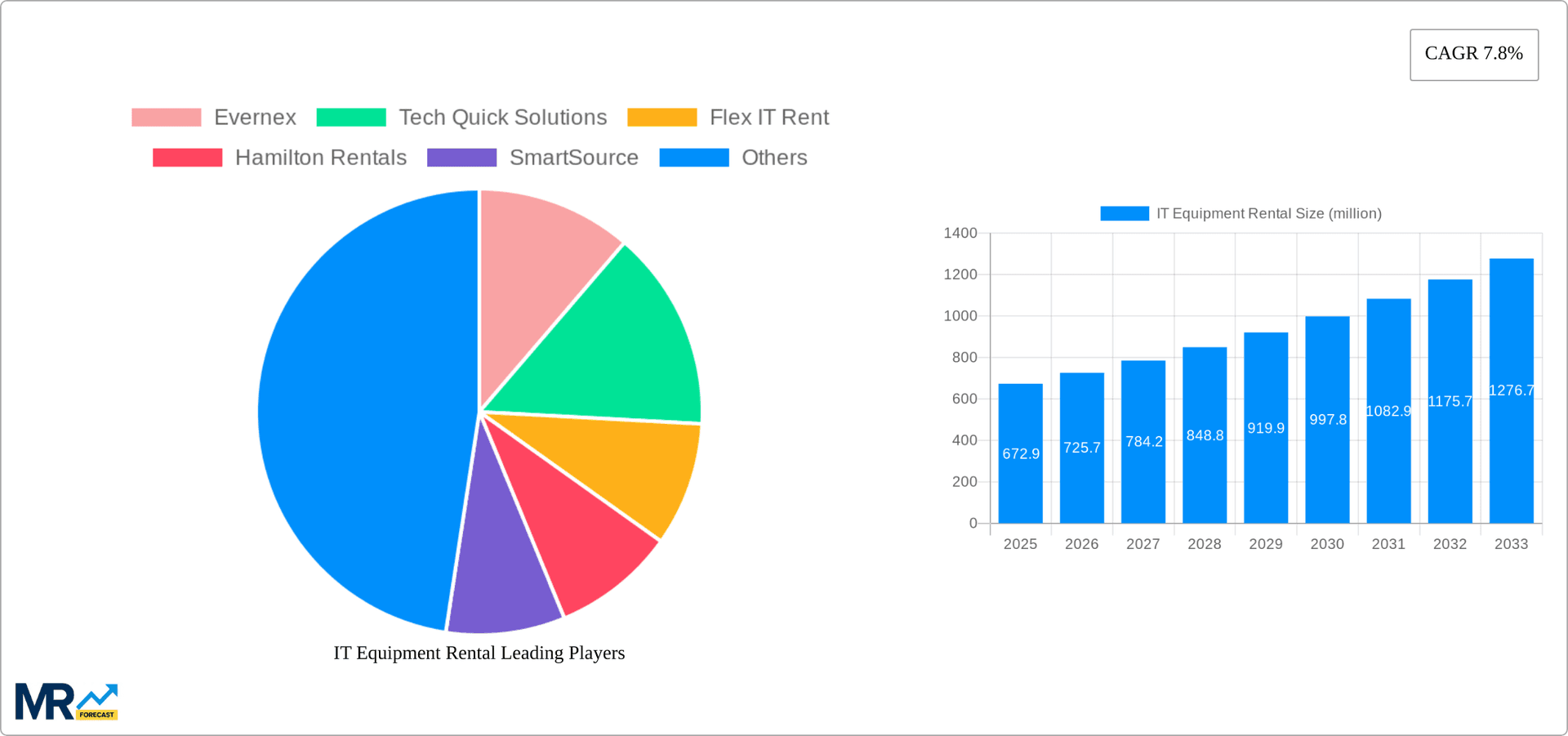

1. What is the projected Compound Annual Growth Rate (CAGR) of the IT Equipment Rental?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IT Equipment Rental

