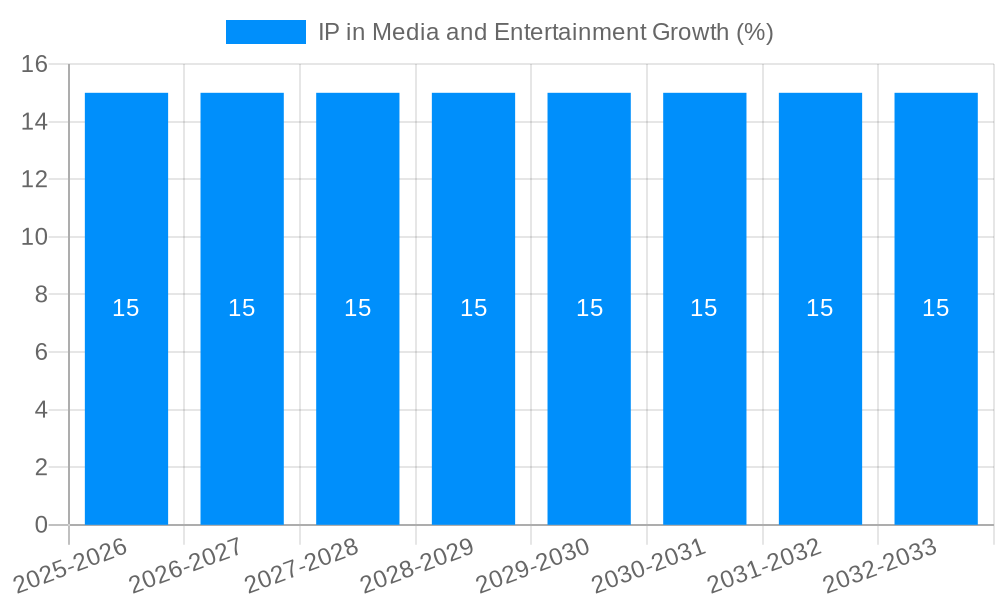

1. What is the projected Compound Annual Growth Rate (CAGR) of the IP in Media and Entertainment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IP in Media and Entertainment

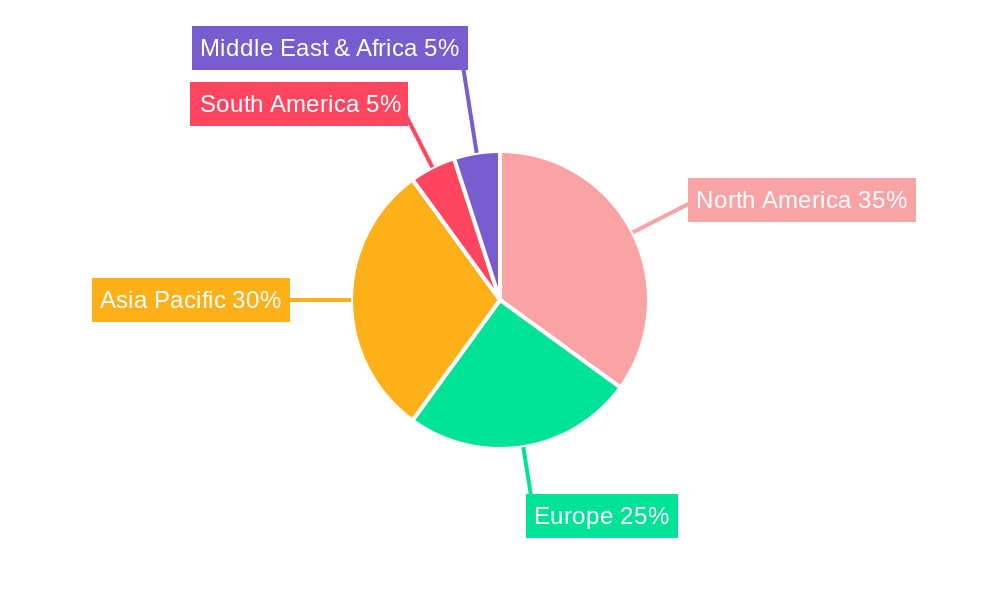

IP in Media and EntertainmentIP in Media and Entertainment by Type (/> Fiction, Comics, Games, Others), by Application (/> Film, TV Drama, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