IT Equipment RentalIT Equipment Rental by Type (Servers, Switches, Laptops and Desktops, Printers and Scanners, Projectors, Keyboard and Mouse, Screens, Others), by Application (Personal Leasing, Business Leasing), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The IT equipment rental market, valued at $1141.9 million in 2025, is experiencing robust growth driven by increasing demand for flexible IT infrastructure solutions, particularly among small and medium-sized businesses (SMBs) and enterprises facing budget constraints or needing short-term equipment. The rising adoption of cloud computing and hybrid cloud models contributes significantly to this trend, as organizations opt for renting specialized hardware for specific projects or during peak demand periods rather than investing in long-term capital expenditures. The market is segmented by equipment type (servers, switches, laptops/desktops, printers/scanners, projectors, peripherals, screens, and others) and application (personal and business leasing), offering diverse rental options to cater to a wide range of customer needs. Geographic expansion, particularly in rapidly developing economies of Asia-Pacific and regions with improving digital infrastructure in Middle East & Africa, presents significant growth opportunities. However, challenges such as the fluctuating prices of IT equipment, potential obsolescence of rented equipment, and the need for robust maintenance and support services could pose restraints to market expansion. Competition among established players and new entrants is fierce, demanding continuous innovation and strategic partnerships to maintain market share. The increasing focus on sustainable practices and environmentally friendly equipment is also shaping the market landscape, with a growing preference for vendors who prioritize energy efficiency and responsible disposal of IT assets.

Looking ahead, the market is projected to maintain a healthy growth trajectory, driven by evolving technological landscapes and increasing digitalization across various industries. The demand for specialized equipment, such as high-performance computing (HPC) servers and advanced networking solutions, is expected to fuel market expansion. Furthermore, the development of flexible subscription-based rental models and advancements in remote IT support and management will further stimulate market growth. A key factor influencing future growth will be the ability of rental providers to offer comprehensive and reliable services that seamlessly integrate with customers' existing IT infrastructure. This will require investments in advanced technologies, skilled workforce development, and effective logistics and supply chain management. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in IT equipment management also promises to enhance operational efficiency and customer experience, leading to further market expansion in the forecast period (2025-2033).

The global IT equipment rental market is experiencing robust growth, projected to reach multi-million unit figures by 2033. The study period from 2019 to 2033 reveals a consistent upward trajectory, driven by several converging factors. The historical period (2019-2024) laid the groundwork, establishing a strong base for future expansion. The base year of 2025 provides a crucial snapshot of the current market dynamics, serving as a benchmark for forecasting the market's performance during the forecast period (2025-2033). This growth is fueled by increasing adoption of cloud computing and hybrid work models, which necessitate flexible IT infrastructure solutions. Businesses, particularly small and medium-sized enterprises (SMEs), are increasingly opting for rentals to avoid the high capital expenditure associated with purchasing IT equipment outright. This trend is further reinforced by the rising demand for specialized equipment used in specific projects or events, making rental a cost-effective and practical solution. The estimated market value for 2025 already showcases substantial growth, and this momentum is expected to continue, with the market demonstrating significant potential across various segments and geographical regions. The market is characterized by a diverse range of players, from large multinational corporations to smaller regional companies, catering to a broad spectrum of client needs. The increasing sophistication of IT equipment and the constant technological advancements necessitate a dynamic approach to IT infrastructure management, fostering the continuous evolution and expansion of the IT equipment rental market. This trend is particularly pronounced in regions with rapid technological adoption and expanding digital economies.

Several key factors are driving the exponential growth of the IT equipment rental market. The escalating adoption of cloud-based services necessitates flexible and scalable IT infrastructure, making rental a logical choice for businesses of all sizes. The shift towards hybrid work models has further amplified the demand for easily deployable and manageable IT solutions, with rental services providing a seamless and convenient option. Furthermore, the increasing popularity of short-term projects and events requires access to specialized equipment, often for limited durations. Rental services effectively address this need, eliminating the need for significant upfront investments. The rising cost of IT equipment ownership, coupled with rapid technological obsolescence, encourages businesses to prioritize rental solutions as a financially prudent approach. This cost-effectiveness is particularly appealing to SMEs lacking the financial resources for large capital expenditures. Finally, the growing emphasis on sustainability and reduced environmental impact is contributing to the rise of IT equipment rental, as it promotes resource sharing and reduces the electronic waste generated by frequent equipment replacements.

Despite the promising growth trajectory, the IT equipment rental market faces certain challenges. Maintaining a large inventory of diverse equipment necessitates significant capital investment and effective inventory management strategies to ensure availability and meet client demands. Managing the complexities of equipment logistics, including delivery, setup, and maintenance, is crucial for providing seamless customer experiences and avoiding costly delays. Competition in the market is intense, with several players vying for market share, requiring companies to differentiate themselves through superior service, competitive pricing, and innovative offerings. The risk of equipment damage or loss during rentals necessitates robust insurance policies and efficient damage assessment procedures. Furthermore, ensuring the security and confidentiality of data stored on rented equipment is paramount and necessitates comprehensive security measures. Keeping abreast of rapid technological advancements requires constant investment in training and upgrades to maintain a competitive edge.