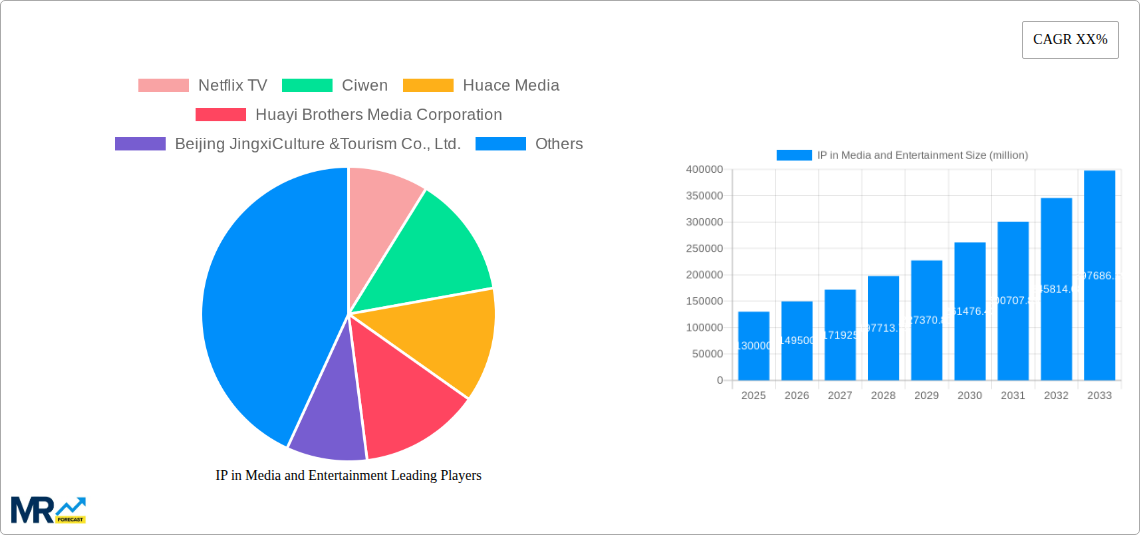

The Intellectual Property (IP) market within the Media and Entertainment industry is experiencing robust growth, driven by the increasing demand for high-quality content across diverse platforms. The global market, estimated at $500 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033, reaching approximately $950 billion by 2033. This expansion is fueled by several key factors, including the rise of streaming services like Netflix and Disney+, the burgeoning popularity of video games based on established IP, and the continued growth of the global middle class with increased disposable income for entertainment. Furthermore, the strategic acquisitions and mergers among major players like Sony and Disney, and the emergence of new production companies in regions such as China (e.g., Huace Media, Huayi Brothers), demonstrate a highly competitive and dynamic market landscape. The industry is witnessing significant technological advancements, including advancements in digital distribution, immersive technologies (VR/AR), and AI-driven content creation, which further amplify growth opportunities.

However, the industry faces certain challenges. The high cost of IP acquisition and development, coupled with intense competition and content piracy, pose considerable hurdles. Regulatory changes regarding IP rights in different territories and the evolving landscape of digital distribution agreements present further complexities. Despite these restraints, the long-term outlook for the IP market in Media and Entertainment remains highly optimistic, driven by ongoing innovation, technological disruption, and the insatiable consumer appetite for engaging and diverse content. Segmentation of the market includes film, television, music, video games, and other forms of media, each exhibiting varying growth trajectories and market dynamics. Successful players will need to adapt quickly to the changing technological landscape and consumer preferences, while strategically managing their IP portfolios to maximize profitability and growth.

The global IP (Intellectual Property) in Media and Entertainment market is experiencing explosive growth, projected to reach hundreds of billions of dollars by 2033. This surge is driven by a confluence of factors, including the increasing demand for high-quality content across diverse platforms, the rise of streaming services, and the lucrative nature of successful IP franchises. The historical period (2019-2024) witnessed a significant shift towards digital consumption, with streaming platforms like Netflix, Disney+, and others becoming dominant forces. This trend is expected to continue throughout the forecast period (2025-2033), with further consolidation and innovation within the industry. The base year of 2025 provides a crucial snapshot of the market's current state, allowing for more accurate estimations of future growth trajectories. Key market insights reveal a significant emphasis on securing and leveraging IP rights across all forms of media, from film and television to video games and merchandise. Companies are investing heavily in the development and acquisition of original IP, recognizing its value in creating long-term revenue streams and building brand loyalty. This trend is particularly evident in the burgeoning animation sector, where successful IP can generate billions of dollars in revenue through sequels, spin-offs, theme park attractions, and merchandise sales. Furthermore, the convergence of technology and media is leading to innovative ways of exploiting IP, such as interactive storytelling experiences and the creation of immersive virtual reality content. The competition for high-quality IP is intense, with major players like Disney, Sony, and Netflix engaging in significant acquisitions and strategic partnerships to expand their IP portfolios. This trend underscores the critical role of IP in driving growth and profitability within the media and entertainment industry. The estimated market value for 2025 reflects the culmination of these trends and sets the stage for continued expansion in the coming years.