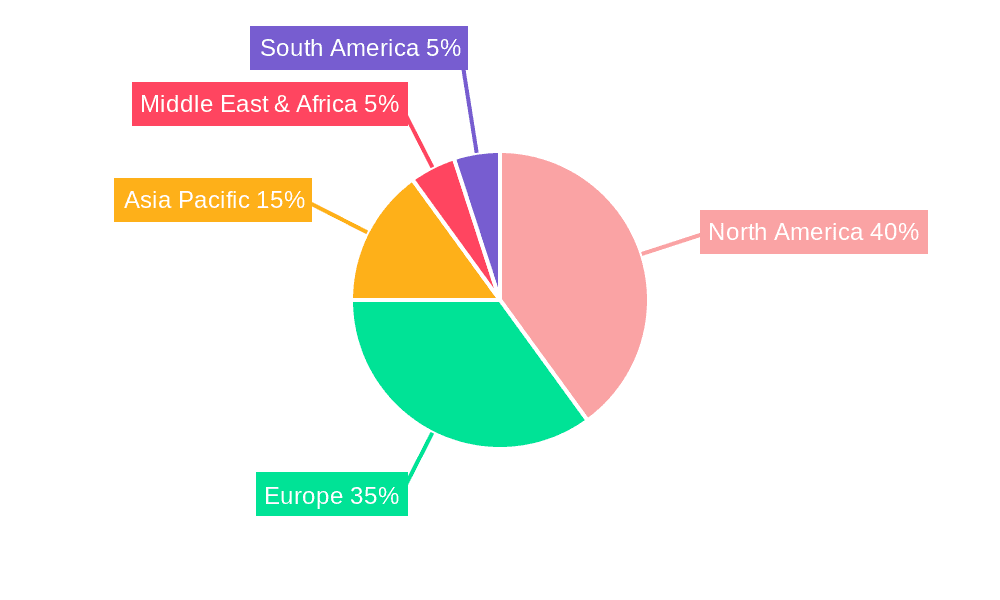

The North American and Western European markets currently dominate the IT equipment rental landscape due to high technological adoption rates and a significant number of businesses actively leveraging IT solutions. However, the Asia-Pacific region is poised for substantial growth, driven by rapid economic expansion and increasing digitalization efforts. Within market segments, business leasing accounts for a considerable portion of the market, demonstrating the high demand for scalable and flexible IT solutions among enterprises. The server segment is another major contributor, reflecting the increasing reliance on robust and efficient data processing and storage capabilities. Laptops and desktops also represent significant market segments due to the high demand for portable and versatile computing devices in various business settings. The following points highlight the key drivers of these segments:

The rental of high-end servers to data centers and cloud computing providers is a significant market driver, demanding specialized equipment and logistics solutions. Similarly, the corporate sector's demand for large-scale laptop and desktop deployment for projects and training needs propels substantial growth in these segments.

The convergence of technological advancements, evolving work styles, and economic factors creates substantial growth opportunities within the IT equipment rental industry. The increasing popularity of cloud-based services, the transition towards hybrid work models, and the rising need for short-term equipment rentals contribute significantly to this growth. Furthermore, the cost-effectiveness of renting compared to purchasing, coupled with the environmental benefits of resource sharing, makes it an increasingly attractive option for businesses.

This report provides an in-depth analysis of the IT equipment rental market, covering historical trends, current market dynamics, and future projections. It encompasses various segments, including equipment types and applications, offering a comprehensive overview of the market landscape. The report also identifies key players and growth drivers, providing valuable insights for businesses operating within or planning to enter the IT equipment rental sector. It also analyzes challenges and restraints, providing a balanced perspective on the industry's future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Evernex, Tech Quick Solutions, Flex IT Rent, Hamilton Rentals, SmartSource, Techbuyer, Micro Image International Corporation, RAC IT Solutions, Beijing Xinquan Technology Co., Ltd., Shenzhen Wangdu Communication Co., Ltd., Wuhan Langlian Technology Co., Ltd., Akesa IT Solutions, .

The market segments include Type, Application.

The market size is estimated to be USD 1141.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "IT Equipment Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IT Equipment Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.