Several key factors are propelling the growth of the IP in Media and Entertainment market. Firstly, the rise of streaming services has significantly expanded the demand for high-quality, engaging content. Platforms like Netflix and Disney+ are constantly seeking fresh IP to attract and retain subscribers, fueling competition and investment in content creation. Secondly, the global reach of digital platforms has facilitated the internationalization of IP, allowing successful franchises to generate revenue across multiple markets. Thirdly, the increasing sophistication of technology, including advanced animation techniques and virtual reality, creates opportunities for innovative and immersive content experiences, further enhancing the value of IP. Fourthly, the expansion of merchandising and licensing opportunities related to successful IP has created substantial revenue streams beyond the initial content itself. Finally, the strategic acquisitions and mergers within the industry demonstrate a clear understanding of the immense value of controlling valuable IP portfolios. Companies are actively seeking to build diversified IP ecosystems that can withstand market fluctuations and generate consistent revenue over time. This strategic approach is driving significant investments in content development and the acquisition of promising new IP assets.

Despite the significant growth potential, the IP in Media and Entertainment market faces several challenges and restraints. The high cost of content creation and acquisition can be a major barrier to entry for smaller players. Protecting IP rights in a rapidly evolving digital landscape presents significant difficulties, with issues such as piracy and copyright infringement becoming increasingly prevalent. The competitive nature of the industry, with major players vying for limited high-quality IP, can result in intense bidding wars and high acquisition costs. Furthermore, navigating complex international copyright laws and regulations can add significant complexities to the global exploitation of IP. The changing consumer preferences and the need to consistently adapt to evolving technological advancements and platform dynamics also pose a challenge. Finally, successfully predicting the market trends and identifying profitable IP can be risky, leading to potential losses on substantial investments. Successfully managing these challenges will be crucial for companies seeking to thrive in this dynamic and competitive sector.

The North American market, particularly the United States, is expected to maintain its dominant position in the IP in Media and Entertainment market throughout the forecast period. This is due to several factors, including the strong presence of major studios, established streaming platforms, and a large, sophisticated audience. However, significant growth is also anticipated in the Asia-Pacific region, driven by rising disposable incomes, increasing internet penetration, and a burgeoning middle class with a high demand for entertainment.

Dominant Segments:

The growth within the film and television segment is primarily driven by an increasing demand for streaming content. The success of streaming services is directly linked to the availability of quality and diverse IP. The gaming segment benefits from the popularity of established IP alongside the emergence of successful new franchises. The competitive landscape in gaming is extremely dynamic, requiring constant innovation and investment to retain a strong market position. The music industry's growth is closely tied to the successful implementation of effective streaming models. These models need to balance revenue for artists and accessibility for listeners in order to foster a sustainable market.

The convergence of traditional media with new technologies, particularly in virtual reality and augmented reality experiences, is creating exciting new opportunities for IP exploitation. This provides avenues for creating immersive and engaging experiences that extend beyond traditional storytelling methods, generating new revenue streams and broadening the reach of successful franchises. This trend is accelerating the development of unique forms of entertainment and is expected to significantly increase the overall market valuation within the next decade.

This report provides a comprehensive overview of the IP in Media and Entertainment market, analyzing key trends, driving forces, challenges, and leading players. The forecast period, extending to 2033, offers valuable insights for investors, businesses, and stakeholders seeking to understand and navigate this dynamic and rapidly evolving market. The report utilizes robust data analysis techniques to provide accurate projections and valuable strategic recommendations, with a specific focus on the significant financial impact of Intellectual Property in this industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Netflix TV, Ciwen, Huace Media, Huayi Brothers Media Corporation, Beijing JingxiCulture &Tourism Co., Ltd., ENLIGHT MEDIA, Shanghai New Culture Media, New Classic Media, Sony, Disney, Charter Communications, AT&T Entertainment Group.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "IP in Media and Entertainment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IP in Media and Entertainment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.